Welcome back everyone, I hope you guys are as excited about your portfolio as I am. As you all know, the cryptocurrency sector has been deflating the bubble. It appears as if price action is slowly starting to form a bottom as traders sort through the noise and understand that the fundamentals are getting stronger. I wrote about this last week and you can catch up on it by reading “Bitcoin - Forex Combo Strategy: Fundamentals Stronger Than Ever”. Stronger fundamentals ultimately support higher prices, just be patient, don’t panic and definitely don’t jump on any piece of news which circulates. Especially not on social media.

While my Bitcoin and Ethererum positions have been grinding out a bottom, my forex portfolio has surged which kept my overall assets in an uptrend. I want to thank the PaxForex expert analysts for their hard work as I follow their fundamental trading recommendations. They are published daily at “PaxForex Daily Fundamental Analysis” and I pick the ones which I believe will give me the biggest return. As the name of my strategy suggests, I use Bitcoin as well as forex and as my portfolio expanded I added Gold and Ethereum to my strategy.

As I have mention, back on November 14th 2018 I entered a new long position in Bitcoin and roughly 24 hours late the most recent crash started to materialize. Please read up on my entry at “Bitcoin - Forex Combo Strategy: Fibonacci Retracement”. While many let their emotions dictate their trading, I kept a cool head. At the time I moved my cash back into Bitcoin, my forex balance decreased to $1,953. I switched 100% to the Bitcoin part of my strategy as I expected support levels to hold. I definitely didn’t expect an almost 50% drop from my entry point, but being wrong is part of trading. The difference between profits and losses depends on how you react to being wrong about a position. It is very important to always approach trading very objective, never let an emotion guide you into a trading decision.

I took advantage of the crash, moved the $250,000 cash I kept in my Gold sub-account in order to enter a second Bitcoin position. I was able to move my emergence cash out of Gold, as my Gold positions surged and I was able to free up cash without increasing my risk profile. You can get the details at “Bitcoin - Forex Combo Strategy: November 2018 Crash”. Plenty of selling pressure for cryptocurrencies came from the hard fork in Bitcoin Cash in what many now refer to as the “Hash War”. This is behind us now and we can focus on what lies ahead, feel free to read “Bitcoin - Forex Combo Strategy: End of Bitcoin Cash Hash War” where I quickly touch on the biggest factors which resulted in the hard fork.

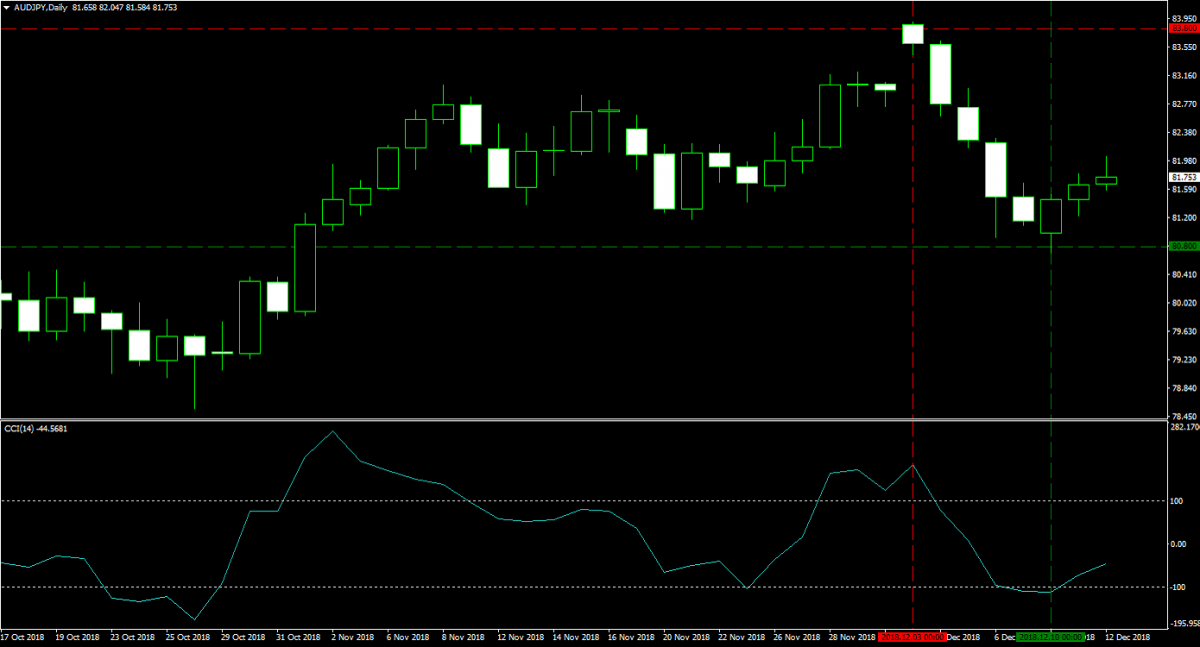

Let me proceed with an update on my three open forex positions from last week. My take profit in the AUDJPY at 80.800 was reached and on December 10th 2018 I closed my 20 lots for a profit of 300 pips or $53,115. I usually don’t exit my trades with a take profit as I move my stop loss to lock in profitable trades. Volatility often triggers my modified stop loss levels before my take profit is reached, but there are exceptions. The image below shows my complete trade.

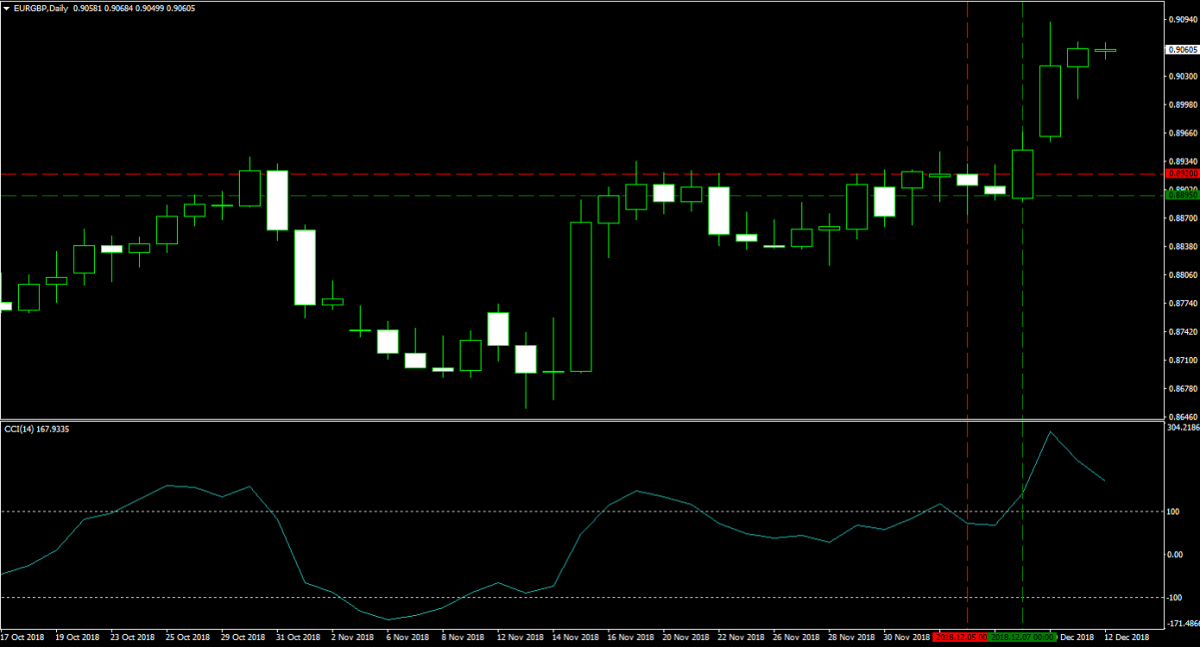

I did take two bullish British Pound positions, but as I stated I was a bit cautious and kept my stop losses tight for small guaranteed profits. I am glad I did as price action moved heavily against my trades. The stop loss in my long GBPCHF position was triggered on December 5th 2018 and I closed my 20 lots for a profit of 25 pips or $5,012. My EURGBP short positions was closed on December 7th 2018, again as my stop loss was triggered, for a profit of 25 pips or $6,383. As you can see in the two images below, after my exit, price action moved sharply in the opposite direction. This is a great example of how you protect your profits by using stop loss orders and lock in guaranteed pips.

In total this has left my forex trading account balance at $83,213. The reason I am so proud of this is that it was $1,953 less than four weeks ago. I did not trade like crazy, but took a few big positions and grew my account. No need to trade hundreds of positions per month. You need a proper analysis and always make sure to follow your trades in order to modify your stop loss levels. This is also a great example that when you have a diversified strategy, not all assets will perform great at the same time. The balance you have in your portfolio will ensure that you can navigate through any market as long as fear is not in the driver’s seat.

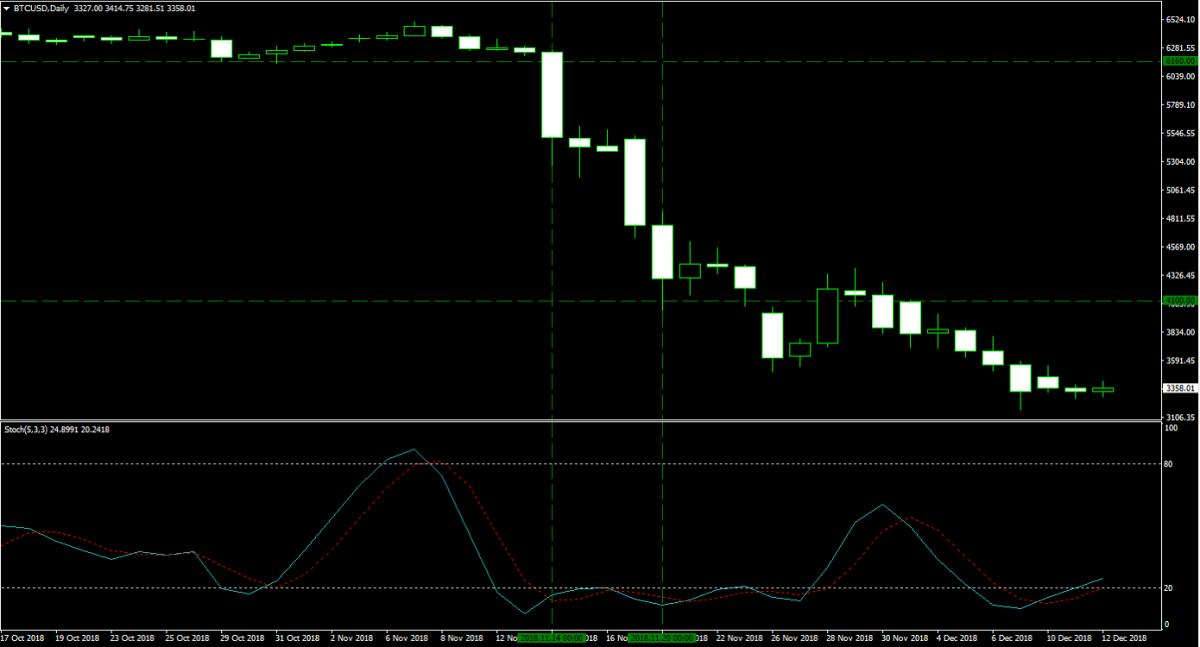

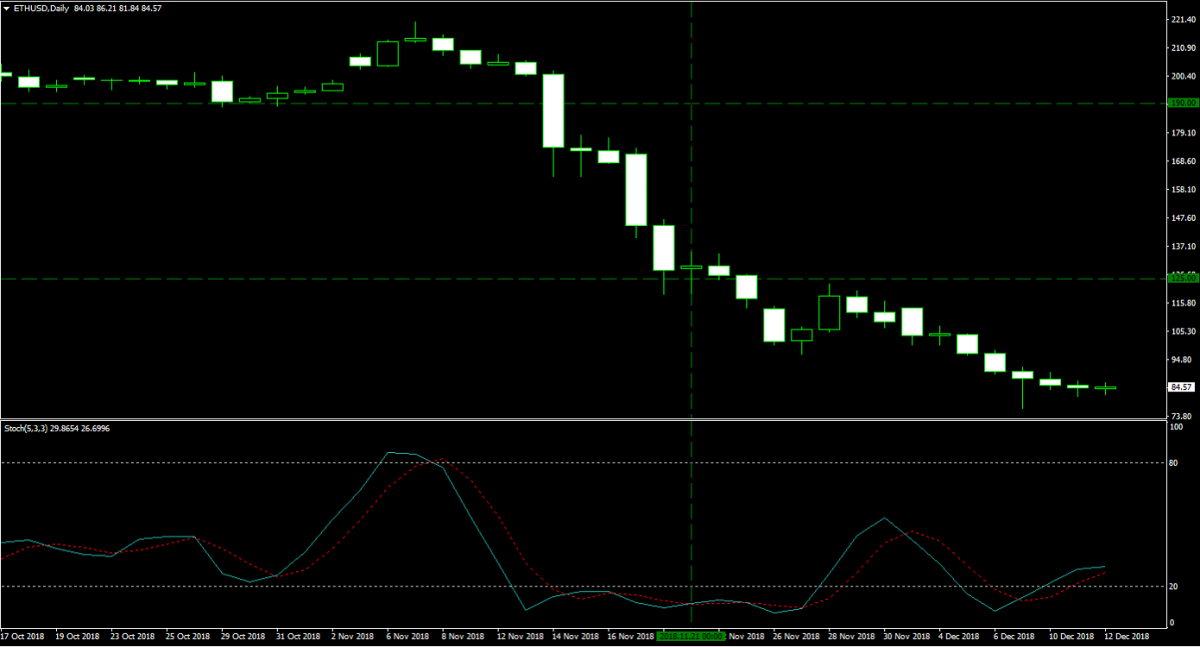

Now let’s take a look at my cryptocurrency positions. Bitcoin is forming a rounding bottom and we are about half-way through the process. I expect price action to slowly advance back above $6,000 in the first-quarter of 2019. I currently don’t plan to add to my 100 Bitcoins. Ethereum is doing the same and I think we will eclipse $200 and then potentially catapult higher from there. As I pointed out last week, fundamentals are only getting stronger and price action will follow suit. My Bitcoin positions carry an average entry price of $5,130 and my Ethereum positions an average entry price of $171.67. The images below show my two entries into each.

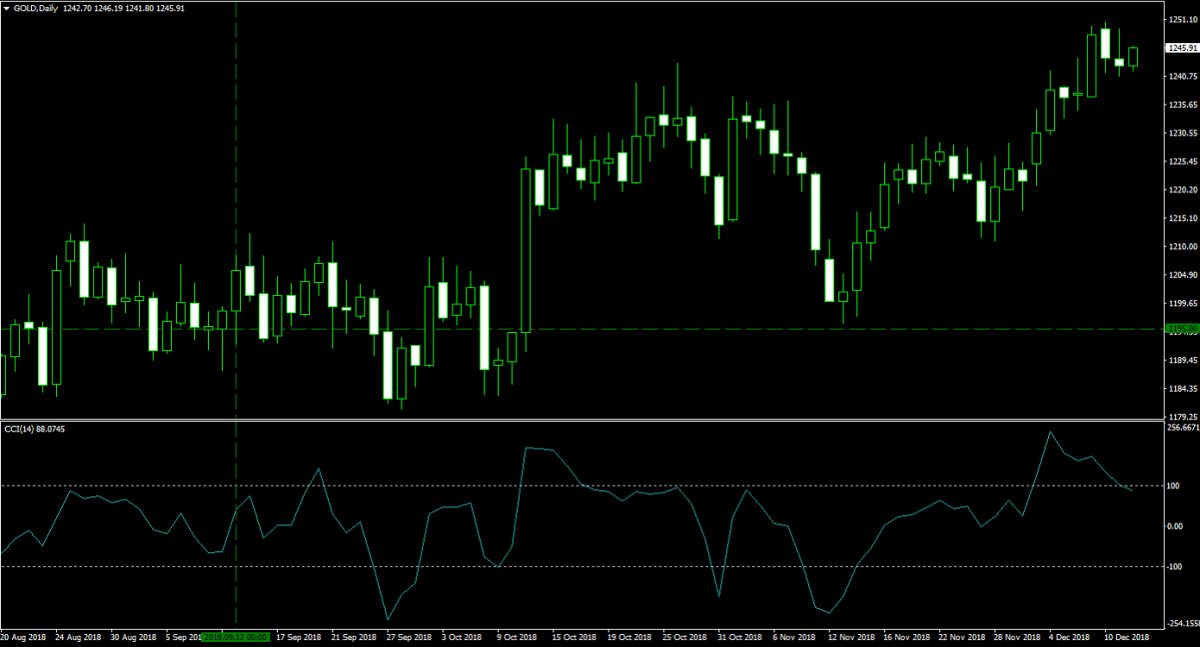

I expect Gold to resume its advance as geopolitical risk as well as macro-economic factors are growing less favorable with each week. As risk and uncertainty is on the rise, Gold tends to attract bids from save haven investors. Adding that the US Dollar is nearing a top and I am confident that we will move above $1,300 in a few months with my price target of above $1,500 still on the table. Gold and the US Dollar often enjoy an inverse relationship so as the US Dollar drops, Gold is likely to rise. You can read more about the forming top in the US Dollar at “US Dollar Nearing Top” and the image below shows my current Gold position, 100 lots taken at $1,195 with a margin requirement of $123,179 and a pip value of $100.

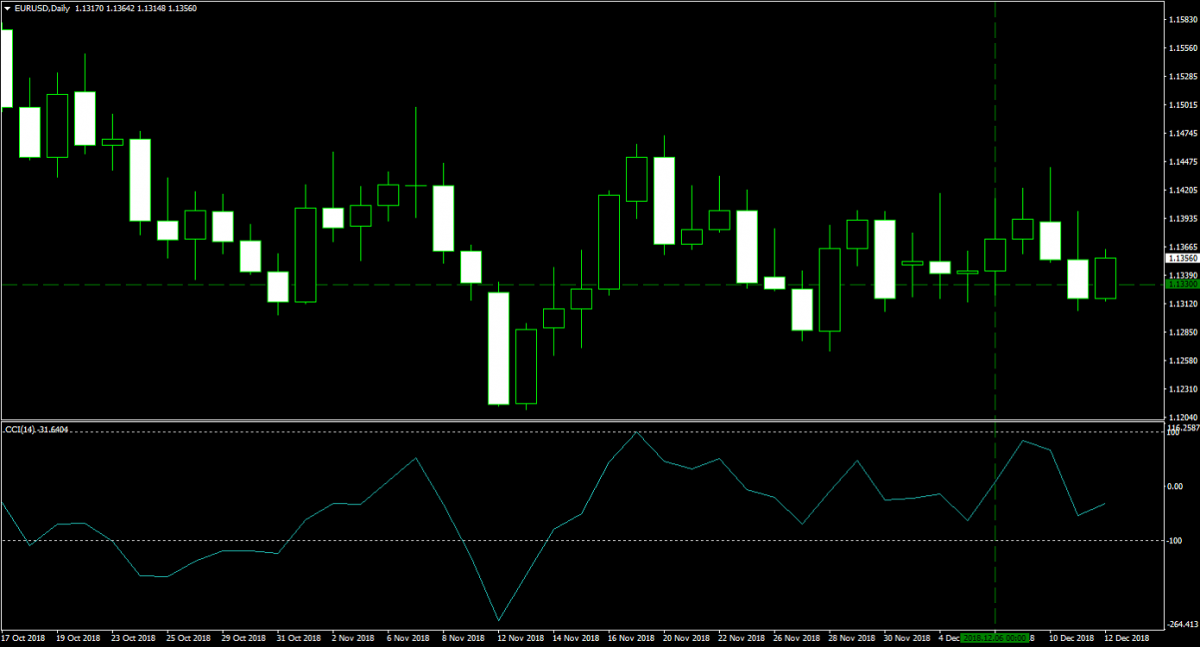

On December 6th 2018 I took a long position in the EURUSD based on this analysis which can be found at “EURUSD Fundamental Analysis – December 6th 2018”. I bought 25 lots at 1.1330 and my margin requirement is $5,677 with a pip value of $250. The image below shows my entry.

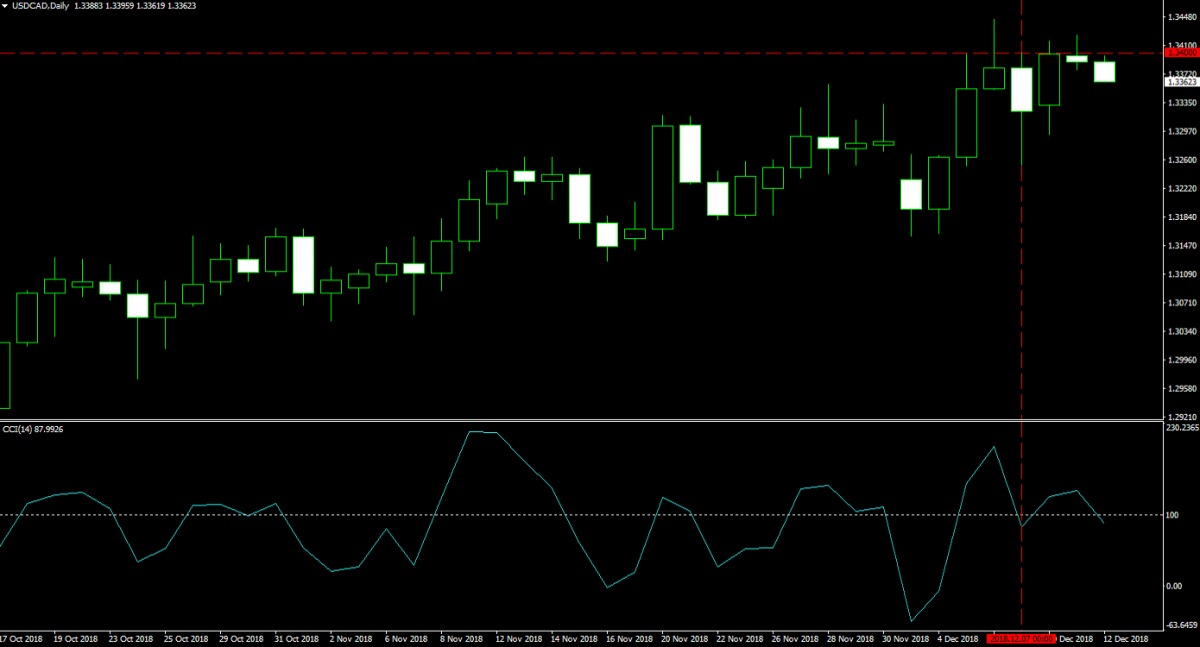

I have added to my bearish trade in the US Dollar with a short position in the USDCAD. I sold 25 lots at 1.3400 on December 7th 2018. My margin requirement is $5,000 with a pip value of $187.06. You can read the original analysis at “USDCAD Fundamental Analysis – December 7th 2018” and the image below shows my position.

Let me conclude this post as always with an update on my overall portfolio. I have 100 Bitcoins worth $336,300 and 1,500 Ethers worth $127,095. In addition I have 100 lots in Gold worth $615,079. My open long position in the EURUSD is worth $12,427 and my open short position in the USDCAD is worth $14,166 while I have total cash worth $72,536. This give my overall portfolio a grand total of $1,177,603 which is up $30,881 as compared to last week and another step closer to my all-time high of $1,395,899. Open your PaxForex Trading Account now and grow your balance the same way I do by using my Bitcoin - Forex Combo Strategy!

To receive new articles instantly Subscribe to updates.