What a difference ten trading days can make. Before US Federal Reserve Chief Powell gave his speech at The Economic Club of New York on November 28th 2018, many analysts expected two to four interest rate increases in 2019. This on top of this month’s expected 25 basis points hike which will bring the Fed funds rate to the low end of the range many currently label as neutral interest rates. The range for neutral stands between 2.50% and 3.50%. Ten trading days later and the unthinkable is being priced into the markets.

The US Dollar has enjoyed a wide range of positive factors which pushed the currency higher despite issues which flared up. Some analysts have questioned the move to the upside as it was not entirely supported by fundamentals, but rather based on hope that the Fed will continue to increase interest rates throughout 2019 despite criticism form US President Trump. Others have pointed out that solid GDP growth around 3%, subdued inflation around 2% and an unemployment rate below 4% will keep pushing the US Dollar to the upside.

Expectations have now shifted and while some analysts predict no interest rate increase in 2019, the possibility of an interest rate cut at the end of 2019 is being priced in. While the chance stands at 5%, it was something nobody dared to think about just a few weeks ago. Goldman Sachs has been the most bullish and has called for four interest rate increases in 2019, but even they have started to trim back. The Co-Head of Global Currency and Emerging-Market Strategy, Zach Pandl, noted “The latest news from the Fed raises our conviction in those forecasts and suggests that dollar depreciation could be more front-loaded than we previously anticipated.”

The change in opinions over what the US Fed will do is expected to increase over the next few weeks as more economic data may disappoint like the US NFP report did on Friday. The US Dollar is therefore likely to create a top near current levels, before 2019 will see an overall weaker US currency. Open your PaxForex Trading Account today and take advantage of trading opportunities presented to you by our expert analysts every day.

The yield curve inversion in US Treasuries is also expected to keep downward pressure on the US Dollar. The 3-Year/5-Year Treasuries inverted while many now watch if the more closely followed 2-Year/10-Year yield will follow suit as the spread narrowed to single digits. An inversion in that pair is likely to result in heavy selling in the US Dollar. Most analysts adopted an overly optimistic outlook on the US economy for 2019 and fail to account for the cracks which appear in their analysis. The US Dollar is nearing a top, but the below three forex trades will top up your trading account balance.

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

While the British Pound has been a recurring theme due to swings in Brexit developments, it remains well mispriced and therefore creates great trading opportunities. The GBPUSD is currently located inside of its horizontal support area following yesterday’s drop which was initiated by fear rather than fundamentals. Bearish sentiment is quickly fading and price action is expected to accelerate to the upside based on a short-covering rally which may take the GBPUSD through its next horizontal resistance level and into its secondary descending resistance level. Buying dips below 1.2615 is recommended.

The CCI plunged deep into extreme oversold territory, but has started to recover as bullish momentum is advancing. A move above the -100 mark is anticipated to further spark the expected advance. Subscribe to the PaxForex Daily Forex Technical Analysis and just copy the trading recommendations posted by our expert analysts into your own forex account.

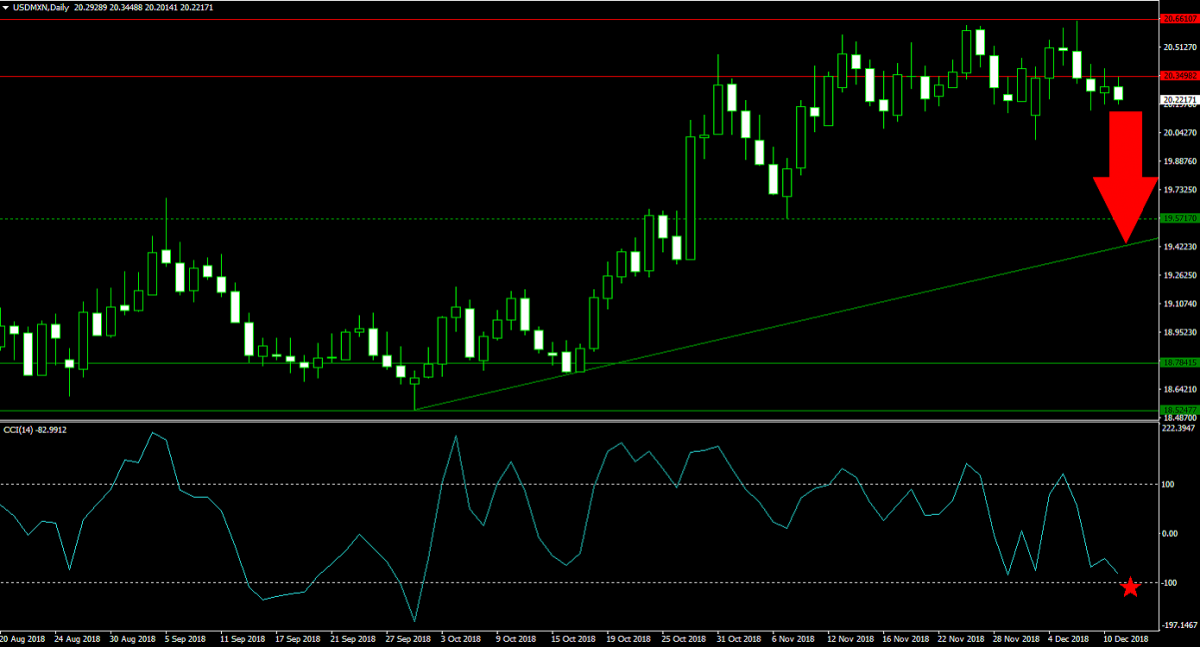

Forex Profit Set-Up #2; Sell USDMXN - D1 Time-Frame

This currency pair has been rejected by its horizontal resistance area which resulted in a contraction in bullish momentum. The USDMXN has now completed a breakdown below resistance which further increased bearish sentiment. As the US Fed is set to scale back and the US economic outlook sours, this currency pair is set to contract below its horizontal support level and down into its primary ascending support level. Forex traders are recommended to sell the rallies in the USDMXN.

The CCI descended from extreme overbought levels, preceded by the emergence of a negative divergence, and bearish momentum carried this technical indicator below the 0 mark. An continuation in the downtrend is anticipated. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market as you earn over 500 pips per month in profits.

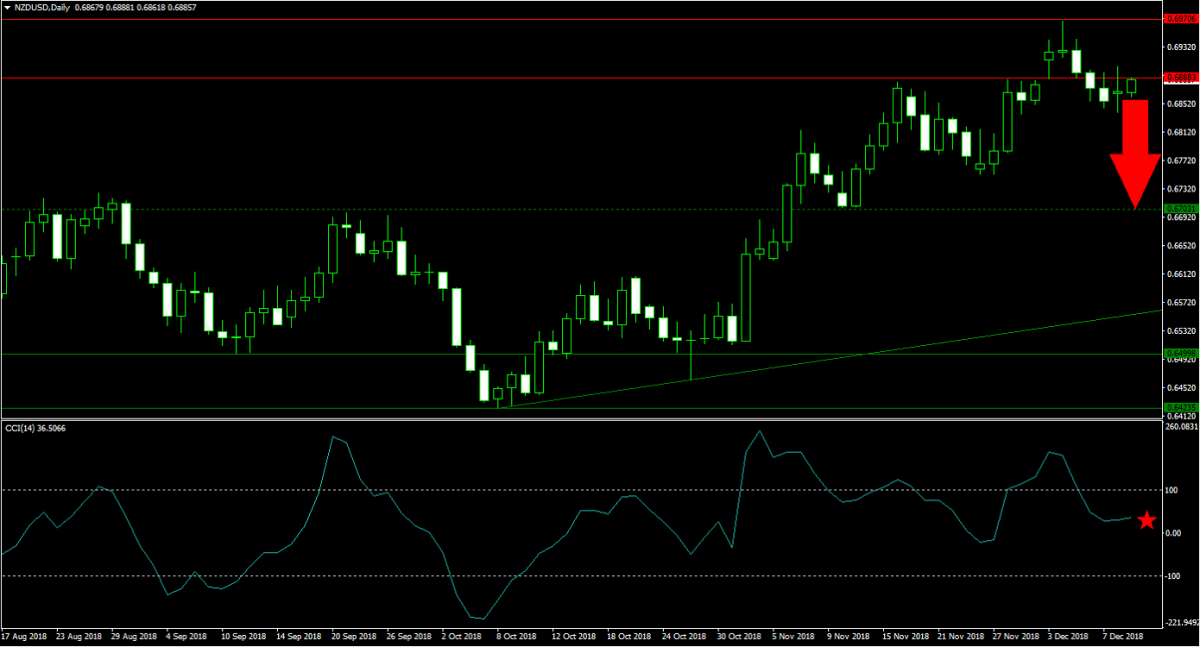

Forex Profit Set-Up #3; Sell NZDUSD - D1 Time-Frame

Forex traders who wish to remain bullish on the US Dollar can find a great long trading opportunity as well as hedge to the above USD short recommendations in the NZDUSD. Price action is currently trading above and below the lower band of its horizontal resistance area from where a contraction is expected to materialize. This currency pair is likely to descend and test its next horizontal support level. Forex traders are advised to sell the rallies in the NZDUSD above the lower band of its horizontal resistance area.

The CCI has formed a negative divergence and this momentum indicator was pushed out of extreme overbought conditions. A contraction below the 0 level and into extreme oversold territory should not be ruled out. Download your PaxForex MT4 Trading Platform and take the first step today in order to create a profitable forex trading portfolio for tomorrow!

To receive new articles instantly Subscribe to updates.