The main concern of a person entering forex trading is the fear of not understanding technical terms and therefore doing mistakes that might cost some money. We believe your worries are totally justified and therefore would like to clarify all things that might sound difficult at first.

The most basic technical terms you need to know and be comfortable with are the concept of Bid Price, Ask Price, and Spread.

Generally speaking:

Now that we introduced the concept of Bid Price, Ask Price, and Spread it is important to understand how two currencies relate to each other and how we can apply the concepts we just introduced to such a relationship.

In order to discuss what we just covered it is important to understand two other concepts; Quote Currencyand Base Currency.

Let’s assume we are looking at the Currency Pair EURUSD, which is a common pair traded in Forex. In this case, the first currency we see is the EUR and therefore we call it EUR Base Currency. The second currency, which is called Quote Currency, is USD.

It is legit to question the meaning of a currency pair and the answer is very simple. Every currency pair expresses how much quote currency is needed to purchase the base currency. It should be clear how the currency pair EURUSD and the currency pair USDEUR are affected by the same factors but do not have the same value!

EURUSD equals 1.5 which means you have to use 1.5 U.S. Dollars to receive 1 Euro. Therefore USDEUR equals 0.667 which means you need to spend 0.667 Euros to purchase 1 U.S. Dollar. This can be obtained by dividing 1 Euro with 1.5 U.S. Dollars (1/1.5=0.667).

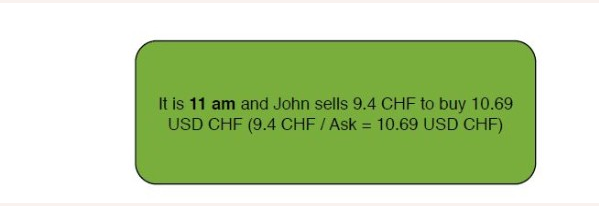

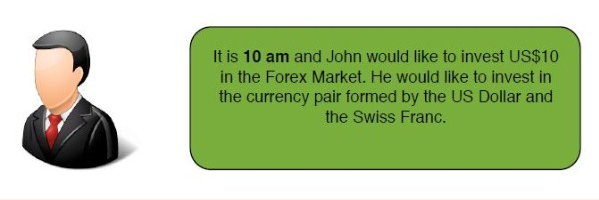

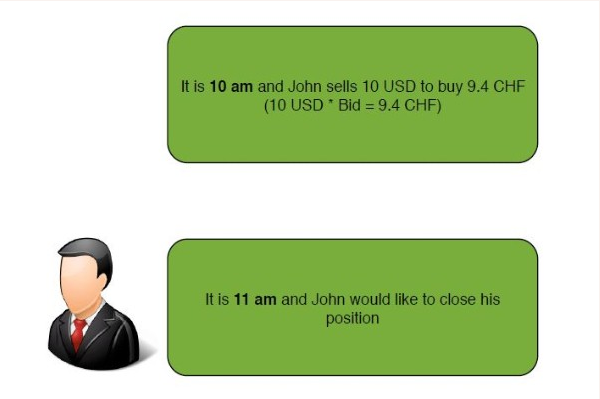

Let’s look at a concrete example in order to make things clearer.

USDCHF Bid - Price we can sell USD and buy CHF = 0.94 Ask - Price you can buy USD and sell CHF = 0.98

USDCHF Bid - Price we can sell USD and buy CHF = 0.89 Ask - Price you can buy USD and sell CHF = 0.93