While trading in forex markets you will meet many forex traders and read plenty of reports using the expressions we just mentioned in the title.

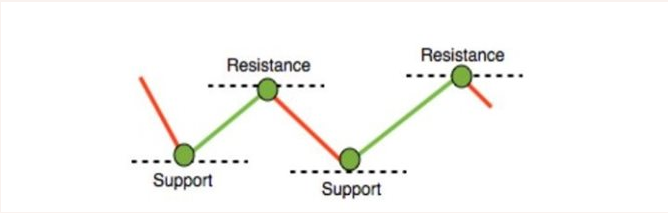

We can refer to resistance as the turning point from the maximum level of a trend, while we can refer to support as the turning point from the minimum level of a trend.

If you study and understand historical values of resistance and support of currency pairs you will be able to maximize you profits. Of course it will be necessary to consider the fact that the present might be influenced by some factors that actually move up or down the level of support and resistance.

It is very important to remember how supports and resistance are not exact numbers and may appear “broken”, which means that the trend went over the support or resistance line. The majority of researchers and technical analysts tend to consider support or resistance is broken if the market actually closes above or below its level. Following this reasoning, they do not consider a trend broken in case price action goes below (in case of support) or above (in the case of resistance) it, but do consider them broker if the price of a currency pair closes below or above support and resistance levels for at least three consecutive days.

Reading carefully what was just outlined, it is possible to understand how when a trend breaks support then support turns into resistance and vice versa. Of course, the more a support or resistance indicator is not crossed by a currency pair, the stronger the support or resistance level is.