Every leap year the U.S. holds presidential elections. The results of this process are unpredictable, judging by frequent mistakes of analytical forecasts and mismatches of exit polls with the real results of the people's will. Uncertainty and non-obviousness of the choice of the head of state are reflected in all markets, including Forex, where the dollar plays the role of the main measure of rates of all currencies.

On November 3 this year, U.S. citizens should decide which of the two candidates will occupy the White House for the next four years - Joe Biden or Donald Trump. Currency and stock market trends depend on the choice of the candidate, the volatility of which at the time of announcement of the first results of the vote counting can bring great losses or profit.

So, today we will get valuable insight into the presidential elections, including how exactly this process works, how the market behaves before and after the elections, as well as what sectors of the economy will benefit in case of victory of either candidate

US Elections

First off, let's start with the election procedure itself. In the U.S. elections, it does not matter who is the favorite of the race. Even with a majority of votes, both Donald Trump and his rival Joe Biden may lose. That's exactly what happened in 2016 when 48% of people voted for Democrat Hillary Clinton and only 46% for the current president.

This is because, unlike most other countries, the result of presidential elections in the U.S. does not depend on who gets the most votes. The winner is determined by the so-called "electoral college".

An electoral college is a group of representatives from each of the 50 U.S. states, who vote for the president. Each state is assigned a certain number of voters depending on how many people live there. In California, for example, there are 55 and in Wyoming, three.

As a rule, voters support the candidate who won the most votes in a given state. It turns out that the one who wins by the results of the national vote in California will get another 55 votes from the college of electors.

To win, a presidential candidate must collect at least 270 votes from the college of electors. In total, the U.S. has 538 voters: 435 state representatives, 100 senators, and three additional voters from Washington.

Another interesting point for the U.S. president is the swing states. As it is well-known, there are two main political parties in the country - the Left Democratic Party and the Conservative Republican Party. Most states vote for either Democrats or Republicans once in a while. In a few states, the results are most often less obvious. As a rule, during the election campaign candidates work hard there.

Such states in 2020 include Pennsylvania, Michigan, Wisconsin, Florida, Iowa, and Ohio, among others. States that typically voted for Republicans, such as Arizona, North Carolina, and Georgia, are also considered potential swing states this year.

It also should be mentioned that this very election approach is heavily criticized since ”electoral college gives smaller states far more power to choose their president than their populations require”.

For example, California has 55 votes and Wyoming has three, even though the population of California is about 68 times larger than that of Wyoming.

Also, the colleges of all states, except two, distribute votes on the principle of "the winner of the national vote gets everything. It means that those who vote for a candidate who does not win in the state, in fact, are not reflected in the results.

That's why one can win the national vote, but lose the election. However, despite the criticism, the system is unlikely to change, as the change in the system requires amendments to the Constitution.

How the Market Behaves Itself During President Election in the US

The U.S. elections, as well as the presidential elections in other leading world countries, is a factor that affects the financial markets. As a rule, the approaching elections lead to higher fluctuations in financial markets, as they bring uncertainty to the prospects of financial instruments. At the same time, it is at this point that one can make a good profit from the price dynamics of various assets.

In the run-up to the presidential election, stock market quotes have been rising and falling after the vote count, as investors begin to fix profits. For example, the day after Obama's victorious 2008 election, the U.S. stock market fell 5.3%.

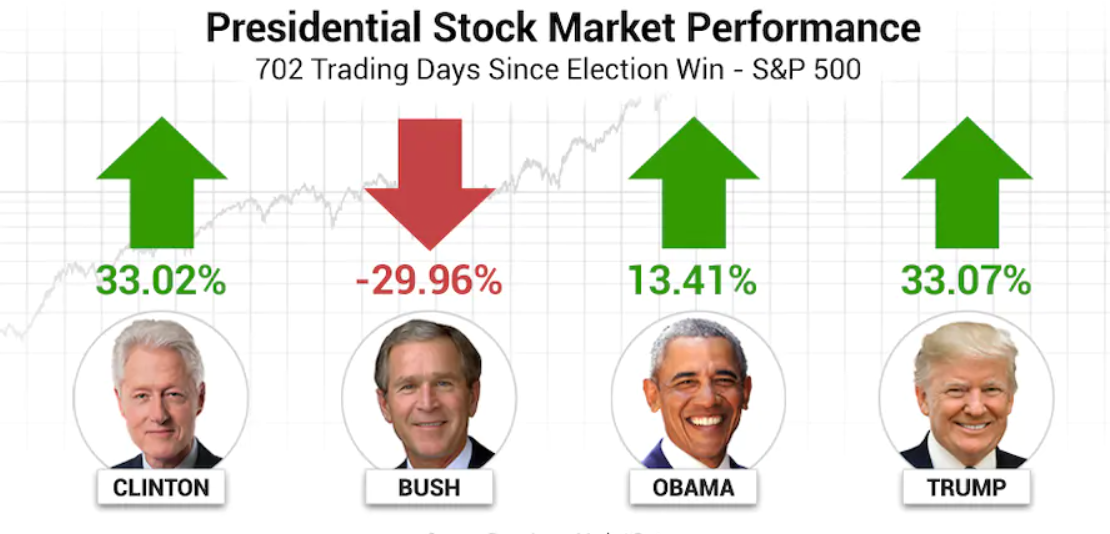

Looking back at the historic S&P 500 index data since 1928, presidential election years have seen an average annual growth rate of 7.0 percent, and all years have seen the growth of 7.5 percent. In other words, the years of presidential elections were rather average.

However, here is what is interesting and important - in the years of election of a new president, the S&P 500 index fell by 4% on average. The worst in this sense was 2008, at the end of the presidency of George W. Bush when the market fell by almost 38%.

The annual yield of the real stock market under Democrats was 10.6 percent, compared to 4.8 percent for Republican presidencies.

Democrats' victory will almost certainly mean a change in taxation for corporations and the rich in a negative way, which will affect the markets. At the same time, Democrats promise economic incentives and stability with China, which are positive factors for markets.

It is not just politics that affect stock markets. Today some experts compare the Trump presidency pandemic with threats such as terrorism under George W. Bush, social unrest under

Johnson and Nixon, and the Reagan presidency's trade war with Japan.

Looking forward, we can get a general idea of the possible reaction of the market to the 2020 elections. The election program of the Democrat candidate envisages an increase in the corporate income tax rate from 21% to 28%. Back in 2018, Trump reduced this tax, which led to the acceleration of the U.S. economy and "trumporally" in the U.S. stock market. If Biden wins, the effect may be the opposite, at least for a while.

On the other hand, markets may support the agreement on a new fiscal stimulus package, as well as Biden's promised infrastructure spending program with a focus on green technologies. However, such steps could increase inflation risks and thus accelerate the Fed's rate increase in the long run. So far, the regulator promises that the key rate will remain close to zero until the end of 2023. Other things being equal, the higher the interest rates, the more likely it is that the dollar will strengthen, and the stock market will fall.

An additional risk factor is the second wave of the pandemic. This time a complete closure of the economy is unlikely, but the offline services sector is again under pressure. As for the online segment and cloud services, many people have already subscribed to their services, so we should not expect such a powerful positive effect as in spring. Vaccines against COVID-19 are being developed, but mass vaccination of Americans can start only in the second or third quarter of next year.

If the economy does not experience a massive second wave shock, the Fed may continue to withdraw from the emergency stimulus program. It is not about interest rates, but quantitative easing (QE) and other complementary measures. The regulator has already significantly reduced the buyback of non-standard instruments - corporate bonds and ETF on bonds. Since the beginning of June, the Federal Reserve's balance sheet has decreased from $7.17 trillion to $7.15 trillion. The American stock market has recovered largely due to the Fed's "cheap money", so the reduction of incentives is negative for investors.

Who Will Benefit if Biden/Trump Will Win

The programs of presidential candidates in the United States differ not only politically, but also economically. So, obviously, different sectors of the economy will benefit (or suffer) from the victory of this or that candidate. Let us have a look at both scenarios to get an idea of the possible consequences and to know what assets to pay attention to.

If Biden Wins:

Currently, Joe Biden is a favorite of the presidential race in the USA. His presidency is great news for some industries: green energy, electric cars, medical marijuana, infrastructure, and even Chinese business. There are a lot of options for investment in each of them.

Biden's victory in the election will give the clean energy sector additional growth momentum. Democrats, who may be in the majority in the Senate by-election results, are in favor of the industry development. This further spurs investors' interest in companies in the renewable energy sector. The biggest growth potential is among key market players.

Biden said he wanted to see America as a world leader in electric cars. He intends to invest $400 billion in automotive infrastructure, battery technology improvements, and government procurement of electric cars and electric trucks.

Tesla is an obvious beneficiary of the Biden presidency. It is the largest company in the industry and the most expensive car maker in the world. Its shares have increased by over 420% this year.

On October 21, the company reported record earnings for the 3rd quarter. Elon Musk called the quarter "the best in history" and confirmed his commitment to the plans to deliver at least 500 thousand cars to customers in 2020.

In the United States, many states have legalized the use of cannabis, but federal laws still restrict access to medical marijuana. Because of this, banks and financial institutions regularly refuse to cooperate with the industry.

However, if Biden wins, this may change. Democratic presidential candidate Kamala Harris said that if Joe Biden wins, he will allow marijuana at the federal level and rehabilitate those previously convicted. After that, the quotes of cannabis producers soared.

Also, it should be noted that Biden is not expected to lead such a tough policy towards China. Reducing the risks of a trade war should help the quotes of Chinese companies, which have been pressured by Trump's aggressive rhetoric over the past couple of years.

Moreover, there are initiatives in Biden's election program that threaten individual industries. The Democrat candidate intends to promote strict antitrust legislation. For example, Amazon, Alphabet, and Facebook have long been accused of abusing their monopoly positions in online services and digital advertising. Such measures will impede business consolidation, and a reduction in the number of mergers/acquisitions could hit investment bankers.

If Trump Wins:

Many no longer believe in Donald Trump, but he may come as a surprise and be re-elected for a second term. Let us have a look at the companies that will be more than happy with that case scenario.

Donald Trump is a supporter of high expenses in the military industry. Back in the first election campaign, he demanded that NATO countries spend 2% of their GDP on defense. And in 2020, he presented a draft federal budget for 2021, which assumes a record defense spending of up to $705.4 billion.

According to BCA Research's strategists, if Trump wins the election, he will be able to maintain spending at a high level despite opposition from the House of Representatives, where Democrats are in the majority. Experts believe that a factor in the struggle against China and Russia will play a role here.

Lockheed Martin is the largest arms manufacturer in the world by sales volume. It is one of the main contractors of the United States government. Lockheed Martin develops and produces weapons, satellite systems, software, warships, aircraft, missiles, and other weapons.

The oil companies will be among the main beneficiaries if Trump wins. While Biden is an active supporter of alternative energy, Trump has always supported traditional energy sources - oil, gas, and coal - in order to save jobs.

Here we cannot but mention ExxonMobil which was hit hard by the COVID-19 pandemic. In April, the company announced a reduction in its investment program - in particular, it reduced investments in shale gas production. The capital budget for 2020 was cut by 30% ($10 billion) and operating expenses by 15%. In August, ExxonMobil was excluded from the Dow Jones index together with Pfizer and Raytheon Technologies.

At the same time, the company continues to pay large dividends despite the drop in revenues and quotations. At the current value of the shares, their dividend yield is about 10%, which is an outstanding result by the American market standards.

ExxonMobil shares have been at their lowest level for 18 years - and another four years of Trump in the White House, combined with gradually recovering oil demand, can bring them back to growth.

Trump's first term was beneficial for the banking industry: all this time financial institutions have been relaxed - the resolutions of the Dodd-Frank Act have been repealed, and supervision of regional credit institutions has been weakened. The banks also benefited from Trump's reduction in corporate tax rates.

But Biden's presidency is not a pleasant development for banks: in this case, a large number of regulations may await them. Trump's victory with the Republican Party of Control over the Senate is the best scenario for banks.

Bank of America is one of the largest banks in the United States. Its shares are loved by Warren Buffett, in the portfolio of which they occupy a second place by volume. For Bank of America, as well as for the entire banking sector, in particular, Trump's victory is much more profitable.

Joe Biden expressed his intention to raise the minimum wage in the U.S. to $15 per hour. At the same time, the Trump program does not address this issue, and during the presidential term, he did not take any initiatives to raise the minimum wage. If his inaction on the issue continues after a possible election victory, large employers with large numbers of low-paid employees will be among the winners.

Walmart is America's largest private employer, employing 1.5 million people. According to Glassdoor, the average sales representative of Walmart earns $ 11 per hour.

If the minimum wage is increased by $4 per hour, it will cost Walmart extra billions every year, which will certainly affect the optimism of investors. But if everything stays as it is, then the company's shares, which have grown by more than 20% in the last 12 months, may continue to grow.

Although many analysts and experts compare the electoral balance of forces in 2016 and 2020, talking about a possible unexpected victory Trump, experts note: the current electoral gaаp between Biden and Trump is greater, and its leaps are more predictable than between Trump and Clinton four years ago.

Besides, the candidate from the Democratic Party of the United States has more than 50% approval from the population on key indicators (in general, the approval rating of his policy is higher than that of Hillary Clinton). One of the reasons for this is the lack of strong representatives of third parties (i.e. politicians not from the camp of Republicans or Democrats).

Another key difference between the situations of 2016 and 2020: six days before the elections, Hillary Clinton was 3.1% ahead of Trump, while Biden is now 8.7% ahead of Trump. In conclusion, analysts note the better work of sociological services this year, compared to the previous election period.

Some experts talk about "nightmare scenarios" that can have a fundamental impact on the election process: for example, fraud and vote-counting fraud, particularly those given by mail.

In this case, the point in the question of the winner of the election will be the U.S. Supreme Court, where the conservatives, traditionally gravitating towards the Republican Party of the United States, have a majority (6 conservatives against 3 liberals). Most likely, in a controversial situation, this judicial body will take the side of Donald Trump.

Why Trade CFDs Market During Elections with PaxForex?

Trading CFDs is one of the most profitable investments since it allows you to invest in a wide range of assets, including shares, precious metals, and indices. Consequently, you will be able to take advantage of the elections with the help of a diversified portfolio, minimizing your risks at the same time. Apart from that, in such a way you will have an option not to just buy an asset but to go short as well, which means that you can make money no matter what happens on the market.

With a decade of experience in this business, PaxForex definitely is the best choice for everyone willing to get the best CFD trading experience, along with decent service and order execution. Add to that the support team of true professionals and low spreads - you wouldn't ask for more.

Conclusion

The U.S. elections in terms of news strength are comparable only to the fundamental change in the Fed's monetary policy. The event takes place every four years, but it is not a reason to "trade at any cost". A trader should compare risk and profit for himself.

This balance will be different in terms of strategies. The greatest risk is for intraday trading - you need to correctly calculate the size of Stop-Losses and Take-Profits and be ready for indicators to "go wild".

Additionally, manual trading on an election day will be a huge emotional burden that can lead to mistakes and unexpected losses.

It may be worth auditing and closing several profitable medium and long-term positions. Currency quotes will fluctuate in all directions and may catch a Stop-Loss before Take-Profit, leaving the trader without a profitable position. Another variant of pre-election readiness is to drag the stop to the break-even level.

It is important to remember that the election is just an episode of a large economic cycle, which does not depend on a single U.S. presidential candidate. Globally, the stock market will continue to grow, coping with the negative of the second coronavirus wave, but the dollar's weakening may be delayed by the lost interest-rate advantage.