Today I would like to briefly talk about the cryptocurrency crash which we saw ripple though the market over the past week. I would like to state that I didn’t see this crash coming and was positioned long. Prior to the crash, cryptocurrencies enjoyed a rather calm trading environment with prices hovering at very big support levels. That and the seasonality which we get to enjoy now, the Christmas period, resulted in me being bullish. I expected cryptocurrencies to embark on what is known as a “Santa Claus” or “Christmas” rally, which has traditionally been one of the strongest bullish periods for many asset classes.

Last Wednesday I told you that I bought 50 Bitcoins at $6,160 for a total price of $308,000. The crash started about 24 hours later and Bitcoin led the cryptocurrency sector down through key support levels. This has created a very good lesson. The crash may have been initiated by the SEC investigations into two US crypto firms who didn’t declare their ICO’s as securities as well as the hard-fork in Bitcoin Cash which itself was the product of a hard-fork from Bitcoin. This does show the continued infighting between the groups who control the code. The sell-off then cascaded and we may have seen some panic selling across the board as many fear the creators of other cryptocurrencies will flood the market.

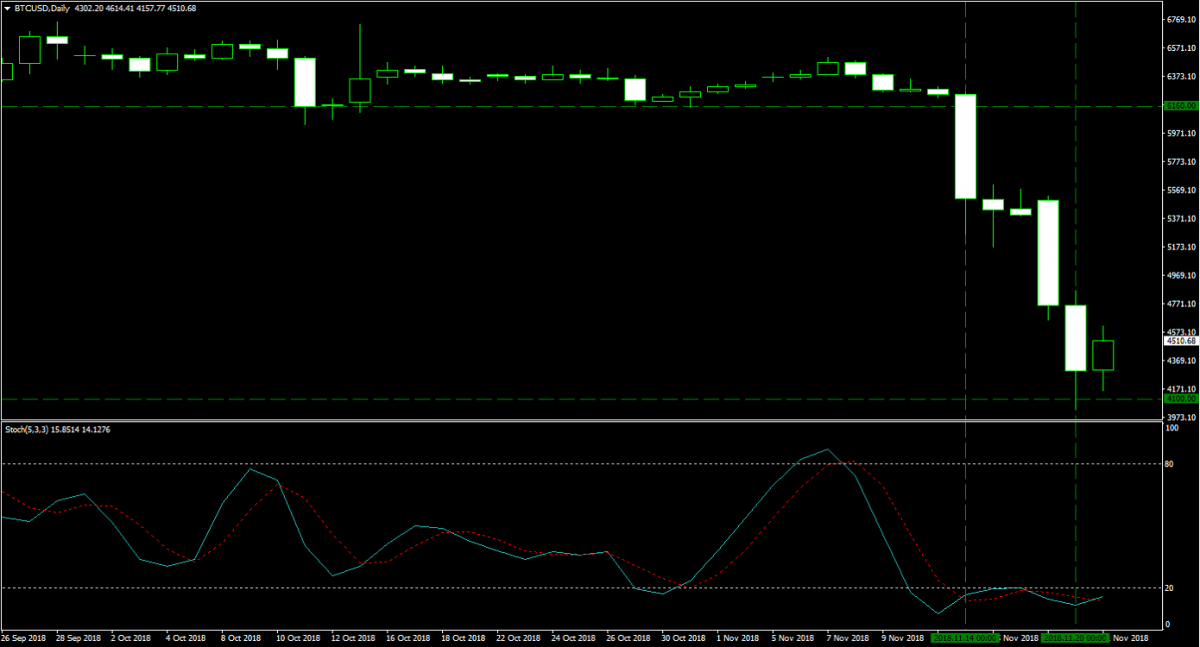

The US Department of Justice is further investigating potential Bitcoin price manipulation with the use of Tether. This combo crushed confidence and fueled the sell-off. Panic never leads to good decisions and while I didn’t like to see my Bitcoin assets tumble, rather than acting motivated by fear, I decided to take advantage of this opportunity. I did something which is a bit more risky, but I did have $250,000 in cash parked in my Gold portfolio as stated during last week’s update. I did buy 50 more Bitcoin at $4,100 for a total consideration of $205,000 on November 20th 2018. I now have a total of 100 Bitcoins with an average entry price of $5,130. The image below shows my second entry and you can also view my first one from last week.

I think it is very important to never act based on any emotions, fear and greed will never result in consistent trading performances. When it comes to cryptocurrencies, I think we will see a recovery as 2018 winds down. I do remain cautious and I will not add to my current holdings. The fundamental news flow was bearish which resulted in a breakdown of support, but from a technical perspective we are extremely oversold from where we should get a relieve rally. Prices could drop further and while they have rebounded today, I will monitor them closely in order to react appropriately.

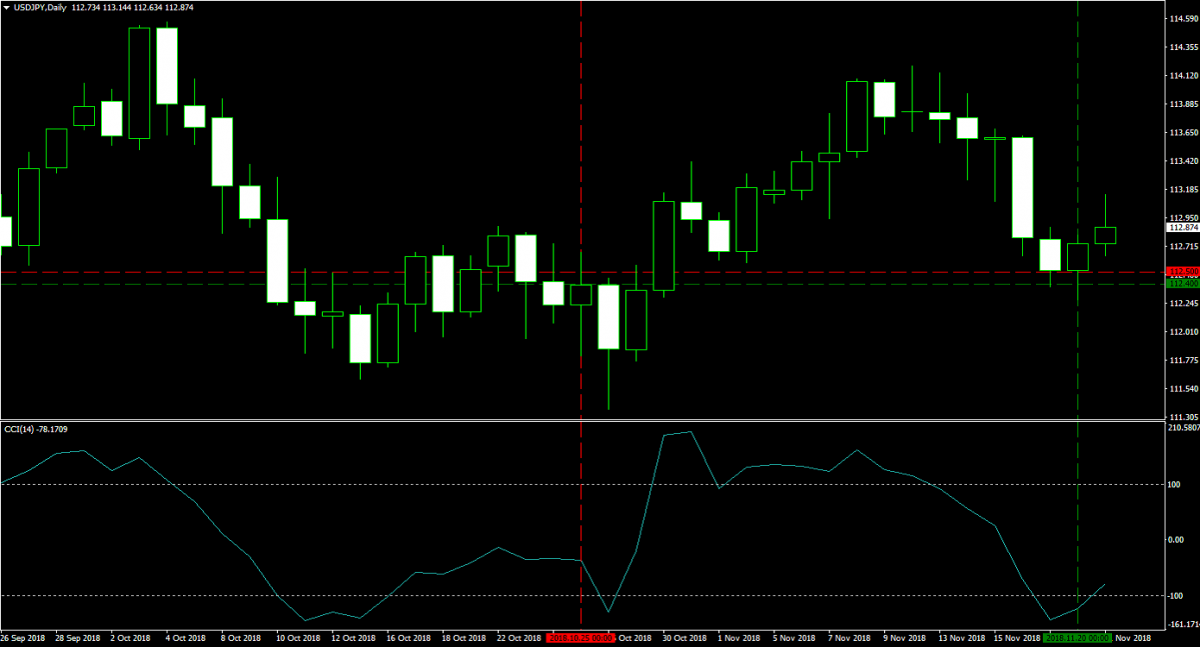

Last week I had one open USDJPY short position, 40 lots at 112.500 for a total margin requirement of $8,000 and a pip value of $355.43. This trade extended to the upside far longer than I anticipated, but as Bitcoin and other cryptocurrency panic selling hit the market, the Japanese Yen attracted bids which finally pushed this trade in my direction. At this point I simply wanted out at a small profit and I exited this position on November 20th 2018 at 112.400. My total profit was 10 pips or roughly $3,554. My forex account balance now stands at $19,453, my USDJPY profit of $3,554 plus the margin requirement of $8,000 plus last week’s closing balance of $7,899. The image below shows my exit.

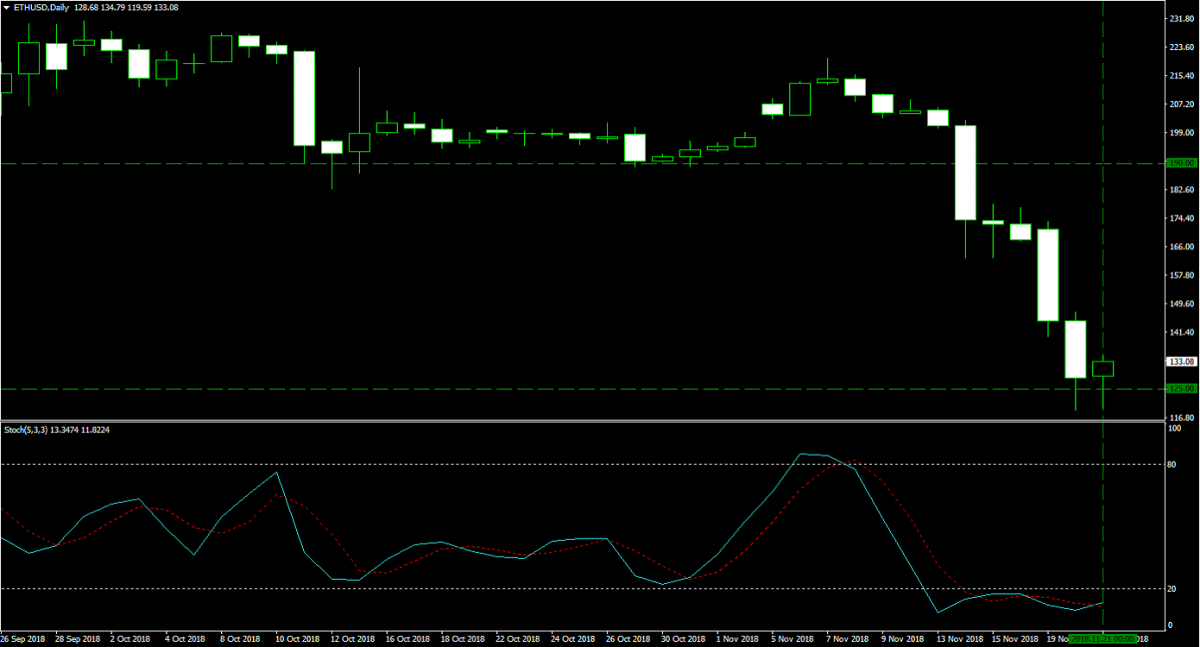

The sell-off in Bitcoin did drag down the entire cryptocurrency sector with very few exceptions. This also dragged down my Ethereum wallet where I hold 1,000 Ether which I bought at $195. I applied the same logic to Ether as I did with Bitcoin. Today, November 21st 2018, I bought 500 more Ether at $125 for a total consideration of $62,500. The capital for this came from the remaining $45,000 of my reserve cash from my Gold portfolio as well as the $19,453 from my primary forex trading account which is now down to just $1,953 in cash. I do have 1,500 Ether with an average entry price of $171.67 and the image below shows my entry level today.

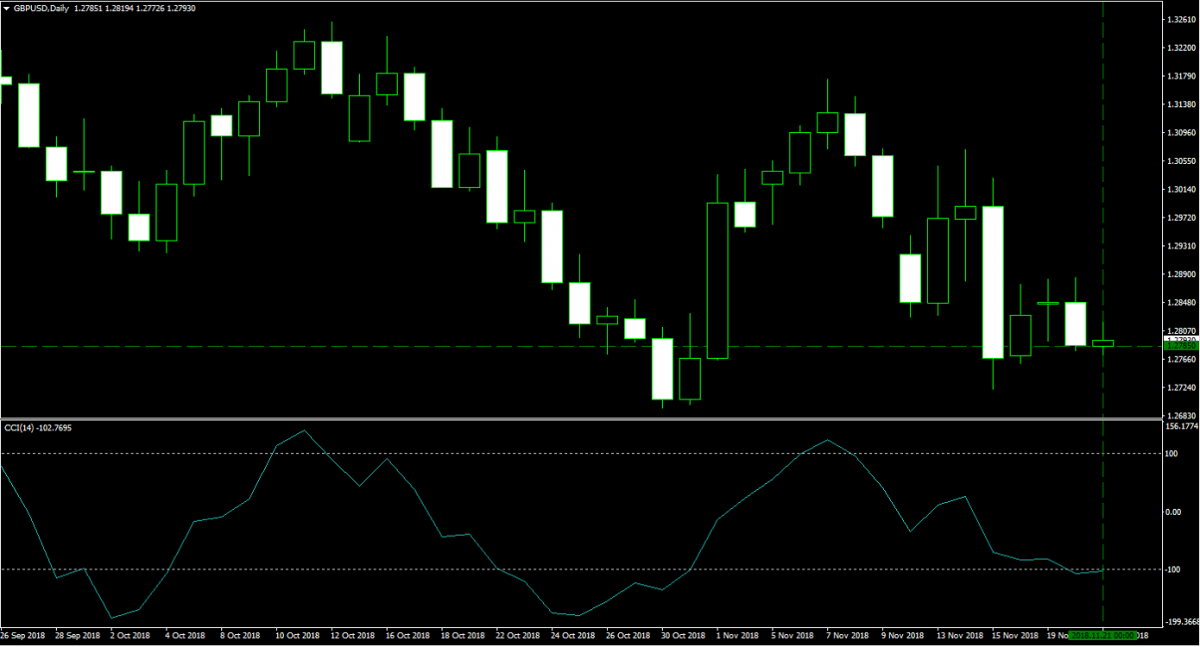

Earlier today I did buy 5 lots of GBPUSD at 1.2785. The margin requirement was $1,279 and each pip is worth $50 and I now have total cash worth $674. You can read the original trading recommendation at GBPUSD Fundamental Analysis – November 21st 2018. I had to reduce my lots sizes as my forex trading cash balance dropped below $2,000, but the sell-off in Bitcoin and Ethereum was offered too good of an opportunity to miss out on. You can see my GBPUSD position which I took in the image below.

The bright spot was Gold which rallied amid safe haven demand. This rally was a great reason why I moved my $250,000 in emergency cash out of my Gold sub-account which I initially intended to use for more Gold purchases if the price dropped to attractive levels. It is always important to have extra cash so that you can react to the markets when trading opportunities present themselves. As a reminded, I have 100 lots of Gold which I purchases at 1,195 for a total margin requirement of $123,179 where each pip is worth $100 or in the case of Gold each $0.01 is worth $100. The image below shows my entry level as well as the up-and-down move in the price of Gold.

Before I wrap things up with an update of my overall assets, let’s revisit the most important lessons one should take from the severe sell-off in cryptocurrencies. The lessons learned will apply to all other assets as well, fundamental surprises pop up all the time. Just look to what happened to the British Pond after Brexit Secretary Dominic Raab resigned or how oil prices dropped amid speculation of how Saudi Arabia and Russia will move forward on production policy. Here are the key lessons:

My overall assets currently consist of 100 lots of Gold worth $452,679, 1,500 Ethers worth $197,400, 100 Bitcoins worth $448,000, one GBPUSD long position worth $1,279 and $674 in cash. My total portfolio is now worth $1,100,032, up $196,454. I finished the week higher despite the sell-off in Bitcoin and Ether as Gold rallied and cryptocurrencies started to rebound which added to my net worth. Last week I dipped below the $1,000,000 for the firs time since eclipsing it, and with this week’s moves I feel confident moving forward that I will increase my portfolio further. Open your PaxForex Trading Account now and use my strategy to grow your assets.

To receive new articles instantly Subscribe to updates.