US President Donald Trump loves to tweet, often at odd hours and to the surprise of his own cabinet. While the world has gotten used to it by now, and despite the Republicans losing the House of Representatives to the Democrats two week ago, the trade war with China shows no signs of easing. On the contrary it only intensifies. The US President doesn’t need Congress for trade policies which means that the Democrats have little power to stop President Trump from pushing through with his current approach in regards to China.

Some market participants started to sound slightly optimistic that both leaders will at the very least call a truce when they will meet on the sideline of the G-20 summit in Argentina at the end of November. Then President Trump decided to skip the APEC summit in Papua New Guinea and send Vice President Pence instead who decided to sound a tough and provocative tone during his speeches. Pence noted that “The United States, though, will not change course until China changes its ways. Our vision for a free and open Indo-Pacific will prevail.”

Pence further attacked China’s massive infrastructure initiative know as the “Belt and Road Initiative” and touted that US democracy is superior to Chinese authoritarianism. He further stated that “Know that the United States offers a better option. We don't drown our partners in a sea of debt, we don't coerce, compromise your independence. We do not offer constricting belt or a one-way road. When you partner with us, we partner with you and we all prosper.” His speech indicates that the US-China trade war is far from over and that it could spill into a new cold war between both countries.

The forex market is caught in the middle of this. While the Chinese Yuan has weakened this year, the US Dollar has surged. This scenario benefits Chinese exporters and only accumulates the trade deficit which Trump has attacked. Will the US Dollar ignore the interest rate increases and give in to economic reality? Open your PaxForex Trading Account now and start building a profitable trading account!

Chinese President Xi spoke before Pence and his speech anticipated the aggressive stance Pence would strike. Xi pointed out that “The rules made should not be followed or bent as one sees fit and they should not be applied with double standards for selfish agendas.” He further added that “Mankind has once again reached a crossroads. Which direction should we choose? Cooperation or confrontation? Openness or closing doors. Win-win progress or a zero sum game?” The APEC summit failed to agree on the wording of a closing statement. Is the US starting a cold war with China? Here are three forex traders to keep in your arsenal.

Forex Profit Set-Up #1; Sell USDCAD - D1 Time-Frame

While the Canadian Dollar will suffer from a contraction in commodity prices as a result of lower global demand, it is likely that the negative impacts on the US economy will be greater. Price action already completed a breakdown below its horizontal resistance area and is now testing this level again. The primary ascending support level has turned into resistance and the USDCAD is anticipated to contract down into its next horizontal support level. Forex traders are recommended to spread their sell orders inside its horizontal resistance area and below its primary ascending support level.

The CCI contracted from extreme overbought conditions, but has halted its descend together with the USDCAD challenge of resistance levels. A resumption of the downtrend is expected to follow. Subscribe to the PaxForex Daily Forex Technical Analysis and receive each trading day’s most profitable trading set-up delivered directly into your inbox.

Forex Profit Set-Up #2; Sell AUDUSD - D1 Time-Frame

The Australian Dollar enjoined a short-term counter-trend move. This pushed the AUDUSD from its horizontal support area through its primary descending resistance level and into its secondary descending resistance level from where price action started to reverse. The Australian Dollar is the primary Chinese Yuan proxy used by forex traders and expected to come under new selling pressure. The AUDUSD is likely to retrace its advance back down to the upper band of its horizontal support area. Selling the rallies from current levels is favored.

The CCI has pushed below extreme overbought territory and bearish momentum is on the rise. Prior to the contraction, a negative divergence formed which represents a strong bearish trading signal. Follow the PaxForex Daily Fundamental Analysis where our expert analysts guide your forex portfolio to over 500 pips per month in profits.

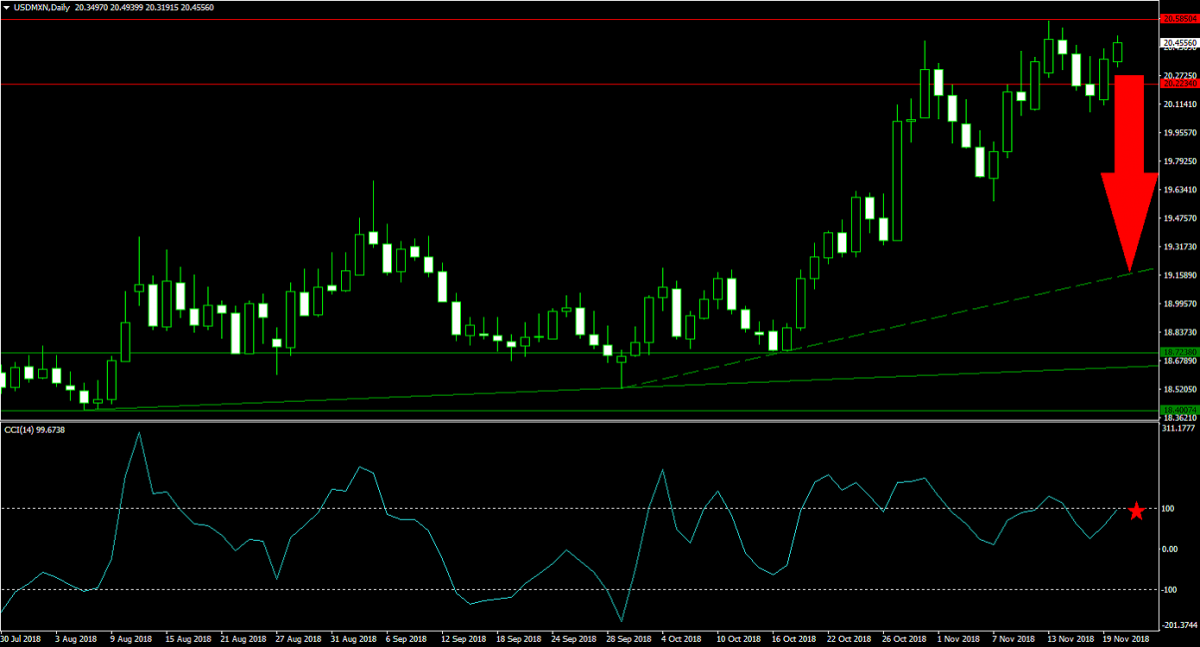

Forex Profit Set-Up #3; Sell USDMXN - D1 Time-Frame

The US Dollar was pushed higher despite the trade war with China as some forex traders preferred it as a safe haven over the traditional currencies. The increase in interest rates by the US Fed helped take the USDMXN into its horizontal resistance area. Bullish sentiment is fading which leaves this currency pair vulnerable for profit taking. A sell-off is anticipated to unfold which will take price action back down into its secondary ascending support level. Forex traders are advised to sell the USDMXN from inside its horizontal resistance area.

The CCI is trading above and below extreme overbought levels, but a negative divergence has formed which suggests that a price action reversal is imminent. Download your PaxForex MT4 Trading Platform today so that you can plant the seed for a profitable forex account tomorrow, join our growing community of profitable forex traders!

To receive new articles instantly Subscribe to updates.