Many blame the big sell-off in cryptocurrencies on the Bitcoin Cash Hash War which erupted as two factions could not agree on how to proceed. This resulted in a hard fork into BCH-ABC and BCH-SV. BCH-ABC won the Satoshi Nakamoto Challenge and the rights to keep the existing Bitcoin Cash infrastructure while BCH-SV will be allowed to co-exist, the SV is an acronym for “Satoshi’s Vision”. As is common with hard forks, miners and developers were unable to agree on how to address the issues in the blockchain and two different ideas emerged. This also took away a lot of mining capacity from Bitcoin which further fueled the sell-off.

Two of the biggest actors in Bitcoin Cash to keep an eye out for are Roger Ver and Craig Wright. Roger Ver was given the nickname “Bitcoin Jesus” for his early support of Bitcoin which he took to an almost evangelical style of outspoken believe. He later moved to Bitcoin Cash where he is backing BCH-ABC which is proceeding with a software update. Market watchers expect that BCH-ABC will likely receive over 60% of hash power. Hash power or hash rate is a measuring unit which illustrates the power use of the network in order to operate continuously or the mean rate at which it finds a new block for mining every ten minutes.

Craig Wright is supporting the new cryptocurrency BCH-SV and some believe that he is indeed Satoshi Nakamoto, the creator of Bitcoin. Those claims have never been confirmed, but he believes that the block size should be increased from 32MB to 128MB which would be more in-line with the vision laid out by Satoshi Nakamoto. Initial reports suggest that a 64MB has already been mined by the CoinGeek Team who is planning to mine 512MB block in the next six months with the ultimate goal being a 2GB block. Increasing the block size and the transaction time has been at the forefront of complains by the community.

Following a sharp sell-off across the board and one failed recovery which resulted in new 2018 lows, the cryptocurrency market is now once again attempting a recovery. We are still below my entry levels from last week when I added to my Ethereum as well as Bitcoin positions as I expected a recovery to unfold going into the end of 2018. Now that the Bitcoin Cash Hash War is over, I believe many will focus the rest of 2018 on the positives of the cryptocurrency space and prepare for an interesting 2019. I will continue to hold on to my long positions in both. Given that fact that I am almost 100% invested, I am not adding to my positions.

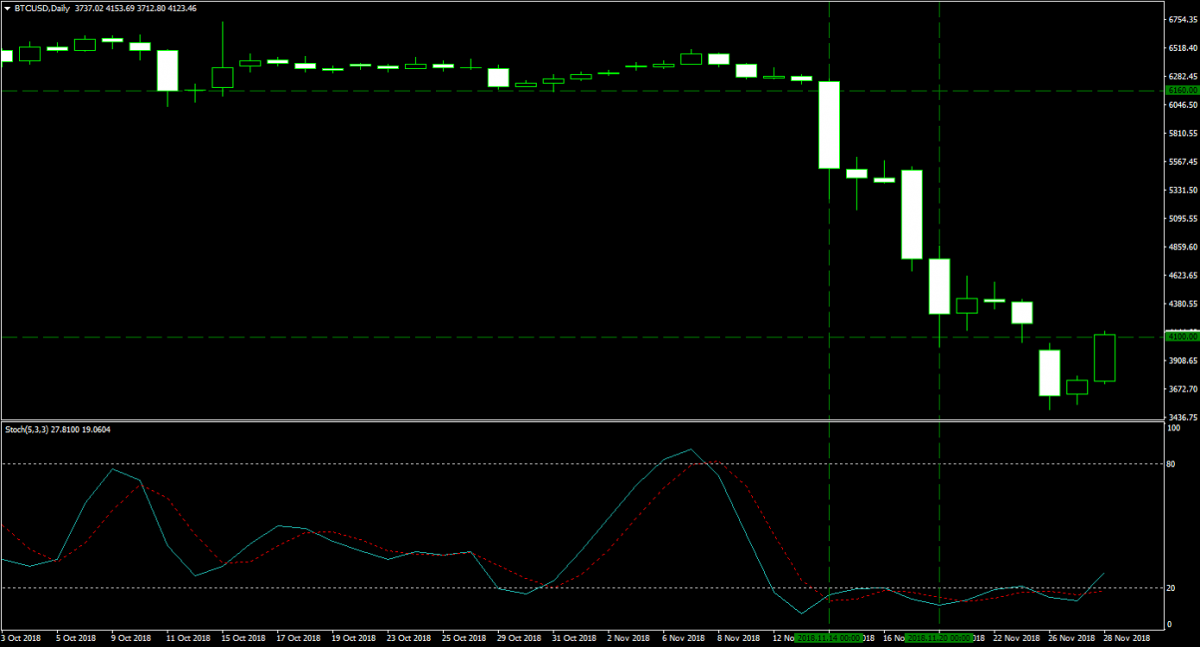

Here is what happened to my overall portfolio. Let’s start with Bitcoin where I initially bought 50 Bitcoins at $6,160 and then added another 50 Bitcoins at $4,100. I now hold 100 Bitcoin with an average entry price of $5,130. In case today’s price gains will hold it will mark the second consecutive day of price gains which may be extended. Bitcoin has been severely oversold in my opinion and I believe that the low price will attract enough bargain hunters to initiate a push back towards the $5,000 level. The image below shows my two entries into Bitcoin.

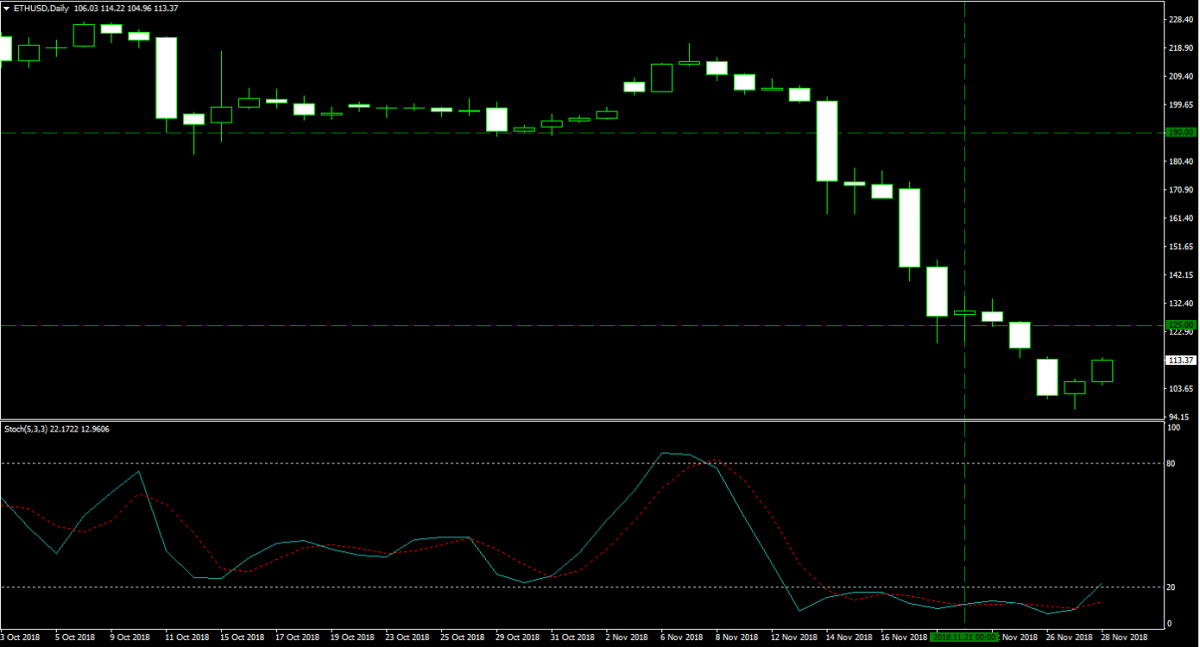

Ethereum shows an identical path and I expect the same as above. I purchased 1,000 Ether at $195 and then added another 500 Ether at $125. My 1,500 Ether have an average entry price of $171.67 and I am more bullish on Ether and its blockchain than I am on any Bitcoin variant which is why I made Ethereum part of my long-term portfolio whereas Bitcoin is a normal trade in accordance with my Bitcoin - Forex Combo Strategy. The image below shows the big sell-off as well as my two entries.

Gold weakened since last week’s update, but it remains above my entry level. As I have outlined before, Gold and Ethereum are the two assets which form my long-term strategy. I think the price of Gold has plenty of upside which will be realized throughout 2019. Trading successfully is a combination of different strategies which different time frames which is how I created the Bitcoin - Forex Combo Strategy. For those who missed the start of it all, please start from Bitcoin - Forex Combo Strategy Part 1. The image below shows my Gold entry of 100 lots at $1,195 and how the trade developed since then.

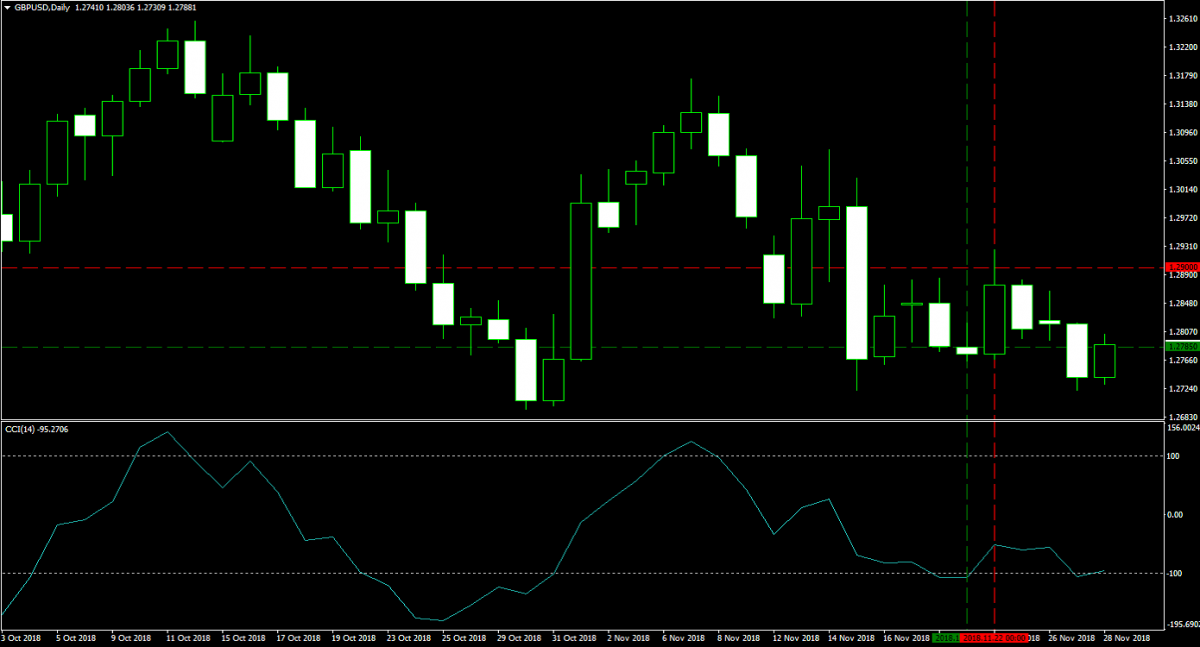

I did have one open GBPUSD long position of 5 lots which was opened on November 21st 2018 at 1.2785. The following day price action spiked, I moved my stop loss to 1.2900 and this was triggered later in the session which closed my position for a profit of 115 pips or $5,750 as each pip values was worth $50. My PaxForex forex account balance therefore increased to $7,703. I keep Gold in a PaxForex sub-account while Ethereum and Bitcoin are kept in its respective wallets. The image below shows my GBPUSD trade.

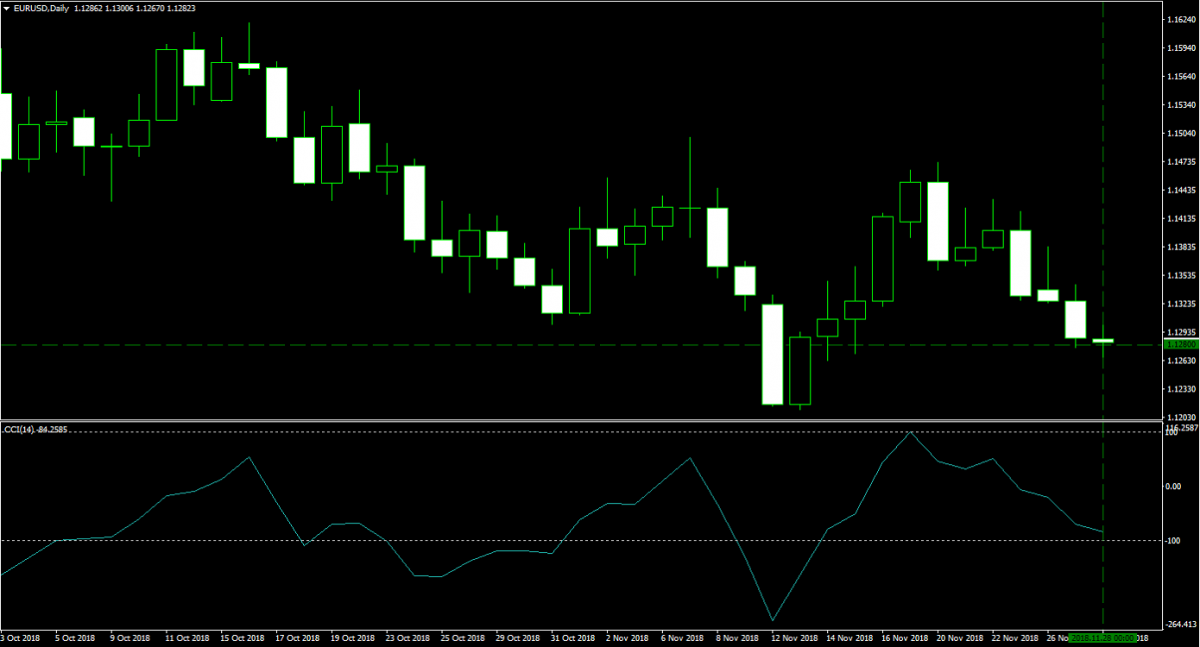

Today, November 28th 2018, I entered a long position in the EURUSD. I bought 10 lots at 1.1280 and the margin requirement was $2,281 with a pip value of $100. You can read the original recommendation at EURUSD Fundamental Analysis – November 28th 2018. Currently I am in the Bitcoin phase of my trading strategy which means that my forex trades will be a lot smaller. The image below shows today’s entry into my EURUSD long position.

I will finish as always with an update on my entire portfolio. I hold 100 Bitcoins worth $411,490 and 1,500 Ethers worth $117,655. I also hold 100 lots of Gold worth $289,679 which includes the $123,179 margin requirement. My EURUSD position is worth $2,281 and I have $5,422 in cash. My total portfolio is therefore worth $826,527, down $273,505 as compared to last week’s balance. The drop in cryptocurrencies as well as Gold took my balance below $1,000,000, but I am confident in my approach as I started with $12,500. Don’t allow panic, fear and greed to dictate trading decisions. Open your PaxForex Trading Account today and start following my Bitcoin - Forex Combo Strategy!

To receive new articles instantly Subscribe to updates.