While some analysts remain hopeful that a sideline meeting between US President Trump and Chinese President Xi at the G-20 meeting in Buenos Aires will yield a truce in the trade war, it appears rather unlikely. The Wall Street Journal published an interview with Trump on Monday where he stated that he is very likely to move ahead with an increase in China tariffs on $200 billion worth of goods from the current 10% to 25%. This would mean that $250 billion worth of Chinese goods will be taxed by 25%.

He further noted that if he can’t reach an agreement with Xi, he will impose tariffs on the remaining $267 billion worth of Chinese goods the US imports. He was unsure if it would be 10% or 25%, but it would mean that all Chinese imports would be subject to a tariff. Trump continues to point out that US companies are not being treated fair in China and that US consumers could easily handle the tariffs which would include popular gadgets like smart phones, tablets and laptops. The increase on tariffs from 10% to 25% on $200 billion worth of goods is set to take effect on January 1st 2019.

Trump further dimmed the likelihood of a truce this weekend by adding that “The only deal would be China has to open up their country to competition from the United States. As far as other countries are concerned, that’s up to them.” China has imposed tariffs on $110 billion worth of American goods in retaliation to the US tariffs. Trump has told US companies who are caught in the trade war to build factories at home and produce goods in the US, but his recommendations have carried little weight as US companies look for cheaper alternatives.

How will the US economy copy in the event of more widespread tariffs? Is Trump correct about the US consumer or will his tactics backfire and through the US into a much deeper recession than many analysts predict? What will happen to the US Dollar? Open your PaxForex Trading Account now and join our growing community of profitable forex traders!

The Trump administration’s pressure tactics when it comes to negotiations is well known. Vice Chairman for Greater China at Credit Suisse Private Banking, Tao Dong, added in Hong Kong that “This is largely a negotiation tactic. Putting high stakes pressure onto the other side seems to be a consistent pattern from the Trump administration.” According to the Wall Street Journal, Chinese officials will try to convince their US counterparts to not increase current tariffs and impose new ones. This would allow both sides to work towards a “mutually acceptable proposal” as agreed on by Trump and Xi during their phone call on November 1st 2018. The US is likely to increase China tariffs and here are three forex trades to increase your profits.

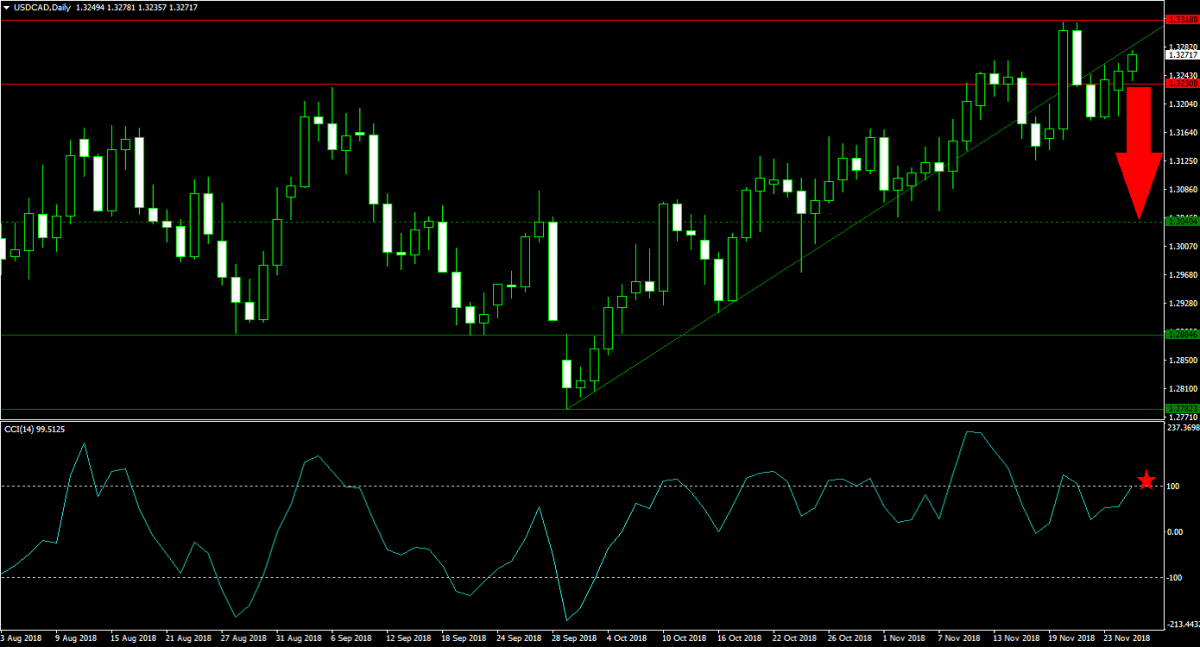

Forex Profit Set-Up #1; Sell USDCAD - D1 Time-Frame

This currency pair has come under pressure after reaching its horizontal resistance area which resulted in a sharp contraction in bullish sentiment. The USDCAD, following a breakdown, is now trading back inside its resistance area and below its primary ascending support level which turned into resistance. Price action is favored to complete a third breakdown below its horizontal resistance area and accelerate down into its next horizontal support level. Forex traders should sell the rallies from current levels.

The CCI formed a negative divergence, which is a bearish trading signal, and is trading above-and-below the 100 mark which indicates extreme overbought conditions. This momentum indicator is expected to contract and lead price action in the USDCAD to the downside. Download your PaxForex MT4 Trading Platform and plant the seed for a profitable forex portfolio with the help of our expert analysts.

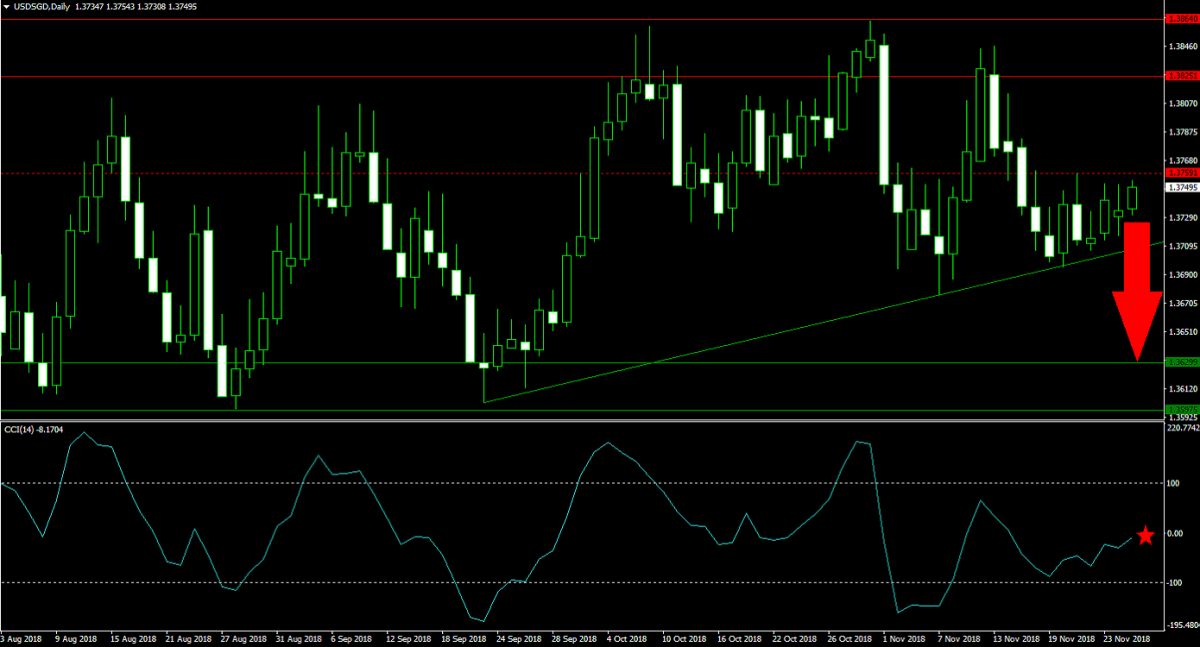

Forex Profit Set-Up #2; Sell USDSGD - D1 Time-Frame

The USDSGD is trapped between its primary ascending support level and its horizontal resistance level. Fundamental developments, on the sidelines of the G-20 meeting, increase the risk of a breakdown in price action which will see the USDSGD accelerate to the downside. With no support levels below its primary ascending support level, this currency pair is expected to contract until it will reach its next horizontal support area. Forex traders are advised to sell the rallies into its horizontal resistance level.

The CCI advanced from extreme oversold levels, but remains below the 0 mark with bearish pressures on the rise. A temporary spike above 0 would confirm a solid short entry opportunity. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the world of forex trading with over 500 pips in monthly profits!

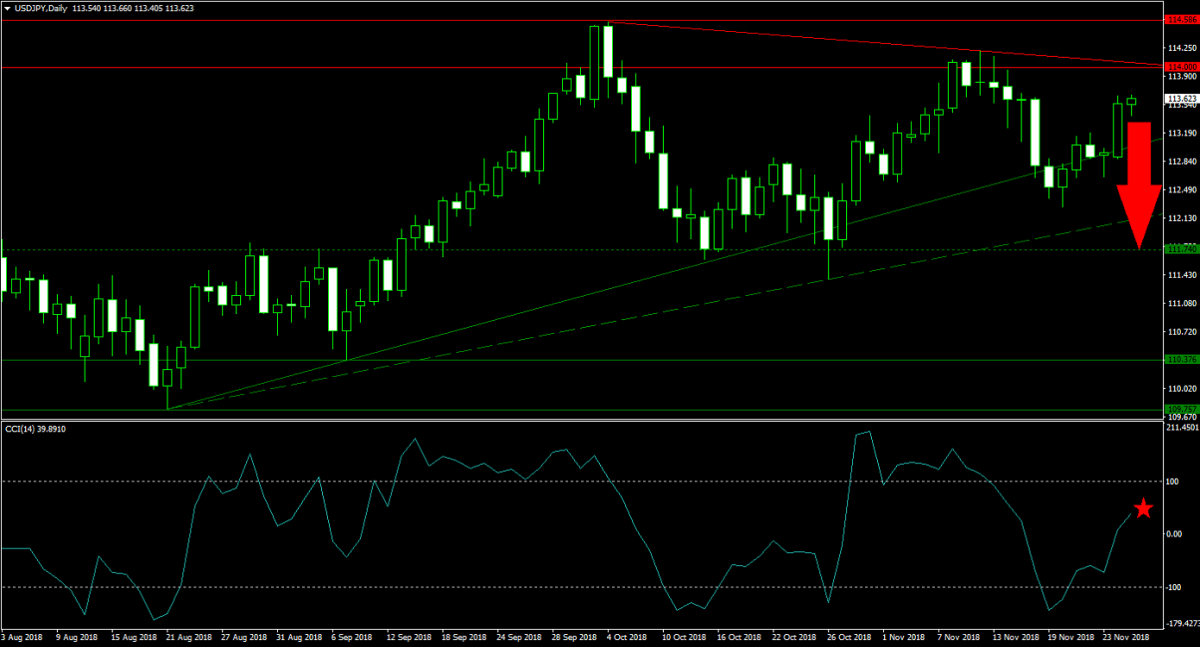

Forex Profit Set-Up #3; Sell USDJPY - D1 Time-Frame

A failed agreement for a truce between Trump and Xi could increase demand for safe haven currencies like the Japanese Yen. This would benefit the USDJPY two-fold and is expected to push this currency pair to the downside until it will reach its next horizontal support level. Preceding this move would be a double breakdown below its primary as well as secondary ascending support levels. Forex traders are recommended to sell the rallies in the USDJPY into its primary descending resistance level.

The CCI advanced from extreme oversold territory and also eclipsed the 0 level which resulted in a bullish momentum change. This is expected to quickly reverse with the anticipated reversal in price action. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended technical trading set-ups into your own trading account!

To receive new articles instantly Subscribe to updates.