Many market participants eagerly waited for US Federal Reserve Chief Jerome Powell’s speech yesterday at The Economic Club of New York. Powell, appointed by US President Trump, has been under increased pressure by Trump to stop the series of interest rate increases his Fed enacted. While higher interest rates are bullish for the US Dollar, they increase the interest burden the US government has to pay for its massive debt load. In addition a stronger US Dollar makes US exports more expensive at a time Trump is engaged in a trade war with China and several trade spats with traditional allies.

While many Fed watchers expect the Fed to increase interest rates in December, the outlook for 2019 has changed drastically with only one 25 basis point hike expected following Powell’s speech yesterday. His remarks that interest rates are “just below” neutral was enough for many to assume that the rate hike cycle is near the end. He further added that “You’re no longer on a forced march to neutrality. As you get closer you tack a little bit more.”

December’s expected 25 basis point interest rate increase would take the US rates to a range between 2.25% and 2.50%. This would take it to the low range of September’s estimate what neutral interest rates look like. 15 Federal Reserve Governors and regional Federal Reserve President’s placed neutral interest rates between 2.50% and 3.50%. Powell himself remains a bull on the US economy and predicted solid growth, low employment and tame inflation. He noted that “There is a great deal to like about this outlook.”

While US equity markets rallied, the US Dollar remained muted as forex traders consider the reasons why the Fed may halt its campaign. The biggest worry is that the change in tone is due to an expected economic downturn in the US. Is your portfolio positioned for growth? Open your PaxForex Trading Account now and take the first step to a prosperous future!

Two weeks ago Powell sounded a lot more pessimistic and cited a global slowdown outside the US, the reduction in fiscal stimulus and the domestic response to the current Fed policy as the three main obstacles to US growth moving ahead. On October 3rd 2018 he stated in an unscripted comment that his Fed policy is “a long way from neutral” which angered Trump and worried markets. Did Powell finally give in to pressure from the White House or does he see an economic slump in the US, similar to the housing and commodity markets? Powell’s Fed to hike less aggressively in 2019, but here are three forex trades for aggressive forex trading profits!

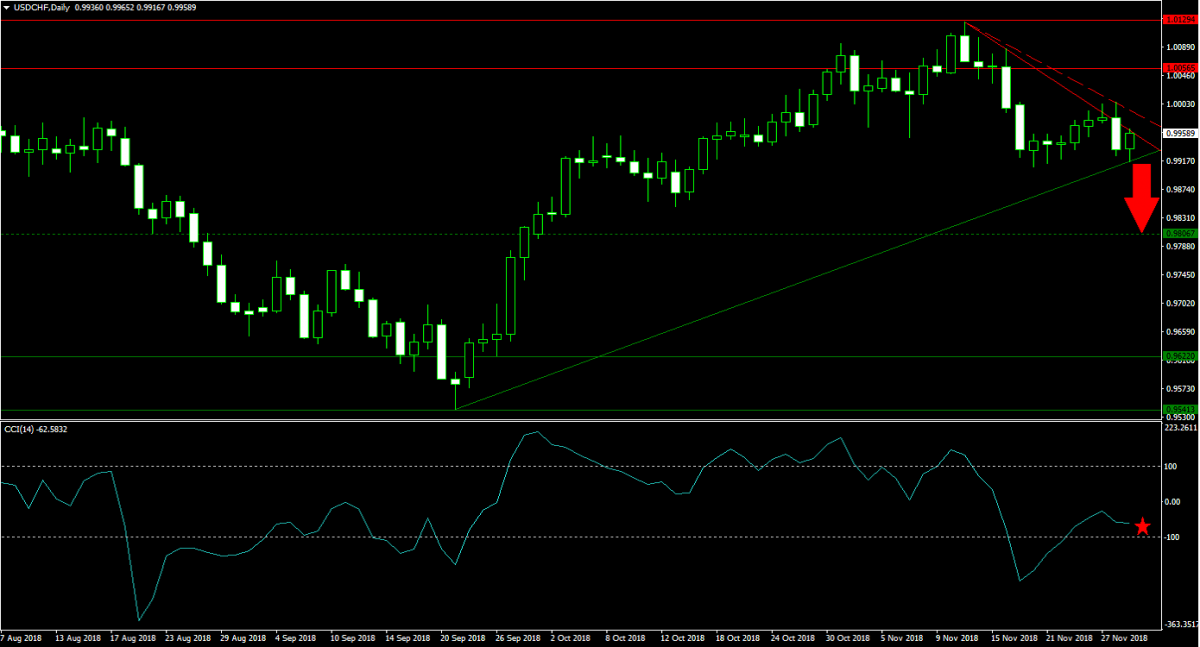

Forex Profit Set-Up #1; Sell USDCHF - D1 Time-Frame

Following a breakdown below its horizontal resistance area, the USDCHF has entered a corrective phase. This currency pair is now trading at its primary ascending support level following a minor pause. The primary as well as secondary descending resistance levels are applying bearish pressures and price action is predicted to complete another breakdown. The USDCHF is therefore expected to extend its sell-off until it will reach its next horizontal support level. Selling the rallies from current levels is favored.

The CCI briefly plunged into extreme oversold conditions, but quickly recovered as price action paused its descend. This technical indicator remains in bearish territory and is expected to once again move to the downside. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide your account to over 500 pips in profits per month!

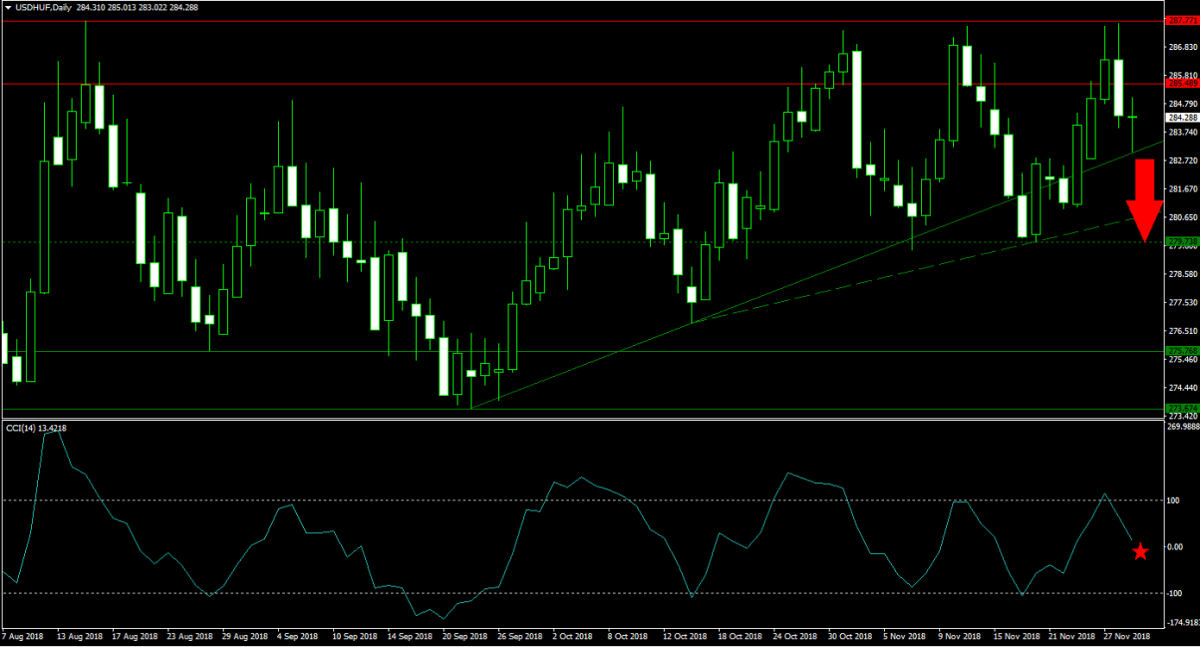

Forex Profit Set-Up #2; Sell USDHUF - D1 Time-Frame

After reaching its horizontal resistance area, the USDHUF ran out of bullish sentiment as evident in the three failed breakout attempts. Price action is now faced with the primary and secondary ascending support levels, but bearish momentum may be strong enough to result in a double breakdown which will take the USDHUF back down into its next horizontal support level. Forex traders are advised to sell the rallies in this currency pair into the lower band of its horizontal resistance area.

The CCI already descended from extreme overbought territory and carries enough momentum to push below the 0 level which will result in a bearish momentum shift. More downside is anticipated to follow. Download your PaxForex MT4 Trading Platform now and plant the seed for a profitable forex future!

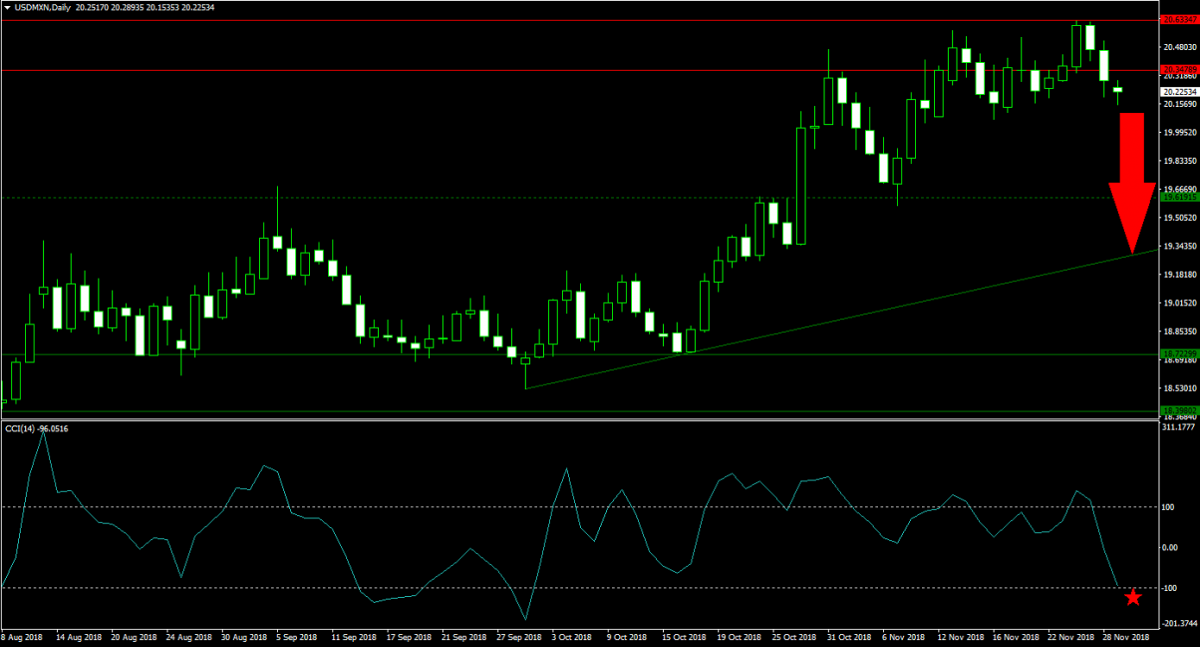

Forex Profit Set-Up #3; Sell USDMXN - D1 Time-Frame

The USDMXN is at a slightly earlier stage in its correction than the previous two short recommendations. Price action just completed a breakdown below its horizontal resistance area and with no support in the way this currency pair is expected to crash into its next horizontal support level. Bearish pressures may further push the USDMXN down into its primary ascending support level. Forex traders are recommended to sell the rallies from current levels.

The CCI has quickly plunged from extreme overbought levels below the 0 mark and is now trading in-and-out of extreme oversold territory, but off of its previous lows. More downside in this momentum indicator is expected. Follow the PaxForex Daily Forex Technical Analysis and follow our recommendations to a profitable outcome!

To receive new articles instantly Subscribe to updates.