It is easy to jump on the bandwagon and claim the death of cryptocurrencies. The market has been filled with speculators who entered the trade based on hopes for something, but with knowledge of nothing. Following tweets and making investment decisions is not a smart approach. Intelligent investors filter through the noise and focus on what matters and what will eventually drive the markets. While the massive Bitcoin tally which took to the $20,000 mark at the beginning of this year was way overdone, so is the recent sell-off.

While the cryptocurrency market continued to bleed, the interesting fact to me is that fundamentals have been at its strongest since Bitcoin opened the gates of cryptocurrencies. Many ignore the underlying strength and improvement in those fundamentals. When Bitcoin rallied to $20,000 fundamentals were weaker, but investors couldn’t buy Bitcoin & Company fast enough. Now that fundamentals have improved, those investors dump their coins. This is how you miss out on the gains which attracted you to the cryptocurrency market in the first place. I am growing more bullish and I am far from alone.

Roger Ver, one of the earliest and most vocal supporters of Bitcoin who then migrated to Bitcoin Cash and now supporting Bitcoin Cash ABC after the hard fork, is also very bullish on cryptocurrencies. While this may not be a surprise, he is so for good reason. In a Bloomberg interview he noted that “If anything I think it’s brought additional awareness to the ecosystem in the fact that such big players are involved. The fact that hackers are trying to hack it shows its worth something. If it wasn’t worth anything, it wasn’t useful, hackers wouldn’t be wasting their time trying to hack it.” You can read more about the Bitcoin Cash fork at Bitcoin - Forex Combo Strategy: End of Bitcoin Cash Hash War.

For those who pay attention to actual developments in this space, they know that adoption on a global space is increasing. Transaction times are being reduced, block sizes increased and more industries warm up to implement cryptocurrencies into their models. This is all good news and support higher prices moving forward. The rally which ended at the beginning of this year was pre-mature and as reality set in, those who flocked to cryptocurrencies without a clear plan are now exiting at huge losses. Now, as the fundamentals improve across the board and the cryptocurrency space, a rally should be warranted and I believe we will see one once the dust settles.

There are a lot more cryptocurrencies which will be created, but it is not quantity but quality which matters. Before talking you through my portfolio updates I want to end my bullish note on fundamentals with a statement by Changpeng Zhao, the CEO of Binance: “We don’t list shitcoins even if they pay 400 or 4,000 BTC. [Ethereum, NEO, Ripple, EOS, Monero and Litecoin and more] listed with no fee. Question is not ‘how much does Binance charge to list?’ but ‘is my coin good enough?’ It’s not the fee, it’s your project! Focus on your own project!”

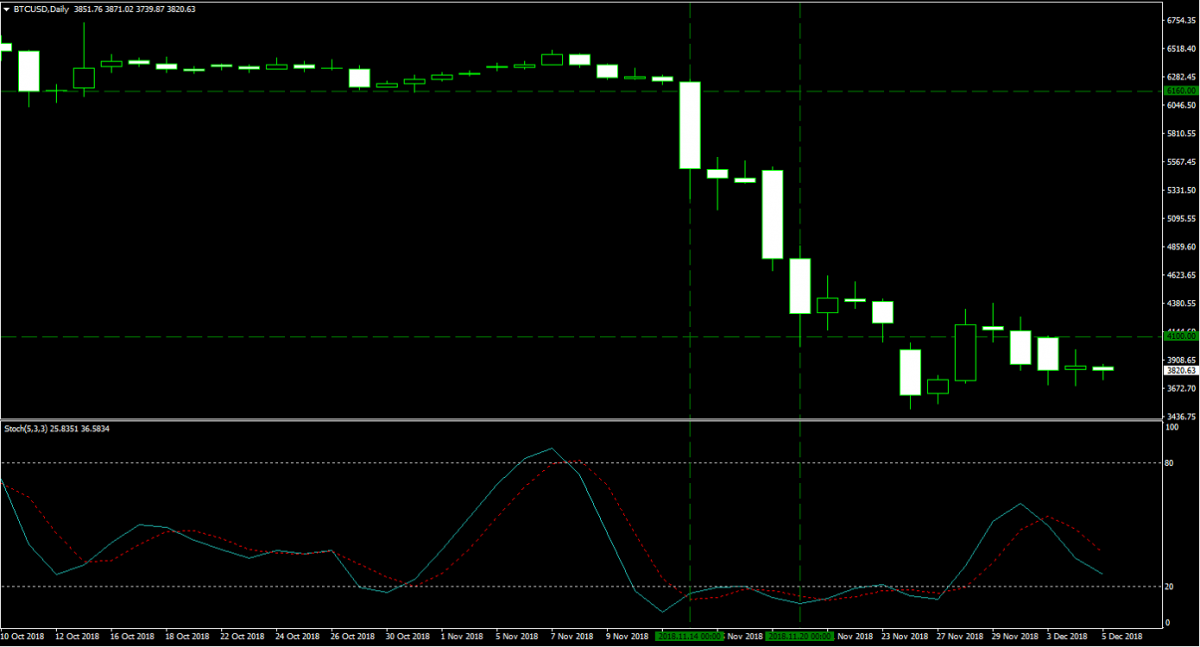

Now let’s talk portfolio. As you may remember, I have 100 Bitcoins with an average entry price of $5,130. As you can imagine I suffered losses as prices contracted and while Bitcoin was unable to hold the $4,000, it does appear as a bottom may be forming just below it. In addition the Stochastic Oscillator has formed a positive divergence which is a very strong bullish trading signal. I am confident that we will see a solid recovery in price action and the image below shows my two entry levels into Bitcoin.

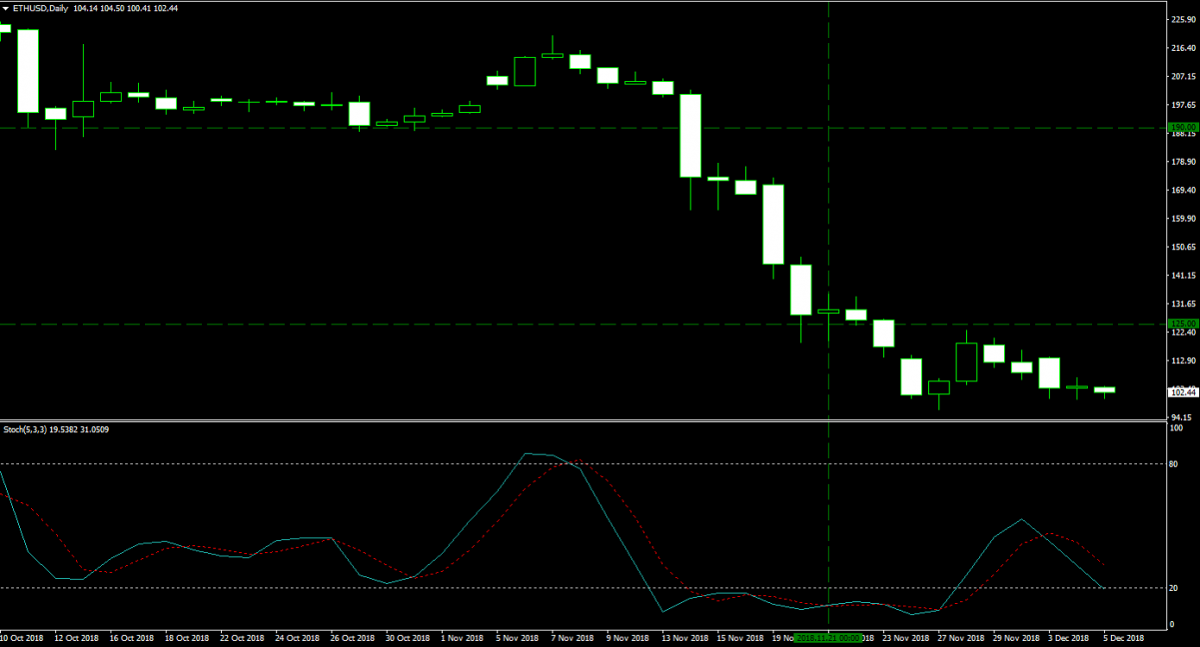

Ethereum is forming a bottom of its own and the $100 level remains key. I hold 1,500 Ethers at an average entry price of $171.67. Ethereum may be forming a chart pattern which is known as a rounding bottom. This suggests that price action will recover and take Ethereum back to the $200 and above level. I think the prospects for Ethereum remain very bright which is why I made it part of my long-term portfolio. The image below shows my two entry levels and I currently have a price target of $220.

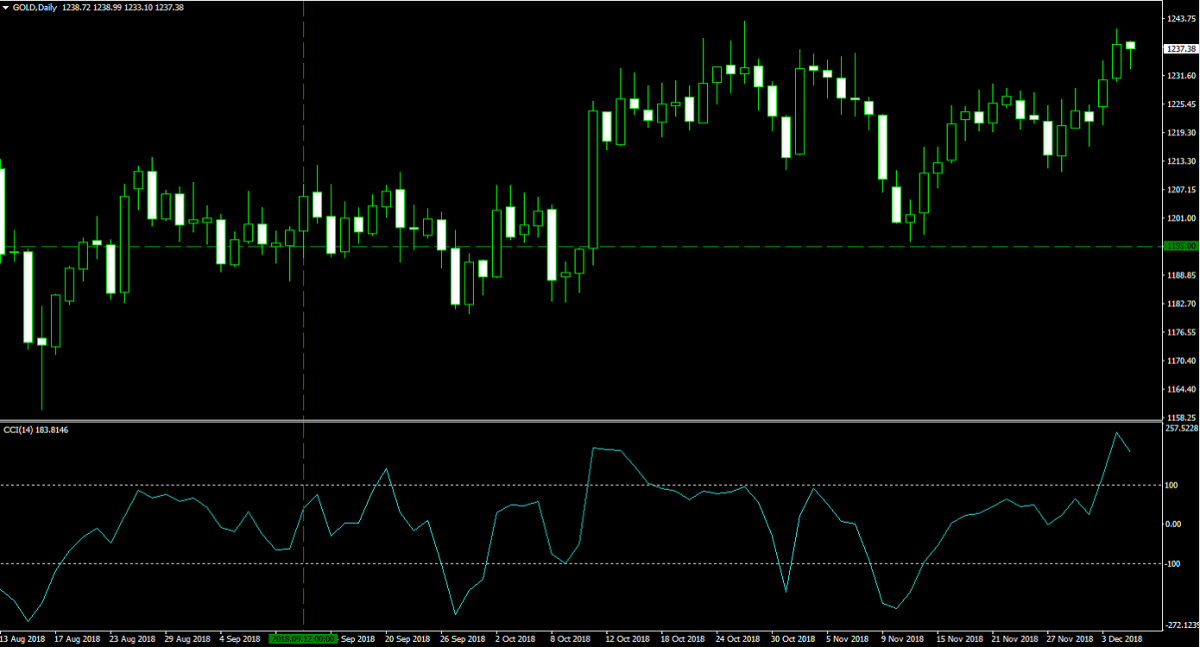

Gold has made a remarkable recovery and my 100 lots which I bought at $1,195 for a margin requirement of $123,179 and a pip value of $100 have boosted the value of my overall portfolio. I added Gold for two reasons, the first one as I see a lot demand moving forward due to the shape of geopolitics and the second as a hedge to counter cryptocurrency market stress. Gold has done just that for me and you can see the rally as well as my long entry into this precious metal in the image below.

The stop loss on my EURUSD long position from last week, 10 lots at 1.1280, was triggered and the position was closed for a profit of 120 pips or $12,000. This brought my PaxForex account balance to $18,703. As I outlined, I keep Gold in a PaxForex sub-account and Bitcoin as well as Ethereum in its respective wallets. I am currently more heavily invested in the Bitcoin part of my Bitcoin - Forex Combo Strategy, but my PaxForex account balance has almost doubled in the past two weeks. You can see my EURUSD trade in the image below.

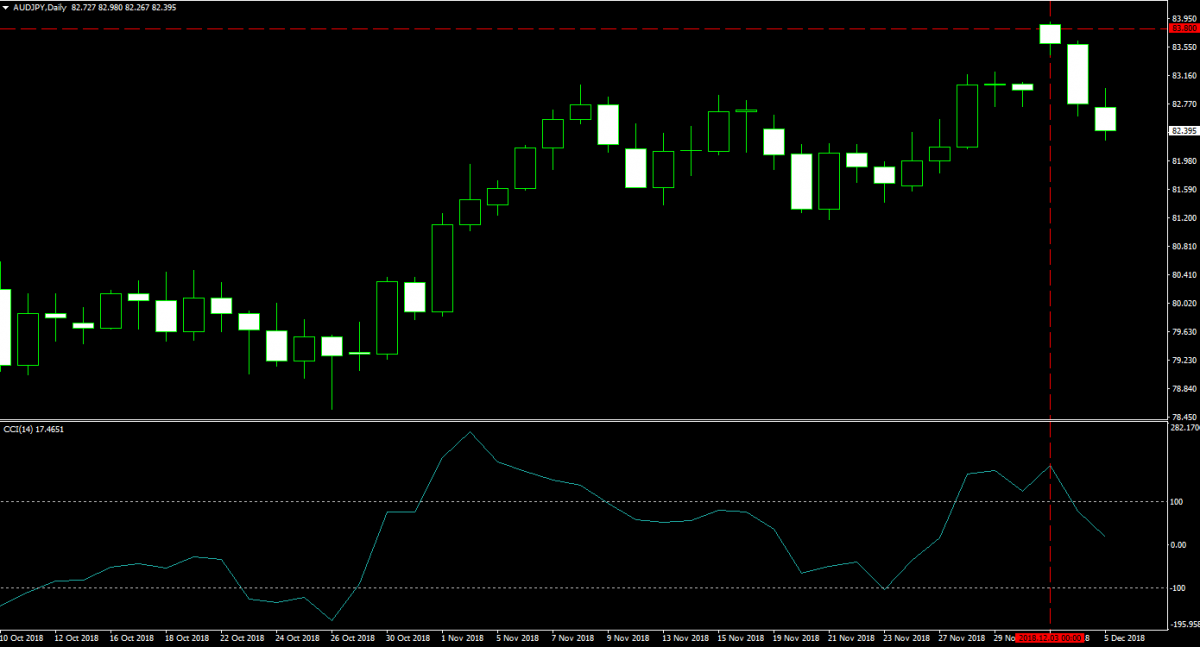

On December 3rd 2018 I took a short position in the AUDJPY according to the trading recommendation which you can read about at AUDJPY Fundamental Analysis – December 3rd 2018. I sold 20 lots at 83.800 for a total margin requirement of $2,917 and with a pip value of $177.05. As I write this update, I moved my stop loss to 82.600 for a guaranteed profit of 120 pips or $21,246 which would more than double my current account balance. The image below shows my entry.

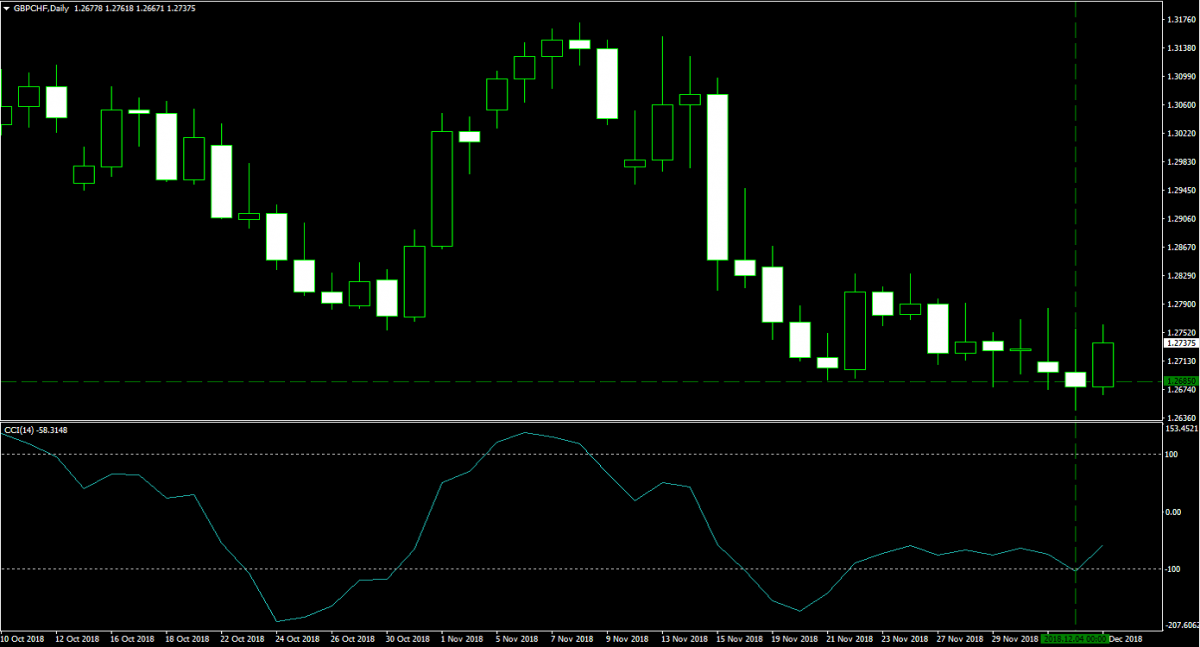

I also bought 20 lots in the GBPCHF at 1.2685 yesterday on December 24th 2018 for a margin requirement of $5,106 and with a pip value of $200.47. You can read the trading recommendation at GBPCHF Fundamental Analysis – December 4th 2018. I am a bit more cautious with the British Pound and this morning I moved my stop loss to 1.2710 for a guaranteed profit of 25 pips or $5,012. You can see my entry in the image below.

Given the solid performance of my two forex trades, I was able to add a short position in the EURGBP today, December 5th 2018. I took a total position of 20 lots at 0.8920 and the margin requirement was $4,545 and each pip is worth $255.31. The original trading recommendation can be found at EURGBP Fundamental Analysis – December 5th 2018. The image below shows today’s entry.

I will finish as always with my portfolio update for this week. I have 100 Bitcoins worth $381,614 and 1,500 Ethers worth $153,615 as well as 100 lots of Gold worth $549,879. My AUDJPY position is worth $27,704, my GBPCHF position is worth $16,131 and my EURGBP position is worth $11,694. I also have $6,135 in cash. My overall portfolio is therefore worth $1,146,772, up $320,245 as compared to last week. This is now once again approaching my record balance of $1,395,899. I look forward to how the next week will shape up and am very proud of how my forex account balance has surged. Open your PaxForex Trading Account today and start following my Bitcoin - Forex Combo Strategy!

To receive new articles instantly Subscribe to updates.