I am glad to see all my loyal readers back for the very exciting Part 4 of my Bitcoin - Forex Combo Strategy and also happy to welcome my new readers. Over the past three parts I have showed you step-by-step how I grew my initial 2.5 Bitcoins which I received on October 12th 2017 at $5,000 each into 72 Bitcoins which I bought at $6,000 each on June 28th 2018. Bitcoin as well as the entire cryptocurrency sector has entered a meltdown over the same period and while many held on to the coins, hoping for a turnaround, I created a strategy which combined my Bitcoin assets with forex trading. Smart traders know when to be where, when to get out and re-enter a trade.

It is one thing to see you account balance increase and decrease, but those are all floating profits or losses until you actually exit a trade. In “Bitcoin - Forex Combo Strategy Part 1” I walked you through my trades and showed how I grew 2.5 Bitcoins into 11.5 Bitcoins. This was followed with “Bitcoin - Forex Combo Strategy Part 2” where I increased my Bitcoin balance to 28.85 and with “Bitcoin - Forex Combo Strategy Part 3” which took my balance to 72 Bitcoins. Buy and hold would have saw my balance increase and decrease, but I still would only have 2.5 Bitcoins.

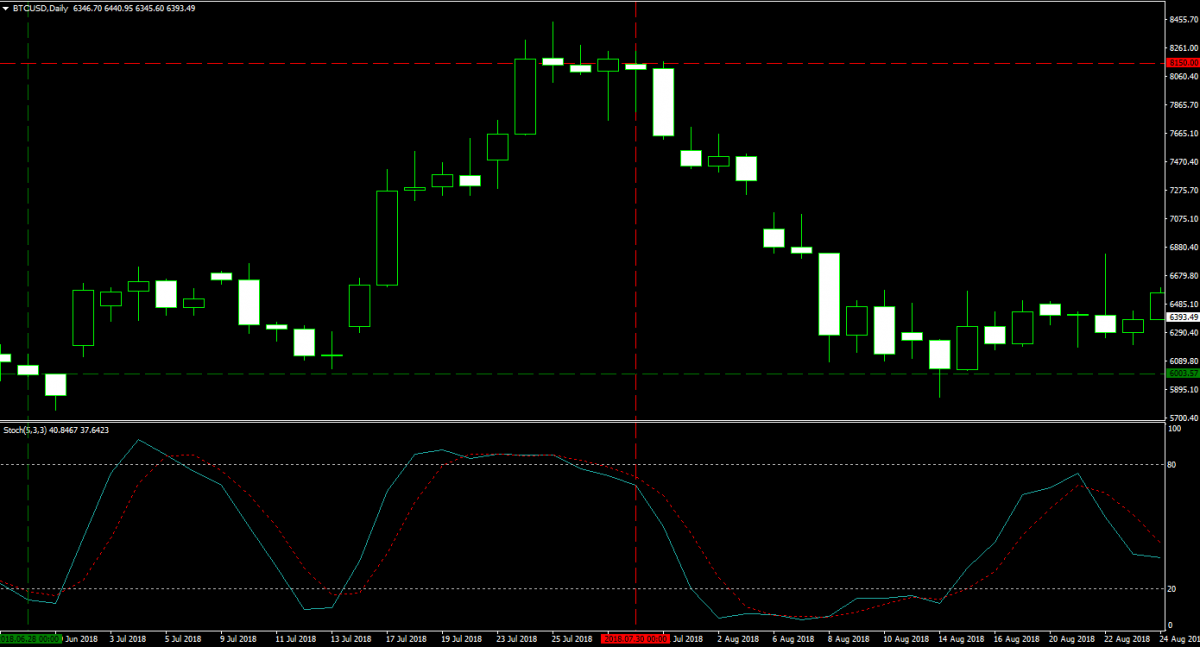

Over the course of 2018, each time I sold my Bitcoins it was done so at a smaller price. My first exit was at $15,000 when I sold my 2.5 Bitcoins. I sold my 11.5 Bitcoins at $11,500 or 23.33% lower and my 28.85 Bitcoins at $9,500 or 17.39% lower. There was a clear downtrend and I decided to exit my 72 Bitcoins at a price of $8,150 or 14.21% below my previous exit for a total of $586,800. I finally breached the half-million mark which made me feel very accomplished in my strategy. As always, I deposited this amount into my PaxForex Trading Account and you can see the below chart with my entry and exit levels.

As I passed this milestone, I needed some time to think about more diversification. So far I either held Bitcoin or I was trading forex, but as my assets grew I wanted to make sure they remain well diversified just in case something goes wrong. During that period Bitcoin dropped back down to below $6,000 and I decided to take that as an opportunity to re-enter my long position. I had a chance to own 100 Bitcoins for the firs time in my life and took that chance to buy at $5,868 on August 14th 2018. This was just about the lowest it dropped and I had a bit of luck to get my pending buy order triggered. This was one example of how luck is created, do the right things over and over again and you will be rewarded.

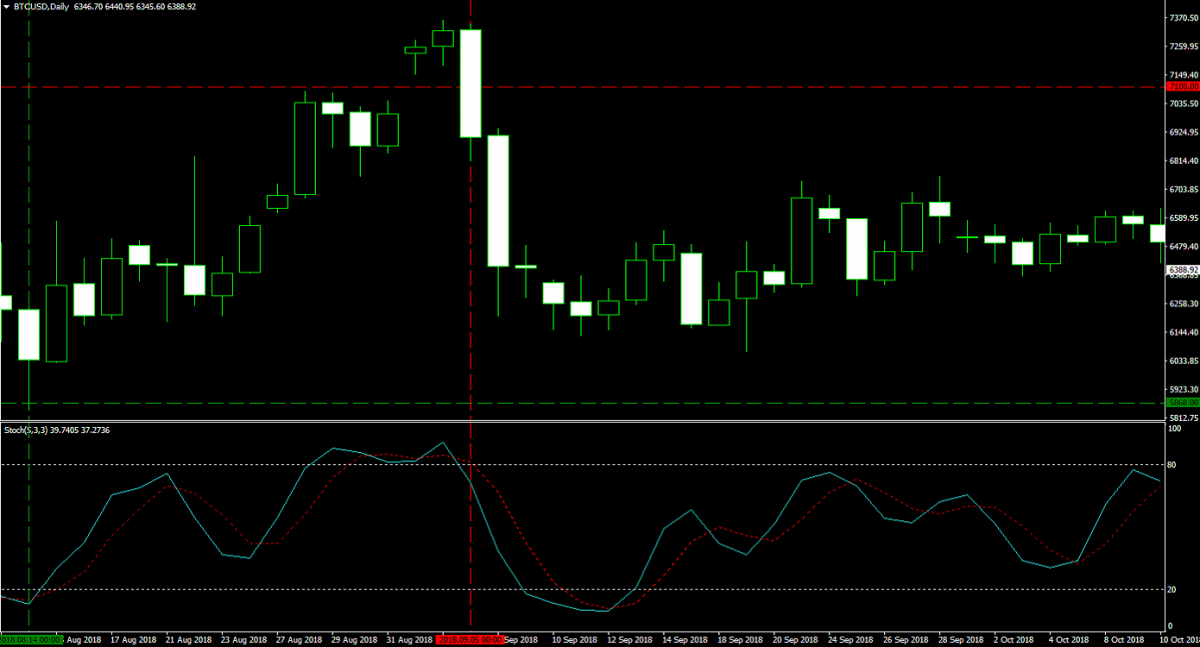

Now I owned 100 Bitcoins, news flow got even more pessimistic and I was looking for my next selling opportunity as I still lacked diversification. Since the price of Bitcoin was trending lower and each time I closed my previous holdings was roughly 15% lower I was looking for an exit just above the $7,000 level. Bitcoin opened with a gap to the upside on September 3rd 2018 and I placed a stop loss at $7,100. My stop loss was triggered on September 5th 2018 and I closed my 100 Bitcoins for a total of $710,000. You can see how I used a stop loss to close a position for a profit in the chart below.

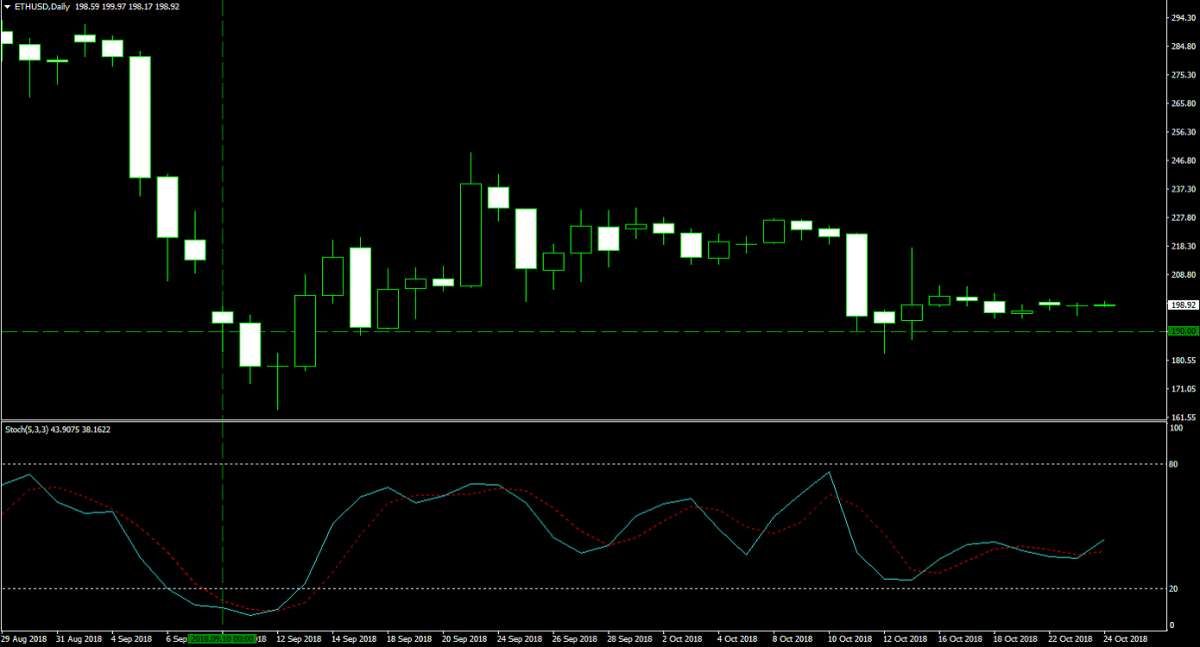

As part of my diversification I decided to add Ethereum to my holdings as it dropped below $200. On September 10th 2018 I purchased 1,000 Ethers at $190 for a total of $190,000 which left me with a balance of $520,000 to diversify. As I am writing this post I still have my Ethers which I plan to sell at $285. A lot of new cryptocurrencies were created on the Ethereum blockchain and I believe that the sell-off was way overdone. Unless something changes fundamentally for the worse, I am happy with my holdings in Ether. You can see my entry in the chart below.

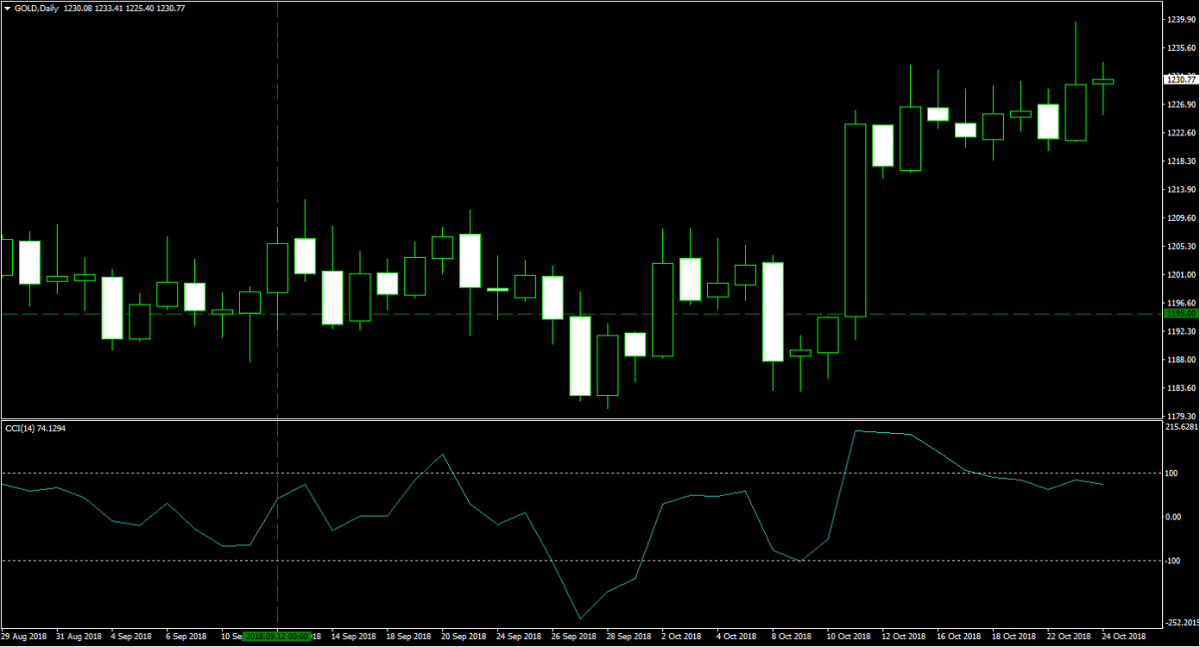

On September 12th 2018 I bought 100 lots of Gold at 1,195.00 for a total margin requirement of $123,179 and each pips is worth $100. You read about the original recommendation at Gold Fundamental Analysis – September 12th 2018. The reason I bought a lot more than usual is because Gold will be part of a longer-term holding for me due to my diversification. The chart below shows my entry level and I continue to hold this position as I am writing this post.

After my Ethereum and Gold purchases, I had a total of $273,642 left in cash to trade or roughly the same amount I started with when I walked you guys through Part 3 of my Bitcoin - Forex Combo Strategy. I bought 30 lots in the EURCHF at 1.1245 on September 17th 2018. My margin requirement was $6,842.88 and each pip was worth $300.09. On October 11th 2018 I closed my position at 1.1445 for a profit of 200 pips or $60,018. The image below shows my trade and the recommendation can be found at EURCHF Fundamental Analysis – September 17th 2018.

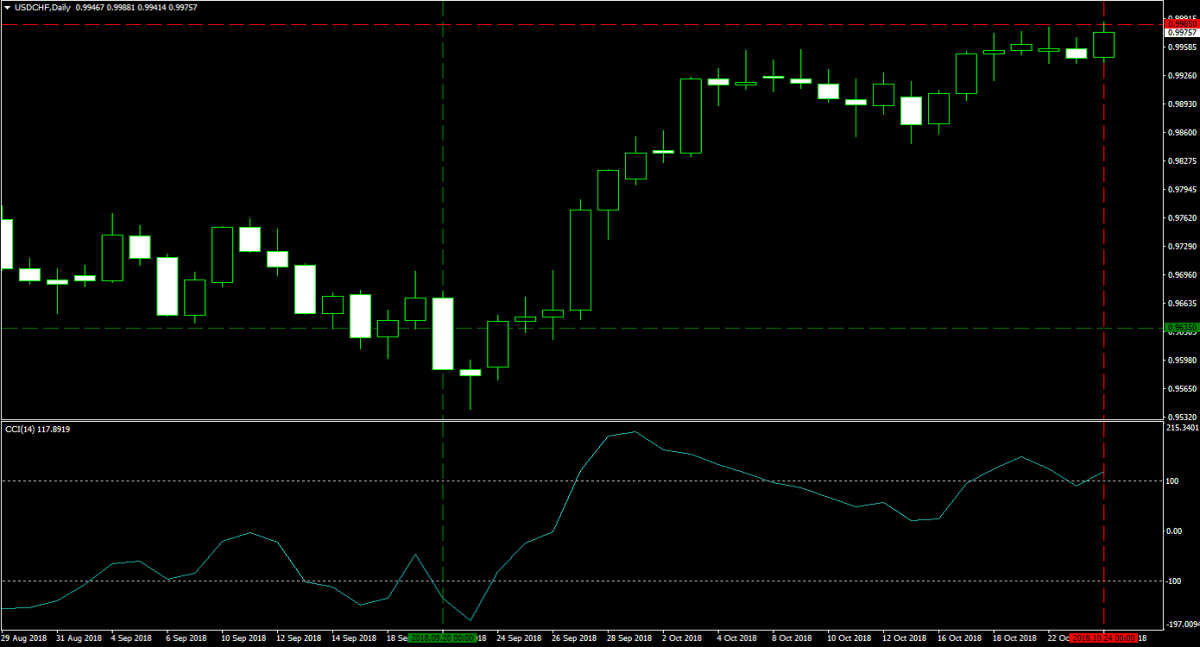

On September 20th 2018 I purchased 30 lots in the USDCHF at 0.9635 as recommended at USDCHF Fundamental Analysis – September 20th 2018. My margin requirement was $6,000 and each pip was worth $300.92. My take profit target was triggered today, October 24th 2018, at 0.9985 for a profit of 350 pips or $105,322. The chart below shows when I entered the trade and when I closed it.

I decided to take a short position in the GBPJPY on September 28th 2018 at 148.500, 30 lots for a total margin requirement of $7,746.78 where each pip was worth $266.57. You can read about the trading recommendation at GBPJPY Fundamental Analysis – September 28th 2018. I still have this trade open as I write this post with a stop loss of 146.500 which will guarantee me at least 200 pips in profits or $53,314. The chart below shows the trade as I took it.

Here is a quick summary of what happened with values as of close of trading on October 23rd 2018. I own 1,000 Ethers worth $198,610 and 100 lots of Gold worth $472,479. I also have total cash worth $438,982 plus one open position worth $76,788. This creates a total worth $1,186,859. I currently don’t have any Bitcoins, but to put it into perspective and for comparison, I could buy 187 Bitcoins. Things will get a bit more complex from here and I will talk you guys through my next steps in Part 5 as I have now reached the classification of millionaire as of today, October 24th 2018. This has all been thanks to my Bitcoin - Forex Combo Strategy and the expert analysts at PaxForex. Don’t miss next week’s edition!

To receive new articles instantly Subscribe to updates.