I would like to welcome all my existing readers back and thank all my new readers for taking a chance and following my journey from Bitcoin through forex and vice versa. At the start of 2018 I had a total of 2.5 Bitcoins in my wallet. Four months later I was proud owner of 28.85 Bitcoins. I would like to ask my new readers to please catch-up and read “Bitcoin - Forex Combo Strategy Part 1” and “Bitcoin - Forex Combo Strategy Part 2” in order to understand the steps I took, the trades I took and why I did all those things. Trust me it will all make more sense.

When I received my first Bitcoins, the price I got them at was $5,000. Now you probably have heard, read or maybe even followed the huge rally in cryptocurrencies which fizzled out at the start of this year. The bubble burst and some claim the cycle is not over yet. So if you look at today’s price around $6,500 you may think nothing happened. Those who were die-hard buy-and-hold investors in Bitcoin, saw their virtual balance spike and drop. Bitcoin Millionaires saw their digital fortunes plunge and not recover. That’s one reason I never approached Bitcoin with this mindset.

Granted, I never planned to enter the cryptocurrency market. I was an observer, I was curious and I was interested, but I never actually planned to get invested with my own cash. As I explained in “Bitcoin - Forex Combo Strategy Part 1”, I received a payment for work done through Bitcoin and then was forced to act rather fast. The good thing was that I at the very least was semi-prepared. I have to admit that watching my initial balance from surge from $12,500 to over $50,000 at the height of the bubble was more than great and for a few moments I was lost in “crypromania”!

I am happy that the dream phase didn’t last that long and I was able to embark on my strategy. Last time we ended my post with me buying 28.85 Bitcoins at $6,750. I did catch the next wave to the upside which initially recorded an intra-day high of $9,695 on April 25th 2018. I missed my exit and was caught on a short reversal over the next two trading sessions which recorded an intra-day low of $8,578 on April 26th 2018. This was my clue that the uptrend is likely near the end and I was looking for a good exit opportunity. On May 4th 2018 I exited Bitcoin at $9,500 as you can see in the image below.

As a reminder, each time I exit my Bitcoin trade I make a deposit into my PaxForex Trading Account. This is where I execute my forex trading strategy with the help of their expert analysts. It is very important to have a trusted broker, no matter how much you deposit. I can only recommend PaxForex which has been vital in allowing me to execute my strategy and grow my balance. I deposited just over $274,000 into my PaxForex trading account. Bitcoin at $9,500 times 28.85 Bitcoins for a total of $274,075. I divided my balance into four parts worth just over $68,000. I like to have $2,500 per traded lot and placed four trades with 27.40 lots. Here are the forex trades which I took next.

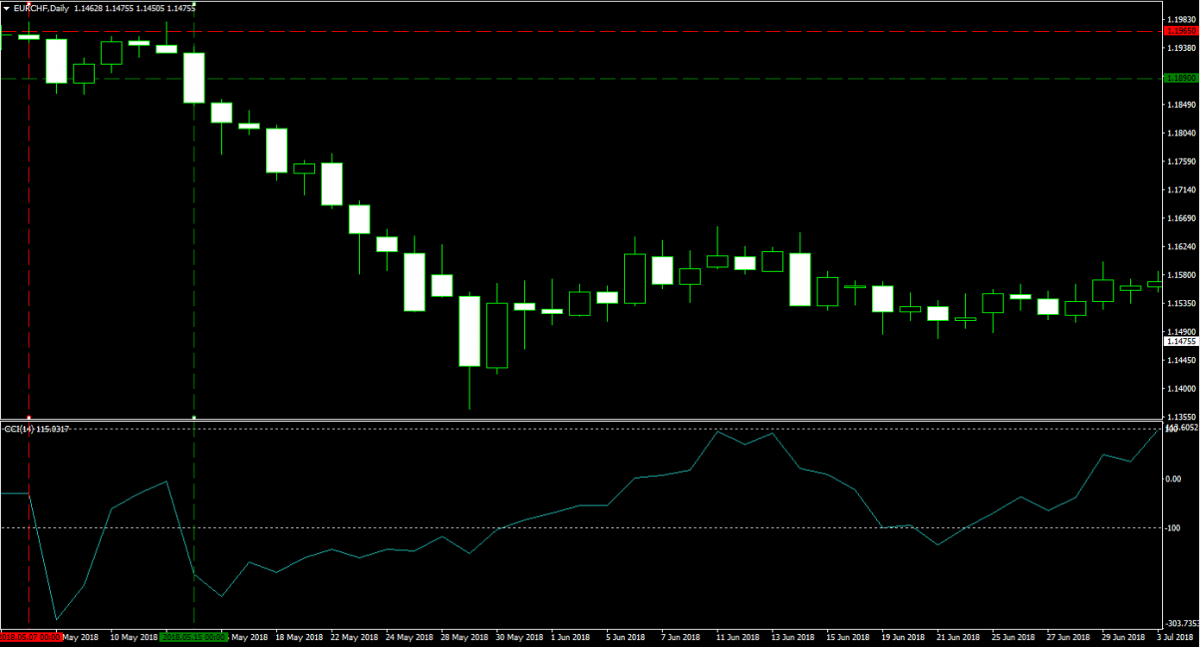

On May 7th 2018 I entered a long position in the EURCHF worth 27.40 lots at 1.1965. My required margin for this trade was $6,332.85 and each pip was worth $276.24. This trade hit the recommended stop loss level the next trading session, but I held on until May 15th 2018 when I closed it for a loss of 75 pips at 1.1890 or $20,718. The original recommendation can be found at EURCHF Fundamental Analysis – May 7th 2018 and below is an image of my entry and exit levels.

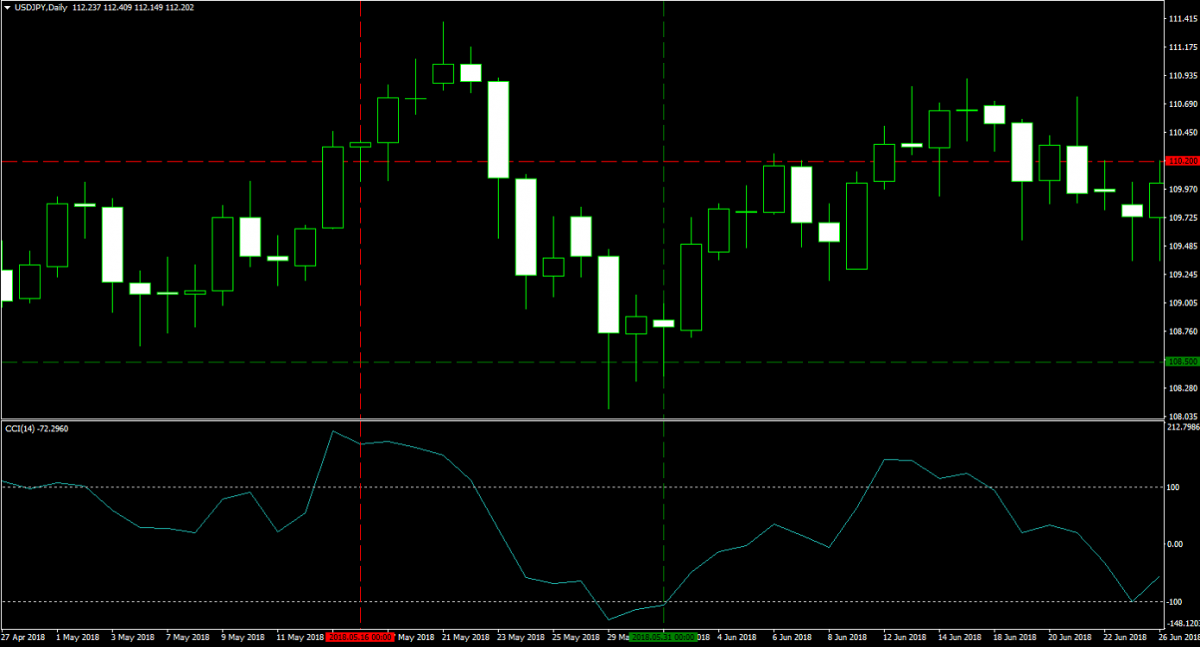

I followed the above loss with a short position in the USDJPY. On May 16th 2018 I sold 27.40 lots at 110.200. My required margin was $5,480.00 and each pip was worth $244.16. While it did hit the recommended stop loss, I let this trade ride and it reversed. On May 31st 2018 I closed my position at 108.500 for a profit of 170 pips or $41,507. You can see the image below and see my trades and read the original recommendation at USDJPY Fundamental Analysis – May 16th 2018.

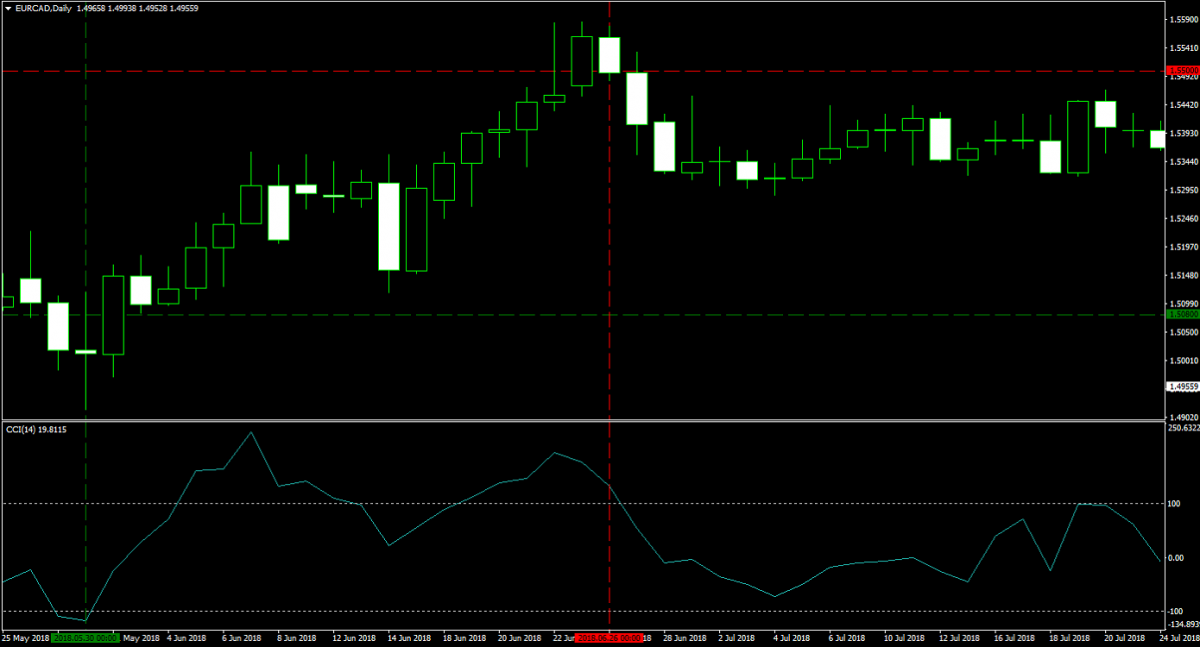

On March 30th 2018 I entered a long trade in the EURCAD. I bought 27.40 lots at 1.5080. You can read up on the original trading recommendation at EURCAD Fundamental Analysis – May 30th 2018. My required margin was $6,332.85 and each pip was worth $211.21. I closed this position on June 26th 2018 at 1.5500 for a profit of 420 pips or $88,708. The chart below shows how I executed the trade.

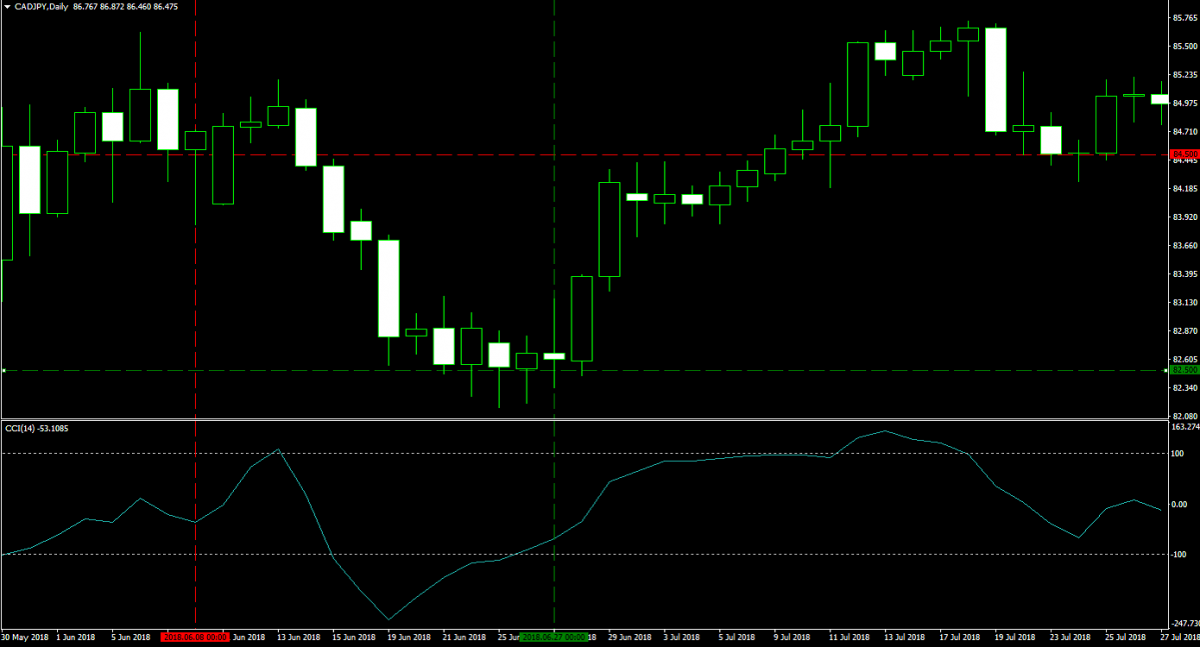

The final trade of this series was taken on June 8th 2018. I sold 27.40 lots in the CADJPY at 84.500. I was able to get in this trade slightly above the recommended level, but within the given range. My margin requirement was $4,224.13 and each pip was worth $244.16. The original recommendation can be found at CADJPY Fundamental Analysis – June 8th 2018. On June 27th 2018 I closed this position at 82.500 for a profit of 200 pips or $48,832 as you can see in the image below.

In summary, I took four positions and closed three for a gross profit of $179,047 and one for a loss of $20,718. This left me with a net profit of $158,329. I wanted to point out that in my first trade, the stop loss level was initially hit the next day. I tend to allow trades develop a bit beyond that. This is a bit risky and should be done by more experienced traders. In the end the result was the same as I closed for a loss at the recommended level. As you will further notice, I closed my three profitable trades before the recommended take profit zone.

I don’t always wait for recommended levels. While the analysis by PaxForex is excellent, things happen after the analysis was conducted which impact price action. Therefore I always tell me readers that you should follow the expert analysts at PaxForex and that you can do so with comfort, but that you need to monitor your trades after that. I pay close attention to candlestick formation, especially near important support and resistance levels. Mastering this technique, and I will write about this in a few weeks, allows you to maximize your profit potential.

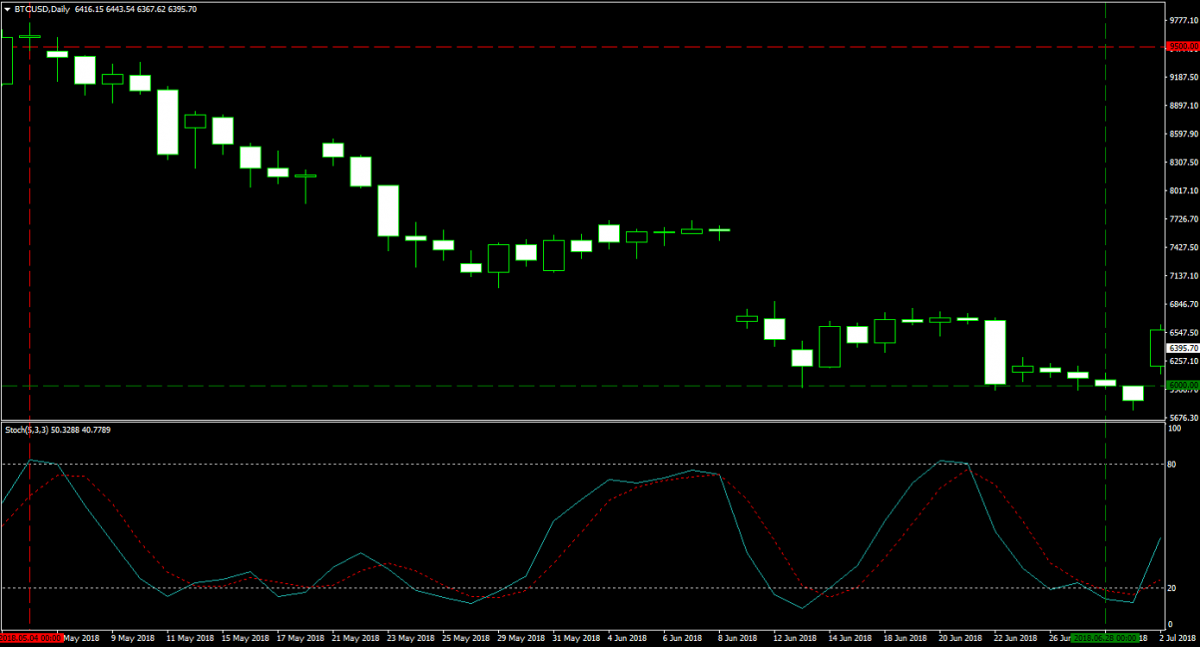

I entered the Bitcoin trade again on June 28th 2018 when I bought 72.00 Bitcoins at $6,000. This was possible thanks to my new account balance which stood at $432,404 following the trades I described above. Compare this to a buy-and-hold approach which would have left my digital balance at $14,994.75, 2.5 Bitcoins at $5,997.90, at the close on June 28th 2018. Thanks to my Bitcoin - Forex Combo Strategy and together with what PaxForex offers me, I was proud owner of 72 Bitcoins worth $431,848.80. Below is the chart which shows my latest entry. Please don’t miss out on Part 4 of my journey which saw a shit in Bitcoin developments.

Get started today and execute my Bitcoin - Forex Combo Strategy at PaxForex! Join a growing community of profitable forex traders and earn more pips per trade. Find out why more and more successful forex traders call PaxForex their home!

To receive new articles instantly Subscribe to updates.