US President Donald Trump has no shortage of starting war of words and making threats to allies and enemies alike. Right now, you are either with Trump or against him. There is little room for anything in between. After Trump has been busy to start a trade war with China over the past few month, his attention has now shifted to Saudi Arabia in regards to the disappearance of Washington Post columnist and Saudi Arabia critic Jamal Khashoggi. He was last reported entering the kingdom’s consulate in Istanbul, Turkey in order to obtain documents for his upcoming wedding.

Turkey claims to have recordings how a Saudi security team detained him inside the embassy, killed him and dismembered his body. Turkey and Saudi Arabia are regional powerhouses and usually on opposing sides. Saudi Arabia initially denied the accusations, but has now opened an internal investigation. Trump is likely to take credit for this step as he threatened “severe punishment” should evidence be presented that the kingdom was responsible for the murder of Khashoggi.

President Trump as a 20 minute phone call with Saudi King Salman bin Abdulaziz and later reported that “His denial to me could not have been stronger. I don’t want to get into his mind, but it sounded to me like maybe these could have been rogue killers. Who knows? We’re going to try getting to the bottom of it very soon.” US Secretary of State Pompeo was dispatched to Saudi Arabia. Crown Prince Mohammed bin Salman stated in an interview that according to his knowledge, Khashoggi left the Saudi consulate in Istanbul alive on October 2nd.

Saudi Arabia is the US biggest ally as well as one of the biggest arms importers of US weaponry. Trump has build his Middle East policy around a close relationship with the kingdom which is now under threat. Will the US Dollar survive Trump’s threats to Saudi Arabia? Open your PaxForex Trading Account now and start to create a portfolio to weather the storm and increase your profits.

This is adding pressures to the health of the global economy. Following Trump’s threats, Saudi Arabia returned the favor with a threat to weaponize its oil exports. Following the 1973 Arab oil embargo, Saudi Arabia adopted a stance to separate oil exports from politics in order to create stability. It appears that Trump is now pushing the kingdom in that direction. Markets already complained about oil prices above $80 per barrel, but an escalation between Trump and Saudi Arabia could easily push prices significantly higher. Trump is threatening stability once again, but here are three forex trades to shine as a result.

Forex Profit Set-Up #1; Buy AUDUSD - W1 Time-Frame

An increase in the price of oil will benefit the Australian Dollar as it is a commodity currency. Therefore the AUDUSD is currently expected to complete a breakout above its horizontal support area as well as above its primary descending resistance level. This would clear the path for price action to extend its advance until it can challenge its next horizontal resistance level which is being enforced by its secondary descending resistance level. Forex traders are recommended to spread their buy orders inside its horizontal support area.

The CCI already pushed above the -100 mark and is now trading out of extreme oversold territory. This resulted in an increase in bullish momentum which is anticipated to increase further, elevating the AUDUSD. Follow the PaxForex Daily Forex Technical Analysis and get our daily trading set-ups delivered to your inbox. Join our growing community of profitable forex traders today!

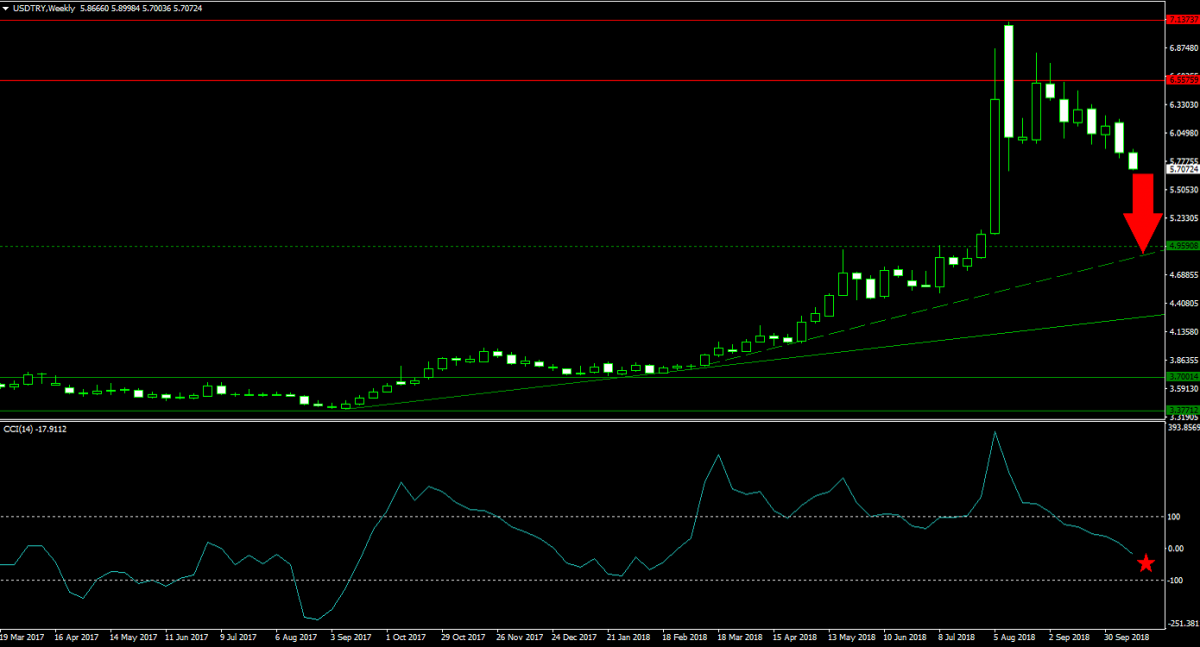

Forex Profit Set-Up #2; Sell USDTRY - W1 Time-Frame

The panic selling in the Turkish Lira peaked in August and forex traders are slowly rotating out of their trades. Turkey is in the middle of the US-Saudi Arabian issues as it claims to have evidence. Regardless of how things materialize from here, the USDTRY is set to extend its current contraction which started with a breakdown below its horizontal resistance area. A move down its next horizontal support area is anticipated as its secondary ascending support level is additionally supporting this level. Selling the rallies in this currency pair is favored.

The CCI already completed a breakdown from extreme overbought conditions which gathered enough bearish momentum to force this technical indicator below the 0 level. This resulted in a bearish momentum shift with more downside expected in the USDTRY. Subscribe to the PaxForex Daily Fundamental Analysis and let our expert analysts guide you through the forex market. Earn over 500 pips per month with our advice!

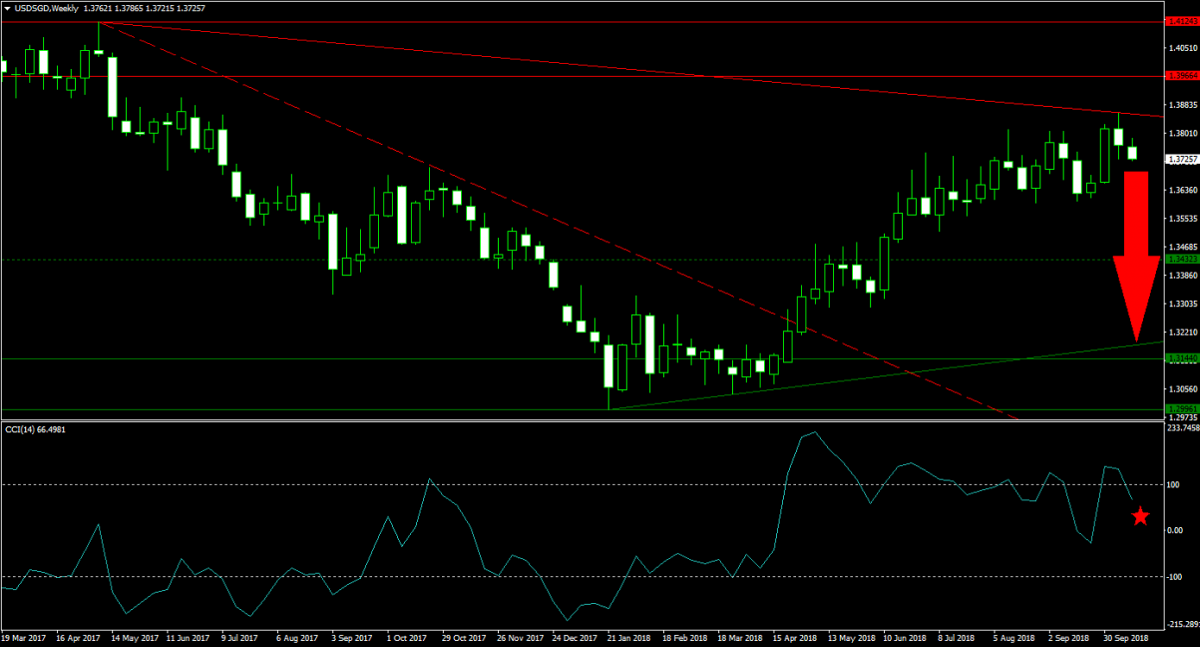

Forex Profit Set-Up #3; Sell USDSGD - W1 Time-Frame

The rally in the USDSGD is running out of steam as price action advanced into its primary descending resistance level, located beneath its horizontal resistance area. As the US Dollar is expected to come under more selling pressure moving forward, forex traders are likely to take profits form current levels. A move down into its primary ascending support level is expected which will include a breakdown below its next horizontal support level. Forex traders are advised to sell the rallies in this currency pair.

The CCI has descended from extreme overbought levels and is expected to extend its contraction. A move below the 0 mark is likely to attract more sell orders in the USDSGD, supporting the predicted extension of the current sell-off. Download your PaxForex MT4 Trading Platform now and take the first step in building a profitable forex portfolio for tomorrow!

To receive new articles instantly Subscribe to updates.