Welcome back to Part 2 of my Bitcoin - Forex Combo Strategy. Last week I showed you how I started 2018 with 2.5 Bitcoins and how I turned them into 11.5 Bitcoins in the first week of February. Now you may think that I did a lot of trading during that period, but I only executed two Bitcoin transactions and three forex trades to accomplish this. You can read all about it in “Bitcoin - Forex Combo Strategy Part 1”, where I walked everyone through the trades with screen shots and links to the original PaxForex trading recommendations which I followed. Today I will continue to outline the steps I have taken between February 6th 2018 and April 2nd 2018.

Let me summarize for those who want a quick insight of what I have done. I received 2.5 Bitcoins as compensation for some work I have done. At the time I received them, Bitcoin was trading above and below $5,000. This was back in October of 2017, on the 12th to be exact. I enjoyed the nice rise up towards $20,000 and then saw my assets drop by almost 50% at which point I knew that I have to make some adjustments if I want to continue growing my assets. A wild ride up to $15,000 was the trigger for me to transfer my 2.5 Bitcoin to PaxForex and my Bitcoin - Forex Combo Strategy was born.

I decided on PaxForex because they don’t only offer a great trading environment, but also allow me to make deposits and withdrawals in Bitcoin which cuts out any payment processor. In addition they offer the type of trading recommendations which are essential to my forex strategy. After making my deposit on January 8th 2018, I took my first forex trade on January 9th 2018. This was followed by two more trades on January 10th and January 12th of 2018. On February 6th 2018 I bought back into Bitcoin and purchased 11.5 at $7,500. Here is what I have done following my purchase.

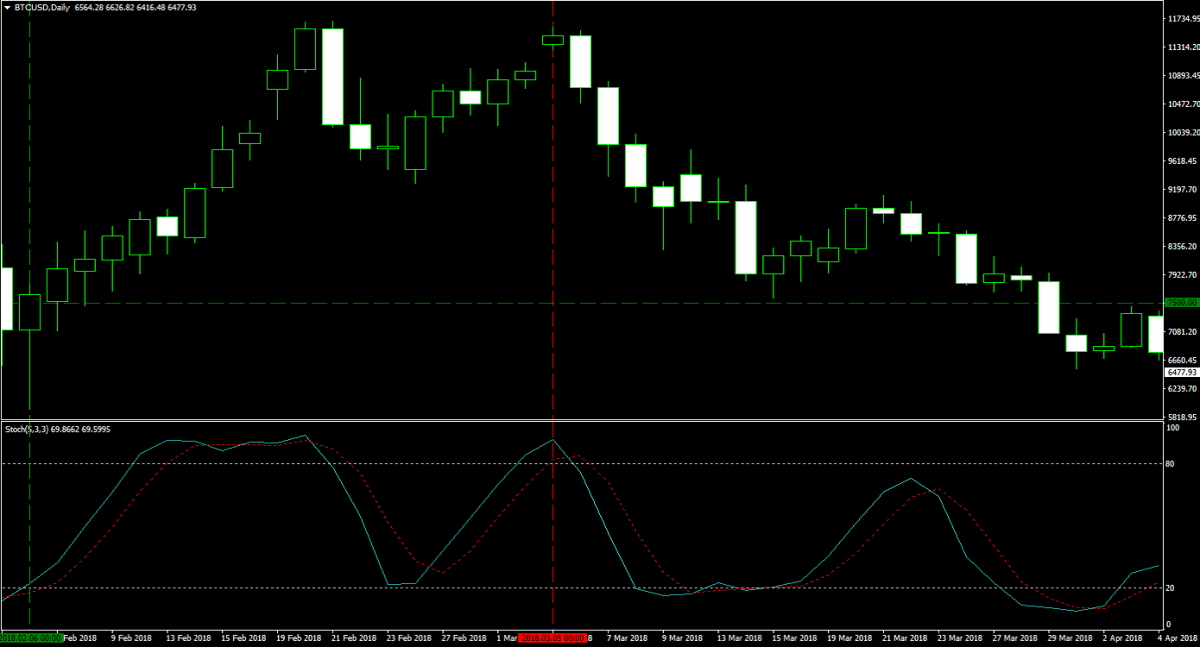

As you can see in the chart below, following my re-entry into Bitcoin, price action advanced sharply from an intra-day low of $5,925.05 on February 6th 2018 to an intra-day high of $11,690.00 on February 20th 2018. Out of the eleven trading sessions, Bitcoin closed higher on all of them with the exception on February 13th 2018. I wish I saw the following sharp drop, but I didn’t and saw my virtual wealth drop sharply again. I have to admit that I am not the biggest fan of those giant swings which can really play a number with your emotions. A drop to an intra-day low of $9,293.20 on February 26th 2018 was followed by another leg up. On March 5th 2018 I deposited my 11.5 Bitcoins back into PaxForex at a price of $11,500.

I now had a forex trading worth $132,250, 11.5 Bitcoin multiplied by $11,500, plus $750 which was leftover from before for a grand total of $133,000. I decided to split my account in five sections worth $26,600. I like to have $2,500 per traded lot which means each trade was 10 lots with the leftover cash as a cushion. I took a total of five forex trades between March 5th 2018 and April 2nd 2018, 10 lots each. In comparison, my previous forex venture consisted of three forex trades with 5 lots each. You need to be patient and not rush it, the earnings will follow if you execute properly. Risk management is very important. Now, here are the five forex trades which I took.

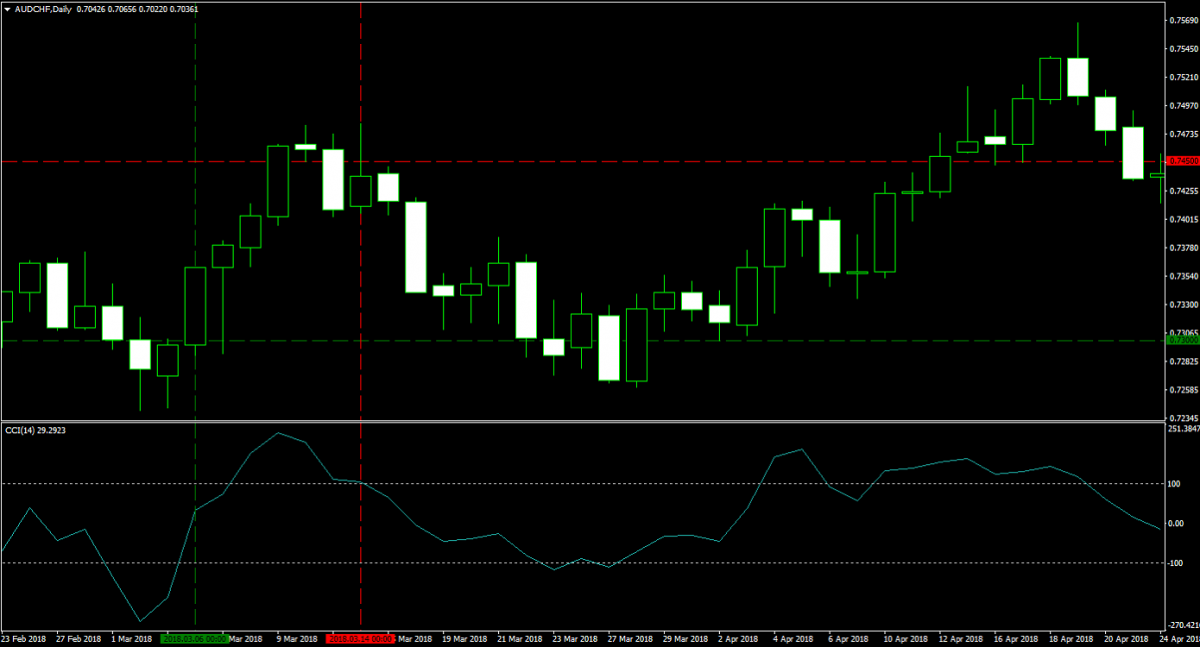

On March 6th 2018 I purchased 10 lots of AUDCHF at 0.7300. My required margin for this trade was $1,419.00 and each pip was worth $100.90. I closed this trade on March 14th at 0.7450 for a profit of 150 pips or $15,135.00. I closed this trade ahead of time because price action contracted during the previous two trading sessions and I acted following the spike higher. You can read the original trading recommendation at AUDCHF Fundamental Analysis – March 6th 2018 while the chart below shows my trade. When you look at trading recommendations, you don't have to follow them down to the latest pip, the marekt is dynamic and you should manage your trade accordingly.

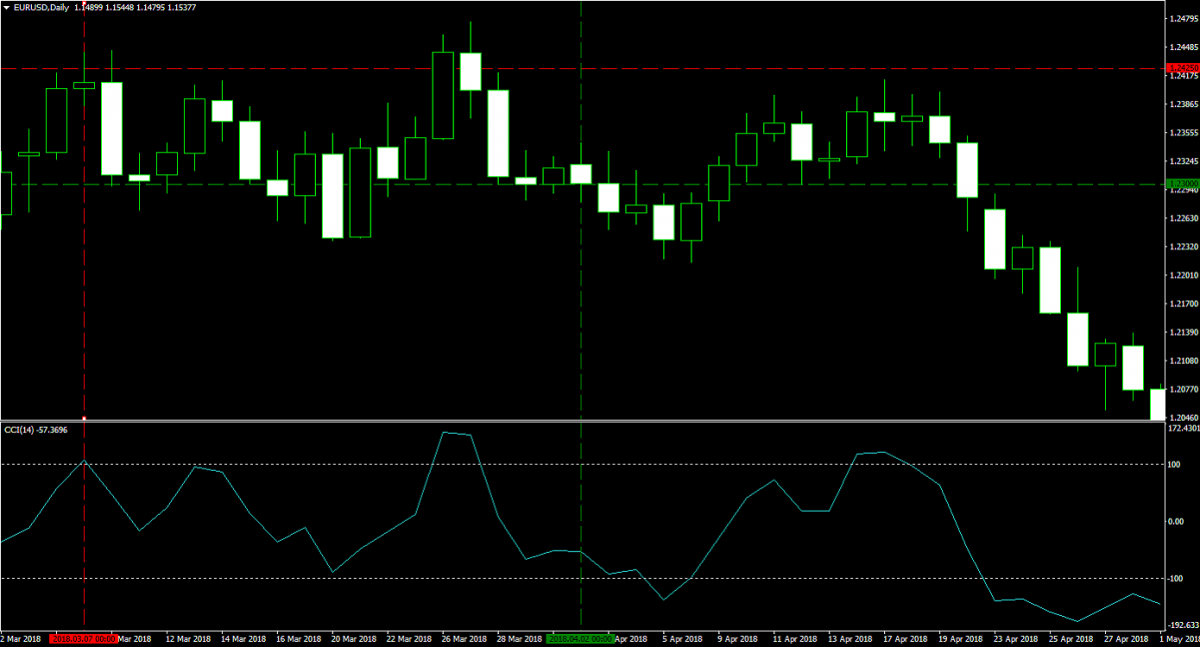

I added a short position in the EURUSD in March 7th 2018. I sold 10 lots at 1.2425, my required margin was $2,305.64 and each pip was worth $100. I closed this trade on April 2nd 2018, way before the recommended take profit level for reasons I will explain in my closing paragraph, at 1.2300 for a profit of 125 pips or $12,500. The original trading recommendation can be found at EURUSD Fundamental Analysis – March 7th 2018 and the chart below shows my trade.

On March 9th 2018 I added a long position in the GBPUSD to my forex portfolio. At 1.3820 I bought 10 lots and my required margin was $2,641.80 and each pip was worth $100.00. On March 27th 2018 I closed this trade at 1.4220 for a profit of 400 pips or $40,000. It was 60 pips shy of the recommended target, you can check out the original recommendation at GBPUSD Fundamental Analysis – March 9th 2018 and the trade I took in the chart below.

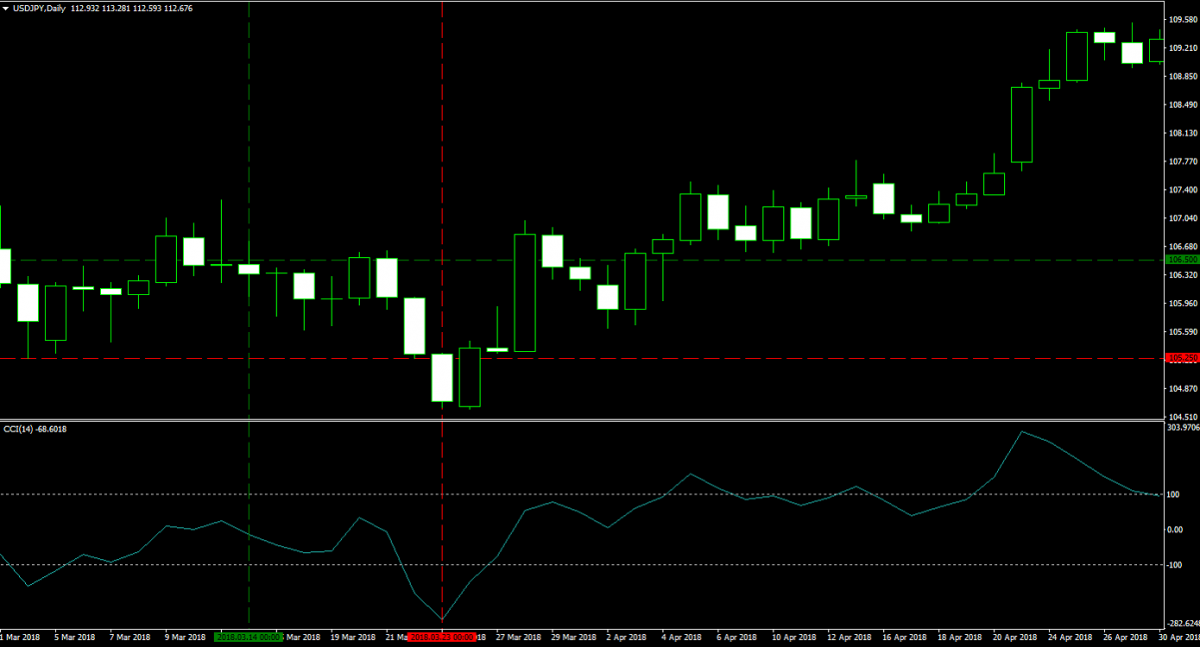

I bought USDJPY on March 14th 2018. Please take a look at the original trading recommendation at USDJPY Fundamental Analysis – March 14th 2018. I bought 10 lots at 106.500, my required margin was $2,000.00 and each pip was worth $88.76. The stop loss was triggered on March 23rd 2018 at 105.250 and I lost 125 pips or $11,095.00. You can see the trade in the chart below, not all trades in the forex market will be profitable. A loss is as much part of trading as a profit.

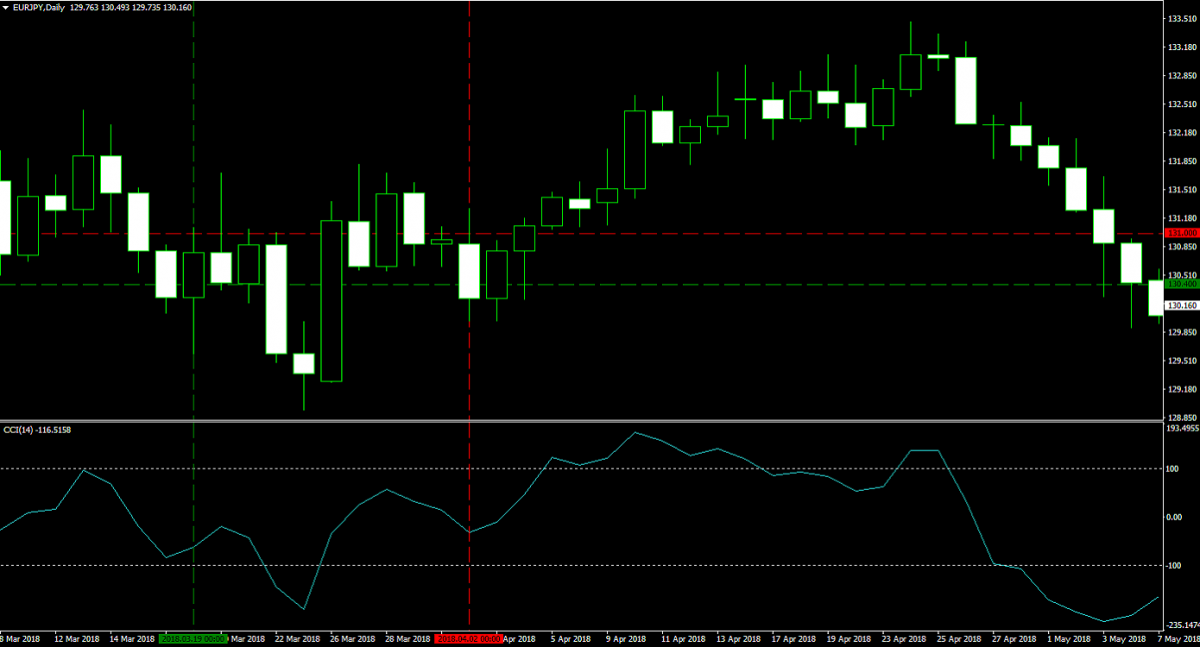

I took my last forex trade in this series on March 19th 2018. I bought 10 lots in the EURJPY at 130.400 and my required margin was $2,305.64 with a pip value of $88.76. I closed this trade on April 2nd 2018 at 131.000 for a profit of 60 pips or $5,325.60. I will explain in a moment why I closed early. The original recommendation can be checked at EURJPY Fundamental Analysis – March 19th 2018 with the chart below showing my entry and exit levels.

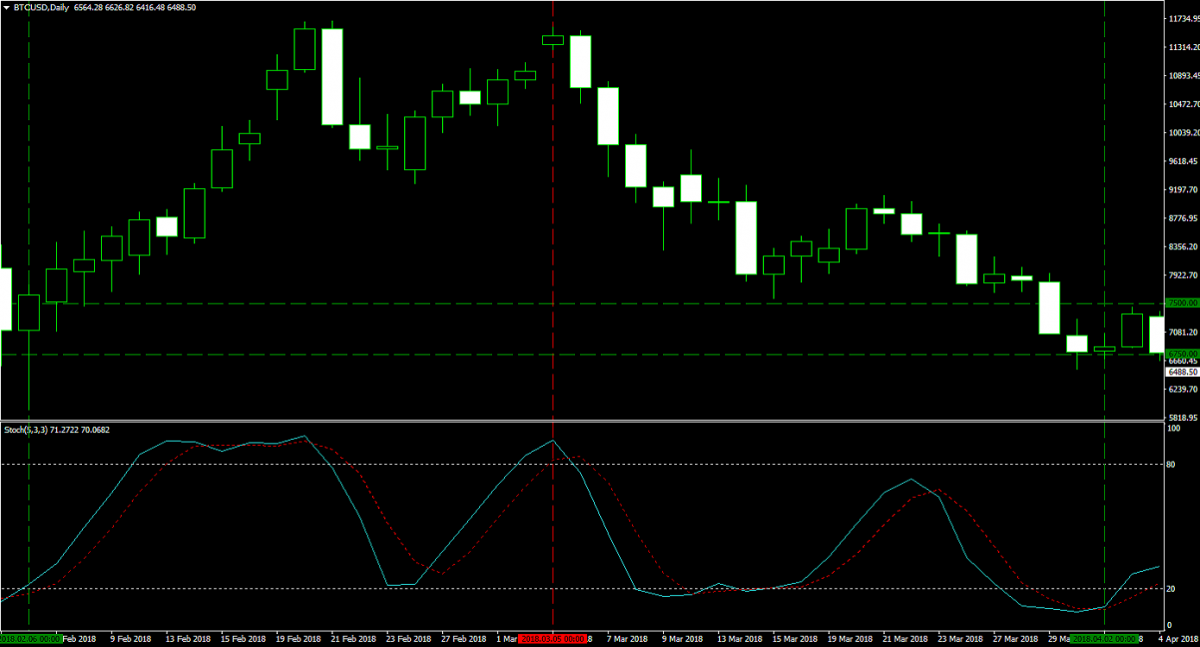

Out of the five trades which I took, I closed four for a gross profit of $72,960.60 and one for a loss of $11,095 for a net profit of $61,865.60. This took my PaxForex account balance to just below $195,000. The reason why I closed two of the trades on April 2nd 2018 and before they reached their take profit levels, which they would have done if I let them develop, is because I wanted to re-enter my Bitcoin trade. On April 2nd 2018 I bought 28.85 Bitcoins at $6,750 for a total of $194,737.50. The below chart shows my trade.

I turned my 11.5 Bitcoins into 28.85 Bitcoins over this period and grew my balance from just 2.5 Bitcoins. I could have opted to just hold on to them and hope it will reach the crazy predictions many called for. The bubble burst and continued to deflate, if I would have done nothing I would only have 2.5 Bitcoins worth $17,176.25 on April 2nd 2018. With my Bitcoin - Forex Combo Strategy and thanks to PaxForex I have 28.85 Bitcoins worth $198,213.93. Next week I will walk you through more trades which helped me grow my overall assets.

To receive new articles instantly Subscribe to updates.