Following yesterday’s Columbus Day holiday in the US, which saw US Treasury markets closed for trading, the trend is back on today. 10-Year yields are hovering near 7-year highs around the 3.25% mark. The yield moves opposite the price which means that US bonds are getting punished by traders. A few weeks ago, a growing number of analysts called for a sustained move in 10-Year Treasuries above 3.00% as the start-of-the-end for the global bull market in equities which was sponsored by global central banks through quantitative easing.

As central banks are either in the process of winding down QE, like the European Central Bank under Draghi, or have already ended it, like the US Federal Reserve under Powell, the period of accommodative policy is coming to a slow end. The US Fed is in a rate-hike cycle which is adding bullish pressures for the US Dollar. Better-than-expected economic data out of the US and a tight labor market have all added to the upside pressures in the 10-Year Yield. An increase in inflation, on the back of stronger commodity prices, is also punishing US bonds and sending yields upwards.

Equity markets remain extremely elevated and the US Dollar is attracting plenty of bids for different reasons. Traders are now in the process of determining who is right and who is wrong: the equity market or the bond market. According to equity investors, where optimism remains dominant with a slight reduction in the buy-the-dips mentality, more upside should be accounted for. Bond traders disagree and hint at a potential meltdown across asset classes. The US Dollar will be caught in the cross-fire, regardless who will end up on the right side.

The US Dollar has enjoyed an inflow of capital as many emerging market currency traders are flocking to the greenback while rotating out of riskier currencies. The hawkish tone of the US Fed is also adding to a build-up in buy orders for the time being. How long will this trend continue? Open your PaxForex Trading Account now and join our growing community of profitable forex traders.

Will a global slowdown and a rise in inflation reverse the positive cash-flow? US bond traders will have to digest $230 billion of new issuance which is expected to push yields even higher. The IMF just downgraded its global growth forecast for the first time since 2016 in yet another red-flag. Adding the upside pressure in inflation which is likely to continue as commodity prices are pushing higher with the increase in interest rates, and the bullish equity scenario can unravel rather fast. The trade war between the US and China is adding further risk into the system. Forex traders should watch US 10-Year Treasury Yields and the US Dollar, here are three trades to boost your pips in the process.

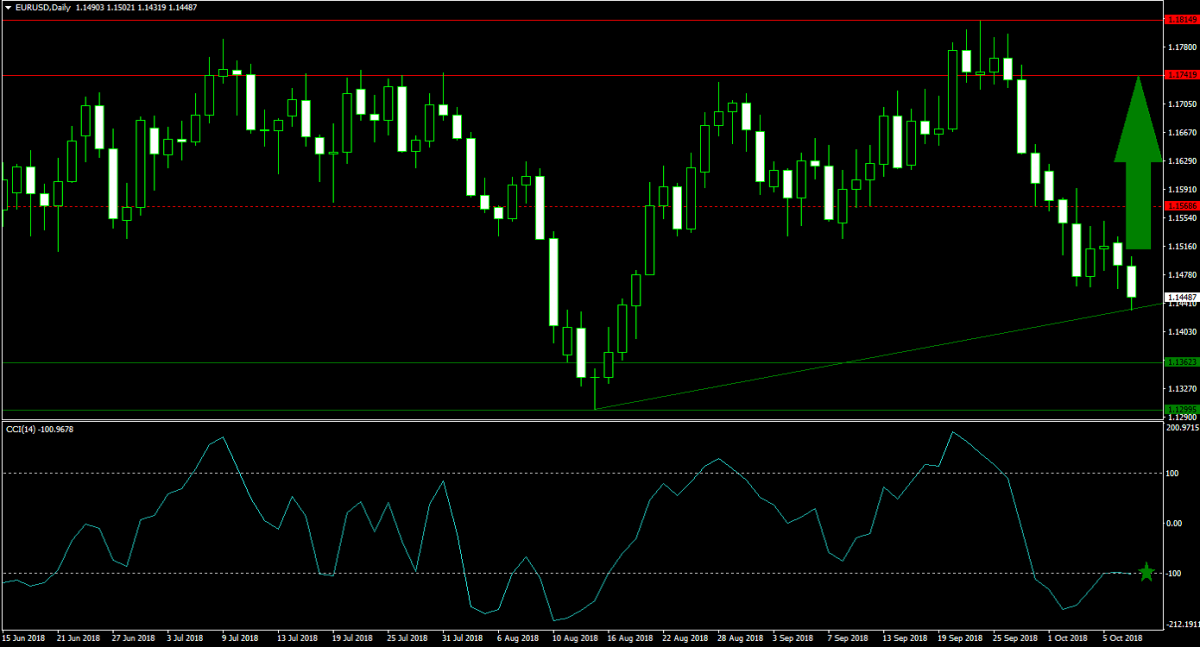

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

The primary ascending support level was able to halt the contraction in the EURUSD which resulted in a decrease in bearish sentiment, slowly being replaced by bullish sentiment. Preceding this half was a double breakdown in this currency pair; initially below its horizontal resistance area and then below its horizontal support level, turning it into resistance. The EURUSD is now expected to reverse the sell-off until it can challenge the lower band of its horizontal resistance area. Buying the dips is therefore recommended.

The CCI contracted into extreme oversold territory, but has started to recover from its lows and is now trading above and below the -100 mark. A sustained push above this level is expected to ignite a short-covering rally in this currency pair. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the help of our expert analysts. We do the hard work so you can reap the easy rewards, only at PaxForex!

Forex Profit Set-Up #2; Sell USDCHF - D1 Time-Frame

A sharp spike in price action is near exhaustion as the primary descending resistance level is applying bearish pressures on the USDCHF. Over the past four trading sessions this currency pair failed to move higher which opened the door for a counter-trend correction. Price action is now anticipated to reverse below its horizontal support level and down into its secondary descending resistance level. Forex traders are advised to sell the rallies in the USDCHF in order to profit from the attractive downside potential.

The CCI started to descend from its most recent peak inside extreme overbought conditions which pushed this momentum indicator below the +100 level. This resulted in an increase in sell orders which are set to accumulate and pressure price action to the downside. Download your PaxForex MT4 Trading Platform now and start building a profitable portfolio today in order to benefit tomorrow!

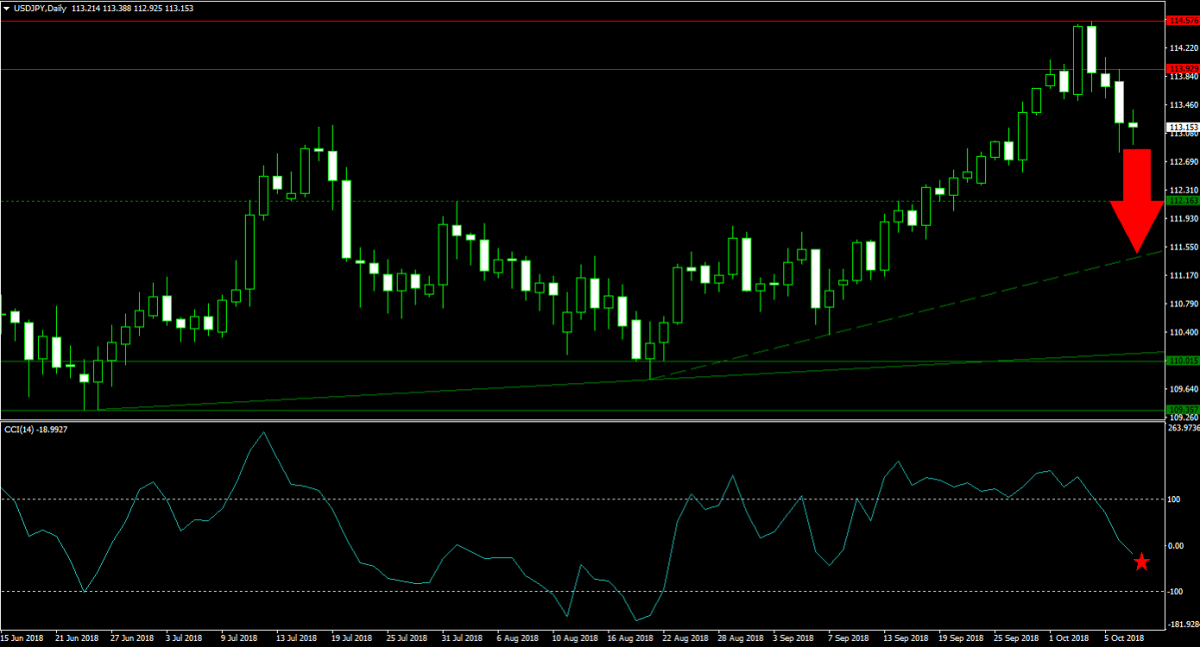

Forex Profit Set-Up #3; Sell USDJPY - D1 Time-Frame

The USDJPY already completed a breakdown below its horizontal resistance area which resulted in a bearish momentum shift. The rise in 10-Year US Treasury Yields as well as the IMF downgrade to global growth also attracted more bids to the Japanese Yen, a traditional safe-haven currency. Price action is now expected to extend its breakdown until it will reach its secondary ascending support level; a breakdown below its horizontal support level will precede this move. Forex traders are advised to sell the rallies in in the USDJPY.

The CCI moved out of extreme overbought territory and bearish momentum sufficed to pressure this technical indicator below the 0 mark and into negative territory. This resulted in a bearish momentum change with more downside anticipated. Follow the PaxForex Daily Forex Technical Analysis and receive all trading set-ups delivered directly into your inbox; just duplicate the trades and profit alongside our expert analysis with ease!

To receive new articles instantly Subscribe to updates.