A lot of attention is reserved for the big currencies which are heavily traded. Coverage of events which directly impact the US Dollar, the Euro, the Japanese Yen, the British Pound and the Swiss Franc is ample. The Chinese Yuan is also receiving a great deal of attention, especially amid the US-China trade war and a potential change by the US Treasury in how it defines a currency manipulator after it stopped short of labeling China one just last week in its semi-annual assessment.

One fact many tend to ignore are minor currencies and so called exotic currencies. While emerging market currencies receive a lot less coverage, it is important to note that when fundamentals change it often leads to cross currency flows which will have an impact on developed market currencies. This is one reason that the Japanese Yen and the Swiss Franc are designated safe haven currencies and together with Gold often attract a lot of capital inflows from forex traders who seek a new home for their funds.

India is currently home to the world’s fastest growing economy, but also to a currency which has been contracting for most parts of 2018. The USDINR is currently trading around 73.5950, following a rebound from a low below 63.3500 at the beginning of this year, but more bearish calls on the the Indian Rupee are piling up. This suggests that Indian Rupee traders will have to reallocate capital and seek safe haven elsewhere which will have an impact on price action of their selected assets.

Where will Rupee traders seek safe haven? Understanding cross currency flows can help forex traders to spot trading opportunities which fly below the radar of many other traders. Financial markets are connected and outflows from one sector means inflows into another one. Open your PaxForex Trading Account now and start preparing your portfolio for an exodus of Rupee traders piling into other currencies in order to profit from it.

The current Rupee recovery is expected to end as the Reserve Bank of India is only focused on inflation and nothing else. The most bearish USDINR call for year-end is at 76.5000 and ING economists Prakash Sakpal noted that “The Rupee is highly correlated with oil prices, which are definitely moving higher, and that’s going to make the current-account situation more difficult. Investors will also start adding the political-risk premium to the currency.” Regional elections in five Indian states over the next two months and a national election in 2019 are also expected to pressure the currency further. Where will Rupee traders seek safe haven? Here are three forex trades to keep in mind and portfolio.

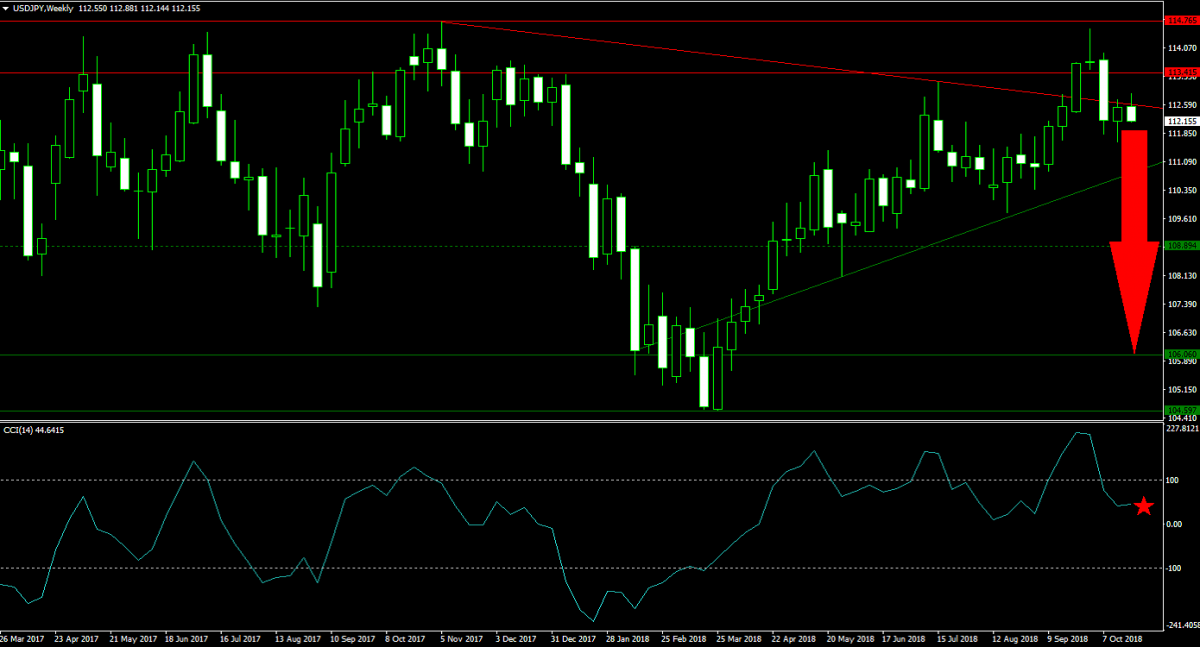

Forex Profit Set-Up #1; Sell USDJPY - W1 Time-Frame

The Japanese Yen is attracting more buy orders as global assets are extending their sell-off. This is also expected to be one of the main beneficiaries of cross currency flows out of the Indian Rupee. Price action already completed a breakdown below its horizontal resistance area as well as below its primary descending resistance level. The USDJPY is predicted to push below its primary ascending support level and into its next horizontal support level, forex traders are therefore advised to sell the rallies.

The CCI has contacted from extreme overbought conditions and accumulated enough bearish momentum to extend its move which suggests more downside for the USDJPY going forward. Download your PaxForex MT4 Trading Platform and plant a forex seed today in order to harvest the profits tomorrow.

Forex Profit Set-Up #2; Sell EURCHF - W1 Time-Frame

The EURCHF was able to use its horizontal support level in order to complete a breakout above its secondary descending resistance level. With the continued contraction in global equity market, the Swiss Franc is expected to get a boost which will force this currency pair into a reversal. Not only Rupee traders will flock to this safe haven currency. A triple breakdown is anticipated to unfold and take the EURCHF back down into its horizontal resistance area. Selling the rallies is therefore recommended.

The CCI advanced out of extreme oversold territory as well as above the 0 level, but is running out of bullish momentum. A contraction below the 0 mark is expected to unfold and invite more sell orders. Subscribe to the PaxForex Daily Fundamental Analysis and let our expert analysts guide you through the forex market; earn over 500 pips per month.

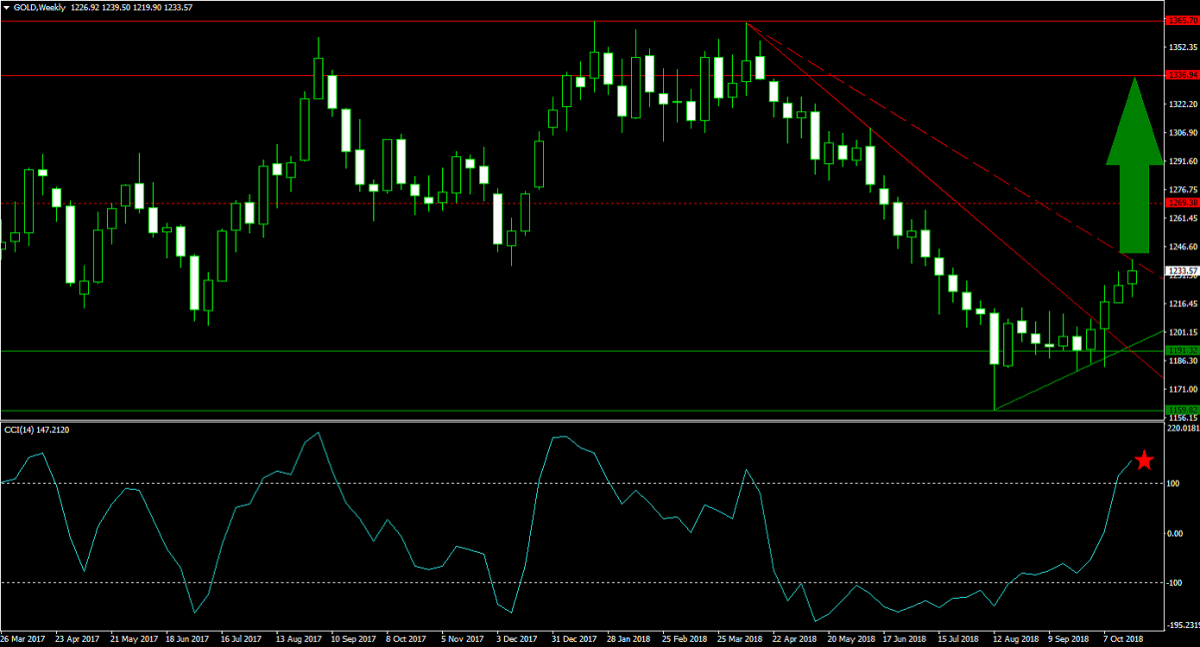

Forex Profit Set-Up #3; Buy Gold - W1 Time-Frame

Gold has joined the safe haven world once again after a brief hiatus. Gold was pressured lower despite an increase in global tension as the US Dollar advanced. This correlation has now ended and Gold is surging higher. India is one of the biggest Gold consumers in the world and Rupee investors are likely to dive into this trade. A double breakout from current levels, above its secondary descending resistance level and its next horizontal resistance level, is anticipated to clear the path into its next horizontal resistance area. Forex traders should buy the dips in this precious metal.

The CCI did spike into extreme overbought conditions, but a contraction in price action will take this momentum indicator into neutral territory with a bullish bias. Follow the PaxForex Daily Forex Technical Analysis and never miss out on a profitable trading opportunity, just place the recommended trades into your own forex trading account.

To receive new articles instantly Subscribe to updates.