The European Central Bank (ECB) is expected to keep its Interest Rate at 0.00%, its Deposit Facility Rate at -0.40% and its Marginal Lending Facility Rate at 0.25%. Many analysts don’t expect an increase in interest rates out of the ECB until September 2019 at the earliest. The press conference by ECB President Mario Draghi will be closely followed as the ECB is facing a series of headwinds as it is winding down its quantitative easing program. No changes is predicted in its current target to exit QE by December. The words Draghi will choose could give a hint how the ECB currently feels about its decision from one year ago.

Twelve months ago, with a very strong Eurozone economy at its back, the ECB took the first step to get out of QE by cutting the amount of bond purchases by 50%. While the ECB made clear it plans to exit QE by December 2018, it also made sure markets understood that interest rates will move at a much slower pace. Draghi may try hard to avoid a direct answer to any question in regards to interest rates. Strong domestic demand inside the Eurozone boosted growth, but now external risks are far greater while domestic demand is contracting.

Since the ECB decided on a path to exit QE, external developments have pressured the Eurozone economy. Brexit negotiations have been stuck and may result in a no deal Brexit. President Trump is pushing his “America First” policy and the world order is being reshuffled while he also started a trade war with China and several trade disputed with other key allies. This has a negative impact in the Eurozone economy which heavily depends on its exports. Inside the Eurozone, Italy started a budget stand-off and is ignoring calls by the ECB to reduce spending. Eurozone PMI reports have shown a much greater slowdown than expected.

It appears as if the ECB decided to unwind its QE program at the economic peak and is now faced with turbulences which could form one big storm for policy makers. The Euro has been under pressure which is secretly welcome by exporters such as Germany and France, but where does the ECB stand? Open your PaxForex Trading Account now and join our growing community of profitable forex traders who earn more pips per trade at PaxForex!

All economic indicators currently point more towards an interest rate easing environment than one which supports tightening. According to a recent survey, the 25 member ECB Governing Council has one vacancy and six neutral votes on interest rates, ten doves who favor the current interest rate environment and eight hawks who prefer higher interest rates. Then there is the lack of inflation as measured by the core CPI. Today is likely to see no change in the status quo and while the €2.6 trillion QE program is coming to an end, proceeds will be reinvested for the time being. ECB QE exit turbulence and the Euro create the following three forex trades to allow a boarding pass into your portfolio.

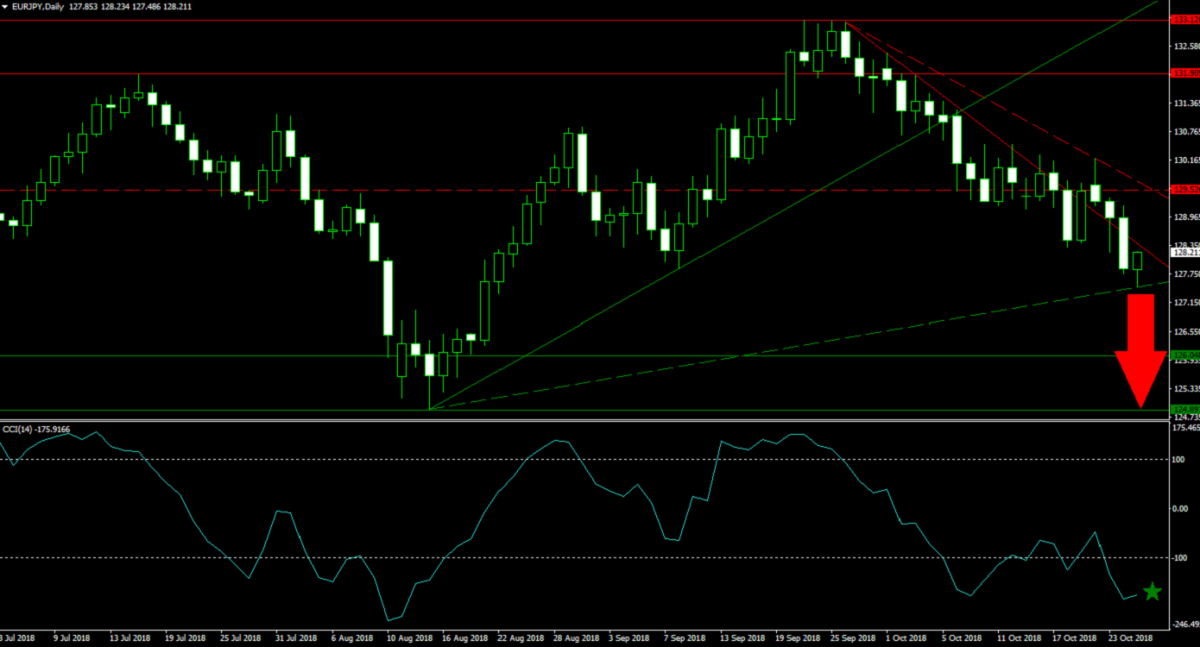

Forex Profit Set-Up #1; Sell EURJPY - D1 Time-Frame

While the EURJPY has been extending its slide following a breakdown below its horizontal resistance area, given the current market environment this currency pair could further add to its current trend. The Japanese Yen is attracting more bids due to its safe haven status which could force the EURJPY into its horizontal support area, guided lower by its primary and secondary descending resistance levels. A breakdown below its secondary ascending support level is expected next and forex traders should sell the rallies from here.

The CCI already collapsed into extreme oversold conditions, but remains of off its previous low. More downside in this momentum indicator is therefore possible, especially during small counter-trend rallies in this currency pair. Download your PaxForex MT4 Trading Platform now in order to build a forex portfolio which allows you to grow your assets through profitable trading decisions.

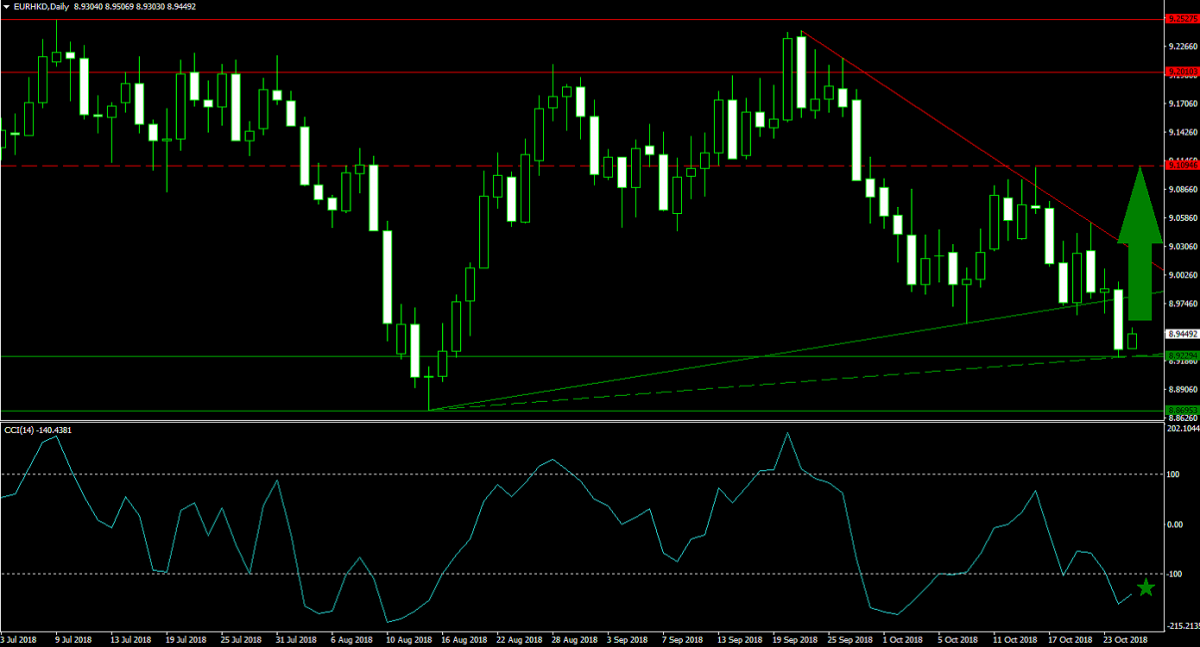

Forex Profit Set-Up #2; Buy EURHKD - D1 Time-Frame

The Eurozone as well as China face trade tensions with the US. It appears that the Eurozone is much closer to resolving their issues which will benefit the Euro over the Hong Kong Dollar. The EURHKD found support at the upper band of its horizontal support area which is being enforced by its secondary ascending support level. Price action is now predicted to complete a breakout above its primary ascending support level as well as above its primary descending resistance level and advance into its next horizontal resistance level. Forex traders are advised to but the dips in the EURHKD.

The CCI is trading in extreme oversold territory and a positive divergence formed which is a strong bullish trading signal. A move above the -100 level is likely to result in a short-covering rally. Make sure to subscribe to the PaxForex Daily Fundamental Analysis where our expert analysts will guide you through the forex market; earn over 500 pips per month by simply following our trading recommendations.

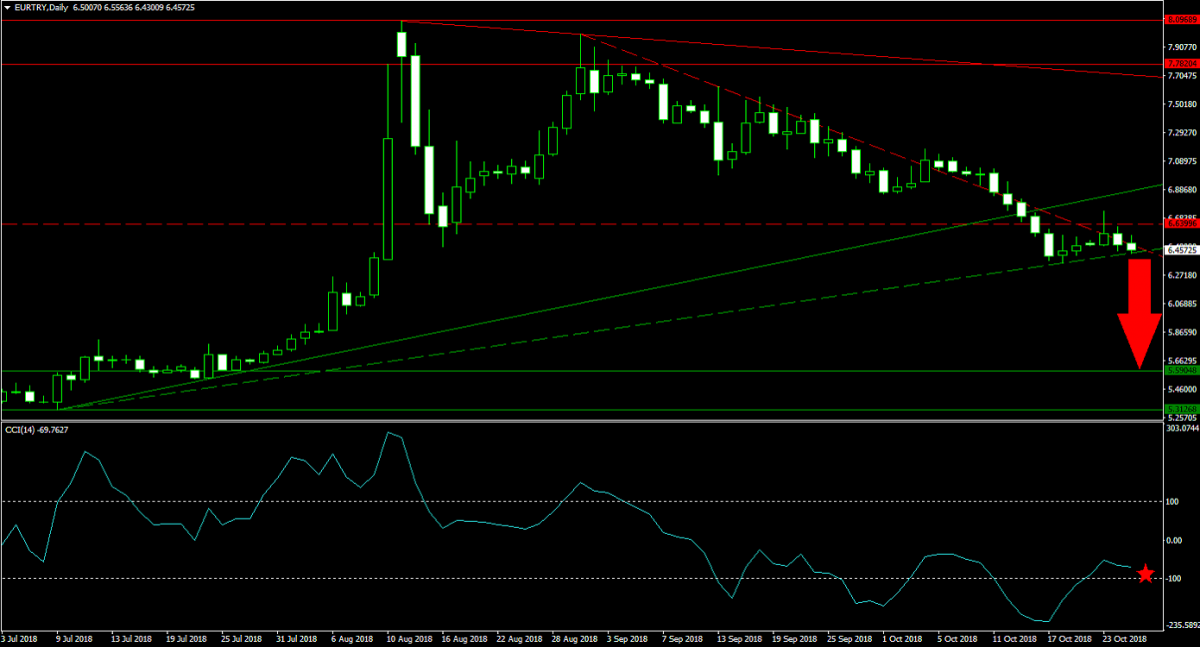

Forex Profit Set-Up #3; Sell EURTRY - D1 Time-Frame

The Turkish Lira has slowly recovered from the panic selling a few months ago which has resulted in a steady contraction in the EURTRY. This trend is expected to continue as Turkey is getting its house in order as the Eurozone economy is losing steam. Price action pushed below its primary ascending support level as well as below its horizontal resistance level. Its secondary descending resistance level is now expected to force a breakdown below its secondary ascending support level which will take the EURTRY back down into its horizontal resistance area. Forex traders are recommended to sell the rallies.

The CCI eclipsed the -100 mark, but remains in negative territory as bullish momentum is fading. This technical indicator expected to contract back into extreme oversold conditions where new lows should be anticipated. Follow the PaxForex Daily Forex Technical Analysis and build a market beating portfolio with the technical trading recommendations posted by our expert analysts daily.

To receive new articles instantly Subscribe to updates.