The Swiss GDP for the first quarter decreased by 2.6% quarterly and by 1.3% annualized. Economists predicted a decrease of 2.0 % and 0.9%. Forex traders can compare this to the Swiss GDP for the fourth quarter, which increased by 0.3% quarterly and by 1.6% annualized.

The US ADP Employment Change for May is predicted at -9,000K. Forex traders can compare this to the US ADP Employment Change for April, which was reported at -20,236K. The US Final Markit Services PMI for May is predicted at 36.9, and the US Final Markit Composite PMI is predicted at 36.4. Forex traders can compare this to the US Markit Services PMI for April, which was reported at 26.7 and to the US Markit Composite PMI, which was reported at 27.0.

US Factory Orders for April are predicted to decrease by 14.0% monthly. Forex traders can compare this to US Factory Orders for March, which decreased by 10.4% monthly. The US ISM Non-Manufacturing PMI for May is predicted at 44.0. Forex traders can compare this to the US ISM Non-Manufacturing PMI for April, which was reported at 41.8. The ISM Non-Manufacturing Business Activity Index for May is predicted at 34.0. Forex traders can compare this to the ISM Non-Manufacturing Business Activity Index for April, which was reported at 26.0.

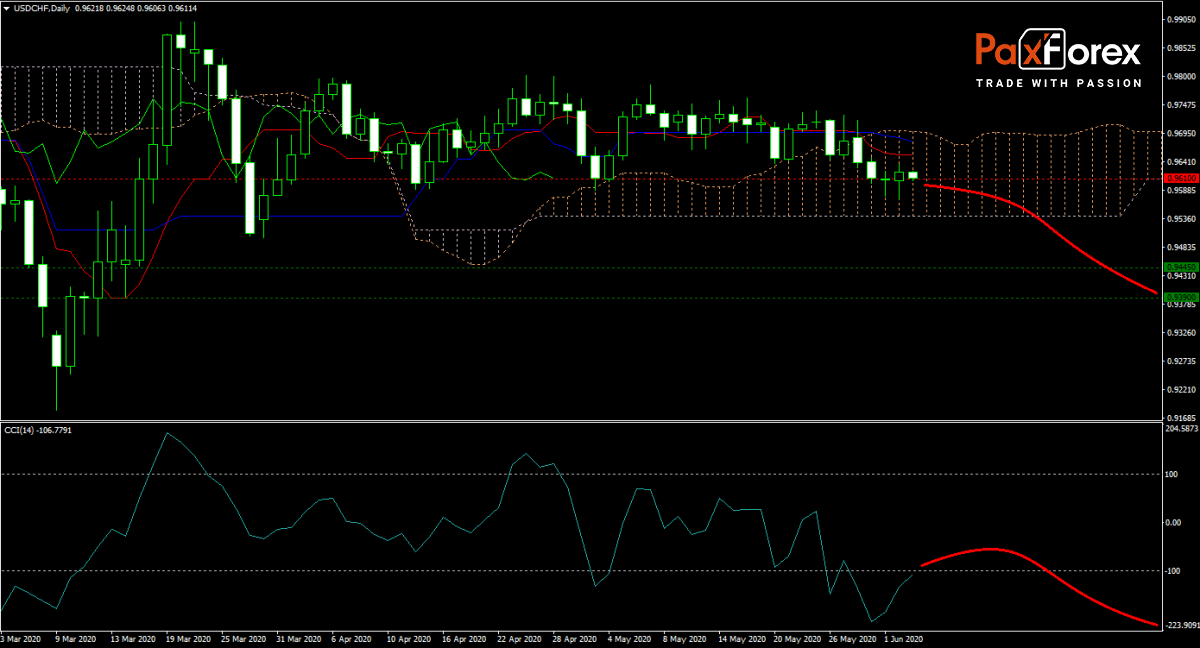

The USD/CHF forecast remains bearish with this currency pair inside the Ichimoku Kinko Hyo Cloud. Swiss GDP data for the first quarter showed the economy contracting, but the Swiss Franc enjoys safe-haven demand. Ongoing riots in the US are limiting the impact of the reopening of the economy as Covid-19 infections are on the rise. The Tenkan-sen is expected to keep selling pressure alive. Will bears launch an attempt to force price action below the cloud and into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CHF remain inside the or breakdown below the 0.9575 to 0.9655 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.9610

- Take Profit Zone: 0.9390 – 0.9455

- Stop Loss Level: 0.9690

Should price action for the USD/CHF breakout above 0.9655 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9690

- Take Profit Zone: 0.9760 – 0.9800

- Stop Loss Level: 0.9655

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.