Swiss Retail Sales for March decreased by 5.6% annualized. Economists predicted an increase of 0.1% annualized. Forex traders can compare this to Swiss Retail Sales for February, which increased by 0.3% annualized. The Swiss KOF Leading Indicator for April was reported at 63.5. Economists predicted a figure of 63.5. Forex traders can compare this to the Swiss KOF Leading Indicator for March, which was reported at 91.7.

US Personal Income for March is predicted to decrease by 1.5% monthly, and Personal Spending is predicted to decrease by 5.0% monthly. Forex traders can compare this to Personal Income for February, which increased by 0.6% monthly and to Personal Spending, which increased by 0.2% monthly. The PCE Core Deflator for March is predicted to decrease by 0.1% monthly, and to increase by 1.6% annualized. Forex traders can compare this to the PCE Core Deflator for February, which increased by 0.2% monthly and by 1.8% annualized.

US Initial Jobless Claims for the week of April 25th are predicted at 3,500K, and US Continuing Claims for the week of April 18th are predicted at 19,238K. Forex traders can compare this to US Initial Jobless Claims for the week of April 18th, which were reported at 4,427K and to US Continuing Claims for the week of April 11th, which were reported at 15,976K. The US Chicago PMI for April is predicted at 38.0. Forex traders can compare this to the US Chicago PMI for March, which was reported at 47.8.

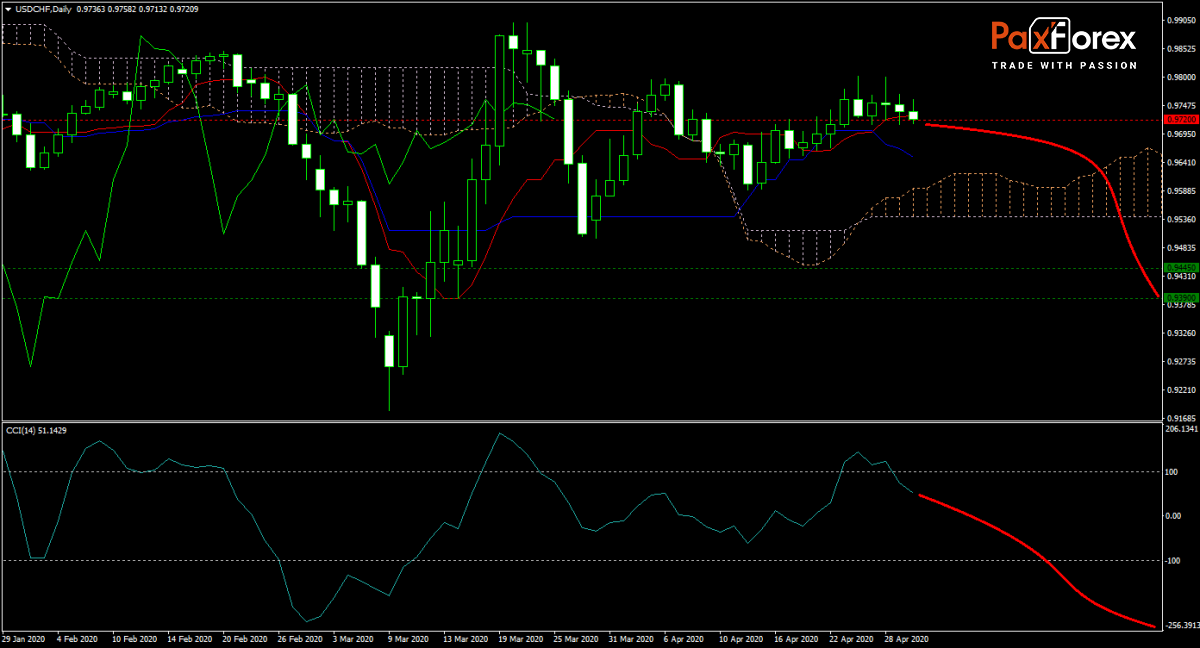

The USD/CHF forecast turned more bearish following yesterday’s first-quarter US GDP data, which came in weaker than expected. Forex traders will await today’s initial jobless claims data after Swiss retail sales plunged and the KOF Leading Indicator confirmed a severe recession. Global Covid-19 cases breached the three million mark with over one million in the US alone. Will bears get the data they need to start another round of selling? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CHF remain inside the or breakdown below the 0.9700 to 0.9755 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.9720

- Take Profit Zone: 0.9390 – 0.9455

- Stop Loss Level: 0.9800

Should price action for the USD/CHF breakout above 0.9755 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9800

- Take Profit Zone: 0.9900 – 0.9935

- Stop Loss Level: 0.9755

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.