The New Zealand Trade Balance for March was reported at NZ$672M monthly and at -NZ$3,460M 12-month year-to-date. Forex traders can compare this to the New Zealand Trade Balance for February, which was reported at NZ$531M monthly, and at -NZ$3,300M 12-month year-to-date. Exports for March were reported at NZ$5.81B and Imports were reported at NZ$5.14B. Forex traders can compare this to Exports for February, which were reported at NZ$4.87B and to Imports, which were reported at NZ$4.34B.

The Preliminary US GDP for the first quarter is predicted to decrease by 4.0% annualized. Forex traders can compare this to the fourth-quarter GDP, which increased by 2.1% annualized. Preliminary GDP Sales for the first-quarter is predicted to increase by 2.1% annualized. Forex traders can compare this to fourth-quarter GDP Sales, which increased by 3.1% annualized. The Preliminary GDP Price Index for the first quarter is predicted to increase by 1.2% annualized. Forex traders can compare this to the fourth-quarter GDP Price Index, which increased by 1.4% annualized. The Preliminary Core PCE for the first quarter is predicted to increase by 1.4% annualized. Forex traders can compare this to the fourth-quarter Core PCE, which increased by 1.3% annualized.

US Pending Home Sales for March are predicted to decrease by 10.0% monthly. Forex traders can compare this to US Pending Home Sales for February, which increased by 2.4% monthly. The US FOMC Interest Rate Decision is predicted to show interest rates at 0.25%. Forex traders can compare this to the previous US FOMC Interest Rate Decision, which showed interest rates at 0.25%.

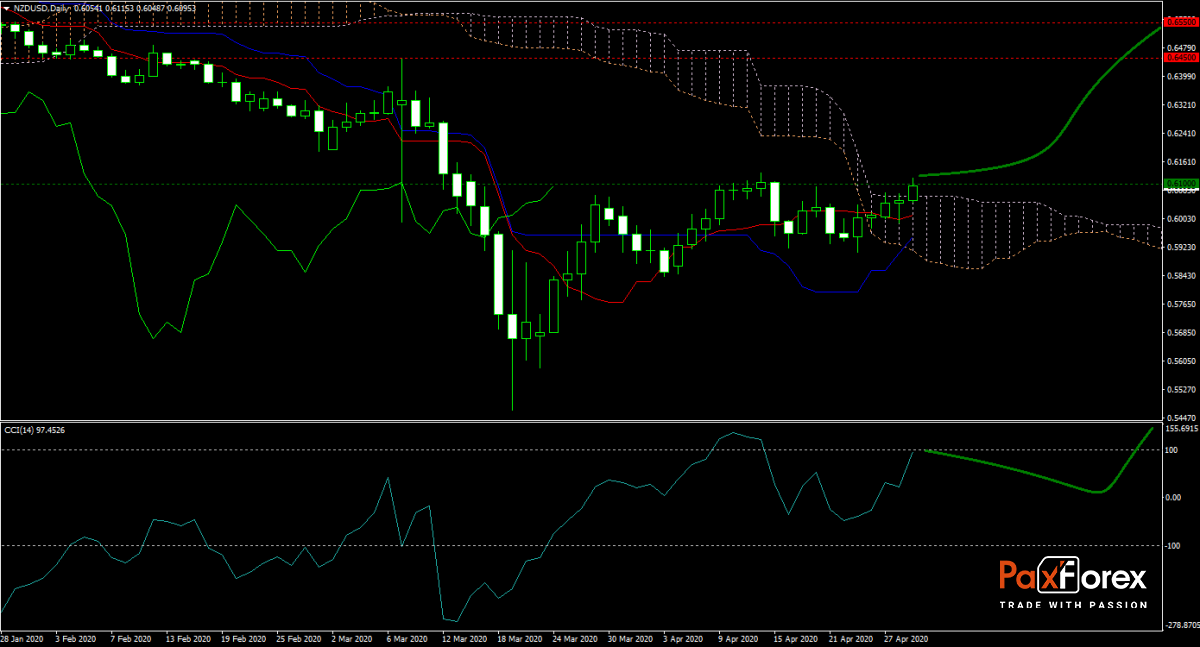

The NZD/USD forecast remains bullish after this currency pair moved above the Senkou Span A with the Tenkan-sen providing support. During the Asian trading session, New Zealand reported weak export data, but today’s preliminary US GDP report is eagerly anticipated. A negative surprise is possible, which will provide bulls with a reason to push price action higher. Will today’s data allow bulls to keep the advance going? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the NZD/USD remain inside the or breakout above the 0.6055 to 0.6130 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6100

- Take Profit Zone: 0.6450 – 0.6550

- Stop Loss Level: 0.6000

Should price action for the NZD/USD breakdown below 0.6055 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.6000

- Take Profit Zone: 0.5735 – 0.5775

- Stop Loss Level: 0.6055

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.