Forex trading involves in-depth knowledge of technical and fundamental analysis, understanding of market laws, and practical experience. Professional traders can easily recognize when the market sends commands to react quickly. Beginners, on the other hand, need to process and assimilate a lot of information to find suitable trading ideas and increase their capital.

What should a beginner do if he does not yet have such a wealth of knowledge? Is it possible to make a profit on the currency market immediately after registration?

Beginner traders, who not only want to stay in the Forex market but also to increase their capital, should be aware of the main instruments of the currency market: various indicators, charts, levels, and other auxiliary elements to find the right moment to enter. Of particular importance in trading are Forex signals which can be really helpful for any trader who wants to either confirm existing signals of their own or just save time. And here comes the first obstacle - choosing the best trading signal provider. Gladly we are here to help you tackle this. Let`s go through what are trading signals, their types as well as how to find reliable signal providers.

What Are FX Trading Signals and FX Alerts?

Forex trading signal is an information notification indicating the point of entry into and exit from trade on this or that asset.

The indication of the timing of opening or closing trading positions comes from professionals or brokerage companies. The use of trading signals is a necessary help for beginners who are poorly versed in the rules of conducting business on the Forex market. Advice from professionals is provided online and is based on proven and reliable strategic decisions.

Any trading signal is generated on a certain strategy that allows getting high profits for a long time. Analysts proposing to use their trading strategies show the results, which are broadcasted as a statement.

Forex signals, like any other signals, cannot be 100% correct (even with a paid subscription). Depending on the source, the accuracy is 60%, which allows you to level out the risks and generate income with the correct approach to trading, following the recommendations of the information provider.

Such a model of automation is also relevant for those who do not have an opportunity to engage in analytics independently. After all, Forex signals indicate the moments of entering and exiting a deal. They also contain information about the asset to which the signal is applied. Often the information is submitted in a detailed manner, and a screenshot from the chart is added there, which confirms the forecast. Stop Loss and Take Profit levels are specified for insurance.

One or another source usually publishes from one to five or six forecasts for one trading day.

Forex trading signals are used for trading analysis to determine whether to buy or sell a currency pair at any given time. Forex signal systems may be based on technical analysis tools or news events. It is simple - in the first case the signals are formed depending on the current market situation, and in the second case - depending on the news and experts' assumptions about how the market situation may change under the influence of this very news.

The type of signal is determined by the specific function it can have and how it normally works. Technically, two types of signals are constantly available in the Forex market.

- Manual Signals

- Automated Signals

If we describe the first type of signal, we recognize that when using this type of signal, a trader has to monitor the charts for a long time waiting for a hint so he can finally decide if this or that asset needs to be sold/bought. As you can see, decisions made as a result of trading here are based on its interpretation and this can be a time-consuming process. Using these daily Forex signals has an interdependent relationship with manual trading.

A trader has abilities to estimate the current situation like computer cannot. They can see when it is moving unpredictably and inconveniently and thus can exit trading. A trader obtained some knowledge and expertise moreover there are no restricting codes and programmed settings such as automatic operations, so he is able to assume if this or that trade will be winning or not.

Let`s have a look at other types of Forex trading signals. What is important for automated Forex signals is that the trader only commands the software to find what signals to look for. The human psychological stress connected with this process is eliminated. As a result, the software automatically interprets how to act: buy or sell a particular currency. Thus, trading can be quite accurate if the program was executed properly and by a real professional.

A robot, as we will call it in this case, can operate more information than a human. This means that you can personally manage multiple currency pairs at the same time and you will also be able to control all the charts you want 24/5 and without any significant signals. However, the most successful signaling device is often the use of a combination of both models, that is by the way what most Forex pros do.

As for buying, either manual or automated Forex trading signals can be purchased online. When you intend to buy, first check if there is a free trial. Legitimate businesses will let you check the information and doublecheck if it`s of good quality and then buy it. For a trader to receive information that will benefit him, in the end, they should only collaborate with companies that are willing to provide previous, evaluated results. Moreover, those firms that verify their information are much easier to trust than companies that refuse to provide traders with a free trial and access to verified results. This is the best Forex signals policy.

Experienced and beginner traders have a great opportunity to increase their capital by using the services of analysts. With the help of profitable trades, presented free of charge or for a small fee by successful traders. Today the currency market offers several options for receiving Forex signals using numerous indicators or trading systems. Alerts to open or close positions are received through notifications sent to your mobile phone, email, a personal cabinet of the provider's platform or platform mail.

What should you pay attention to when choosing a provider of Forex trading signals?

- Reliability of the service providing trading signals.

It is quite understandable that you will be disappointed in Forex signals if they turn out to be wrong and your trades are unprofitable. However, even the best trading signals cannot always be 100% correct. All you need is for profitable trades to be more than losing ones. So, choose a provider with a maximum rate of positive signals.

The number of signals and their frequency.

Additional information and analytics. It would be nice to know what the signal is justified.

Subscription price. The cost of signals can vary greatly not only from the provider of trading signals but also from the service package. You can find services that provide free Forex signals. The cost of paid services depends on the quantity and quality of signals and services provided.

If you want to use Forex trading signals in your work, we suggest you get acquainted with some ways how you can get signals.

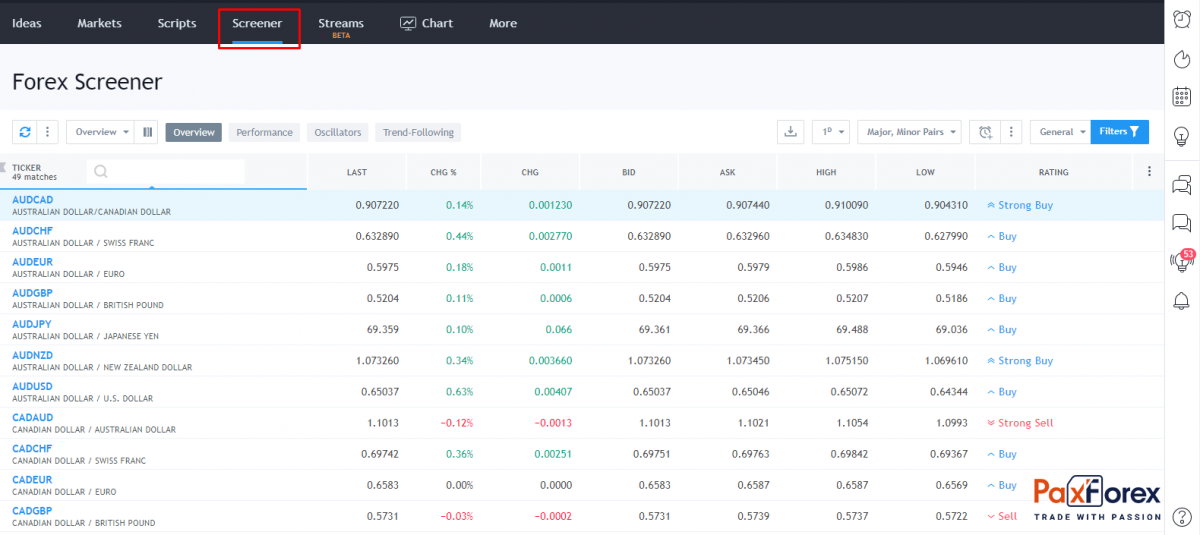

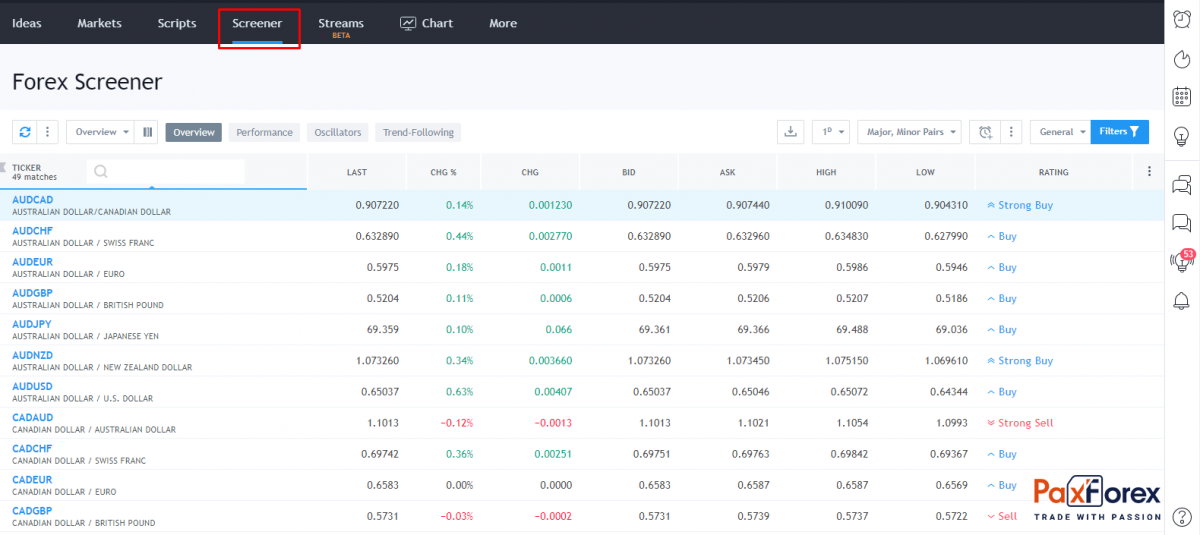

- TradingView.com

TradingView is a service that provides an online chart of quotes movement, an absolutely independent source of useful information for traders (economic news, current data) and a professional social network for traders. Here they exchange their ideas and opinions, and beginners can get useful information.

One of the key advantages of the service is charts with quotes, which have wide functionality and a set of useful features for every trader. Here you can see price movements of various assets, stocks, bonds, futures, futures, cryptocurrencies, etc. As a service of trading signals, you can use the screener section (there is a screener of Forex, stocks, and cryptocurrencies). It looks as follows:

There are many options for setting up the screener: currency pairs, time frame, dynamics of changes, indicators, and much more. The TradingView Screener is free, as well as many other options on the portal.

The TradingView platform offers a very wide functionality, which is superior to many others, including the MT4 trading terminal. To feel the full power of the platform, it is recommended to use a paid plan.

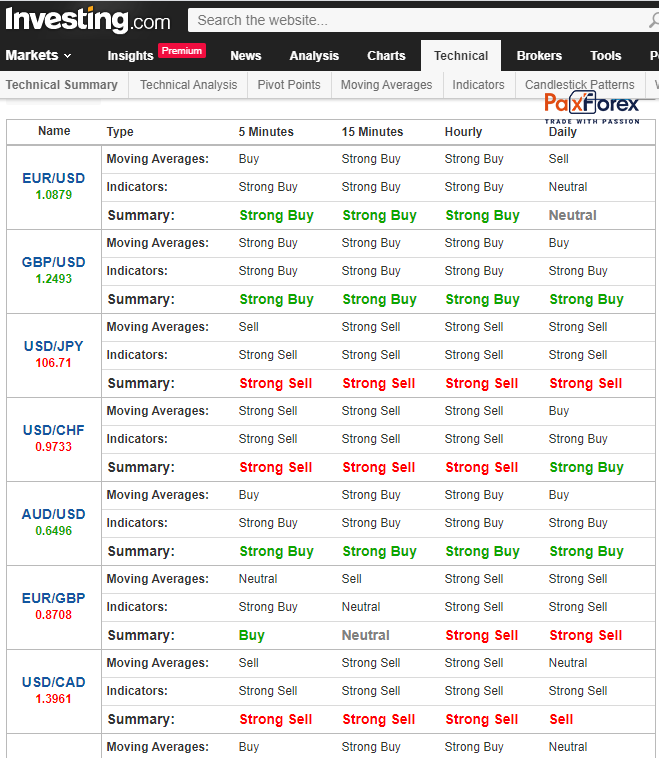

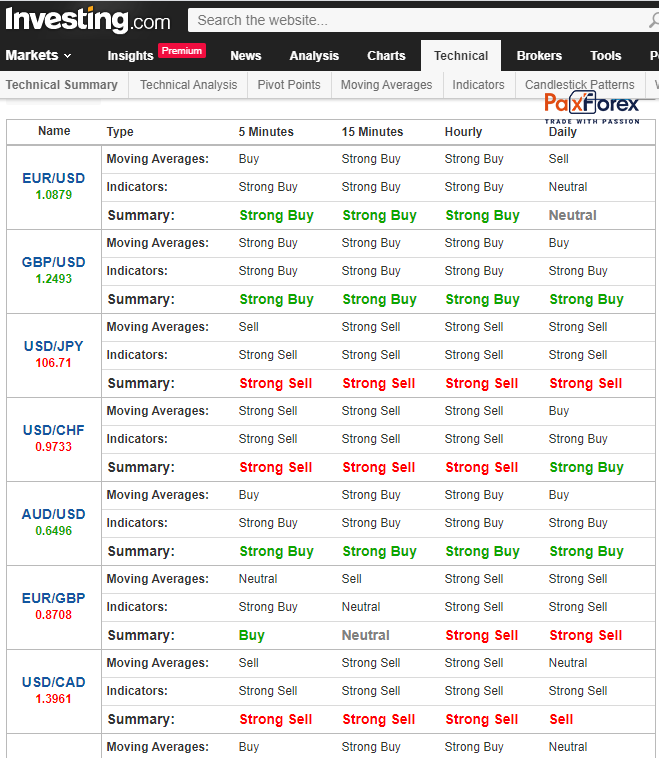

- Investing.com

One of the most famous and major financial portals. This site provides extensive economic information on all financial markets. It is more than just a convenient economic calendar and a platform for traders to share their opinions. It can be called an aggregator of a huge array of data on all asset groups. For all types of instruments without exception, you can find here solid analytics in different languages, technical assessment of the market situation. But that's not the main thing: at investing you can get comprehensive statistics on stock market instruments, which is invaluable for an investor.

As trading signals, you can use the "Technical Summary " section. Here you can choose almost any asset. You can choose from over 500 different currency pairs, including gold and silver, indices (over 250), stocks (over 50), futures (over 180), and commodities (about 100).

The analysis is based on indicators on various time frames, which give signals. The signals are presented in a simple form: buy, strong buy, sell, strong sell. If you see that most indicators signal to buy, you should buy, if most indicators signal to sell, you should sell.

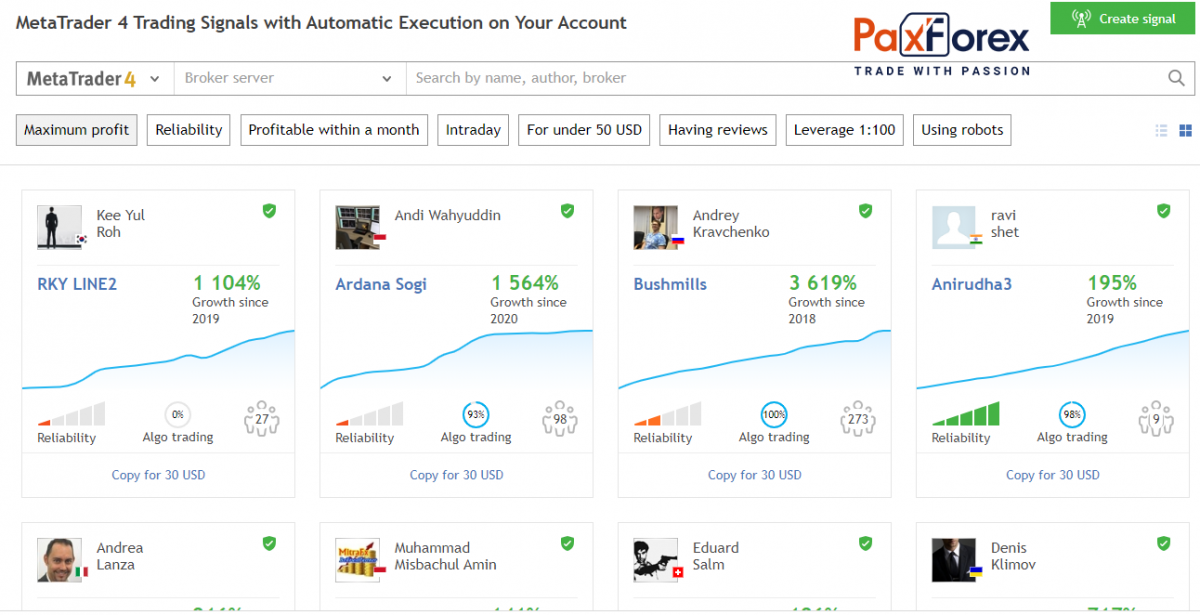

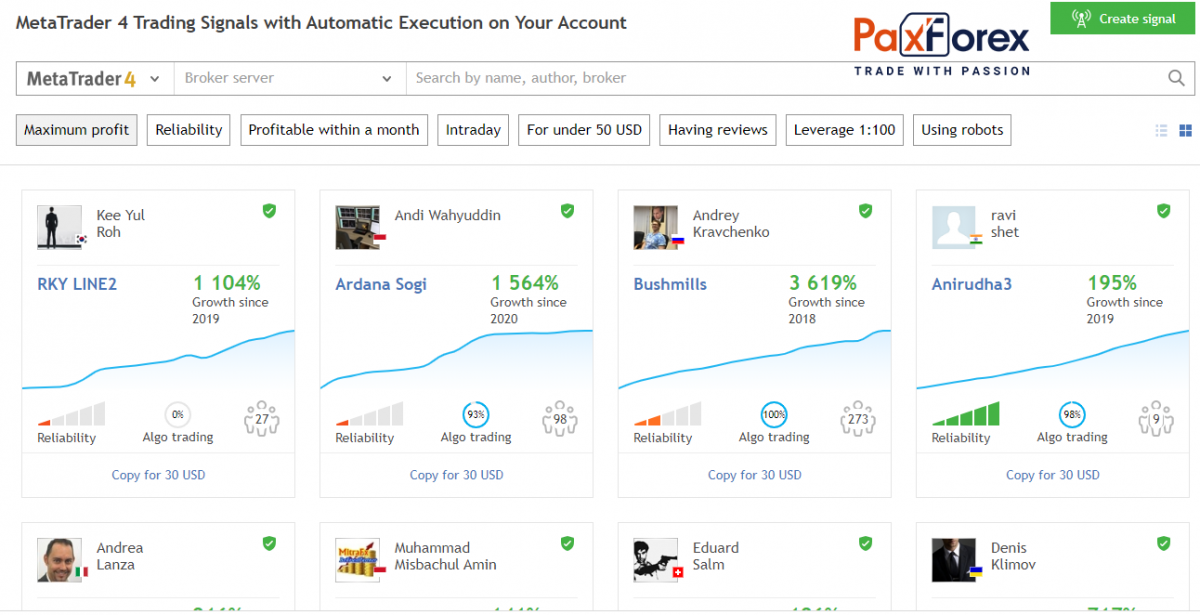

- MQL signals

This one is a very convenient service of trading signals, which you get immediately in your trading terminal. The solution from Metaquotes has a great advantage. As the signal service is provided by the developers of the MetaTrader 4 trading terminal.

Among the benefits of MQL signals are:

- The technical part is already integrated into the terminal.

The Metaquotes signal service is built into the Metatrader terminal by default, so everything works quickly and clearly. You do not have to deal with external software bugs.

- Synchronization of subscriber`s and signals provider`s accounts

It's a very interesting feature that tries to protect the subscriber from himself. The essence is that during the initial synchronization there should be no orders on the Subscriber's account. Otherwise, the system will not work.

Also, at first, the orders that are present in the signals provider's account will be copied only if their profit is negative or equal to zero. And there is a rule: one account=1 subscription to 1 signals provider.

Such restrictions are made so that a subscriber would not bring his account to a margin call by his manual trades or by subscribing to another signal provider.

If you want to subscribe to several signal providers, you should open several accounts.

- All signal providers are verified

Before a signal provider appears in the list, it must pass one month of the probationary period. If a provider shows a loss of 60% or more, its signals remain unavailable for the subscription.

Today, from a technical point of view, it is probably the most advanced solution on the market. And the global coverage (the Metatrader terminal is used by most traders) will soon provide a large number of both signal providers and subscribers.

- Paxforex Daily Trading Analysis

Some brokerage companies provide their clients with the best trading signals, PaxForex is not an exception. It`s free of charge and performance can be checked with the trading report is emailed every two weeks. The analysis is performed on the major currency pairs on the 30 minutes and 4-hour charts using RSI, Bollinger Bands, MACD, and MA of different periods. Recommendations given are easy-to-follow even for novice traders.

So, how to recognize best Forex signals provider among such a variety of choices? Is it worth using such services at all?

Obviously, to evaluate the prospects of using the service of trading signals (no matter, free or paid) on the Forex market, it is necessary to test them. This is the only way to understand what results can be expected in trading. Open a demo or Cent account and strictly follow the recommendations of the signals provider for two weeks. At the end of this period, you will have the statistics of signal performance. If you are satisfied with the results, you can use it in a real trading account. If the result is unsatisfactory, you should look for other trading signal providers

Summary

Taking advantage of a signal provider can contribute a lot to affecting your returns, so make sure to choose wisely. Subscribing to any of the paid services can be high-priced since first you will have to pay for the offer and only then find out if it satisfies you. Furthermore, keep up with the reviews provided by other users to see if it is trustworthy.

We wish you to find a reliable forex signal provider that will meet your expectations.