Source: PaxForex Premium Analytics Portal, Fundamental Insight

The UK BRC Shop Price Index for July decreased by 1.3% annualized. Forex traders can compare this to the UK BRC Shop Price Index for June, which decreased by 1.6% annualized. South African M3 Money Supply for June increased by 11.07% annualized. Forex traders can compare this to South African M3 Money Supply for May, which increased by 10.6% annualized. Private Sector Credit for June increased by 5.64% monthly. Economists predicted an increase of 6.50%. Forex traders can compare this to Private Sector Credit for May, which increased by 6.26% monthly.

The South African CPI for June is predicted to increase by 0.5% monthly and by 2.2% annualized. Forex traders can compare this to the South African CPI for May, which decreased by 0.6% monthly, and which increased by 2.1% annualized. The Core CPI for June is predicted to increase by 0.3% monthly and by 3.0% annualized. Forex traders can compare this to Core CPI for May, which decreased by 0.2% monthly, and which increased by 3.1% annualized.

UK Mortgage Approvals for June are predicted at 33.9K. Forex traders can compare this to UK Mortgage Approvals for May, which were reported at 9.27K. UK Net Consumer Credit for June is predicted at -£2.000B, and Net Lending Securities on Dwellings is predicted at £1.8000B. Forex traders can compare this to UK Net Consumer Credit for May, reported at -£4.597B and to Net Lending Securities on Dwellings, reported at £1.220B.

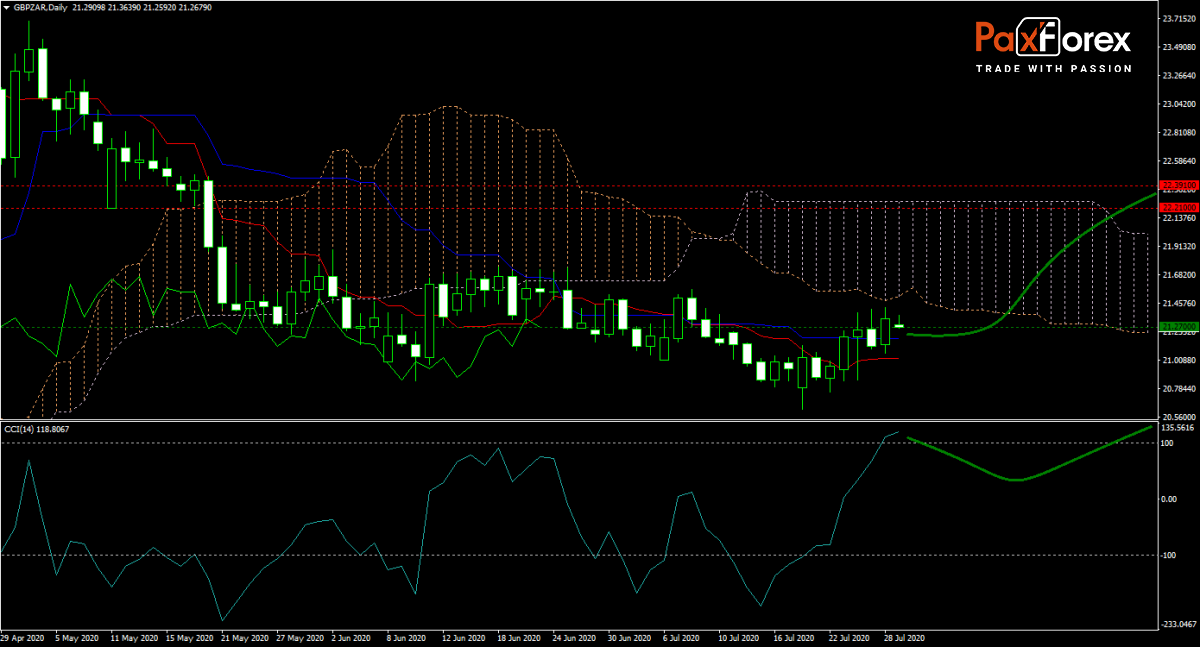

The forecast for the GBP/ZAR is increasing in bullishness after this currency pair rose above its Kijun-sen. Economic data out of South Africa suggests more difficulties ahead due to the rise in Covid-19 infections. It supports more upside in price action, which can move into its broad Ichimoku Kinko Hyo Cloud. Its next horizontal resistance area engulfs the Senkou Span B at the top of it. Will bulls be able to break into the cloud and force more upside? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/ZAR remain inside the or breakout above the 21.1770 to 21.4285 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 21.2700

- Take Profit Zone: 22.2100 – 22.3910

- Stop Loss Level: 21.0225

Should price action for the GBP/ZAR breakdown below 21.1770 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 21.0225

- Take Profit Zone: 20.6165 – 20.7535

- Stop Loss Level: 21.1770

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.