The coronavirus pandemic took investors around the world by surprise. Volatility on world stock exchanges has increased sharply, and to avoid unpleasant consequences, professional traders find it wise to buy dividend shares.

Indeed, dividend investing can be a great way to make a profit and increase your investment portfolio over time. If you focus on blue-chip companies that regularly increase dividends, a small amount of the initial investment may turn into a fortune over time.

For long periods of time, dividends can reward a patient investor in full. By selecting the right securities to add to the portfolio, the investor can obtain an almost guaranteed cash inflow. By the way, since 1929, reinvested dividends have accounted for approximately 40% of the total S&P 500 return.

We understand that deciding to invest in dividend-paying stocks is not an easy decision, left alone the choice of the best dividends stocks. That is why we have done some investigation. In this article, we will tell you by what criteria should best dividends stocks be selected, will have a look at the UK and USA stock with best dividends, and as a bonus will give you some tips on how to invest in stocks properly.

How to Invest in Dividend Stocks

Before moving to the central part of the article, let's find out how dividends work. Basically, for every share of a dividend stock that you hold, you are paid a piece of the company’s earnings. You get paid simply for owning the stock!

For instance, let’s say you own some Caterpillar shares, and the company pays an annualized dividend of $4.12 per share. Most companies pay dividends quarterly (four times a year), meaning at the end of every business quarter, the company will send a check for 1/4 of $4.12 (or $1.03) for each share you own. It may not seem like a lot, but when you have built your portfolio up to thousands of shares, and use those dividends to buy more stock in the company, you can make a lot of money over the years. The key is to reinvest those dividends!

What is a Dividend Yield?

The dividend yield is an essential factor in determining the true value of dividend stocks. This fact holds especially true when investors are seeking to derive dividend income from their investments.

It is an easy way to analyze the relative attractiveness of numerous dividend-paying stocks. It indicates the yield that investors can expect in case of purchasing this stock. The dividend yield is the relation between a stock annual dividend payout and the current stock price. Baring in mind the price fluctuations, the dividend yield is regularly changing.

To determine dividend yield, we need to apply the dividend yield formula - we divide the annual dividend by the current stock price.

Imagine there is a company A with the shares priced $100 and an annualized dividend $4.00, in this case, the yield would be 4%.

$4.00 / $100 = 0.04.

What Are the Best Dividend Stocks?

In order to buy stock with best dividends, one has to understand the basic criterion influencing the dividend yield. Hee are the most important indicators to pay attention to while choosing the best dividends stock to invest in:

Capitalization. An almost win-win situation is the blue chips. These are large companies with stable markets and business connections, so they can survive even long crisis periods.

Dividend yield. The success of the purchase also depends on the moment when the stock is bought. When it is possible to buy cheap with relatively high dividend activity - this is a perfect time to buy. At the same time, if the share price is unreasonably high and the dividend yield is low, it is better not to buy the shares at that point. It will make sense to wait or choose the shares of another company with a higher dividend yield.

Payout history. It's a very illustrative indicator. There is nothing much to discuss here - if a company has successfully pleased its shareholders with the payment of dividends for 10, 15, 20, or more years, we can assume that this idyll is very likely to continue. So it is best to invest in these stocks.

Dividend payout ratio. It sounds more complicated than it is. The payout ratio is a percentage of the profit that the company allocates to dividend payments. Some might think that the higher it is, the better for the investor. But it's not. After all, net profit is the company's principal resource for development. If, for example, all net profit is paid to investors, and there is no "safety cushion", there is a risk that the nearest crisis will bury the company. Therefore, if there is a calculation on long-term investment, the optimal indicator of P/E can be considered a figure up to 70-75%.

Prospects. If you need a big but short-lived profit, you can choose young start-ups that are experiencing a surge in demand for their product or service. For long-term investments, it is better to prefer a company whose products have been in demand for a long time, and according to analysts' reports will remain so shortly. One can focus on the nature of the product (at all times, people need food, hygiene products, basic benefits of civilization, etc.).

Ease of asset ownership. Undervalued by many, but essential criterion. For example, owning shares of IBM, each modern person will more or less navigate in a subject and understand the general picture. But having bought shares of some overseas Helmerich & Payne (a company engaged in drilling oil and gas wells), an ordinary person cannot be sure that he will be able to cope with the prediction of subsequent ups and downs in this industry.

It is profitable for investors to invest in shares in order to stabilize their income and reinvest in the acquisition of new stocks in the future. Most companies in the US and Europe are financially stable and mature, so it is possible that the value of their shares will increase, thus allowing shareholders to receive their payments regularly.

Advantages of investing in dividend stocks

Speaking of benefits, it is important to highlight the following points:

Effective diversification of the investment portfolio;

Guaranteed regular payments;

The prospect of increasing profitability through dynamic development.

Investment portfolio flexibility (hundreds of companies from different industries are traded on the stock exchanges);

Profitability (some companies can generate hundreds of percent per annum).

It is also worth noting the logic of the US stock market: economic reports are better than analysts' expectations, which is immediately reflected in the share price.

The second and third echelons on the NYSE though have their peculiarities, but follow the same rules as the American giants - Apple, Microsoft, General Electric, and others.

The Best Dividend Stocks in the United States

Today, the U.S. stock market is the largest in the world and the most attractive for investors. American companies like to pay dividends and are proud of it. For example, Coca-Cola has been paying quarterly dividends since 1920 and increasing dividends in each of the last 55 years. But Dover Corp is a record-breaker in payouts: it has been increasing dividend payments for 63 years.

So, using the criterion we have discussed above, here are some of the best dividends stocks to consider.

A List Of The Best Dividend Stocks For Income

Wells Fargo

Wells Fargo (NYSE: WFC) is one of the largest American banking holdings. Its share price is far from its highs, and it has a high dividend yield of around 7%.

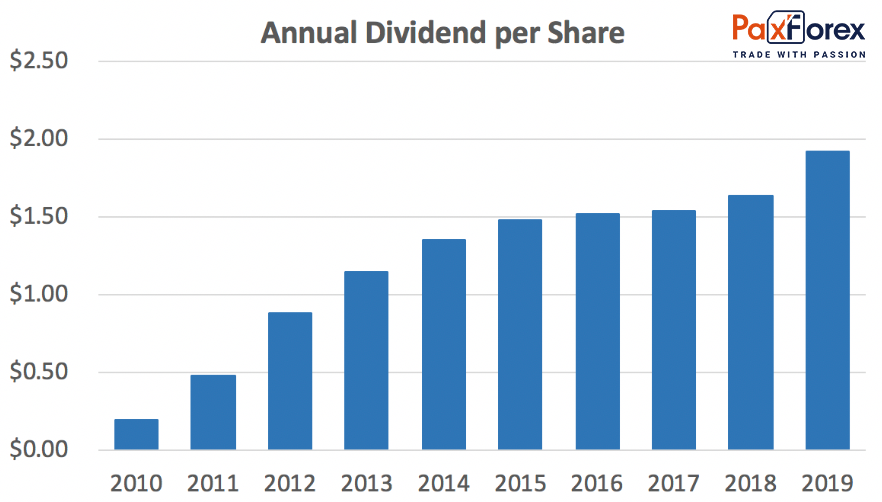

Wells Fargo paid investors $0.20 per share ten years ago, and over the last decade, the dividend has soared to $1.92 – an 860% increase.

The compound annual growth is 25.4% over ten years, but over the last year, the dividend rose 17.1%. Obviously, Wells Fargo might be a reasonable investment going forward. Let’s take a look at the yield.

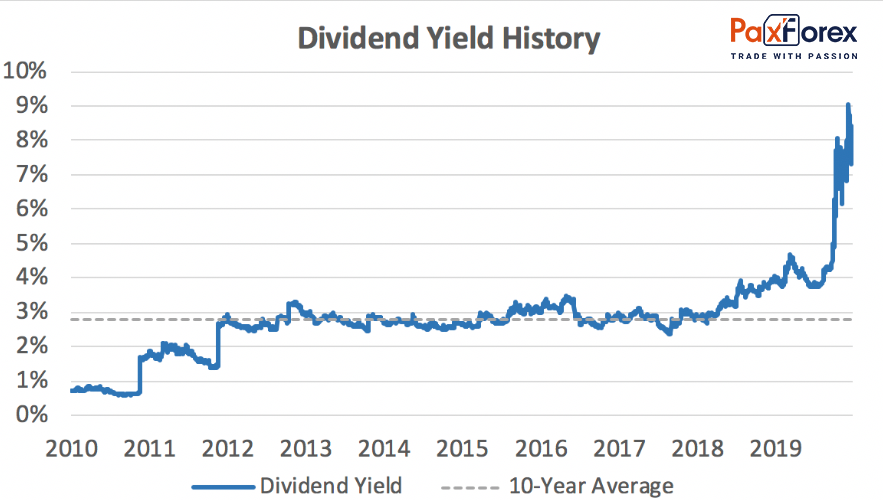

The dividend yield is 7.38%, quite above the 10-year average of 2.78%. The chart below shows the dividend yield over the last 10 years.

With the current situation in the world, the company may cut its dividend to save more money. But it’s not apparent if the economy as a whole accompanies the stock market’s quick recovery.

The bank`s long history of paying dividends makes it one of the best dividend stocks around, and it will likely continue for many decades to come.

Johnson & Johnson

Johnson & Johnson (NYSE: JNJ) is a $342 billion business running within the consumer sector and maintains a solid credit rating (AAA) from the S&P. It owns a portfolio of premium brands that make products people always need - specifically healthcare items. Johnson & Johnson gained the Dividend Aristocrat title, as it has increased its dividend for 57 years in a row.

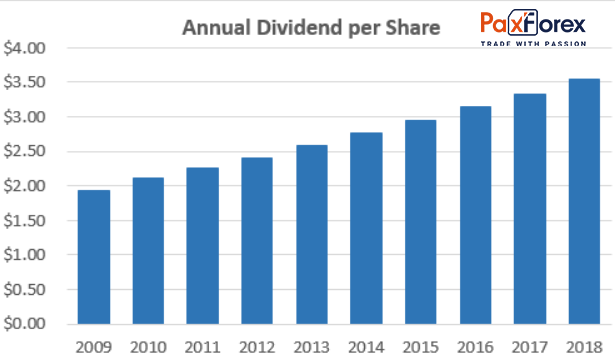

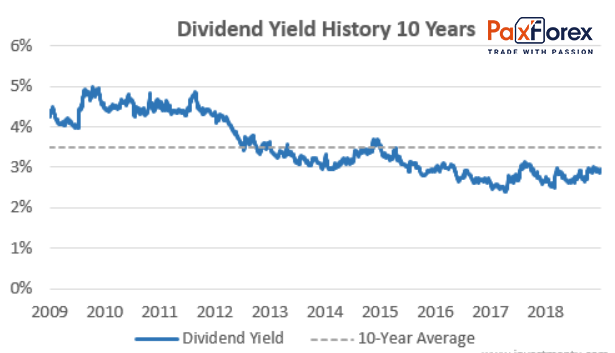

Investors were paid $1.93 per share in 2009, and over the last ten years, the dividend has climbed to $3.54, an 83% increase.

The dividend yield is at 2.93%, and that’s below the 10-year average of 3.5%.

The lower yield indicates that investors have bid up the shares price. They may be anticipating a higher increase and payouts.

The company had a problematic year in 2019. Because of the several opioid-related lawsuits, Johnson & Johnson’s stock has been volatile. Some investors are concerned that possible lawsuit settlements could impact the company's reputation. Notwithstanding the turbulent year, Johnson & Johnson’s dividend still might be a reliable investment.

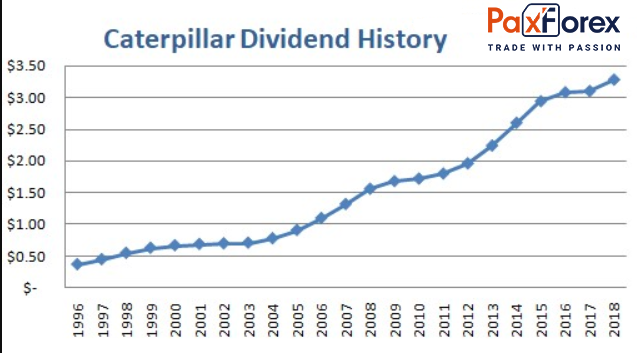

Caterpillar

Caterpillar is the world leader in the market of large machine building. The company's share in the world market of construction equipment reaches 20%, which is twice as high as the share of its nearest competitor - Japanese company Kamatsu.

Caterpillar's dividend yield is stable at 3%. The company allocates 35% of its annual net profit to dividends. In terms of free cash flow, Caterpillar's performance is excellent, reaching $7.45 per share. The current share price is about $139. So Caterpillar shares are a good choice for a dividend strategy.

The Best Dividend Stocks in the UK

It should be mentioned that the USA stock market is not the only place to find the best dividend stocks. A lot of professional traders opt to trade the UK stock market since it allows taking advantage of the most influential companies in the world. Consequently, no wonder some of the best UK stocks are highly correlated with the high-yield companies. These are some high dividend UK stocks that should be taken into account when choosing the stock with best dividends.

Unilever PLC

British-Dutch multinational Unilever is one of the world’s leading consumer goods businesses, selling some of the best-known food, cleaning, and personal care brands. It is a joint venture of Unilever NV (The Netherlands) and Unilever PLC (UK), the parent companies. Unilever's popular brands include Dove, Knorr, Lipton, Magnum, Omo, Cif, Slim-Fast, Iglo, Birds Eye, Becel, Blue Band, Unox, Calve, Conimex, and Lever2000.

With such a diversified portfolio of products, the company sells them worldwide, together with developing markets like Africa, China, and India. Consequently, Unilever is an influential candidate for one of the best dividend stocks not just in the UK, but in the world.

Like we have already mentioned, Unilever consists of two entities, and is traded at 3 stock exchanges: Unilever NV in NYSE and Euronext Amsterdam. Unilever NV, in its turn, is traded on the London Stock Exchange. While each stock exchange uses different currencies, some traders might use this feature to benefit from the difference in the exchange rates in Unilever shares price.

Nevertheless, probably the most advantageous property of Unilever is the increase in the price of its shares since 1990. The high dividends paid in the UK rarely coincide with such a steady stock value, but Unilever has both - increasing stocks and substantial dividends (£1.35 per share). Of course, it will not last forever, but right now, it is definitely worthy to be added to the list of best dividends stocks.

GlaxoSmithKline

GlaxoSmithKline is a UK-based pharmaceutical holding operating internationally with major production facilities in the UK, Spain, Ireland, the USA, and Singapore, with its shares listed on the LSE and NYSE under a single GSK ticker. The corporation was formed after the merger of two pharmaceutical companies, Glaxo Wellcome and SmithKline Beecham, whose names are derived from the founding businessmen John Smith and Marlon Klein.

GlaxoSmithKline produces a variety of medicines, including vaccines against HIV, tuberculosis, and malaria.

Today, GlaxoSmithKline is a large pharmaceutical group with many divisions specializing in various areas of pharmaceutical and medical science.

Investors can easily add GSK to the dividend watchlist since the company has a 4.98% dividend yield. Nevertheless, the higher dividend yield comes at a toll. As practice shows, pharmaceutical businesses' shares can be extremely volatile, since billions can be wasted as a result of failed clinical trials.

The Best Dividend Stocks in Europe

If investors focus too much on American companies, they may miss out on the many attractive investment opportunities offered by markets in other parts of the world. To help some of them broaden their views, let's look at three European companies, each one offering an attractive combination of dividends with returns over 3% and long-term growth prospects.

BASF SE. It is the world's largest chemical company with its main production facilities located in Germany. From 2010 to 2019, the company increased its dividend per share from 1.70 euros to 3.20 euros. The average dividend payout is 5-8%.

Volkswagen. The German car concern was in the epicenter of the scandal because of the emission of its diesel engines, which caused the stock quotes to collapse. However, this temporary phenomenon is a good opportunity to invest in assets and expect the business to recover with the prospect of higher quotes and higher dividend yield. The most recent dividends were at 4-5%.

Publicis Groupe SA. It is the European leader in advertising communication technologies. It pays 3-9% of its dividends steadily, and its shares have growth potential in the long term.

Total. It is a European oil and gas company, headquartered in France. To date, large amounts of investments have been made in wind energy development, as well as in the opening of new wells for oil production. Despite the crisis period, there was no decrease in dividends (5-6%), which speaks for reputation and guarantees for shareholders. So far, the shares remain undervalued, which allows new investors to consider buying them.

Michelin. It is a world-known brand of quality car tires. The shareholders of the company receive a stable dividend payment. Recently, due to the crisis conditions, it has been reduced from 3.85 to 2 euros per share. However, quotations now make it possible to buy stocks at an advantageous price.

Novartis. A pharmaceutical company with a subsidiary focused on the production of eye care products. Right now, the business is going through some bad times, and the share price is around 2014. Nevertheless, there is potential for recovery and a new wave of development. It is a good time to invest in assets and to receive stable dividends from 3.2% in the future.

How to Buy Dividend Stocks

In order to invest in stocks, investors should have a trading account giving access to the market itself.

PaxForex offers a wide range of American stocks, as well as Forex, commodities, and cryptocurrencies, which will be quiet beneficial for those who want to diversify the portfolio.

You will be able to create an account within 2 minutes and get access to a secure and functional platform to trade and generate substantial profits.

If you want to diversify your investment portfolio, it is also possible on the trading platform, where each client is provided with favorable conditions for trading:

A broad selection of shares;

Leverage for securities up to 1:4;

Low entry threshold to the market;

The ability to invest with even a small initial capital;

Effective portfolio diversification;

Possibility to short the assets;

The most popular tools are available for competent analysis and making profitable trading decisions.

Three simple rules when buying dividend shares:

Past income does not guarantee the same future income

High dividends for one year do not guarantee their payment in the future. The company's earnings may change, the profit may decrease, and the value of dividends paid may decrease accordingly.

It does not always make sense to buy shares of a company that can pay high, but one-time dividends, and in the future, due to deteriorating financial performance will not be able to maintain their level.

The main thing is the constant cash flow.

It is better to make a dividend portfolio of those companies that can generate consistently high cash flows and are willing to share them with shareholders. It is also necessary to consider the debt burden of the company.

Make your own decision.

When choosing an object for investment, the investor should not rely solely on advice, albeit from professional consultants. It is necessary to study the financial statements of companies on their own - it will help to project the dividends as well.

Conclusion

The stock market is an attractive and advantageous area for investors to ensure prosperous investment and stable income in the long term. By choosing among the companies described above, you can become a member of the global business and receive dividend payments. Besides, the purchase of shares allows you to diversify your portfolio and distribute financial risks wisely.

Of course, investing in stock with best dividends is certainly not the main thing for investors. Even a conservative strategy can show profits higher than dividend payouts. Nevertheless, if one chooses between a bank deposit and investments in stocks, stocks certainly win. A dividend strategy for investing in stocks is a good assistant to a stable profit.

When you invest in stocks, you become the owner, and even if the company you loses market value, it is always possible to receive those dividends. And if the price of the shares skyrockets, the profit will definitely exceed the conservative bank deposits many times.