It is known as the most famous search engine and browser in the world. Everyone, who has the Internet, has heard about it. The most popular operating system installed on most smartphones around the world.

It's all Google. Alphabet`s subsidiary actually, but that's not the point. A technology giant that's penetrated almost every home on the planet. Google is rapidly developing from year to year and acquires a large number of sub-companies, start-ups, and services. The annual profit of the corporation for 2019 made up 162 billion dollars! At the same time, Google's (Alphabet`s) market capitalization is over $1.044T. Not surprisingly, the shares of such firms in the top of popularity. Having such an asset in your portfolio, you are not afraid of any difficulties and crises. Although any business has problems, IT giants such as Google have successfully overcome any obstacles and are rising even faster.

Let's have a look at Alphabet shares price today - we will analyze the stock situation from different angles, will find out how to buy the shares, as well as the perspectives of this tech giant.

What Is Google Alphabet?

Larry Page and Sergey Brin worked at Stanford in 1996, creating a digital library for their home university. As a result, they created a new search algorithm with data ranking, which went to the domain google.com.

Two years later, they received their first investment as a startup. Two more years after they started selling advertising. The company's revenue grew rapidly to hundreds of millions of dollars. In 2001-2010, on a wave of rapid growth Google has bought more than 100 projects, most of which are successfully operating today.

In 2004, Google became a public company by placing its shares on the stock exchange.

Those who want to invest in Google shares should know that the corporation has changed its name since October 2015. As a result of the restructuring, a conglomerate Alphabet Inc. was born, which, in addition to Google, owns Android, YouTube, and other assets. After the official restructuring, Google shares were converted into shares of Alphabet, but on the stock exchanges, they continue to be listed with the GOOG ticker.

Google's main product is the development, use of Internet technologies and software. First of all, it is a search engine, Chrome browser, and the Android OS for mobile devices. There are more than 30 Internet services in operation. Besides, the holding produces mobile devices and is engaged in investment activities. It works in the field of renewable energy technologies and biotechnology.

So how does Google earn $100 million a day? First of all - it's advertising, and 94% of the income of the holding depends on advertising revenue Ad Words and Ad Sense, and this even against the background of declining average price per click. That is, all essential services, search engine Google, Android and YouTube, revolve around advertising.

Additional revenue comes from affiliate programs and the sale of your own devices: Chromebook computers, Chromecast digital media players, Google Cloud services, and Google Play app download directions.

Google has the advantage of linking ads to search queries, but there's no such thing as targeted advertising as Facebook, where the collection of customer information will be more extensive.

The company is also looking to the future, investing in the development of such areas as artificial intelligence, Waymo self-driving cars, infrastructure for broadband Internet access GoogleFiber.

To date, Alphabet shares are included in the calculation of such stock indices as NASDAQ 100, NASDAQ Comp., S&P 100, S&P 500, and others. The use of shares in the calculation of the most popular indicators of the American stock market makes them attractive assets for investment.

How Do I Buy Alphabet Shares On The Stock Market?

Securities of the most reliable and liquid companies providing stable income to their shareholders were called blue chips. If you decided to choose them, let's try to figure out how to buy Alphabet shares?

If you are not a dollar billionaire and are not going to get a job in Google shortly, the only way to buy stocks is through a CFD broker. Everyone interested in investing in securities, it is vital to find a reliable brokerage company, without which it is impossible to take advantage of the stock markets.

So, once the broker is chosen, open an account, verify it by sending documents required and make a deposit. Now you have access to the trading terminal and just moments away from buying Alphabet shares. Follow these instructions:

Log in to your PaxForex account in MetaTrader 4;

Click on the Market Watch tab or Ctrl+M;

In the Symbols list find #Google and double-click on it pay attention that the asset is the US-based, so don't get confused when it is not available in non-operating hours or when the price is not moving);

In the New Order popped-up window, specify the trading volume and click BUY.

Trading terminal is an essential tool for every trader since it allows to:

Watch Alphabet stock price in real-time;

Check the historical fluctuation of Alphabet shares price;

Place an order by longing and shorting the asset;

Analyze the market situation;

Monitor and adjust open positions;

Close positive or negative positions.

Stocks CFDs are a great solution for everyone willing to make the most out of any situation on the market, no matter if the stocks are decreasing or increasing in the value.

Shorting Google

In order to place a short position and sell Alphabet shares CFDs use this instruction:

Log in to your PaxForex account in MetaTrader 4;

Click on the Market Watch tab or Ctrl+M;

In the Symbols list find #Google and double-click on it pay attention that the asset is the US-based, so don't get confused when it is not available in non-operating hours or when the price is not moving);

In the New Order popped-up window, specify the trading volume and click SELL.

With the PaxForex trading account, one can get access to the most famous US stocks and take advantage of all the benefits of CFD trading.

Alphabet and Google Have an Evolving Business Model

The creators of the American giant managed to create a unique business model that generates billions of dollars.

Google is currently the most powerful search engine in the world. At the same time, the service is free for users - this is the original idea of the developers. It was made possible thanks to the competent monetization of advertising using Adwords and Adsense services. They allow publishers to monetize their content, and entrepreneurs to find potential customers with minimal time and money costs (advertising with payment for the result).

Furthermore, with a purchase of YouTube 14 years ago, Alphabet boosted its market share in online advertising so much so that it' s become the world's dominant business leader in this area.

Eager to decrease the reliance on advertising, it has also advanced in new technologies such as Chromecast for wireless video streaming, Chromebook for laptops, and the Android operating system which is deservedly considered to be one of its golden geese.

The complementary nature of advertising and technology has given the tech giant an honorable place in people's daily lives. At the same time, companies see it as an excellent means of communication to advertise their products and services, thus gaining recognition and better customer orientation.

Technical Analysis of Google's Stock Price

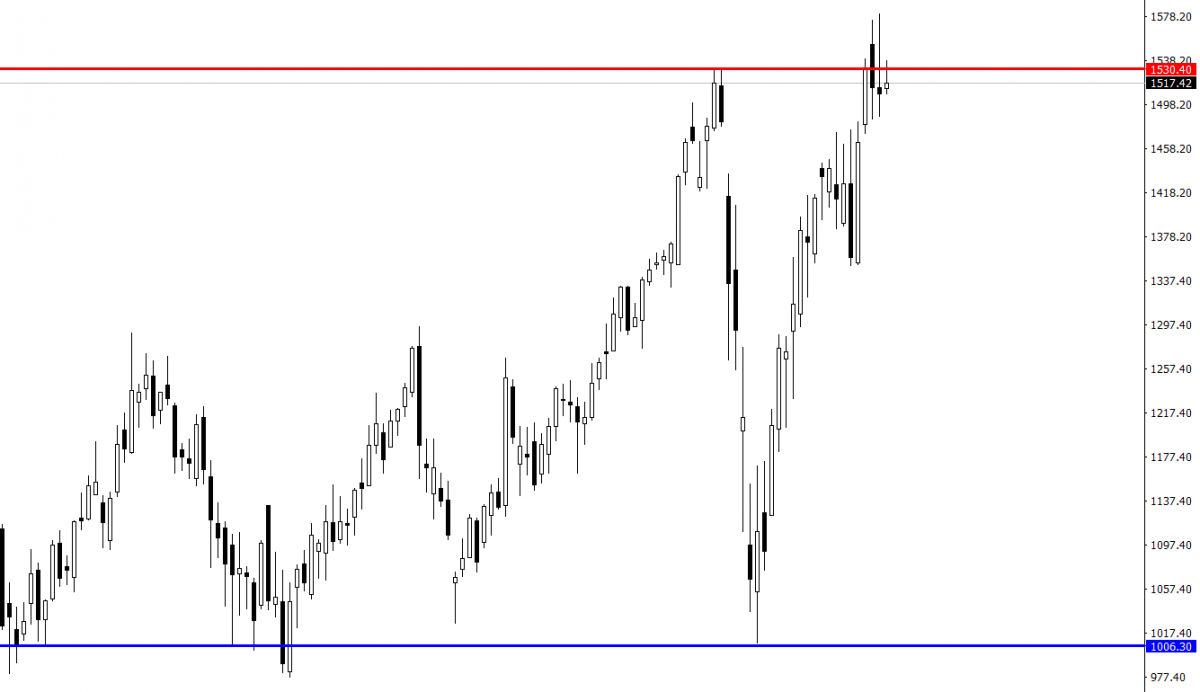

To perform the technical analysis we are going to use the weekly chart of Alphabet shares.

You can see that the buyers aimed at the level of 1580 and tried to get close to it twice. In February 2020, they reached 1525 on optimism and volumes, and after the positional battles in a month, they pulled back down to support levels around 1006.30.

In July 2020 - the second attempt, which sellers easily repelled and increased the price below 1100 at high trading volumes. More than likely, short positions were opened at maximum levels.

For today the buyers don't have enough forces to make a real assault of the level 1580, the sellers have to work out at least short-term shorts, driving out quotations for support around 1350. And suddenly the buyers are lucky, the up-trend defense won't resist, and the next target of decline will be 980. Position balance in the corridor 1350-1530. This is how the situation can be characterized in terms of technical analysis.

Analysts of large investment structures are mainly enthusiastic about the prospect of Google stock price rise above 1600 in the investment corridor for the next year. For example, according to J.P. Morgan analyst, Doug Anmuth, Alphabet share price should be above $2,000, which is 35% higher than the current share price.

Google Alphabet Profits disappoint in Q1 2020, but outlook reassures

In the first quarter, Alphabet increased revenue by 13% to $41.2 billion, which was above market forecasts. The average estimate among financial analysts surveyed by Refinitiv was $40.3bn. Alphabet's net profit for the three months increased to $6.8bn, while earnings per share (EPS) for the quarter was $9.87.

Despite the slowdown in economic growth due to the pandemic, Google advertising revenue rose 10% to $33.8bn. However, Alphabet CFO Ruth Porat warned that in March the company recorded a slowdown in advertising revenue, and the second quarter will be challenging for the advertising business.

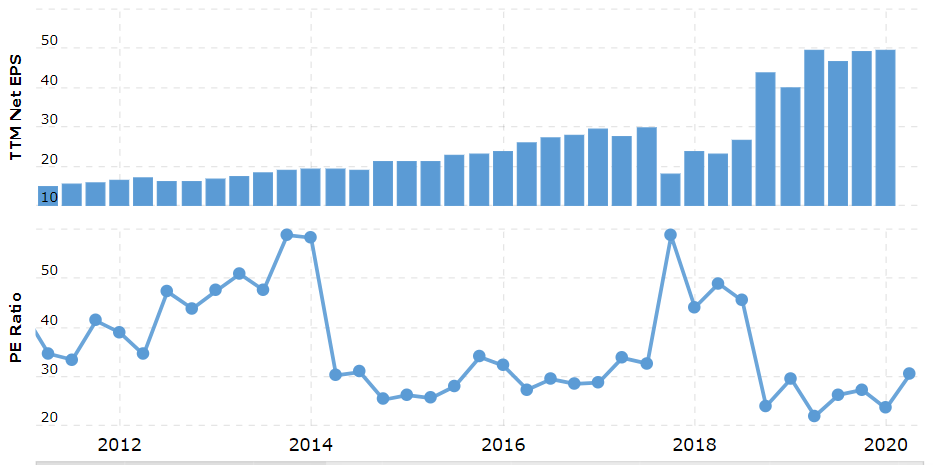

Experts expect the Alphabet's revenue to increase due to the recovery in consumer demand and increased activity of advertisers. Credit Suisse Bank increased its estimate of revenue growth in the search segment (Search) for the second quarter of 2020, while revenue forecasts from YouTube remained unchanged, and the estimate of revenue from the Google Network segment was reduced. Alphabet EPS is estimated to be $46.52 in 2020 and $54.96 in 2021. The company will present its second-quarter results on July 30.

Google's direct response ads continued to grow

Direct response ads on YouTube (also part of the Alphabet group) remained popular throughout the quarter. Advertising revenue on YouTube was $4.04 billion, a 33% improvement over the previous year. Officials said YouTube's revenue growth remained steady until mid-March when the coronavirus officially became the global pandemic.

The performance gap between branded and direct response advertising (which is designed to encourage viewers to take action, such as visiting a website or making a purchase) was noted by the Financial Director Ruth Porat. While branded advertising has slowed down, direct response advertising "continued to show strong year-on-year growth throughout the quarter".

Confinement encourages massive online engagement

People are increasingly counting on Google services as existing travel restrictions adjust their behavior, Pichai said.

He noted that Coronavirus research activity was incredible, reaching a peak four times higher than during the Super Bowl. Downloads of Android apps climbed by 30% between February and March, and YouTube viewing time "increased dramatically."

He also stated 100 million students and teachers now use the Google Classroom, twice as many as in early March.

Google search expected to recover quickly

Also, Alphabet CEO noted during the earnings call that Google search advertising is definitely bringing higher yield on expenditure than any other type of promotion, as businesses are able to get results right away. It helps advertisers to see which campaigns are fulfilling their function, and if something is not right, they can promptly react accordingly.

Alphabet Controls Costs

Porat and Pichai vowed to reduce staff and money spending. Generally, the investment will suffer a modest cut this year as the tech giant is going to decrease global office space, acquiring office buildings will be put on hold, as well as construction delays are expected.

Moreover, according to Porat, Alphabet has tightened its staff estimate, which was supposed to be increased by 20 percent, but it was before the pandemic and following economic crisis. This headcount reduction is to be implemented in the third quarter.

Alphabet Chief Financial Officer also backed up CNBC's preceding news that the company was going to cut some of its marketing funds. As per Porat: "In terms of marketing, advertising, and promotion costs... It all has been reduced from our previous plans at the beginning of the year. Since any physical activities are not to take place for most of the year, marketing expenses will also be decreased."

Share Buybacks Continue

Ruth Porat also stated that the Alphabet share buybacks would proceed as outlined previously. The company management is sure that the re-acquisition will boost the share price by rising earnings per share.

She noted: "As I highlighted earlier this year, we intend to buy back the shares at least at the same pace as in the fourth quarter of the previous authorization, and it is still our priority for the second quarter."

Google Financial Analysis

Once we have covered the fundamental and technical picture around Alphabet, it's time for us to move to figures. It may be even the most essential part of the analysis before deciding to invest in Alphabet shares. Each trader should do due diligence while reviewing the company's financial background and track record. An Alphabet balance sheet can help investors decide what a tech giant is really worth, warn of any potential problems (if any), and help to make a sound investment decision to buy or not to buy.

While going through the track record, we will analyze the Alphabet with the help of:

Analysis of Alphabet Revenue

Alphabet Earnings Per Share Analysis (EPS)

Google's Profitability Analysis

Google's Cashflow Analysis

Analysis of Alphabet Revenue

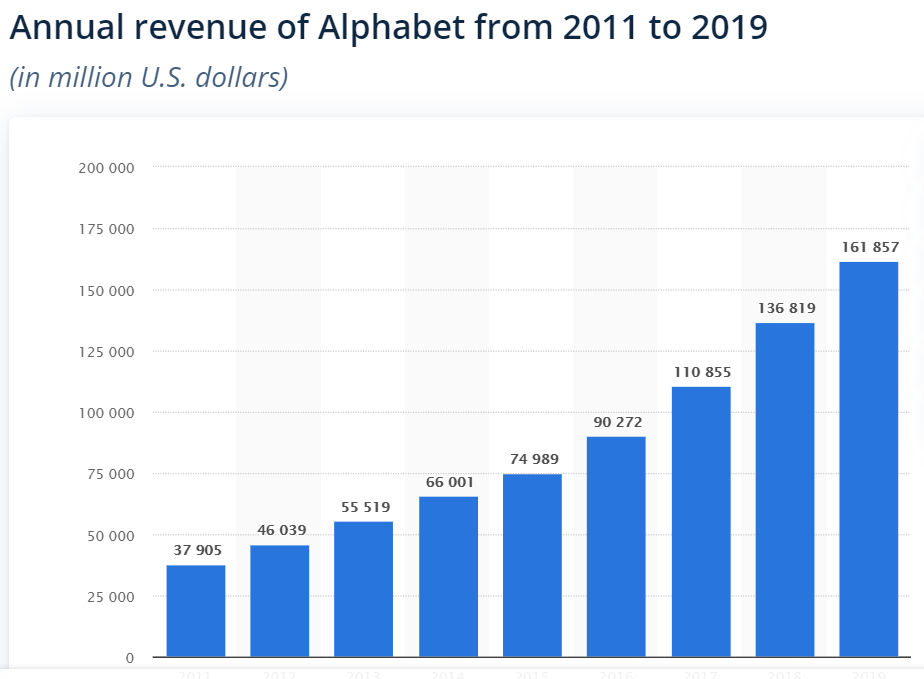

Revenue of the company is a crucial criterion allowing investors to estimate the current situation in the company - either it is in a good shape or necessitates some adjustments.

In the most lately reported fiscal year, Google's revenue amounted to 160.74 billion US dollars, which is 18% more than in 2018 (20% including exchange rate). Alphabet revenue is mostly made up of advertisement revenue, which amounted to 134.81 billion US dollars in 2019.

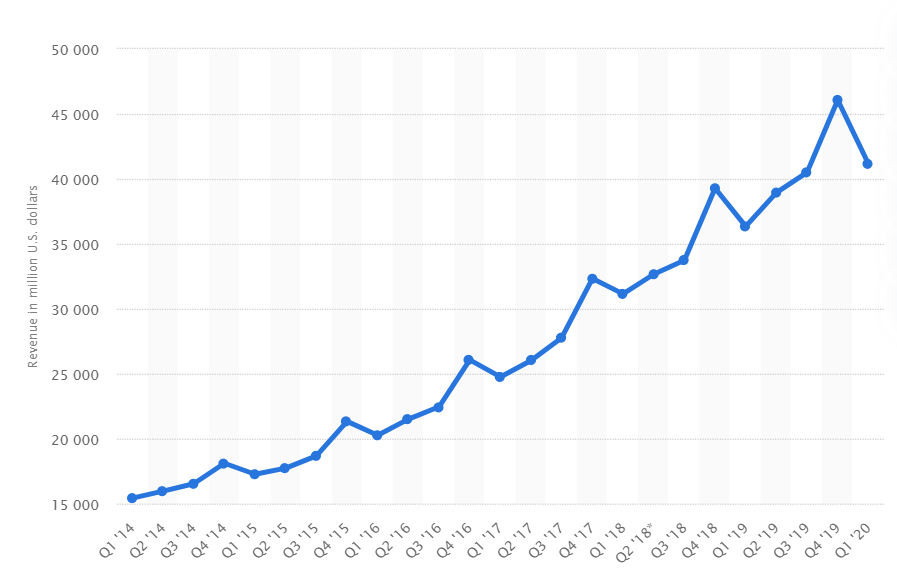

A key moment in analyzing the company's finance is to check not just figures for one year, but view it in terms of progress.

In the chart below, we can have a look at the Alphabet revenue for the ten years between 2009 - 2019:

As it is shown on the chart, Alphabet showed an impressive increase, which is a cornerstone of a company`s health. In the case of Google's parent, this growth is explained by the large-scale implementation of online advertising. Indeed, the advertising market shows steady growth rates, which also adds to the optimism of investors and provides significant support for Google stock value today. According to some studies, the global market may grow from $333 billion in 2019 to $517 billion in 2023. Good news for Alphabet, isn't it?

Another distinctive feature of Google is that it overcomes the business models of established marketing giants such as Publicis, Omnicom, and WPP.

Google's EPS Analysis

The earnings per share metrics are one of the principal variables in defining a share price. A higher EPS designates more value because investors will pay more for a company with higher profits.

EPS is calculated as the net income (also known as profits or earnings) divided by the available shares. The number presents an indication of how much profit the Alphabet shareholder makes for every share owned.

As you can see in the diagram, there was a decline in Google EPS in 2017. It occurred due to the imposition of fines by the European Union for abuse of dominance. It was an extraordinary situation, and in other respects, Google's EPS growth looks very solid over the last ten years.

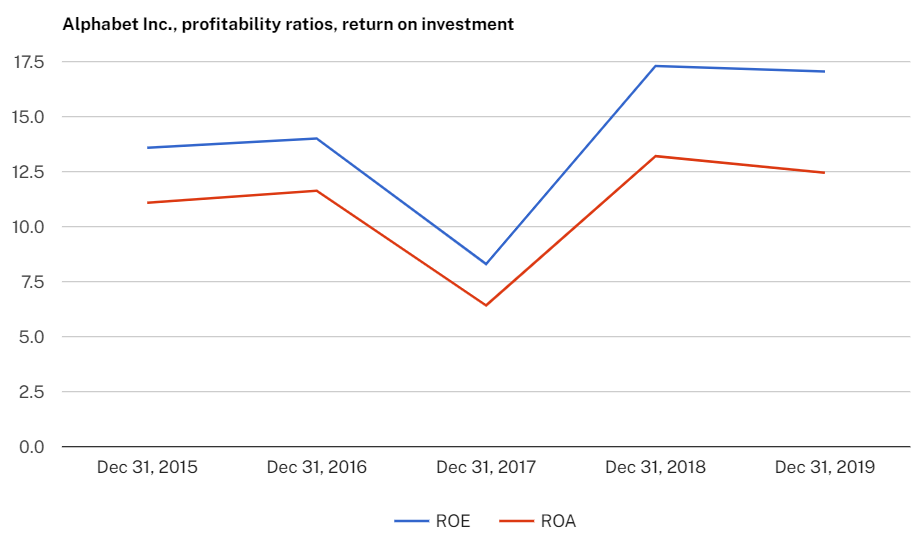

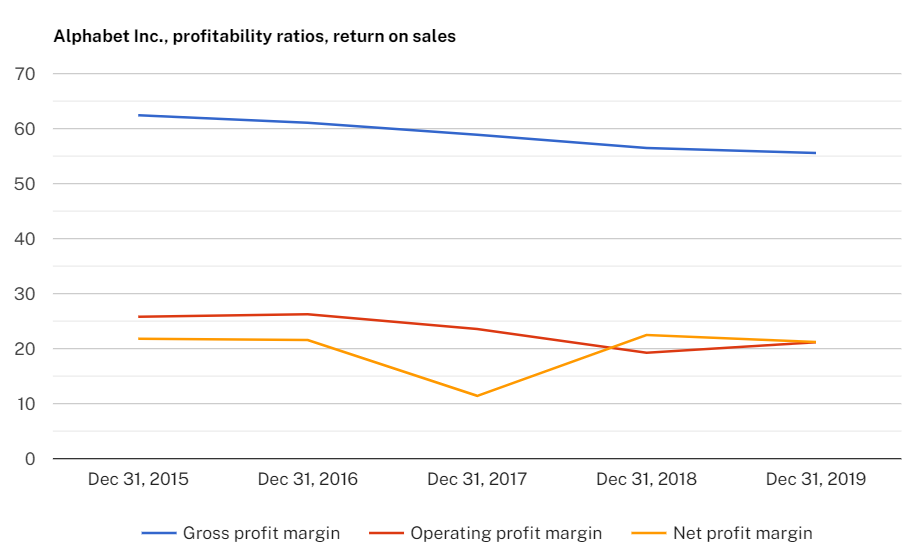

Google's Profitability - Margin Analysis and Alphabet Profitability

Google is one of the most valuable public companies in the world, after Amazon and Apple. As of January 16, 2020, Google's parent company Alphabet Inc. became the fourth company ever to reach a $1 trillion market value.

Powered by the high profitability of its AdWords and AdSense products, Google stands as one of the five most valuable businesses in the world. Notwithstanding some investors' outlooks that Google's other projects are driving down the profitability of the company, its diversification of main business groups still takes the company to reach new financial milestones.

Though Alphabet operates an incredible business model providing a sufficient operating margin, there is some general decline.

Does it mean that a company is in a tough position?

The reason for the decline in operating profit is pretty easy to pinpoint - the company faced rising expenses. It does make sense since the company is investing in its new technologies, including AI and cloud solutions.

The Alphabet CFO commented that: "We run our business for the long term and not on a quarterly basis. We remain very focused on continuing to improve the experience for users over the long term.

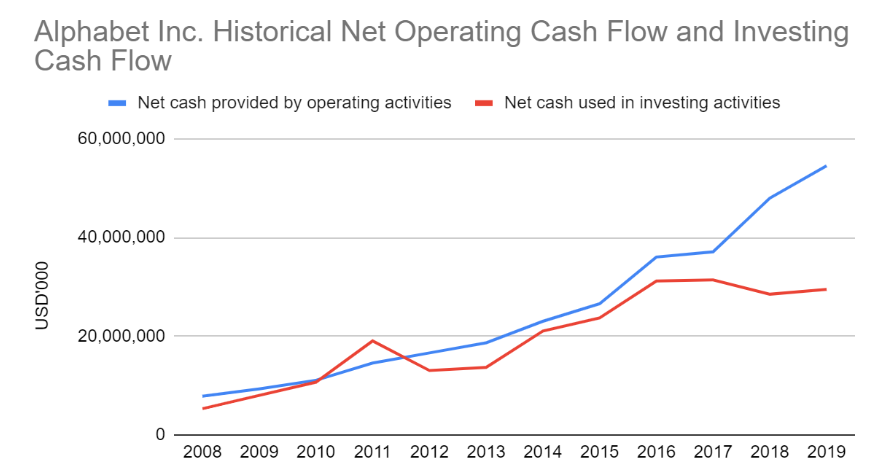

Google Alphabet Cash Flow Analysis

The cash flow statement (CFS) ranks how properly a company handles its cash position, indicating how well the business generates cash to cover its debt obligations and back its operating expenditures. That is why it is under the constant attention of investors.

Alphabet operating cash flow has increased significantly over the last decade, meaning that cash flow is not something shareholders should be anxious about.

And taking into account all the subscription services, we can assume that constant cash flow is guaranteed in the long run.

Alphabet shares dividends

Traders working with shares of GOOGL and GOOG of this American issuer make a profit from fluctuations in the stock value. Google Inc. has not paid dividends since 2006, and Alphabet Inc. holding has not paid dividends since 2015.

It might be due to the desire of the corporation's management to direct all profits to business development, as well as to acquire other companies operating on the Internet. The absence of dividend payments reduces the attractiveness of the issuer's securities among such market participants as pension funds and other organizations related to collective investments.

How to Trade Google Stock?

Creating an account with PaxForex, you can trade the Alphabet shares with the help of CFDs. CFD trading gives you a lot of advantages, including access to margin trading (1:4), the ability to take advantage of the falling market by opening a short position, and low initial capital requirements.

Alphabet shares in 2020

2020 Google has met one of the most technologically advanced companies in the world. In addition to the traditional advertising and media business, it is developing in some other promising areas. The divisions of the corporation have made significant progress in quantum computing, declaring the achievement of the legendary quantum superiority - the computing capacity solving problems beyond the control of ordinary computers. Google is one of the world leaders in the development of artificial intelligence. The company's biotechnology divisions are working to extend the life and improve human health.

The real "black swan" for the value of Alphabet shares was the coronavirus pandemic, which collapsed financial markets in late February and March 2020. Google lost more than $400 in a couple of weeks, falling from a yearly high of more than $1500 to $1053. Alphabet has not seen such a sharp drop in its history.

However, the sharp drop is not so surprising in the context of global markets because, at the same time, the S&P 500 lost over 40%. No security in the index could hold out above the 50-day moving average.

Numerous frightening forecasts for the global economy in 2020 are playing against Google stock quotes today. The IMF, OECD, and influential economists estimate that global GDP could lose up to 2%, which is even worse than during the 2008-2009 crisis. Naturally, the digital advertising market, which is the main market for the corporation, has also been threatened by a sharp decline.

Google's Future Prospects

The development of Google Inc. and the holding company Alphabet Inc. in the future is likely to focus on strengthening the business on the Internet, as well as in mobile technology, in particular, the further development of new versions of the Android operating system and applications for it. Besides, it is planned to actively develop a specially created platform, known as Firebase, designed for mobile software developers. The software created using this platform can be installed on portable devices running both iOS and Android. All of this can significantly improve the revenue forecast of an American company.

Shortly, it is likely that the advertising system on projects owned by Google Inc. will be changed. It is due to increased competition on the Internet among a large number of principal players, which include search services, social networks, video hosting, and other companies. The change in the advertising system may lead to an increase in the dynamics of the Alphabet shares price.

The main share growth drivers are:

improvements in the Google ad display system. The company is regularly working on the effectiveness of this product. One of the latest updates is the introduction of artificial intelligence;

income from projects not related to search - YouTube, Cloud, and Play. For example, in the first quarter of 2020, the total revenue of YouTube increased by 23% to $4.4 billion. It is more than 10% of the income of the entire holding for the same period;

monetization of other products such as Google Maps. The ecosystem of the IT giant provides opportunities for the development of smaller projects with a larger potential audience.

By the way, Credit Suisse analysts gave the highest forecast for Alphabet shares price among the experts surveyed by Refinitiv service. The consensus price forecast is a few percents higher than the current share price of $1609.5. In this case, 32 analysts recommend buying shares, and four - to keep the shares in the portfolio.

The financial situation of the Internet giant is not very worrying. Low debt, high cash flow liquidity, and huge cash reserves create a reliable financial cushion during the crisis.

In terms of risks, any asset involves risk. In the case of Google, we should mention a couple of episodes:

The drop in quotes in 2004 (this was due to the release of a large shareholding on the market);

The decline in the company's earnings in 2017, when the European Commission imposed a huge fine on the corporation for violation of anti-monopoly legislation.

However, as time has shown, the company can quickly cope with temporary financial problems: the share price is again showing positive dynamics.

Promising Alphabet projects

The stability and development prospects of Alphabet company are ensured by a successful business model, where most services are free and used everywhere: Android mobile operating systems, which are distributed free of charge, and Google Chrome browser, which is used by 70% of people who go online. This massive popularity creates a huge client base to promote their own products and generates sources for Big Data databases, thanks to which there are competitive advantages of end-to-end market analysis and super scalable targeting, ranging from global advertising campaigns to sniper targeting for a particular home or even a person. The cherry on the cake Alphabet inc is the production of its own line of smartphones Google Pixel.

The popularity of these phones is constantly growing.

The rest of the Alphabet projects, despite their large number, do not yet bring significant income. The share of the profit generated by these companies does not exceed 0.5% of total profit. However, a subsidiary company of X Development LLC, a semi-secret laboratory that specializes in "brain-dealing" technologies, must be singled out. By the way, they were considering such projects as a space elevator, teleport, and flying skateboard. None of these projects have been developed due to economic inexpediency or lack of necessary technologies.

Nevertheless, thanks to this company, such revolutionary projects as:

Waymo - autonomous vehicles

Loon - Internet distribution using bots

Wing - drone delivery system

Chronicle Security - safety in virtual space and networks of the Internet

These projects are already at the last stage of testing or are already in the process of commercialization, but due to weak media support, they are highly undervalued by the market. Another promising company that is owned by Alphabet is DeepMind, which is engaged in the design and development of artificial intelligence, and Google Brain - a research company for training neural networks. Moreover, the Alphabet has two venture capital funds that buy and invest in promising projects and technologies. Thus, in 2018 the company Nest Labs, which is engaged in the development and commercialization of IoT-technology, was taken over.

What is listed here is only a small part of the projects and companies that Alphabet invests in and develops.

Businesses of this conglomerate have long gone beyond the virtual space and occupy all the free niches of promising technologies, without fear of the riskiest experiments. Thanks to this approach, the real value of the Alphabet shares can hardly be overestimated, because no one knows which direction will make a breakthrough.

Why Invest in Google Alphabet with PaxForex

One of the ways to take advantage of the fluctuations of the Alphabet share price is to trade CFDs with PaxForex. It allows traders to increase the funds deposited with the help of leverage and, what is more important, makes it possible to benefit from the crisis by placing Sell orders.