Source: PaxForex Premium Analytics Portal, Fundamental Insight

The final UK GDP for the first quarter decreased by 2.2% quarterly and by 1.7% annualized. Economists predicted a decrease of 2.0% quarterly and 1.6% annualized. Forex traders can compare this to the previous UK GDP for the first quarter, reported flat at 0.0% quarterly, and which increased by 1.1% annualized. The final UK Total Business Investment for the first quarter decreased by 0.3% quarterly and increased by 0.8% annualized. Economists predicted a flat reading of 0.0% quarterly and an increase of 0.7% annualized. Forex traders can compare this to the previous UK Total Business Investment for the first quarter, which decreased by 0.5% quarterly, and which increased by 1.8% annualized. The UK Current Account Balance for the first quarter was reported at -£21.1B. Economists predicted a figure of -£15.4B. Forex traders can compare this to the UK Current Account for the fourth quarter, which was reported at -£9.2B.

The US S&P/Case-Shiller Composite 20 for April is predicted to increase by 0.50% monthly and by 4.00% annualized. Forex traders can compare this to the US S&P/Case-Shiller Composite 20 for March, which increased by 0.50% monthly and by 3.90% annualized. The US Chicago PMI for June is predicted at 45.0. Forex traders can compare this to the US Chicago PMI for May, which was reported at 32.3. US Consumer Confidence for June is predicted at 91.8. Forex traders can compare this to US Consumer Confidence for May, which was reported at 86.6.

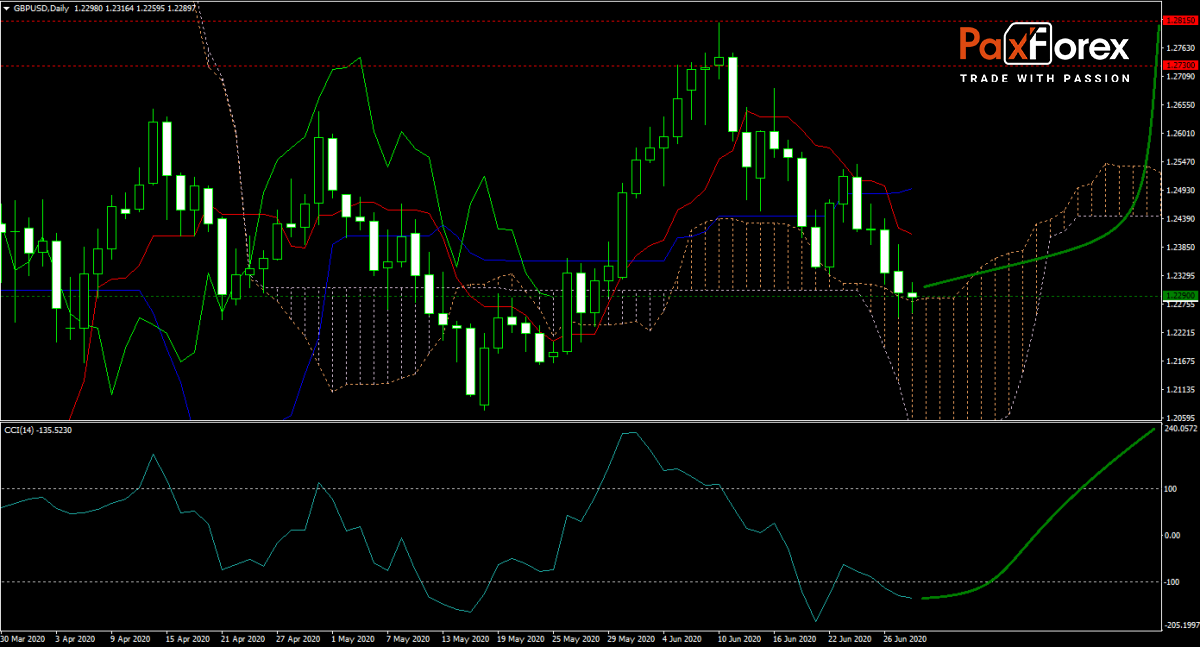

The outlook for the GBP/USD is increasingly bearish after price action moved into its Ichimoku Kinko Hyo Cloud. Despite today’s minor downward revision in the final first-quarter GDP report, the prospects for economic recovery remain elevated. Prime Minister Johnson is eyeing massive infrastructure investment across the UK, in a post-Covid-19, post-Brexit environment. This currency pair is expected to advance into its horizontal resistance area. Will today’s US economic data provide the spark for bulls to march ahead? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.2260 to 1.2315 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.2290

- Take Profit Zone: 1.2730 – 1.2815

- Stop Loss Level: 1.2200

Should price action for the GBP/USD breakdown below 1.2260 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.2200

- Take Profit Zone: 1.2000 – 1.2075

- Stop Loss Level: 1.2260

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.