- The Significance Of Market Analysis

- What Is Candlestick Trading

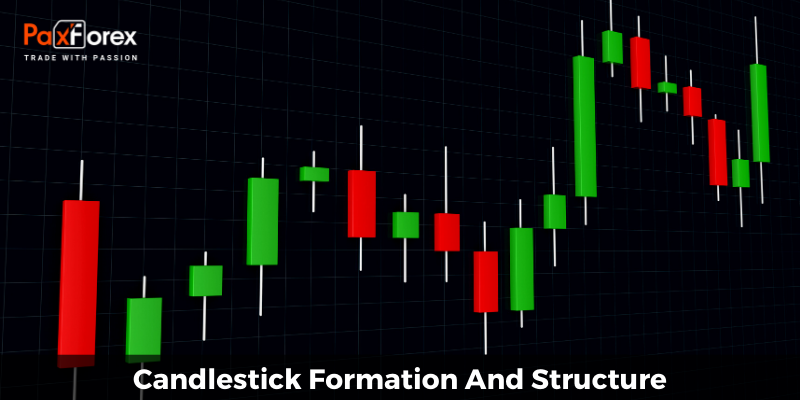

- Candlestick Formation And Structure

- Bulls Vs. Bears In Candlestick Trading

- Basics Of Candlestick Pattern Trading

- Types Of Candlestick Patterns

- Candlesticks Trading Strategies

- Candlestick Trade In Demo Account

Candlestick charts are one of the first things that come to mind when we talk about trading. Even those, who have zero experience on Forex, will most likely be able to recognize and somewhat interpret a candle chart. Today we are going to break down everything you need to know about trading candlesticks in 2020, including the candle formation, structure, patterns and strategies.

The Significance Of Market Analysis

For starters, let’s say a few words about the importance of market analysis. Although it might seem at first that the market moves randomly, there is always a certain composition. In fact, the major difference between a trading pro and a beginner is the ability to see patterns and predict the upcoming movement of the price.

So, there is really no need to prove that analysis is important. But there is a trick: what type of analysis to choose? The modern currency trading scene is flooded with expert opinions on how to look at the price movement, which tools to use to extract the necessary data and what steps to take after you found the information you were looking for.

Any new trader becomes instantly confused with the amount of possibilities and that can quickly lead to giving up altogether. However, if you focus on slowing down and taking a closer look at each of the options, you might just discover your very own path to success.

In order to gradually go through the vast sea of market-related knowledge, you’ll first need to map it out. Or, in other words, get an idea of how much information is out there to learn. The good news is that any well-established broker will provide plenty of free learning materials, usually organized in logical order.

Before we zoom into the technicalities of candlestick trading, it would make sense to point out that this is just one segment of what market analysis is. After you get comfortable with candlesticks, make sure to move on to other aspects and learn more about various analysis types.

Now, let’s move on to what we came here for, starting with finding out what candlesticks trading is.

What Is Candlestick Trading

In case you are entirely unfamiliar with the term “candlestick trading”, it’ll be fair to start by explaining what these candlesticks actually are. As you know, currency trading is primarily based on the price speculation that is enabled by different values of currencies around the world. And in order to know what is happening at the market, traders require some sort of visualization of value fluctuations.

That’s what trading charts are for. A chart is simply a visual representation of price values for the chosen currency pair or any other trading instrument over a specific period of time. By looking at the chart a trader can judge about trends, market conditions, possible upcoming events and much more.

Forex traders mostly operate with three chart types: line, bar and candlestick. A line chart is the most basic way to look at the price progression, as it consists of a single line that connects closing price points over the chosen timeframe. Although the setting of a line chart can be adjusted to any other parameter, such as average price or opening price, for example, this type of charting is rarely used on its own. Simply because there is not enough information to build a complete trading plan. For the most part line charts are utilized for the purposes of trend outlining and general understanding of how the currency pair behaved over long periods of time.

The bar charts are slightly more complex. Each element of such a chart is called a bar and it consists of several information pieces: the open and the close prices, and the lowest and highest values within the selected time period. These elements are presented in the form of a vertical line with short horizontal markings at each side. Depending on which price was higher, the opening or the losing one, the bar will be structured differently.

One of the easiest ways to remember the specifics of bar formation is: the start on the right, the end of the left. This way, when the opening price is lower than a closing one, we will have a short marking on the right towards the bottom of the chart and another one on the left side towards the top. In case the opening price was higher it will be indicated at the top on the right side, and the lower closing price is going to be placed towards the bottom on the left. Now, the high and low values will always remain at the same place, top and bottom respectively.

Bar charts are often used by traders who want to see more information in the short period time frames. It is very common amongst bar chart users to turn off the color-in setting (green for bullish, red for bearish) to be left with bare data. They say that by stripping off the color, they can see trends more clearly and therefore, make faster decisions. This, of course, is one of the many available opinions and isn’t necessarily fit for everyone.

Last but not least, there is the candlestick chart. The elements are essentially the same as in the bars: open, close, high and low. However, candlesticks appear chubbier and get formed a little differently. Candlesticks trade decision-making is the most popular approach, as candles are more visually comprehensive and easier to read for even the most inexperienced traders. Next, let’s explore how the candles get formed and what they consist of.

Candlestick Formation And Structure

As already mentioned, every candlestick consists of four informational elements: opening price, closing price, highest and lowest values. The time period represented by one candle is determined by the time frame setting of the chart. This way, on a one-hour chart a candle can express the data for one minute, while on a monthly chart it will represent an entire day.

The way each candle is formed is pretty straightforward, although it does take some getting used to. What comes naturally to experiences traders can seem like nonsense to any newbie. So, we are going to take it one step at a time and break down each of the elements of a candle to master the candlestick trade process to the fullest.

Length And Size

From the first glance at the chart you’ll notice that candles vary not only in color, but also in size. In the regular setting the width of candles is the same, however the length varies based on the difference between the opening and the closing price. This distance between two values is considered the candle’s body. The longer the body, the stronger is the move in the direction it indicates.

A trader can judge on many factors by the length alone. For instance, when the length of consecutive candles gradually increases it usually points out that the trend is progressing and intensifying. And, by applying the same logic, we can conclude that the candles that start to get shorter indicate a weakening trend and a potential reversal. Stable trends are usually represented by candles that are consistent in length, while sporadic lengths show that traders’ opinion is not unified.

There is also a specific setting on the candlestick chart that can also affect the width of candles. These are referred to as volume candles, and they form significantly wider than the regular ones, provided there was a lot of volume in the presented time period. Volume can serve as an important factor in the decision-making process, as it usually dictates stronger price confirmations and faster movements.

You’ll see that some candles don’t seem to have a body at all and appear as thin plus signs on the chart. This type of candle is called Doji and it comes in three variations: Doji, Dragonfly and Gravestone. Dojis form when there was little to no difference between the opening and the closing prices, which usually points out to the fact that the market is currently uncertain and might reverse. Keep reading to find out more about Doji candles, as well as other candlestick patterns that can come in handy during trading.

Open/Close Correlation

Now, let’s address the candles’ color difference that plays a very big role in successfully trading candlesticks. In the MT4’s default setting, candles will appear red and green. Traders can adjust the colors to whichever else they prefer, however most analytical reports and news will often feature the classic red/green chart. So, what do these Christmas-like colors mean?

A green candle forms when the closing price is higher than the opening one, which indicates that the value of an asset grew. Green candles are referred to as bullish because they point out to the advantage of buying interest over selling interest. Groups of green candles can be found in upward trends and tell traders that the value is continuously increasing.

Red candles appear in the opposite scenario: when the closing price is lower than the opening. This means that more traders are currently selling than buying, which reflects in a decrease of an asset value. These candles are called bearish.

It’s important to note that several candles of the same color one after another don’t necessarily mean a full-on trend. As a rule of thumb, when the bullish interest is more or less equal to the bearish, the market isn’t trending, but rather going in a straight line, although the candlesticks seem to form waves of price movement. A little more on the bulls and bears balance later on.

Candlestick Shadows

Apart from the body, a standard candlestick will also consist of two additional elements: vertical markings at the top and at the bottom. These lines are often referred to as wicks or shadows. The upper shadow will stretch out from the top to the highest price point, and the lower shadow from the bottom to the lowest price.

The lengths of the wicks are directly associated with uncertainty. The longer the shadow, the stronger is the indication that bulls and bears are actively competing, however neither is able to overpower the other one just yet. You can normally observe the gradual wick lengthening from candle to candle in long-going trends, since any trend, no matter how strong, will eventually be reversed. From this we can also safely conclude that short or invisible wicks are a sign of healthy and stable trend progression.

The relationship between the body and wicks is another noteworthy component of any productive candlestick trade analysis. From what we’ve learned so far, we can say that strong trends are represented by long bodies with relatively short wicks. And once the bodies begin to shorten, while shadows grow longer the trend is believed to be slowing down. Neutral and turning points are often the Dojis we described above: extremely small bodies with long wicks. In a lot of cases they serve as a reversal sign, although sometimes they are simply a moment of uncertainty within an ongoing trend.

Candlestick Position

Finally, although it’s not exactly an element, we need to consider the position of the candle. Each candle carries a good load of important information, however if we take it out of context of other candles it becomes virtually useless. That’s why, when you are implementing candlesticks trading, it is important to consider the chart as a whole and notice specific formations within it.

We’ll go into candlestick patterns in more detail in a bit, but at this point the main takeaway in terms of position is two principles: dominance and indecision. The candles of the same type (color) that have long bodies and little to no wicks, the ones with smaller bodies and more noticeable wicks and the ones with rather insignificant bodies and long shadows can all be considered signs that the certain side is currently dominant. And the small, nearly invisible body with very long shadows is a sign of indecision that alerts traders to pay close attention to the chart.

Now you know what candle charts look like and what are the elements that make up a candlestick. Next we need to look into implementing this information for profitable candlesticks trading.

Bulls Vs. Bears In Candlestick Trading

You might initially think of the bullish versus bearish movements as a tug of war competition. However, it isn’t exactly the case. The goal of either side is not to take dominance forever, because Forex is not a contest, it’s a market. For sellers to be profitable someone needs to be buying, and vice versa. Which brings us to the conclusion that every trader is constantly switching from buying to selling.

This is, at the end of the day, is exactly what pushes the price movement to fluctuate. After all, can you picture a scenario where any currency’s value will continue on constantly growing or dropping? That just doesn’t make any sense.

But the reason we are taking a moment to discuss this is not the mechanics of price formation. By knowing that both bullish and bearish movements are vital to the market, a trader establishes a healthy philosophy of acceptance and forward thinking. This philosophy consists of two statements:

The price is ever-changing. If things are not going as planned, they will eventually. This is just how the market works. But does it mean you should sit idly and wait for the situation to turn around? Not at all. Which leads us to the second statement.

There is always a way to benefit. Disregarding where the price is headed, someone is profiting off it. Basic supply demand: if people are willing to buy, others will be willing to sell. So, any trader who is in it for a long run, should always focus on having a strategy for either case.

So, once you wholeheartedly believe that no matter what the chart in front of you looks like, there is always a way to benefit from it, you are basically a professional trader already. Which means it’s time to equip you with more precise and practical knowledge for executing a perfect candlestick trade.

Basics Of Candlestick Pattern Trading

From what we have discussed so far, you might have figured that candlestick trading is essentially the science of reading how other traders are behaving in order to plan your own trades. Every single active trader is a part of the market mechanism, which means that being able to see and understand what others are doing is very important.

Trading candlesticks is a subcategory of technical analysis, a way to look at the market from a purely numerical point of view. Technicalists believe that everything you need to know about the currency you are working with is encrypted in its value. And the main task becomes to figure out that code and use it in your advantage.

A lot of this decoding is a skill of noticing patterns. Any market has a tendency to repeat itself. As a completely non-trading example, think of your favorite clothing store. At the beginning of the new season, there are many new items and the price can be rather high. However, as the time passes and a new season approaches, prices begin to crawl down, eventually resulting in everything-must-go sale to make space for new items. This is a pattern.

Same applies to the currency exchange marketplace: some currencies are naturally more in demand than others, and all of them tend to have changes in value over the course of time. Once again, nothing can grow or drop in price forever as it will always lead to complete devaluation. So, how can we use this information to benefit from candlesticks trading?

By learning to read the chart from the perspective of patterns and repetitions. You might think that the amount of possibilities is virtually limitless when it comes to candlestick formations, however, as proven by years of observations the options are somewhat lean. Although it is hard to say how many candlestick patterns are out there, most popular ones are widely known to the trading community, which makes them more than possible to recognize and memorize.

Types Of Candlestick Patterns

There are two general types of candlestick patterns: simple and complex. Simple patterns are also called single-candle patterns, because they consist of just one candle. More complex patterns can include several candles, usually two or three. Additionally, patterns can be either bullish or bearish, predicting or confirming an uptrend or a downtrend respectively.

What makes studying candlestick patterns kind of easier is their names: most of them are connected with the visual effect of the pattern. This makes them simple to notice and remember. Plus, many patterns mirror each other, which can help even more in understanding how they affect the market. Now, for you to see how all of this might look at the chart, let’s describe ten most popular candlestick patterns. Starting with the single-candle ones:

Marubozu. This candle is very easy to notice: it’s unusually long and has no wicks at neither the top nor the bottom. The absence of wicks indicates that there were no major pulls and the closing and opening values matched the high and the low. Whether the Marubozu is bullish or bearish it most probably indicates the continuation of the ongoing trend. Many traders choose to set their stop loss in accordance with this candle.

Hanging Man. Just as Marubozu, this pattern can be both red and green with its structure consisting of a small body and a very long bottom wick, with no upper wick. In an ongoing uptrend this pattern can signal that a short bearish pull back is about to take place. This can mean a good opportunity for newcomers to take a long position at a more favorable price and continue riding the trend with the rest.

Doji. The Doji pattern is perhaps the easiest one to spot at the chart, it looks like either a plus sign or a cross, with a barely noticeable body and long wicks on top and bottom. Although Doji is an effective simple pattern it can also be a part of complex patterns and provide an even stronger signal. This is a classic uncertainty candle, which means that both sides of the market are pushing with equal effort.

Dragonfly Doji. This Doji looks like a capital letter T and indicates that the highest point matched the opening and closing prices. Traditionally, the longer the shadow the bigger is the possibility of an upcoming bullish trend. And when the Dragonfly Doji is found at the bottom of the chart it nearly always guarantees a bullish reversal of an ongoing bearish trend.

Gravestone Doji. The complete opposite of the Dragonfly Doji, Gravestone Doji tells us that opening and closing price matched the lowest value. The appearance of this candle can be an omen of an upcoming bearish trend. And if the Gravestone Doji is found at the top of the chart it is very likely to predict a bearish reversal of an ongoing uptrend.

As you can see, we can say a lot from looking at just one particular candle. But single patterns are not always enough for a full-blown candlesticks trade. That’s when we turn our attention to complex formations that consist of two, three or more candles.

Three White Soldiers. Although the name suggests otherwise, these “soldiers” are usually green. This formation consists of three equally long, short wicked candles appearing one higher than the other. It is very logical to judge that this is a very bullish pattern. When located at the bottom of the chart during a downtrend, Three White Soldiers are an almost absolute guarantee of a bullish reversal.

Three Black Crows. Alternatively, the three long red candles are foreshadowing a bearish movement. It’s important to note that the wick length is not very important to identification of this pattern, although traditionally both Crows and Soldiers have short wicks. When found at the top of the chart in an uptrend, Three Black Crows serve as a signal of a starting bearish reversal.

Evening Doji Star. Remember how we said that Doji can be read as a stronger signal, when it is backed up by other candles. Evening Doji Star is a great example. It consists of a long bullish candle, a Doji at its top and then a long, or rather long, bearish candle that has closed higher than the first bullish one. At the top of the chart the Evening Doji Star indicates a highly-possible beginning of a bearish trend. The bullish opposite of this pattern is a Morning Doji Star.

Three Line Strike. This pattern can be both bullish and bearish, as an example we will look at the bullish one. Three Line Strike consists of four candles: the first three are a mini version of three white soldiers, consecutively closing higher than the previous one, and the fourth candle is a big fat bearish candle that closed far lower than either of the shorter green ones. In general, this formation is interpreted as a continuation pattern. It’s also worth mentioning that Three Line Strike doesn’t appear very often, so traders should always have back up trend-confirmation solutions.

Bearish Abandoned Baby. This rather gruesomely-names pattern consists of three candles: first long bullish, then a short bullish or a Doji located visibly higher than the top of the first candle, and at the end a long bearish candle. Bearish Abandoned Baby is another classic bearish reversal sign when found at the top of the chart, and its opposite, the Bullish Abandoned Baby, is a classic bullish reversal signal.

Yes, even though these are far from all candlestick patterns that can be observed at the market, it is a lot to take in. But the important news here is that excellence comes with practice. The more time you spend watching charts form and progress, the easier it will be for you to highlight noteworthy patterns and use them as signals in your candlesticks trade journey.

On top of that, if you choose to go with a candlestick based strategy, you will only have to remember several formations by heart. Further on are some of the ways candle patterns can serve as a foundation for a trading strategy.

Candlesticks Trading Strategies

A comprehensive trading strategy consists of several crucial components: the preferred market conditions, specific entry and exit points, realistically measured expectations and risk management techniques. The skill of recognizing candlestick patterns can really come in handy in covering many of these requirements.

Most candlestick trading strategies are designed with the purpose of locating most suitable entry points. We learned today that patterns can predict either trend continuation or reversal. Depending on the current direction of the market and what position you are holding, both reversal and continuation can be helpful.

For example, if you are just beginning your trading session and your multiple time frame analysis indicated a presence of an uptrend you may want to look out for continuation patterns such as a bullish Mat Hold or a Bearish three Line Strike. This way you’ll know that it is safe to open a position in the general direction of the trend.

And in terms of risk management, the most popular candle-based technique is to place take profits and stop losses in line with previously formed candles. This way, while scalping in an uptrend you might want to take profit several pips from the top of the previous bullish candle.

Just before we wrap this up, let’s say a few words about the best way to practice candlestick trading in an entirely risk-free environment.

Candlestick Trade In Demo Account

Trading candlesticks is a skill that can be mastered. But how exactly do you perfect a skill when it comes to something as financially sensitive as currency trading? The answer is simple: trading simulator.

Demo account is a free practice tool that allows you to explore the world of foreign exchange without investing any money and, therefore, without taking any risks. Get to know every function of your trading platform, learn new trading methods, test out trading tricks you came across online or create your own approaches and strategies: demo account is perfect for either of these.

The demonstration mode is a perfect copy of a live trading account, which means that once you are done gaining confidence through practice, you will be able to seamlessly transition onto your real market and start earning. Sign up for a free of charge demo account today to experience the convenience and effectiveness of stress-free learning.