Australian Inventories for the first quarter decreased by 1.2% quarterly, and Australian Company Operating Profits increased by 1.1% quarterly. Economists predicted a decrease of 0.7% and 3.5%. Forex traders can compare this to Australian Inventories for the fourth quarter, which increased by 0.3% quarterly and to Australian Company Operating Profits, which decreased by 3.5% quarterly. Company Pre-Tax Profits for the first quarter decreased by 16.2% quarterly. Forex traders can compare this to Company Pre-Tax Profits for the fourth quarter, which decreased by 0.6% quarterly. The RBA left interest rates unchanged at 0.25%. Economists predicted no change in interest rates. Forex traders can compare this to the previous RBA Interest Rate Decision, where interest rates were left unchanged at 0.25%.

UK Nationwide House Prices for May decreased by 1.7% monthly and increased by 1.8% annualized. Economists predicted a decrease of 1.0% and an increase of 2.8%. Forex traders can compare this to UK Nationwide House Prices for April, which increased by 0.9% monthly and by 3.7% annualized. UK Net Consumer Credit for April was reported at -£7.399B, and Net Lending Securities on Dwellings was reported at £0.29B. Economists predicted a figure of -£4.500B and of £1.15B. Forex traders can compare this to UK Net Consumer Credit for March, which was reported at -£3.803B and to Net Lending Securities on Dwellings, which was reported at £4.78B. UK Mortgage Approvals for April were reported at 15.85K. Economists predicted a figure of 23.78K. Forex traders can compare this to UK Mortgage Approvals for March, which were reported at 56.14K. UK M4 Money Supply for April increased by 1.5% monthly. Forex traders can compare this to UK M4 Money Supply for March, which increased by 3.2% monthly.

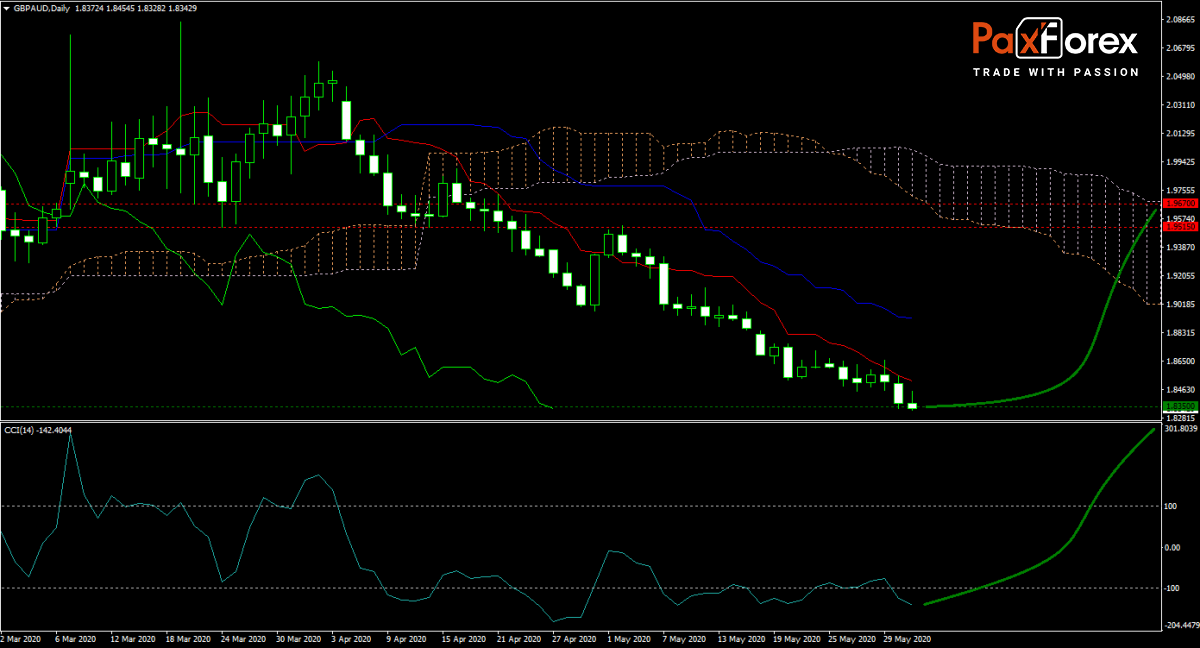

The GBP/AUD forecast is cautiously turning positive after disappointing UK economic data. Australia sowed tensions with China due to the Covid-19 pandemic, which resulted in retaliatory measures implemented. With the start of winter the Southern hemisphere, epidemiologists predict an accelerated spread of the virus, alongside flu season, adding to uncertainties for the Australian economy. Will bears end the bull run heading into the winter season? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/AUD remain inside the or breakout above the 1.8300 to 1.8400 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.8350

- Take Profit Zone: 1.9515 – 1.9670

- Stop Loss Level: 1.8275

Should price action for the GBP/AUD breakdown below 1.8300 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.8275

- Take Profit Zone: 1.8025 – 1.8075

- Stop Loss Level: 1.8350

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.