Source: PaxForex Premium Analytics Portal, Fundamental Insight

French non-arm payrolls for the first quarter increased by 2.0% quarterly. Economists predicted a decrease of 2.3%. Forex traders can compare this to French non-arm payrolls for the fourth quarter, which increased by 0.4% quarterly. Italian Industrial Production for April decreased by 19.1% monthly and by 42.5% annualized. Economists predicted a decrease if 24.0% and 40.0% Forex traders can compare this to Italian Industrial Production for March, which decreased by 28.4% monthly and by 29.4% annualized.

US Initial Jobless Claims for the week of June 6th are predicted at 1,550K, and US Continuing Claims for the week of May 30th are predicted at 20,000K. Forex traders can compare this to US Initial Jobless Claims for the week of May 30th, which were reported at 1,877K and to US Continuing Claims for the week of May 23rd, which were reported at 21,487K. The US PPI for May is predicted to increase by 0.1% monthly and to decrease by 1.2% annualized. Forex traders can compare this to the US PPI for April, which decreased by 1.3% monthly and by 1.2% annualized. The US Core PPI for May is to decrease by 0.1% monthly and to increase by 0.4% annualized. Forex traders can compare this to the US Core PPI for April, which decreased by 0.3% monthly, and which increased by 0.6% annualized.

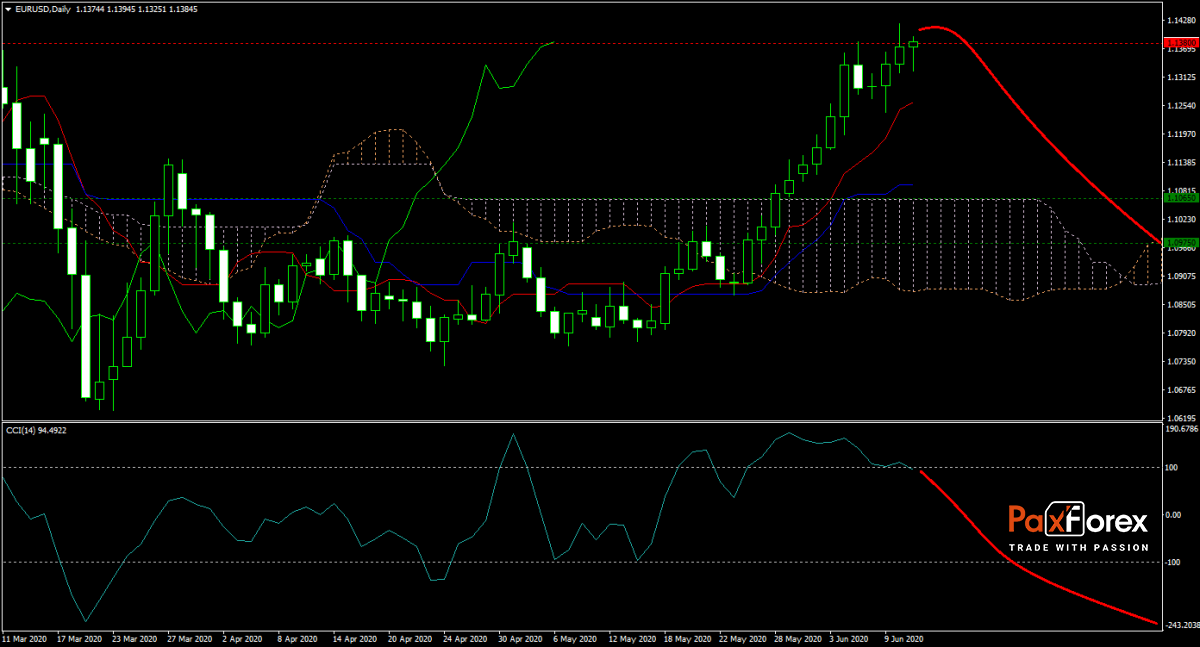

The EUR/USD forecast is turning bearish for the short-term as forex traders are likely to realize floating trading profits. Technical indicators confirm slowing bullish momentum, and today’s light economic trading day could offer bears an excuse to pressure this currency pair back into its horizontal support area. It is partially located inside the Ichimoku Kinko Hyo Cloud, with the Kijun-sen providing support to the upper band. Will today’s session feature a profit-taking correction? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakdown below the 1.1330 to 1.1420 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.1380

- Take Profit Zone: 1.0975 – 1.1065

- Stop Loss Level: 1.1450

Should price action for the EUR/USD breakout above 1.1420 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.1450

- Take Profit Zone: 1.1515 – 1.1570

- Stop Loss Level: 1.1380

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.