Source: PaxForex Premium Analytics Portal, Fundamental Insight

German Factory Orders for May increased by 10.4% monthly. Economists predicted an increase of 15.0%. Forex traders can compare this to German Factory Orders for April, which decreased by 26.2% monthly. Spanish Industrial Production for May decreased by 24.5% annualized. Economists predicted a decrease of 18.5%. Forex traders can compare this to Spanish Industrial Production for April, which decreased by 34.1% annualized. The German Markit Construction PMI for June was reported at 41.3. Forex traders can compare this to the German Markit Construction PMI for May, which was reported at 40.1.

Eurozone Sentix Investor Confidence for July was reported at -18.2. Economists predicted a figure of -10.9. Forex traders can compare this to Eurozone Sentix Investor Confidence for November, which was reported at -24.8. Eurozone Retail Sales for May are predicted to increase by 15.0% monthly and to decrease by 7.5% annualized. Forex traders can compare this to Eurozone Retail Sales for April, which decreased by 11.7% monthly and by 19.6% annualized.

The Preliminary US Markit Services PMI for June is predicted at 46.7. Forex traders can compare this to the US Markit Services PMI for May, reported at 37.5. The Preliminary US Markit Composite PMI for June is predicted at 46.8. Forex traders can compare this to the US Markit Composite PMI for May, reported at 37.0. The US ISM Non-Manufacturing PMI for June is predicted at 50.0. Forex traders can compare this to the US ISM Non-Manufacturing PMI for May, reported at 45.4. The ISM Non-Manufacturing Business Activity Index for June is predicted at 50.0. Forex traders can compare this to the ISM Non-Manufacturing Business Activity Index for May, reported at 41.0.

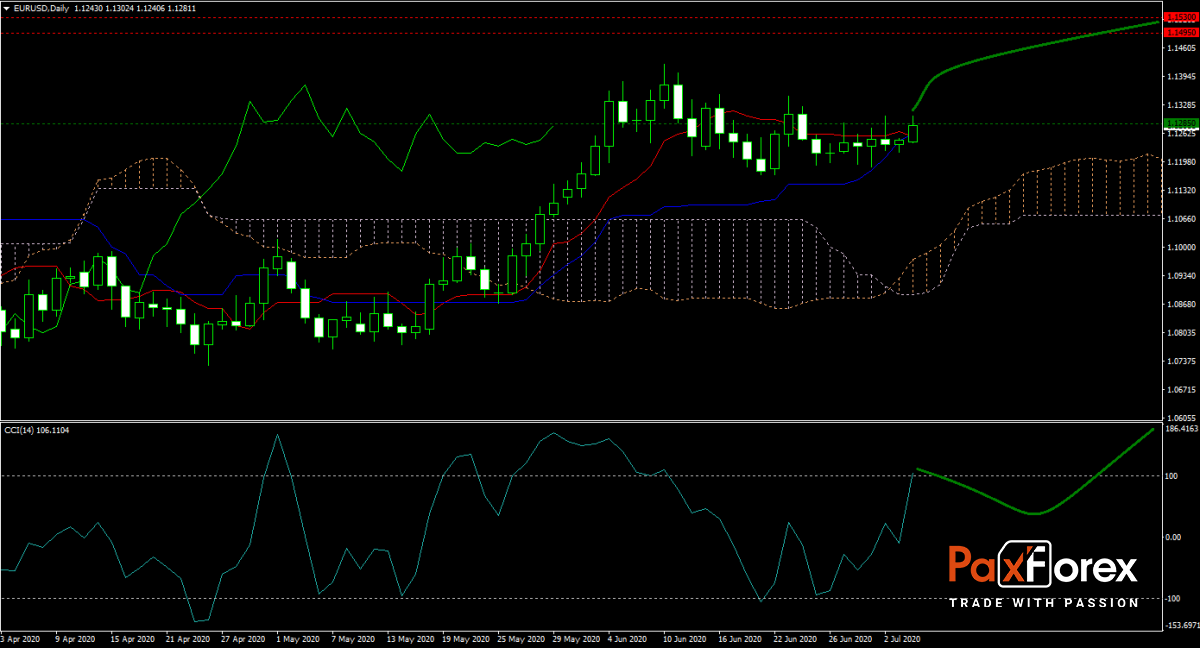

The EUR/USD forecast remains bullish despite this morning’s disappointing German factory orders and Spanish industrial production data. Eurozone retail sales for May could disappoint, but the focus remains on US data, which showed mixed readings with a worrisome reversal in the labor market reversal over the past two weeks. Price action moved above its Kijun-sen and Tenkan-sen, with the Span A of the Ichimoku Kinko Hyo providing a stable support level. Will bulls push this currency pair into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakout above the 1.1255 to 1.1310 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.1285

- Take Profit Zone: 1.1495 – 1.1530

- Stop Loss Level: 1.1185

Should price action for the EUR/USD breakdown below 1.1255 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.1185

- Take Profit Zone: 1.1010 – 1.1070

- Stop Loss Level: 1.1255

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.