The Preliminary Japanese Current Account Balance for April was reported at ¥260.3B. Economists predicted a figure of ¥480.0B. Forex traders can compare this to the Japanese Current Account Balance for March, which was reported at ¥1,971.0B. The Final Japanese GDP for the first quarter decreased by 0.6% quarterly and by 2.2% annualized. Economists predicted a decrease of 0.5% and 2.1%. Forex traders can compare this to the Japanese GDP for the fourth quarter, which decreased by 0.9% quarterly and by 3.4% annualized. Final Private Consumption for the first quarter decreased by 0.8% quarterly, and Final Capital Expenditure increased by 1.9% quarterly. Economists predicted a decrease of 0.7% and an increase of 1.4%. Forex traders can compare this to Private Consumption for the fourth quarter, which decreased by 2.8% quarterly and to Capital Expenditure, which decreased by 0.5% quarterly. Final External Demand for the first quarter decreased by 0.2% quarterly. Economists predicted a decrease of 0.2%. Forex traders can compare this to External Demand for the fourth quarter, which increased by 0.5% quarterly.

The Japanese Eco Watchers Survey Current Index for May was reported at 15.5. Economists predicted a figure of 10.7. Forex traders can compare this to the Japanese Eco Watchers Survey Current Index for April, which was reported at 7.9. German Industrial Production for April decreased by 17.9% monthly. Economists predicted a decrease of 7.5%. Forex traders can compare this to German Industrial Production for March, which decreased by 9.2% monthly. Eurozone Sentix Investor Confidence for June is predicted at -22.5. Forex traders can compare this to Eurozone Sentix Investor Confidence for May, which was reported at -41.8.

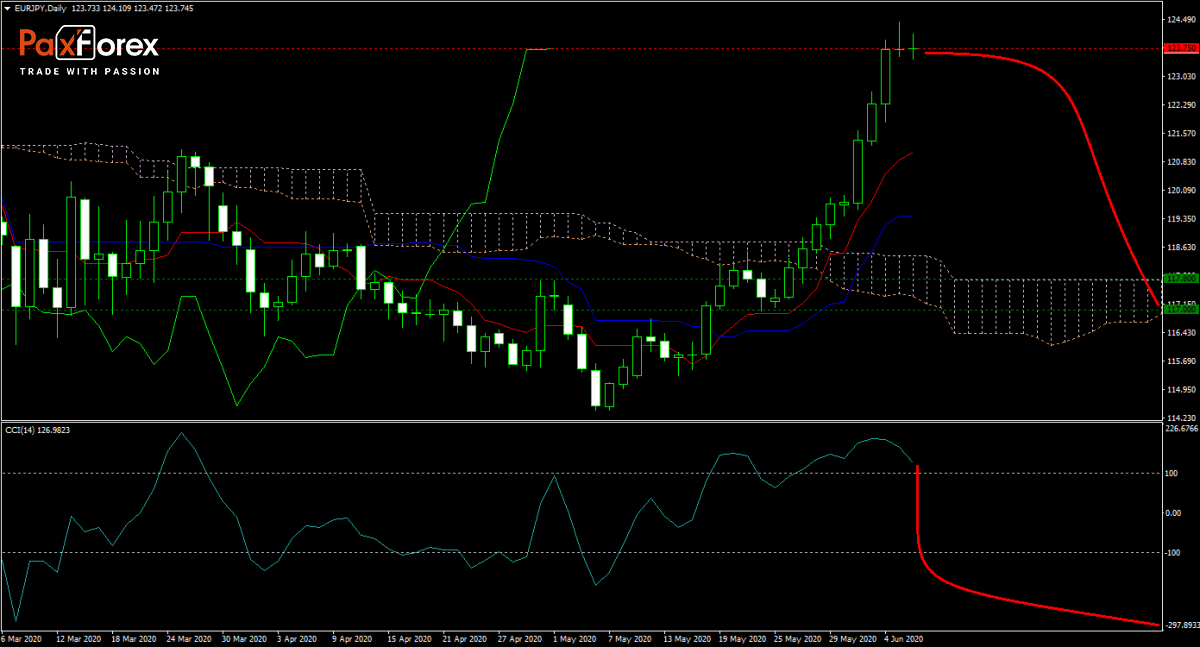

The EUR/JPY forecast has taken an aggressive bearish stance after accelerating higher. Risk-on appetite depleted safe-haven demand in Japanese Yen. Economic data out of Japan disappointed, but the ECB’s monetary policy is designed to weaken the Euro and disregards its mandate. The German high court is attempting to reign in the irresponsible approach of the central bank. This currency pair is expected to fall back into the Ichimoku Kinko Hyo Cloud. Will bears force price action into retreat? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EURJPY remain inside the or breakdown below the 123.450 to 124.450 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 123.750

- Take Profit Zone: 117.000 – 117.800

- Stop Loss Level: 125.000

Should price action for the EURJPY breakout above 124.450 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 125.000

- Take Profit Zone: 126.800 – 127.500

- Stop Loss Level: 124.450

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.