Source: PaxForex Premium Analytics Portal, Fundamental Insight

German Retail Sales for May increased by 13.9% monthly and by 3.8% annualized. Economists predicted an increase of 3.9% monthly and a decrease of 3.5% annualized. Forex traders can compare this to German Retail Sales for April, which decreased by 6.5% monthly and by 6.4% annualized. The German Unemployment Change for June was reported at 69K and the German Unemployment Rate at 6.4%. Economists predicted a reading of 120K and of 6.6%. Forex traders can compare this to the German Unemployment Change for May, reported at 238K and to the German Unemployment Rate, reported at 6.3%.

The Spanish Markit Manufacturing PMI for June was reported at 49.0. Economists predicted a figure of 45.1. Forex traders can compare this to the Spanish Markit Services PMI for May, reported at 38.3. The Italian Markit/ADACI Manufacturing PMI for June was reported at 47.5. Economists predicted a figure of 47.7. Forex traders can compare this to the Italian Markit/ADACI Manufacturing PMI for May, reported at 45.4. The Final French Markit Manufacturing PMI for June was reported at 52.3. Economists predicted a figure of 52.1. Forex traders can compare this to the French Markit Manufacturing PMI for May, reported at 40.6. The Final German Markit/BME Manufacturing PMI for June was reported at 45.2. Economists predicted a figure of 44.6. Forex traders can compare this to the German Markit/BME Manufacturing PMI for May, reported at 36.6.

The Final Eurozone Markit Manufacturing PMI PMI for June was reported at 47.4. Economists predicted a figure of 46.9. Forex traders can compare this to the previous Eurozone Markit Manufacturing PMI for May, reported at 39.4. The Swiss Markit Manufacturing PMI for June was reported at 41.9. Economists predicted a figure of 48.3. Forex traders can compare this to the Swiss Markit Services PMI for May, reported at 42.1.

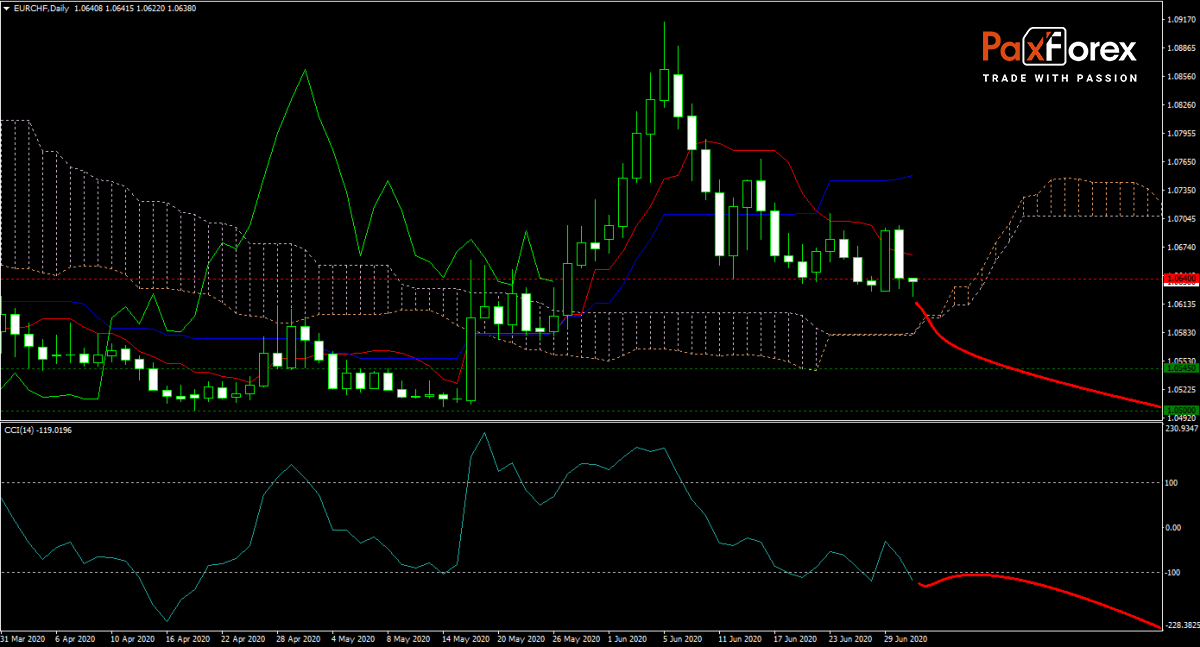

The EUR/CHF forecast remains bearish after mixed manufacturing PMI data for June out of the Eurozone and Switzerland. It raises concerns over the strength of the expected economic recovery, adding to capital inflows into the Swiss Franc based on safe-haven demand. The Tenkan-sen is expected to force this currency pair below its narrow Ichimoku Kinko Hyo Cloud and into its horizontal support area. Will bears launch their attack during today’s trading session after the release of US economic data? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/CHF remain inside the or breakdown below the 1.0620 to 1.0665 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.0640

- Take Profit Zone: 1.0500 – 1.0545

- Stop Loss Level: 1.0690

Should price action for the EUR/CHF breakout above 1.0665 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.0690

- Take Profit Zone: 1.0750 – 1.0790

- Stop Loss Level: 1.0665

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.