Source: PaxForex Premium Analytics Portal, Fundamental Insight

Data published by Ethereum mining pool Sparkpool revealed a sharp increase in the daily profitability of miners. It rose from $1.85 per MH/s to $3.27 before retreating to around $3.00. Demand for decentralized finance (DeFi) apps contributed to the increase. Enthusiasts should remain cautious as the total computing power for Ethereum remained stable near 190 PH/s. The current increase in profitability may remain temporary as the hype tends to fizzle out. The Covid-19 pandemic continues to depress economic activity and could lead to another crash if it persists, amid a flight to preserve capital.

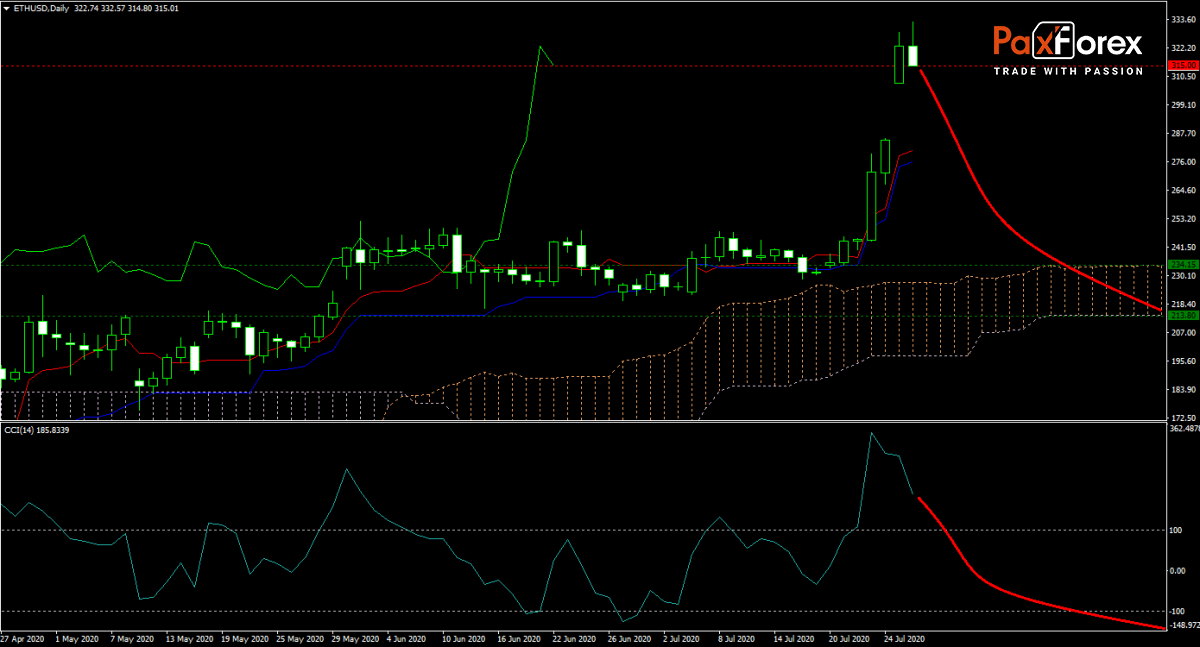

The forecast for the ETH/USD turned bearish after running into resistance. Demand for DeFi apps is likely to increase, but competition is heating up. A price gap formed during the explosive advance, vulnerable to be closed. The downside pressure can take price action below its Tenkan-sen and Kijun-sen and into its Ichimoku Kinko Hyo Cloud, where its horizontal support area awaits. Is ETH/USD exposed to a sell-off after a powerful advance? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the ETH/USD remain inside the or breakdown below the 307.90 to 332.55 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 315.00

- Take Profit Zone: 213.80 – 234.15

- Stop Loss Level: 338.00

Should price action for the ETH/USD breakout above 332.55 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 338.00

- Take Profit Zone: 358.70 – 366.45

- Stop Loss Level: 332.55

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.