Source: PaxForex Premium Analytics Portal, Fundamental Insight

Australian Westpac Consumer Confidence for June increased by 6.3% monthly to 93.7. Forex traders can compare this to Australian Westpac Consumer Confidence for May, which increased by 16.4% monthly to 88.1. Australian Home Loans for April decreased by 4.4% monthly, and Investment Lending decreased by 4.2% monthly. Forex traders can compare this to Australian Home Loans for March, which decreased by 1.0% monthly, and to Investment Lending, which decreased by 3.9% monthly. The Chinese PPI for May decreased by 3.7% annualized, and the Chinese CPI increased by 2.4% annualized. Economists predicted a decrease of 3.3% and an increase of 2.7%. Forex traders can compare this to the Chinese PPI for April, which decreased by 3.1% annualized and to the Chinese CPI, which increased by 3.3% annualized.

The US CPI for May is predicted to decrease by 0.1% monthly and to increase by 0.2% annualized. Forex traders can compare this to the US CPI for April, which decreased by 0.8% monthly, and which increased by 0.3% annualized. The US Core CPI for May is predicted to decrease by 0.1% monthly, and to increase by 1.3% annualized. Forex traders can compare this to the US Core CPI for April, which decreased by 0.4% monthly, and which increased by 1.4% annualized. The US Monthly Budget Statement for May is predicted at -$625.0B. Forex traders can compare this to the US Monthly Budget Statement for April, which was reported at -$738.0B. US FOMC Interest Rate Decision: The US FOMC Interest Rate Decision is predicted to show interest rates at 0.25%. Forex traders can compare this to the previous US FOMC Interest Rate Decision, which showed interest rates at 0.25%.

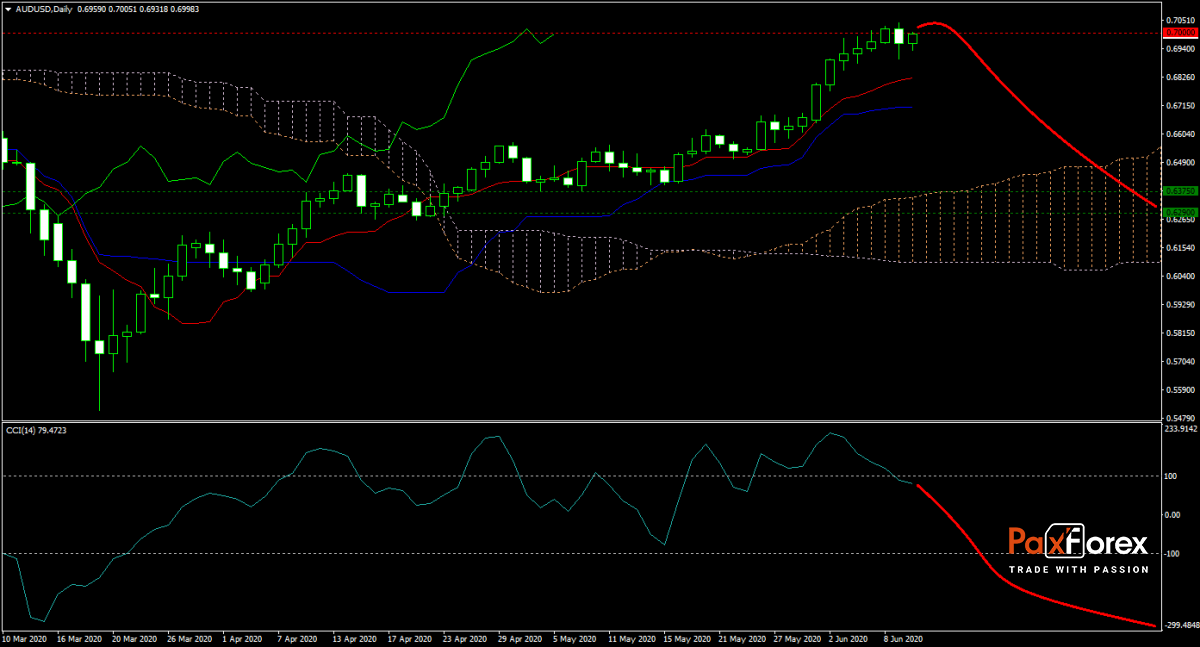

The AUD/USD forecast adopted a minor bearish bias after commodity currency accelerated. Today’s US CPI data is expected to show a build-up in deflationary momentum, while the Fed is likely to maintain interest rates inside of its current band. Technical indicators are breaking down, and this currency pair is under slowly expanding selling pressure. A correction into its horizontal support area, located inside the Ichimoku Kinko Hyo Cloud, is expected. Will today’s US data encourage bears to force a retreat in price action? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/USD remain inside the or breakdown below the 0.6950 to 0.7050 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7000

- Take Profit Zone: 0.6290 – 0.6375

- Stop Loss Level: 0.7070

Should price action for the AUD/USD breakout above 0.7050 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7070

- Take Profit Zone: 0.7175 – 0.7210

- Stop Loss Level: 0.7000

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.