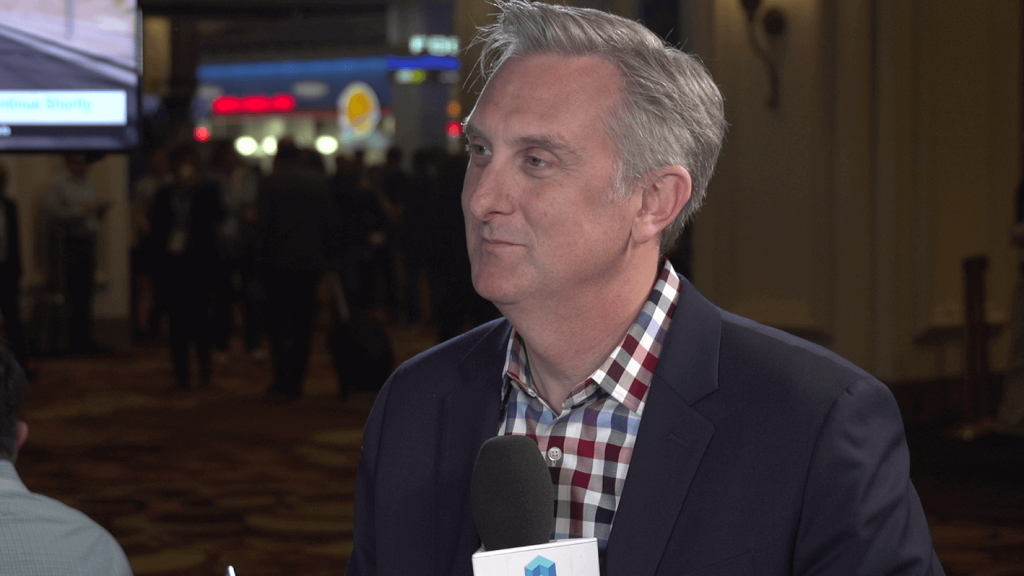

The rally extends across the cryptocurrency sector! Welcome back everyone to this week’s edition of my Bitcoin - Forex Combo Strategy. At last week’s update “Bitcoin - Forex Combo Strategy: The Facebook Coin” I outlined that I closed my short position in Bitcoin at a nice profit and that I was willing to short if we would see an unwarranted spike in price action. While I remain overall bullish on Bitcoin long-term, which is why I keep hodling my long position, the path to $10,000 won’t be a straight line up. We will see strong moves higher with reversal along the way which is the sign of a healthy uptrend. What is important is that we will set higher highs during rallies and higher lows during pullbacks and I believe we are in for just that. With that in mind, on May 27th 2019 I shorted 500 Bitcoins at $8,800 and I am looking to book my profits in the mid $6,000 range.

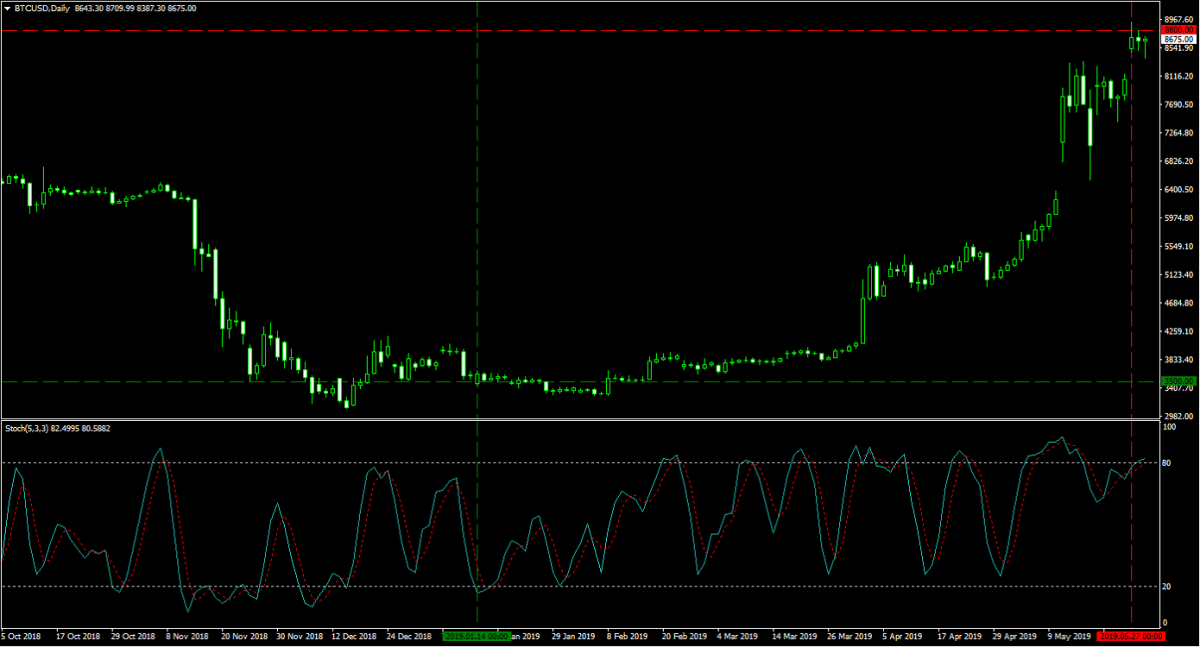

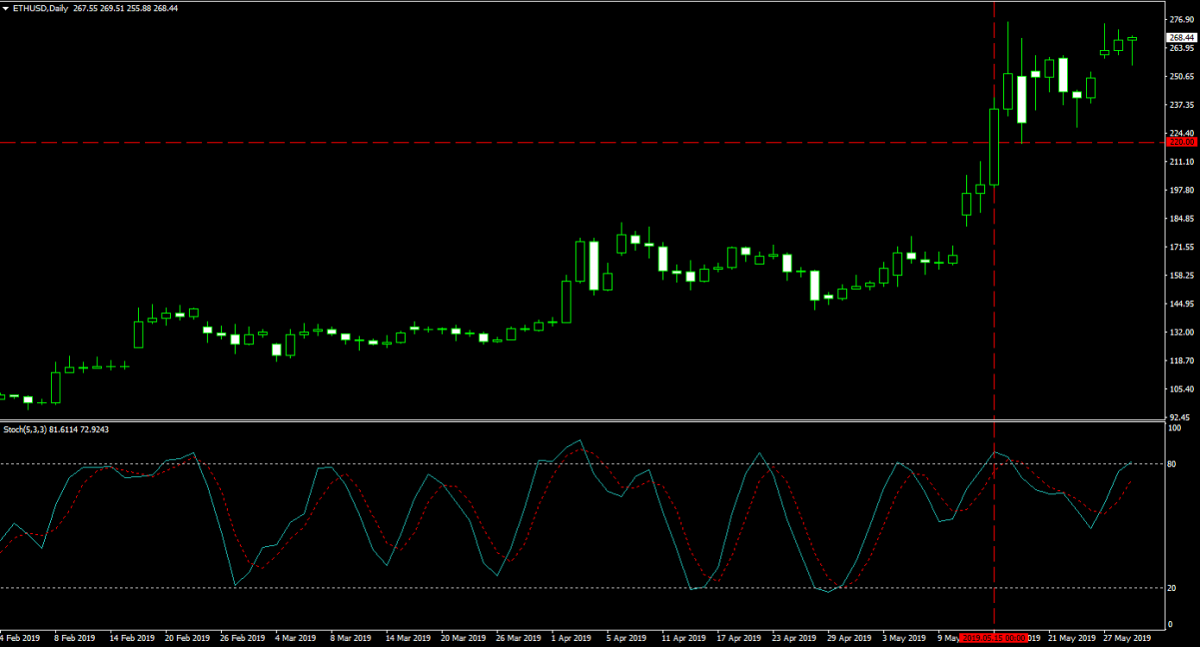

I keep hodling my 100 Bitcoins which I bought on January 14th 2019 at $3,500, but I will be happy to rotate out of this position at $10,500. I know many prefer to keep hodling, but my focus is more on generating value without hoping that prices will just rise, rise and rise. I am trading around key levels for the time being. While I remain very bullish on Bitcoin, I remain bearish on Ethereum. I currently have a 10,000 Ether short position which I took on May 15th 2019 at $220. I am open to add another 15,000 Ether short position if the price manages a breakout above $330. On May 23rd 2019 I decided to add 5,000,000 Ripple to my portfolio and bought in at $0.3700 as I am bullish on Ripple and was looking for a good entry opportunity after I closed my previous long position a few weeks ago. The images below show my cryptocurrency holdings.

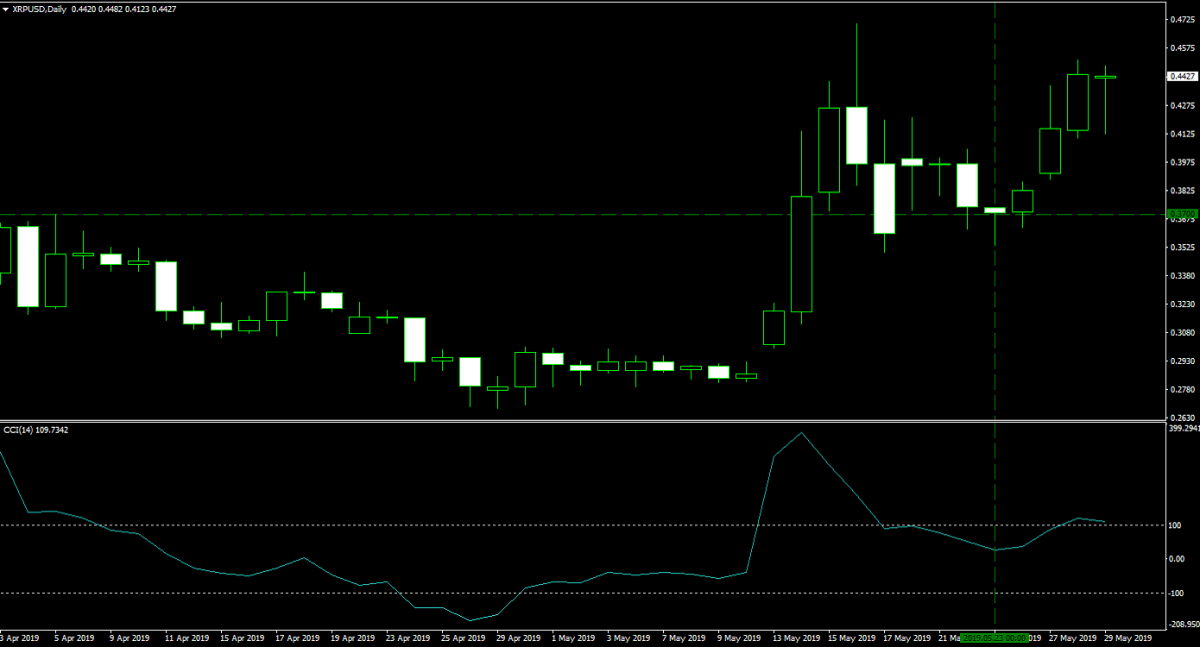

So who is Jesse Lund? Some of you may be familiar with this die-hard Bitcoin bull while to the majority he remains unknown. He used to be IBM’s Global Head of Blockchain and Digital Payments and was part of the team which build the IBM World Wire platform in a partnership with Stellar. The platform is currently available in 72 countries and has 46 banking endpoints which allow money transfers in 48 different currencies. Some may know Lund from his time before he joined IBM when he was part of the executive committee behind R3’s DLT (distributive ledger technology) and helped foster a relationship with US bank Wells Fargo for R3’s Corda platform. Now that her has moved on, some wonder what will be next for him and how he may influence innovation in the cryptocurrency sector.

Lund may be best known for his bullish prediction that we will see the price of Bitcoin hit $1,000,000 in our lifetime. He confirmed his departure from IBM and stated “Yes, I’ve left IBM but am still optimistic about payments innovation using Blockchain.” After Lund’s departure, the task of advancing IBM’s World Wire platform lies on the leadership of Jerry Cuomo. You may never heard of his name, but you have seen his work if you are using instant messenger application as he invented the “someone is typing” feature. According to the co-founder of Stellar, Jed McCaleb, Lund’s departure won’t have an impact on the project as he added “No, we are still full steam ahead with World Wire.”

In regard to Lund’s Bitcoin price prediction, he justified is by stating that “I have a long-term outlook. It goes back to that discussion about the utility of the network with a higher price. I see Bitcoin at a million dollars someday. I like that number because if Bitcoin’s at a million dollars, then the Satoshi is on value parity with the US penny. And that means there’s over $20 trillion of liquidity in this network. Think about $20 trillion in liquidity and how that changes things like corporate payments.” While his point of view is shared my quite a few die-hard bulls, we are a long and tough road away from this. As I have pointed out at the beginning of this year in my post “Bitcoin - Forex Combo Strategy: Cryptocurrency Acceptance Grows”, we are on track to go more mainstream. The community is likely to diverge into different camps as more acceptance often comes with more oversight and regulation which would go counter the decentralized and free community many love to support.

One of Lund’s last commentary at IBM included his excitement that more big players are partnering up and entering the cryptocurrency sector. After Microsoft announced its partnership with US bank JP Morgan Chase, Lund explained “Great to see more major players piling on this use case as we approach the tipping point of transforming global financial services. What’s next is an extended solution to bring open fungibility of liquidity and FX across major banking institutions… I wonder if any other big players are working toward that(?!)!” It is indeed another sign that the sector is maturing and sucking in more global player who previously shied away. We don’t know what is next on Lund’s agenda as his latest LinkedIn profile doesn’t show an update after IBM which likely means that he either hasn’t moved on or keeps it secret for now.

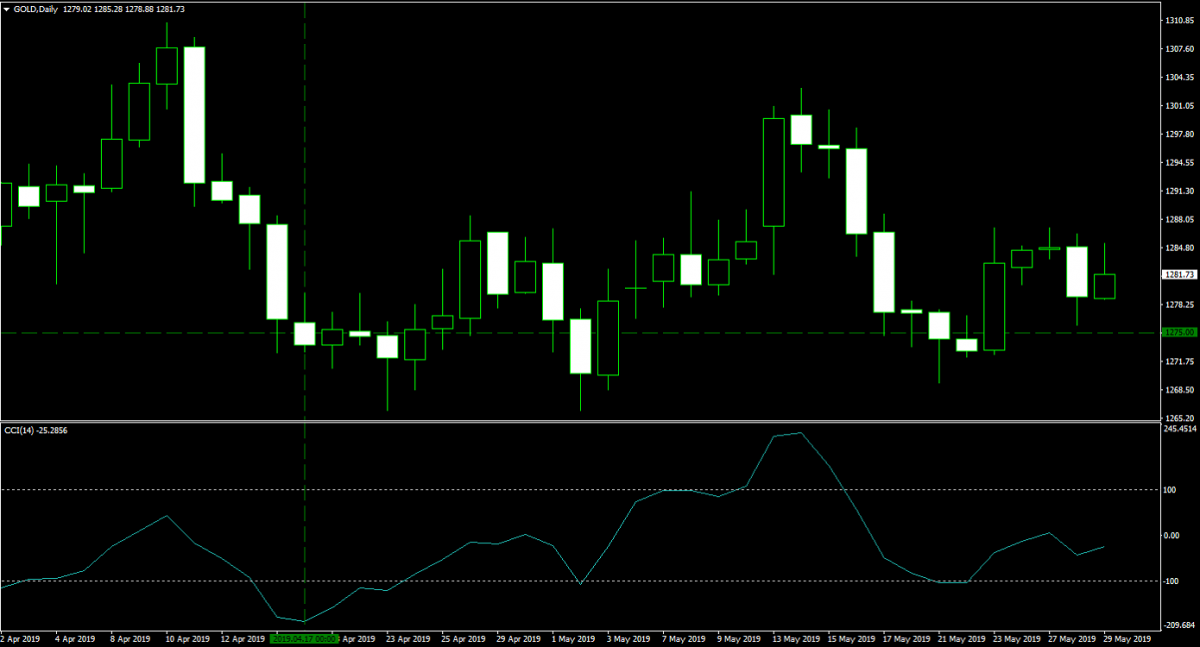

Now let’s take a look at the rest of my portfolio. Gold has been stuck in a narrow trading range, hugging a solid support level. I have not added to my long Gold trade and maintain the 100 lots which I bought at $1,275.00 on April 17th 2019 for a margin requirement of $127,367 with a cent value of $100. I think we will see another push higher and retake the $1,300 level. The image below shows my Gold position.

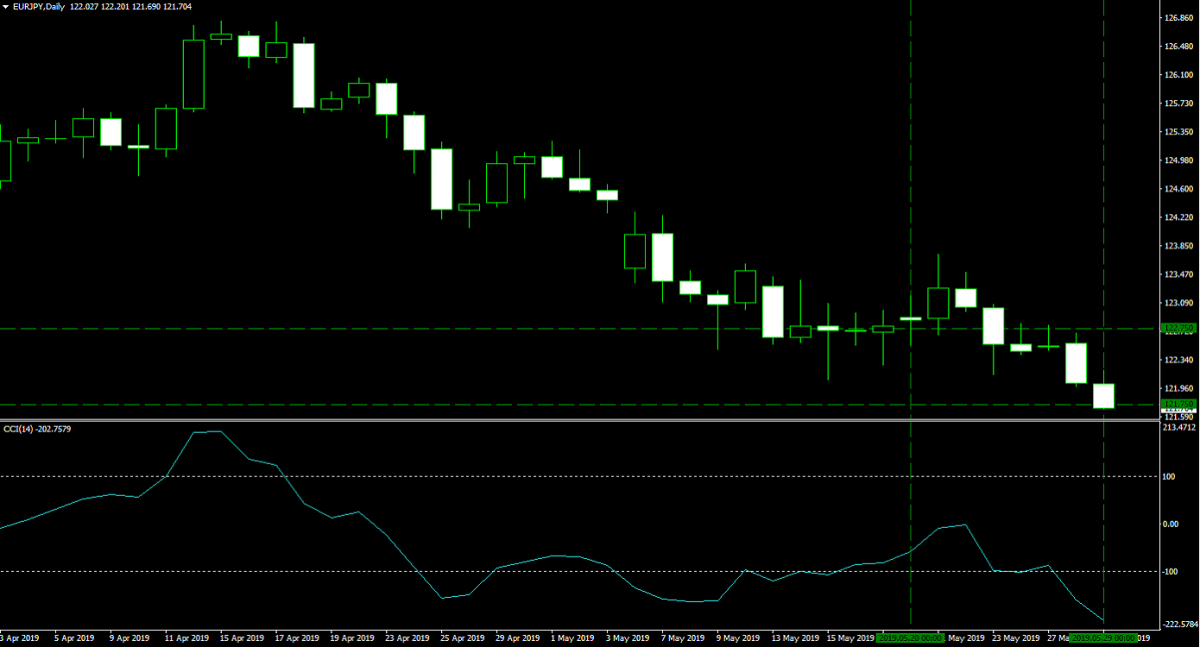

I have maintained all four forex positions which I had last week without making any changes to them. Price action moved in my favor on three of them and I added to my EURJPY position. This has me now resulted in heavy exposure to the US Dollar, the Australian Dollar, the New Zealand Dollar, the British Pound and the Euro which means that I will not add any more forex trades until I exit some of those positions. My forex portfolio is only hedged by a Gold position and I may have to add more Gold in order to counter the FX risk, unless price action moves into an area which allows me to exit for small profits.

I have the following two long positions in the AUDUSD: a 200 lots position taken on April 26th 2019 at 0.7025 for a margin requirement of $28,158 with a pip value of $2,000.00 and a 400 lots position taken on May 15th 2019 at at 0.6925 for a margin requirement of $55,366 with a pip value of $4,000.00. In addition I have the following two long positions in the NZDUSD: a 200 lots position taken on May 1st 2019 at 0.6650 for a margin requirement of $26,600 with a pip value of $2,000.00 and a 400 lots position taken on May 8th 2019 at at 0.6530 for a margin requirement of $53,199 with a pip value of $4,000.00. The two images below show my bullish position in commodity currencies which I have taken despite the negative impact from the US-China trade war.

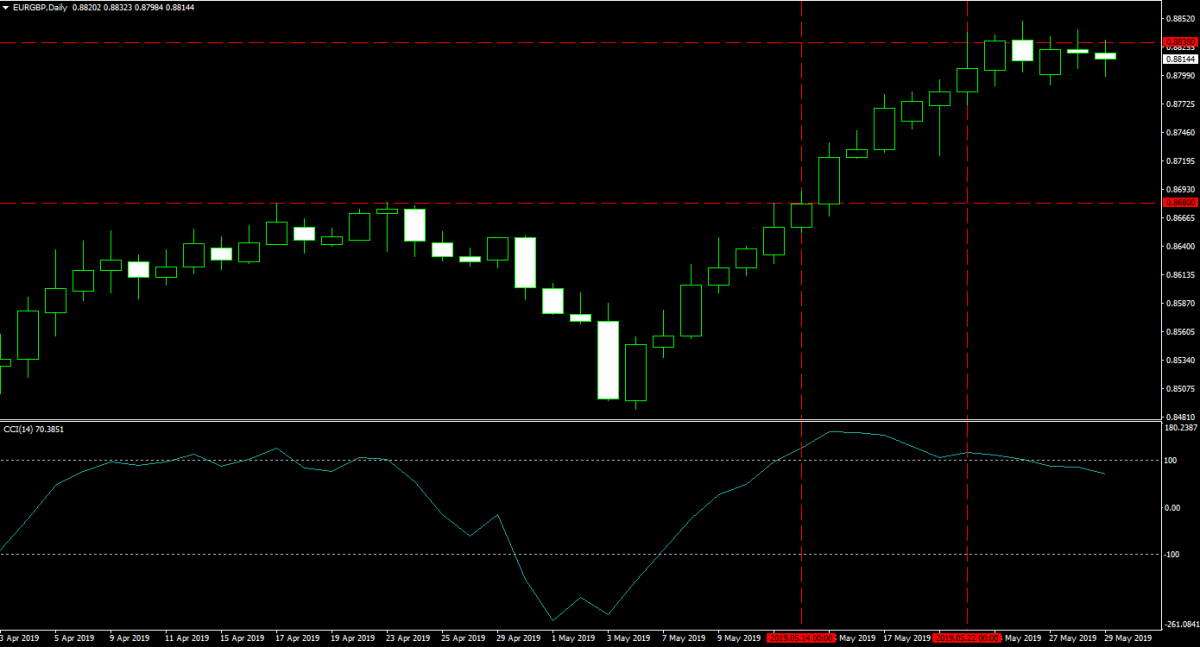

My two short positions in the EURGBP consist of 200 lots shorted on May 14th 2019 at 0.8680 for a margin requirement of $44,730 with a pip value of $2,568.48 and of 400 lots shorted taken on May 22nd 2019 at at 0.8830 for a margin requirement of $89,357 with a pip value of$5,061.60. After I added my existing EURJPY short position, I have the following to long positions: a 200 lots position bought on May 20th 2019 at 122.750 for a margin requirement of $44,678 with a pip value of $1,812.25 and a 400 lots position bought on May 29th 2019 at 121.75 for a margin requirement of $89,156 with a pip value of $3,656.57. The two images below show my positions.

Here is the summary of my Bitcoin - Forex Combo portfolio: I hodl 100 Bitcoins worth $867,280 and have a 500 Bitcoin short position worth $4,425,000, a 10,000 Ethereum short position worth $1,624,000, a 5,000,000 long position in Ripple worth $2,219,000, a 100 lots Gold position worth $196,067 and a total cash portfolio worth $2,435,768. In addition I have the following forex positions on my portfolio: a 600 lots AUDUSD long position worth -$170,476, a 600 lots NZDUSD long position worth -$292,201, a 600 lots EURGBP short position worth -$182,515 and a 600 lots EURJPY long position worth -$9,109. My total Bitcoin - Forex Combo portfolio is worth $11,112,814, up $191,198 from last week’s value of $10,921,616 and just shy from my all-time high of $11,436,520. I think more exciting times are ahead and I encourage you to act now and open your PaxForex Trading Account where you can execute my Bitcoin - Forex Combo Strategy and earn more money per trade. Feel free to comment below with any questions you may have and I will be happy to help you get started!

To receive new articles instantly Subscribe to updates.