The second biggest election in the world, trailing only India which also just concluded and gave incumbent President Modi a major victory, are behind us. Over the next few weeks, as the EU Parliament will be reshuffled, forex traders will assess how this may impact the Euro moving forward. The EU has been plagued by infighting and slow bureaucratic progress and after the new mix of politicians following heavy losses by the Grand Coalition, this will only get more complicated over the next five years. This has possible been the most important EU parliamentary elections since they were first introduced in 1979.

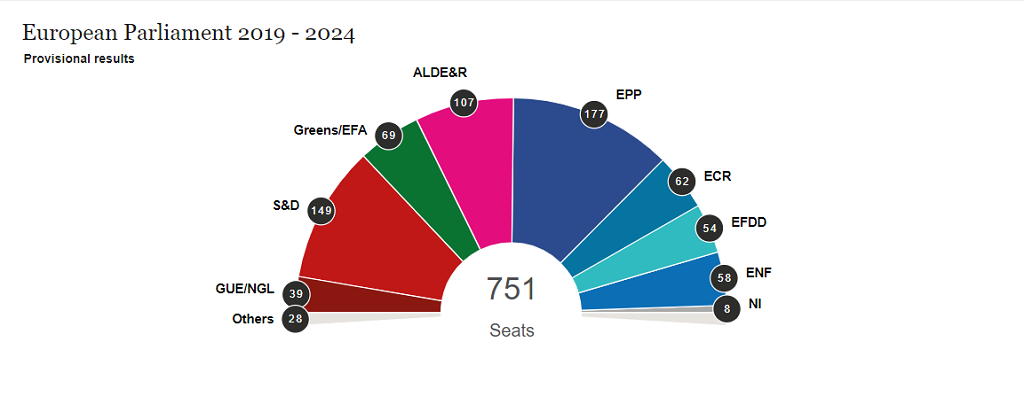

Voter turnout since the 1979 elections has decreased at every five year election and was below 50%. This past weekend, turnout eclipsed 50% in a sign that more EU citizens decided to vote against the Grand Coalition which has governed the majority of the continent for decades. The EU Parliament has usually been governed by the center-right European People’s Party (EPP) with German Chancellor Angela Merkel as key figure and by the center-left Progressive Alliance of Socialists and Democrats (S&D) with Spanish Prime Minister Sanchez as key figure. Combined they formed the Grand Coalition which held a majority in the 751 seat EU Parliament. This majority is now gone as the EPP lost 39 seats and the S&D lost 36 seats. Despite the losses, both parties remained the top two with the EPP securing 177 seats and the S&D holding on to 149 seats.

Making the biggest gain was the Alliance of Liberals and Democrats for Europe (ALDE&R), which counts French President Macron as its members, which gained 38 seats and is now the third biggest party with 107 seats. The European Conservatives and Reformist Group (ECR), with UK Prime Minister May’s Tory’s as member, lost 15 seats and now hold 62 seats. This was not a total loss as it is a right-wing, anti-EU party and together with the gains of the other two key anti-EU parties they combine for the second biggest grouping, trailing the EPP by only 3 seats. The Europe of Nations and Freedom Party (ENF) gained 22 seats and now holds 58 while the Europe of Freedom and Direct Democracy (EFDD) added 12 seats for a total of 54. Key figures in the ENF include Italy’s Deputy Prime Minister Matteo Salvini and in the EFDD the UK’s Brexit Party Leader Nigel Farage. The ECR, ENF and EFDD combine for 174 seats in the new EU Parliament.

What does this mean for the Euro? There will be some key changes to the EU Parliament and while the Euro initially gained ground, forex traders will await appointments in order to get a better idea. Uncertainty over the Euro is on the rise as the global economy is heading towards a recession. The Eurozone economy, dependent on exports, is caught in the middle of the trade war between the US and China as US President Trump is also eyeing the EU as its next tariff target. Is it time to buy the Euro? Open your PaxForex Trading Account now and join our fast growing community of profitable forex traders!

Adding to uncertainty over the EU and the Eurozone economy was the rise of the Greens/European Free Alliance (Greens/EFA) party which gained 17 seats and now controls 69. While this was a clear victory for right-wing, anti-EU parties, the loses besides the Grand Coalition was the far-left European United Left/Nordic Green Left (GUE/NGL) which shed 13 seats down to 39 while non-aligned MEPs lost 12 seats to hold onto only 8. There are an additional 28 MEPs which have not declared their allegiance as of yet and could add to the shift in the dynamic of the next EU Parliament which will govern from 2019 to 2024. How will this shift impact the Euro? The new EU Parliament and the Euro will undergo an uncertain period which could lead to fundamental changes and here are three forex trades to fundamentally increase your profits!

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

While the Euro is faced with an uncertain future as the EU Parliament gets reshuffled and anti-EU parties are gaining seats, the US Dollar is in a potentially more uncertain environment as it prolongs its trade war with China. While the US Fed stated it wont cut interest rates, the situation could change fast. The EURUSD is stable at a very strong support level following the breakout above its horizontal support area which also took price action above its secondary descending support level and turned it into support. With a rise in bullish sentiment, the path is clear for the EURUSD to extend its breakout until it can challenge its next horizontal resistance level which is being approached by its primary descending resistance level. Buying any dips in this currency pair remains the favored trading approach.

The CCI has ascended from extreme oversold conditions and bullish momentum is now anticipated to push this technical indicator above the 0 mark fro a bullish momentum crossover. Download your PaxForex MT4 Trading Platform now and find out how our traders earn more pips with every trade!

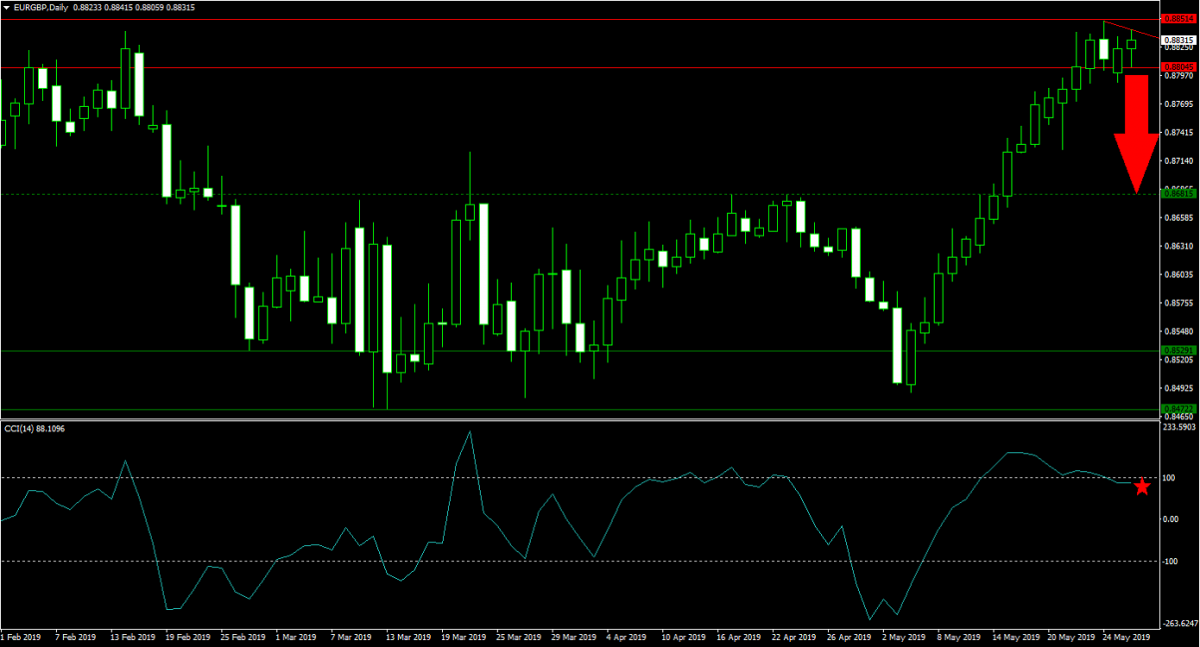

Forex Profit Set-Up #2; Sell EURGBP - D1 Time-Frame

With UK Prime Minister Theresa May stepping down, her replacement is expected to be a Brexiteer who will push for an exit on UK terms. While some forex traders will pull the sell trigger on the British Pound, overall the EURGBP is expected to come out on top after the dust settles. Price action is currently depleting bullish momentum inside of its horizontal resistance area from where a breakdown is expected to materialize. A new primary descending resistance level is in the process of forming which further adds t the rise in bearish pressures. A breakdown from current levels is expected to guide the EURGBP back down into its next horizontal support level. Forex traders are advised to spread their sell positions inside the horizontal resistance area.

The CCI already drifted out of extreme overbought territory which further added to the rise in bearish momentum. An extension to below 0 is favored which supports more downside in this currency pair. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month!

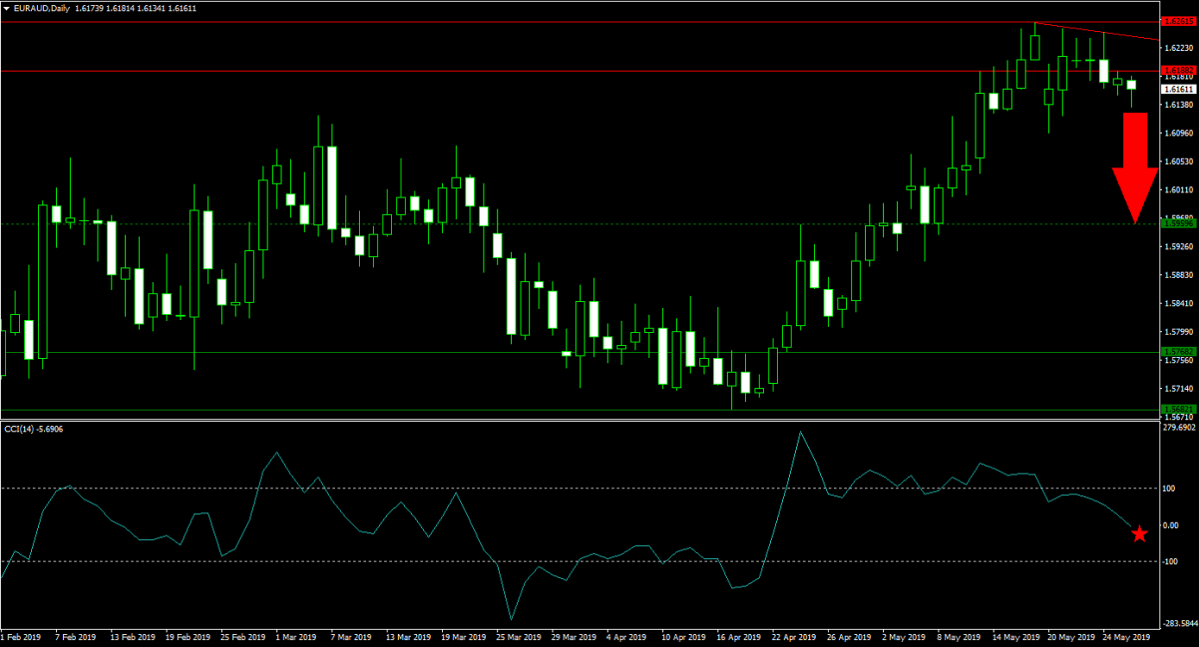

Forex Profit Set-Up #3; Sell EURAUD - D1 Time-Frame

As the US-China trade war is intensifying and with the Australian Dollar the top Chinese Yuan proxy trade, the Euro is expected to lose ground against the Australian currency. Price action in the EURAUD already completed a breakdown below its horizontal resistance area which added to selling pressure. Its primary descending resistance level is further adding to bearish momentum and this currency pair is expected to accelerate to the downside until it can challenge its next horizontal support level. Forex traders are recommended to sell any rallies up into its primary descending resistance level which is located inside of its horizontal resistance area.

The CCI completed its move out of extreme overbought conditions and extended its slide to below the 0 level which completed a bearish momentum crossover. More downside is expected to follow. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.