The trade war between the US and China is heating up with the People’s Daily, the official newspaper of China, stating “We advise the U.S. side not to underestimate the Chinese side’s ability to safeguard its development rights and interests. Don’t say we didn’t warn you! United States, don’t underestimate China’s ability to strike back.” At the same time, trade talks between the US and EU collapsed which added another layer of issues for the slowing global economy and distress for the US economy specifically. Many market participants from all parts of the equation have not properly priced in the issues which have been created for the domestic economy which is headed towards a recession faster than most realize.

The last time the People’s Daily printed the phrase “Don’t say we didn’t warn you!” was in 1962 before the Chinese-Indian border war and in 1979 before the Chinese-Vietnamese war which were both hot wars. While the situation with the EU is currently less heated than with China, from a US perspective, things are falling apart quicker than they Trump administration can cater to them. Just ten months ago, US President Trump and European Commission President Jean-Claude Juncker signed a truce labeled the Rose Garden truce which was intended to give both sides time to iron out differences. Prior to the truce, Trump threatened tariffs on EU auto exports to the US which would have dealt a blow to the stagnant Eurozone economy and would have resulted in retaliatory tariffs from the EU.

The Trump administration has started too many fires and has had little time to focus on EU bureaucracy which is already facing little to no respect from Trump’s inner circle. A lot of energy has been spend on signing a quick trade deal with Japan in order to ease the stress on the US agricultural sector, a core base of support for President Trump. After EU Trade Commissioner Cecilia Malmstrom met with US Trade Representative Robert Lighthizer, she stated that “I don’t think the US is ready to start on the tariff negotiations.” At the same time, the EU is dealing with its own range of issues. The Head of the Europe Program at the Center for Strategic and International Studies, Heather Conley, added “You’re seeing an EU that is fighting fires on so many fronts that I just don’t think they are going to be confident and able to negotiate that deal.”

The Euro has been refined to a narrow trading range at very strong support levels against the US Dollar as the most traded currency pair is being pulled in both directions. Is it time to buy the Euro as Trump’s deadline for a deal is ending at the same time the new European Commission will take over the reigns following a big reshuffle as a result of the EU parliamentary elections? Open your PaxForex Trading Account today and find out why more and more successful trader chose PaxForex as their prime broker!

Adding to the issues is that France and Germany, the two biggest economies in the EU, have a different agenda when it comes to trade. Trump’s threat of car tariffs is a bigger issue for Germany which generated a surplus of €22 billion with the US in the car sector. France is more concerned with agriculture which is also a key aspect for the US. Bilateral talks have yielded no progress and the US has not been unwilling to even discuss auto tariffs. Adding to the complications from the US is their showing off a 150 page binder from the negotiations with China which did noting more than anger the EU. While Japan may be Trump’s best bet to sign a trade deal before the 2020 election campaign, the EU made it clear that it will retaliate against tariffs from the US side. Before trade talks started in earnest, US-EU trade talks collapse. Here are three forex trades which will support your forex portfolio and keep the profits flowing!

Forex Profit Set-Up #1; Sell EURSGD - D1 Time-Frame

Singapore just took the number one spot as 2019’s most competitive economy and the Singapore Dollar received a boost. Given the headwinds faced by the Euro and the strong gains in the EURSGD since the end of April, this currency pair offers forex traders a great trading opportunity to short the Euro. The horizontal resistance area rejected a further advance and bearish pressure is further increased by its primary descending resistance level. Over the past week the uptrend has been exhausted and a corrective phase materialized which is anticipated to drive the EURSGD back down into the upper band of its next horizontal support area. Forex traders are recommended to sell any rallies into its primary descending resistance level.

The CCI collapsed from extreme overbought conditions and downside momentum was string enough to push below the 0 mark for a bearish momentum crossover. This has attracted more sellers to this currency pair, a trend which is favored to extend. Download your PaxForex MT4 Trading Platform and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #2; Sell USDCAD - D1 Time-Frame

The US Dollar is coming under pressure as forex trader re-evaluate their long positions, especially since the 3-Month US Treasury yield and the 10-Year US Treasury yield posted the biggest inversion since 2007. This is flashing a string recession signal and is further pressuring the US Fed. The Canadian Dollar is ripe for a reversal on the back of a short-covering rally which makes the USDCAD vulnerable to a big downside risk. Price action is currently in the process of completing a breakdown below its horizontal resistance area. This is expected to lead to another breakdown below its secondary ascending support level which will open the way for more downside. The USDCAD is anticipated to extend its sell-off until it can challenge its next horizontal support level. Forex traders are advised to sell any rallies into the upper band of its horizontal resistance area.

The CCI remains in extreme overbought territory, but started to retreat from its high with a build-up in bearish momentum. This technical indicator is now anticipated to drop below the 100 level which could ignite a bigger sell-off. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips in monthly profits!

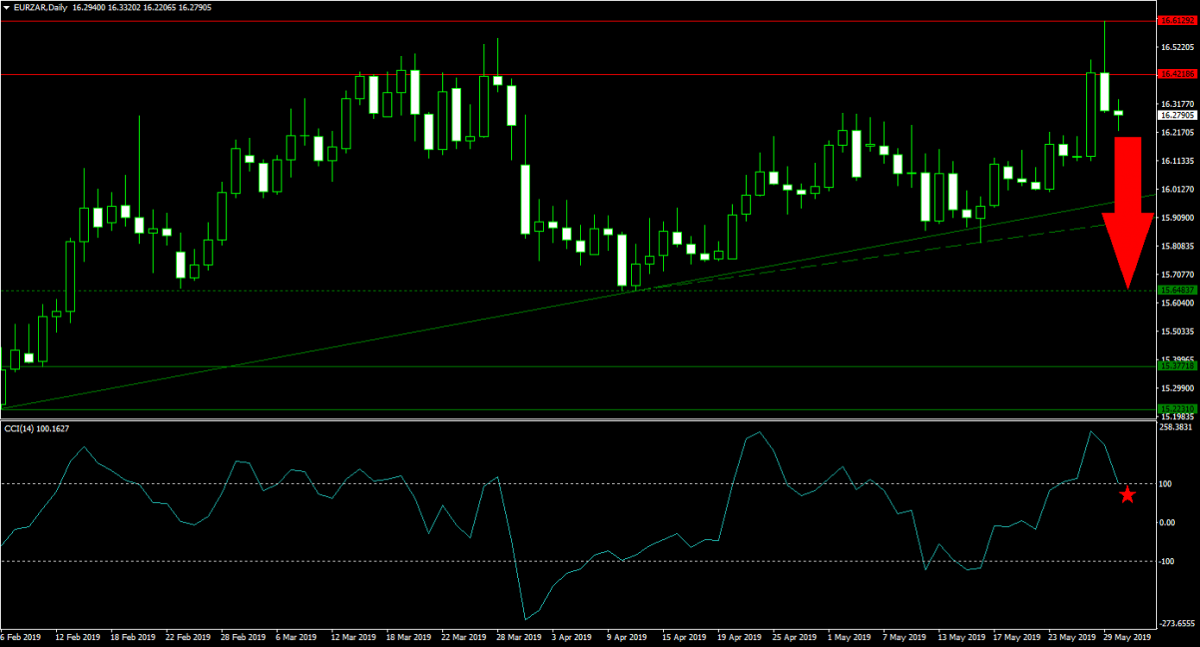

Forex Profit Set-Up #3; Sell EURZAR - D1 Time-Frame

Just as the US is applying tariffs on trading partners, the African continent is in the early stages to eliminate tariffs and create the world’s largest free trade zone. While this remains a big challenge, the South African Rand is on track to outperform the Euro in a short-term basis and on the back of profit taking. Over the past two trading sessions, this currency pair was rejected by it horizontal resistance area and accelerated to the downside with a sharp rise in bearish momentum. This is now expected to lead to a double breakdown in the EURZAR, below its primary as well as secondary ascending support levels, and clear the path for a move into its next horizontal support level. Selling any rallies in the EURZAR into its horizontal resistance area remains the favored trading approach.

The CCI is currently trading in-and-out of extreme overbought conditions and this momentum indicator is favored to push below this level which is anticipated to encourage more selling in this currency pair. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts; we do the hard work so you can earn the easy profits!

To receive new articles instantly Subscribe to updates.