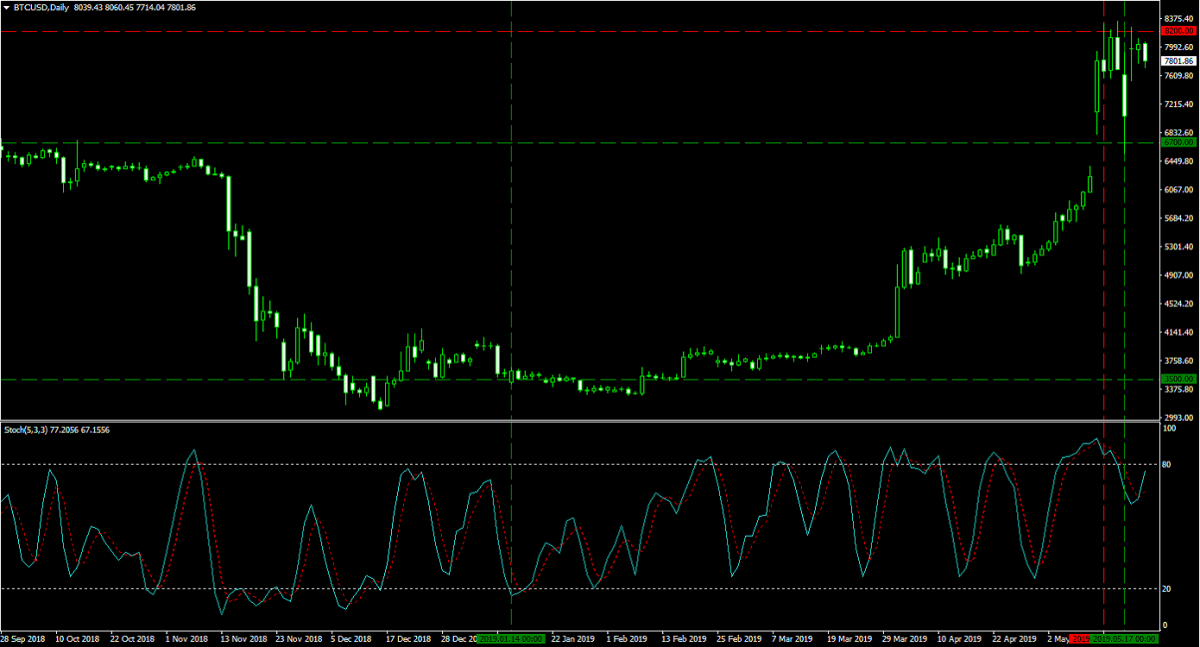

Welcome back to this week’s update to my Bitcoin - Forex Combo Strategy. After Bitcoin eclipsed the $8,000 mark we saw a spike in volatility and a drop in bullish momentum. Price action currently struggles with this level which is a normal development after the strong rally we have had. The markets are waiting for the next catalyst and some institutional investors may want to lock in some profits and re-enter after a short-term sell-off. This is often the time when professionals traders seek to sell while retail traders who were watching Bitcoin rise want to buy based on hope it will accelerate further. Once the price drops further, retail traders exit with losses and professional traders step back in. The cycle has been in place since the existence of financial markets and will continue.

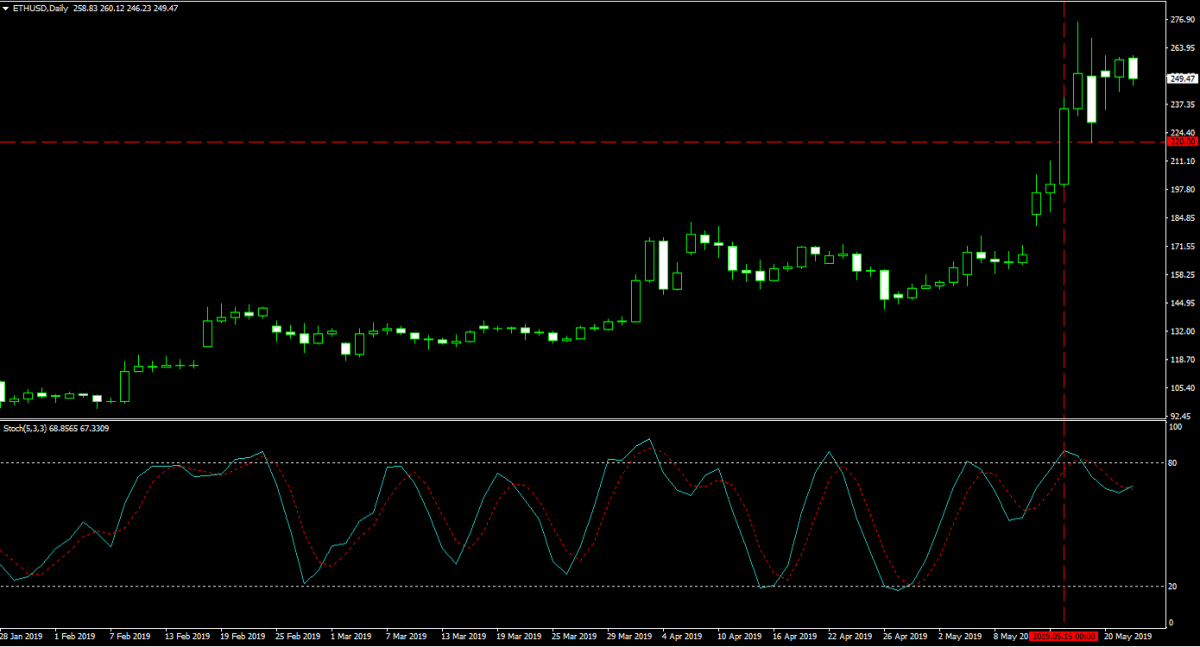

I sold my short position In Bitcoin last week and am looking to enter another short position if price action pushes above $8,200 again. This was the entry level of my previous short position which I closed at $6,700 for a profit of $300,000. I keep my 100 Bitcoins which I bought at $3,500 on January 14th 2019. I also kept my 10,000 Ether short position, which I took at $220, unchanged as I am looking to add to it if price action extends further to the upside. I am rather bearish on the outlook of Ethereum and BlockFi slashed its interest rate on Ethereum holdings from 6.20% to 3.25% annualized, citing a decrease in loan demand. I missed a great short opportunity in Ripple and am now waiting for my next entry level. Overall I remain bullish on Ripple and think we can push higher. I look to buy on the next dip, but won’t hesitate to short of we see an unwarranted spike. The two images show my current cryptocurrency portfolio.

Now let’s talk about the mysterious Facebook Coin which is in the making and could be released this year in India as a test case. The company has now taken the next step and open the Libra Network in Geneva, Switzerland. This FinTech start-up is intended to house and support the infrastructure for the Facebook Coin. While Facebook remains unusually quiet when it comes to Project Libra, the Swiss Commercial Register list the social media form as one owner. Project Libra, besides infrastructure support for the planned Facebook Coin, is also expected to develop technology and financial services for clients. The rumors for this coin started over one year ago when Facebook started to hire experts in blockchain technology.

While not much is agreed on when it comes to the rumors surrounding Project Libra, one thing most can agree on is that Facebook wants to deploy blockchain technology to its messenger app WhatsApp. This would enable users, in theory, to send payments between each other. Facebook is copying this from Chinese companies such as Tencent as well as other Asian tech giants who have rolled out this type of service years ago. According to one report, the company has over 50 engineers working on Project Libra and the Facebook Coin. In addition to WhatsApp, it will also be launched on Instagram which would give Facebook over 2.7 billion users to market is financial services to.

How many will trust Facebook with their finances remains to be seen. Competitors across Asia have a loyal customer base and given the recent news surround about the US and its blacklisting of Huawei, it could be a tough sell to consumers who are doing the majority of banking with local champions they know and trust. This doesn’t mean that there is no base for Facebook as the market is immense and growing fast. Another alternative would also create healthy competition and ultimately the consumer is expected to win. The timetable for a launch is unclear, but if it won’t launch in 2019 is expected to be unleashed in 2020 at the latest.

Some analysts are extremely bullish on the financial impact the Facebook Coin could have. Barclays released a research note claiming that a successful rollout across all thee platforms could add up to $19 billion in revenues to the company. This appears as a rather lofty goal and the actual impact could be less than 10% of this figure. Since details are scarce, it is impossible to properly analyse the impact of Project Libra. There are too many unknowns circling around, but one thing appears all but guaranteed: the Libra Project is shaping up to be a tremendous project and could be the biggest of its kind in the year it will be launched.

Another big unknown is the value equation of the Facebook Coin. While some initial reports suggested it would be pegged to the US Dollar, similar to a growing number of stablecoins, this is now unlikely. The latest predictions call for it to be pegged against a basket of currencies which would make more sense. Should this rumor materialize, it would give the Facebook Coin an edge over competing coins. Let me circle back to my opening sentence, it is very likely that India will be the first country who gets to test the Facebook Coin. It is a logical choice with over 200 million WhatsApp users and a young and growing population eager for new services which will make life’s most basic tasks a lot easier.

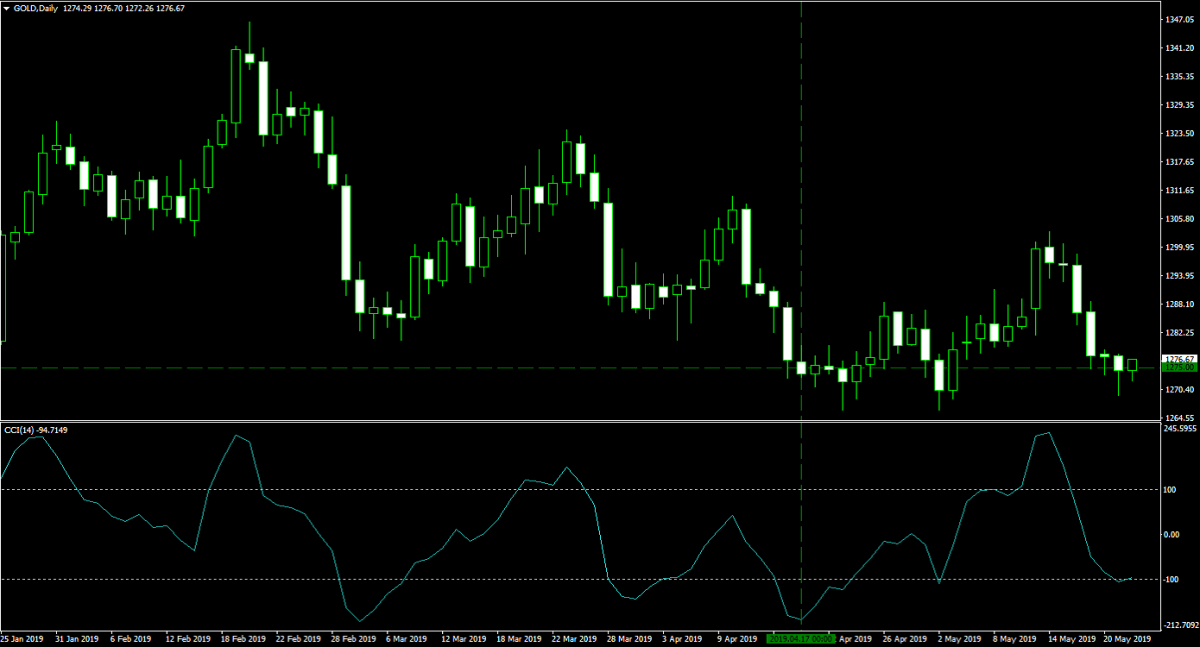

Now let’s finish my portfolio update since last week’s post “Bitcoin - Forex Combo Strategy: RIP Cryptopia”. I have already discussed the cryptocurrency portfolio of my dual strategy. Gold was unable to hold above the $1,300 mark and started to reverse direction yet again, dropping to a strong support level. I believe that given the geopolitical landscape, we will see higher prices. I continue to hold my 100 lots of Gold which I bought on April 17th 2019 at $1,275.00. The margin requirement was $127,367 and each one cent move is worth of $100. The image below shows price action in Gold.

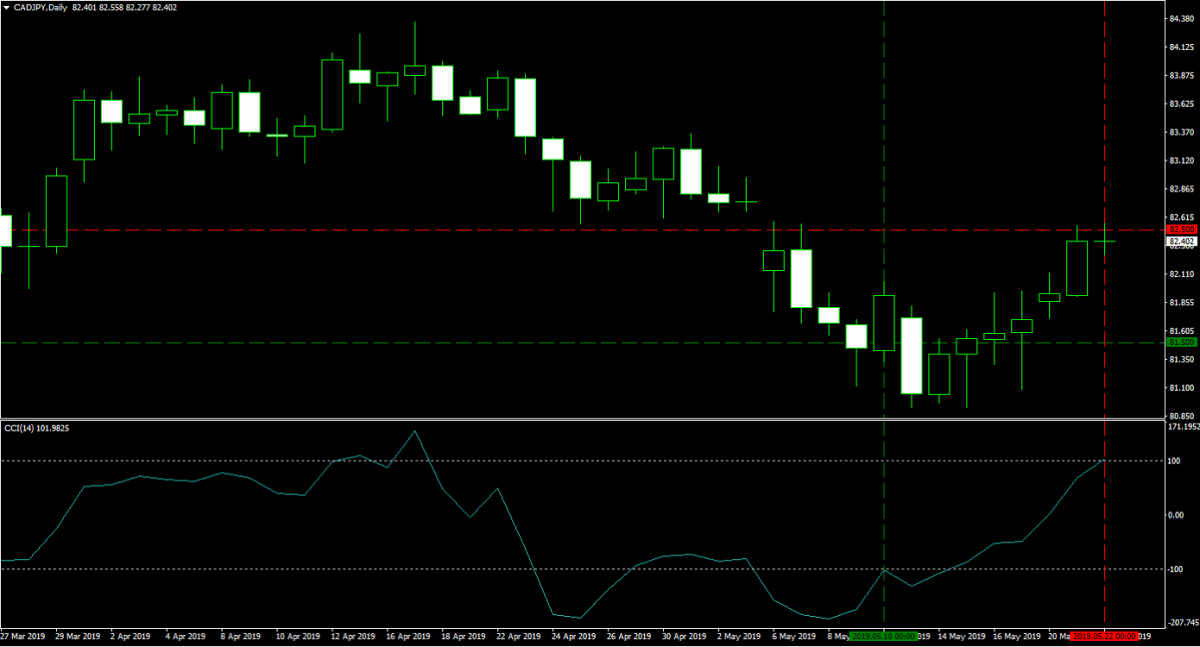

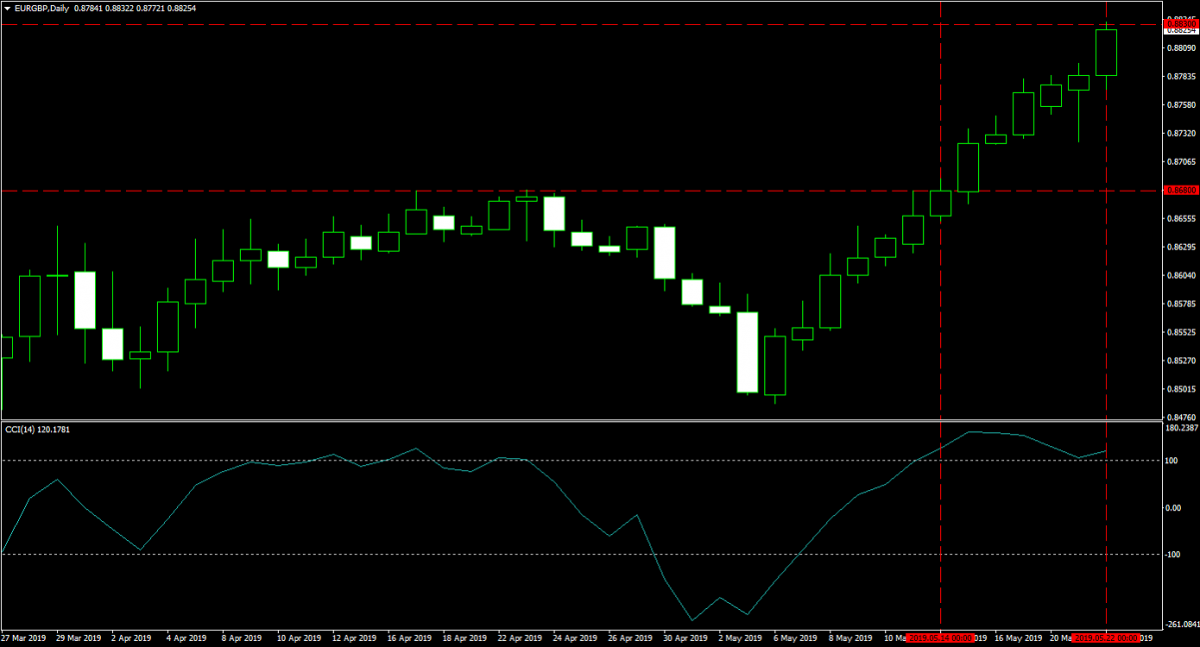

Last week I ended with multiple positions in four currency pairs. Since then one was closed for a profit, I added to one position and two remained unchanged. Earlier today I closed my 200 lots long position in the CADJPY at 82.500. This resulted in a profit of 100 pips or $183,078. Also earlier today, I added to my 200 lots short position in the EURGBP which I took on May 14th 2019 at 0.8680. The margin requirement was $44,734 with a pip value of $2,568.48. I sold an additional 400 lots today, May 22nd 2019, at 0.8830 for a margin requirement of $89,357 and with a pip value of $5,061.60. The two images below show my exit and entry in these two currency pairs.

I kept my long positions in the Australian as well as New Zealand Dollar unchanged, but the extended slide could result in me taking losses and moving on. I have not decided yet and will monitor price action closely. My two long positions in the AUDUSD consist of a 200 lots position taken on April 26th 2019 at 0.7025 for a margin requirement of $28,158 with a pip value of $2,000.00 and a 400 lots position taken on May 15th 2019 at at 0.6925 for a margin requirement of $55,366 with a pip value of $4,000.00. My two long positions in the NZDUSD consist of a 200 lots position taken on May 1st 2019 at 0.6650 for a margin requirement of $26,600 with a pip value of $2,000.00 and a 400 lots position taken on May 8th 2019 at at 0.6530 for a margin requirement of $53,199 with a pip value of $4,000.00. The two images below show my positions in both currency pairs.

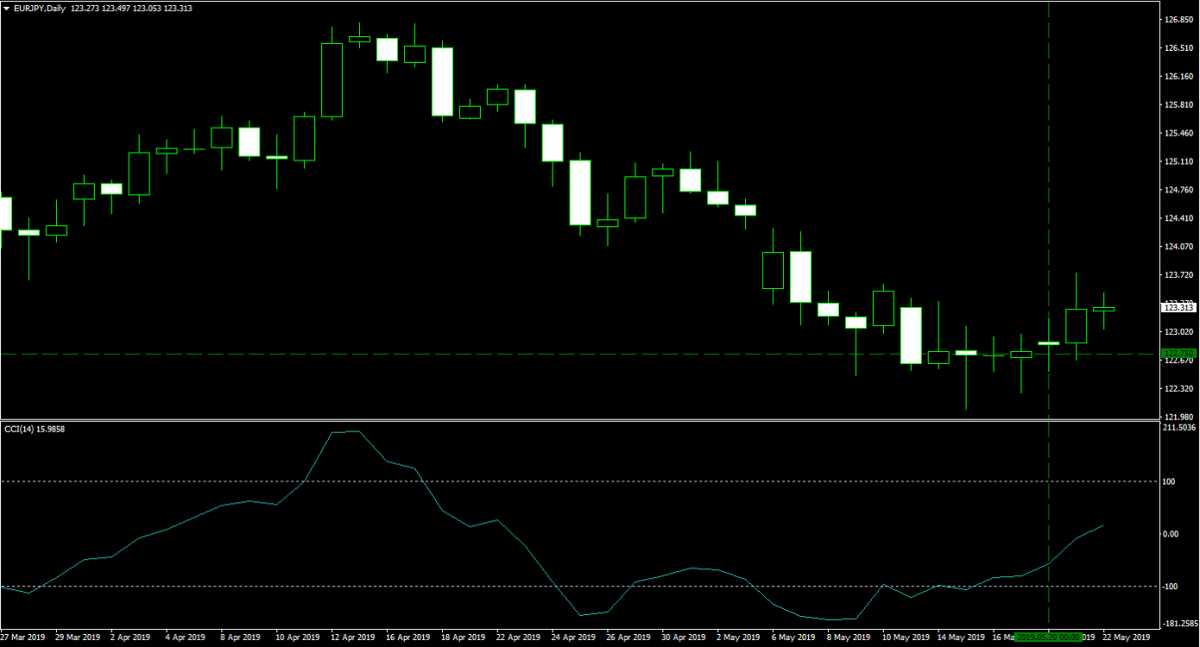

Due to my heavy exposure to the US Dollar, the Australian Dollar, the New Zealand Dollar and now to the British Pound, I won’t be adding to trades in there currencies until I trade out of them. On May 20th 2019 I bought 200 lots in the EURJPY at 122.75 according to this trading recommendation “EURJPY Fundamental Analysis – May 20th 2019”. The margin requirement was $44,678 and each pip is worth $1,812.25. The image below shows my entry.

Here is the summary of my Bitcoin - Forex Combo portfolio: I hodl 100 Bitcoins worth $779,475, a 10,000 Ethereum short position worth $1,912,900, a 100 lots Gold position worth $143,667 and a total cash portfolio worth $8,774,924. In addition I have the following forex positions on my portfolio: a 600 lots AUDUSD long position worth -$326,476, a 600 lots NZDUSD long position worth -$298,201, a 600 lots EURGBP short position worth -$205,400 and a 200 lots EURJPY long position worth $140,727. My total Bitcoin - Forex Combo portfolio is worth $10,921,616, down $514,904 from last week’s all-time high of $11,436,520. After a strong advance in my Bitcoin - Forex Combo portfolio, I expected a pause and reversal. This is healthy as no portfolio can only go up every single week. I will monitor my big positions closely and see if I keep holding them or if I decide to close them for a loss and move on. I invite you now to open your PaxForex Trading Account and use my Bitcoin - Forex Combo Strategy in order to replicate the huge success I have had. Feel free to comment below with any questions you may have and I will be happy to help you get started!

To receive new articles instantly Subscribe to updates.