UK Prime Minister Theresa May has been resilient in her premiership and was able to hold on so far, but it was only a matter of time until she would travel to the end of her road. Today she is facing another showdown in Parliament after cross-party talks to reach a Brexit deal compromise with the Labour Party broke down. May will now try to win over rebel Labour MP’s in order to have enough voted to pass her much hated Brexit deal after it was voted down three times before. It is unlikely that she will succeed as it will require a much closer customs union with the EU, objected by the majority of her own Tory party.

May is expected to face heavy objections by Brexiteers who now await her departure. Her Withdrawal Agreement Bill is scheduled for a fourth vote on June 3rd 2019 and is currently on track to be voted down again. The UK will now have to participate in EU parliamentary elections this weekend and many in the EU hope this will result in the cancellation of Brexit altogether. As May tries to secure votes, the Irish backstop will remain the key sticking point besides any form of a customs union which May said should be renamed. She agreed to step down after her Brexit deal is approved, but she may be forced to do so even if it is voted down again.

Over 66% of Tories prefer a no-deal Brexit and only 27% support May’s deal. The next UK Prime Minister is currently expected to be a Brexiteer who will deliver the type of Brexit which was voted for in the 2016 referendum. Frontrunner for the job is Boris Johnson, former Mayor of London as well as former Foreign Secretary and key Brexiteer. He favors leaving the EU without an agreement in place so that the UK can focus on its future as soon as practical. He currently stands to win the party vote, but he still needs to convince rank-and-file MP’s to put him on the ballot to replace May. Former Brexit Secretary Dominic Raab is also a potential candidate and share a similar view to Johnson in regards to Brexit.

The British Pound came under pressure over the past few trading sessions as the chance for a no-deal Brexit has increased. The uncertainty has spooked any traders, but a growing number of analysts point towards a strong rebound in the British Pound after the dust settles. Is now the right time to look for long entry opportunities in the British currency? Open your PaxForex Trading Account today and start building a profitable forex portfolio with the help of our expert analysts!

Philip Hammond, the Chancellor of the Exchequer, is trying to convince Parliament against a no deal Brexit. He noted that “There is a real risk of a new prime minister abandoning the search for a deal and shifting towards seeking a damaging no-deal exit as a matter of policy.” Andrea Leadsom, the Leader of the House of Commons, also pointed out that she would be ready for a no deal Brexit. She further stated that “The key for me will be that it does deliver Brexit. I would define the difference between a customs union and a customs arrangement as being in a customs arrangement you can still write your own trade deals with the rest of the world.” May is under pressure again as she runs out of options, but here are three forex trades which will increase your options for a profitable outcome!

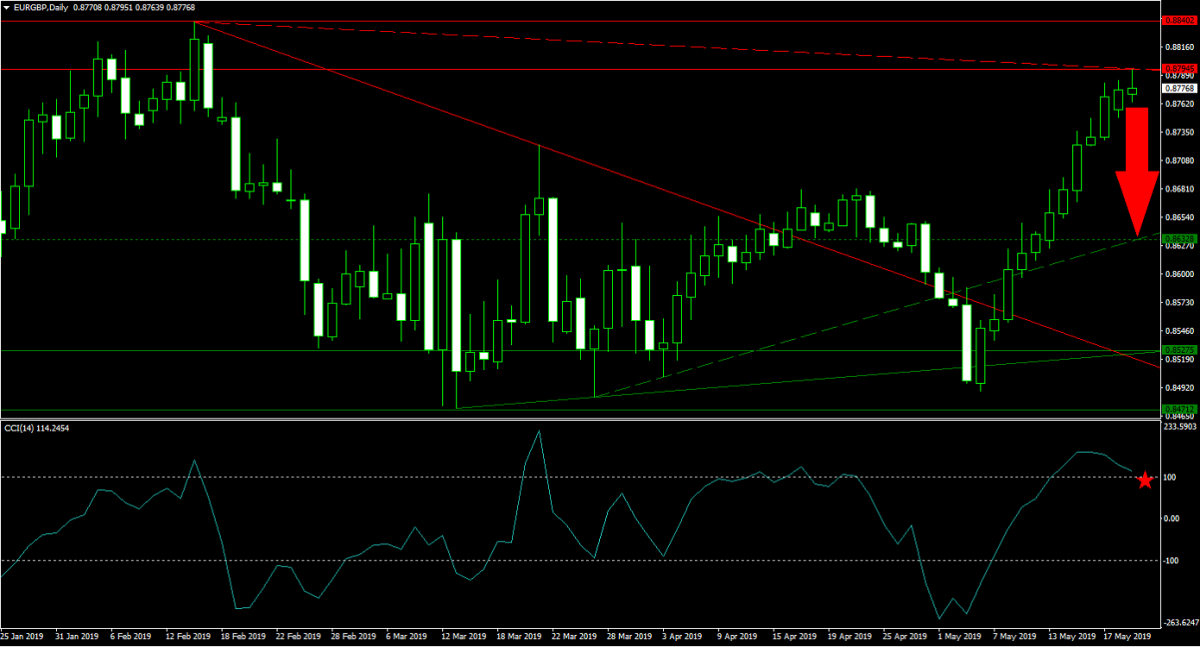

Forex Profit Set-Up #1; Sell EURGBP - D1 Time-Frame

As the chances for a no deal Brexit has increased, so has the EURGBP. Forex traders opted to ignore the weakness in the Eurozone economy and focus on short-term uncertainty of how Brexit will play out with a potential leadership change imminent. Price action exhausted its bullish momentum as it reached the lower band of its horizontal resistance area. With bearish pressures on the rise, this currency pair is now favored to enter a corrective phase on the back of profit taking. Its secondary descending resistance level is adding to downside pressures in the EURGBP which could move back down into its next horizontal support level which is enforced by its secondary ascending support level. Forex traders are advised to sell any rallies into the upper band of its horizontal resistance area.

The CCI is trading in extreme overbought territory, but has started to move away from its high with a rise in bearish momentum. A drop below 100 cold trigger a sell-off as forex traders opt to realize floating trading profits. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market yielding over 500 pips on monthly profits!

Forex Profit Set-Up #2; Buy GBPCHF - D1 Time-Frame

As risk and uncertainty is on the rise, the Swiss Franc usually outperforms most of it peers. Given the sell-off in the British Pound, the GBPCHF had a double dose of bearish forces pushing price action down into its horizontal support area. The sell-off has now been exhausted and a rise in bullish momentum is expected to pressure this currency pair into a breakout. A short-covering rally is likely to follow and extend gains into its next horizontal resistance level which is enforced by its primary descending resistance level. Spreading buy orders inside its horizontal support area remains the favored trading approach for the GBPCHF.

The CCI remains in extreme oversold conditions, but is approaching the -100 mark. Additionally a positive divergence has formed which is a strong bullish trading signal. A move above -100 is anticipated to further attract bullish traders to this currency pair. Download the PaxForex MT4 Trading Platform and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #3; Buy GBPSGD - D1 Time-Frame

The GBPSGD is currently trapped between its secondary ascending support level and its primary descending resistance level. This narrow sector is hovering just above its horizontal support area and an increase in bullish momentum started to pressure price action higher. This is now anticipated to result in a breakout above its primary descending resistance level which will clear the path for an extended advance. Following a breakout, the GBPSGD is clear to move back up into its secondary descending resistance level which has intersected its primary ascending support level. Forex traders are recommended to buy any dips down into the lower band of its horizontal support area.

The CCI is recovering from its lows in extreme oversold territory. This momentum indicator is now predicted to push above the 0 level from where further upside is likely to attract buyers. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.