While some analysts call President Erdogan’s pre-election market meddling as a failure which backfired, it may be a bit too early to judge. Short-term it appears as if it was unsuccessful, but traders need to keep in mind that any transition requires time and is associated with short-term pain. Even without government market interference, Turkey has been faced with a few disruptive developments and the economy should be given time to heal and shouldn’t be judged by the exodus of foreign capital which so far in 2019 stands at $1.8 billion. This marked the largest outflow since 2015.

After the Turkish central bank hiked interest rates by 6.25% in September of 2018, it resorted to other measures into the March election in order to prevent a run on the Turkish Lira. The central bank made it more difficult for foreign investors to access Lira funding at the same time it reign in the local bod market. In addition it instructed local banks to ensure cheap credit which hurt profitability, but kept borrowing costs in check. This has contributed to the outflow of foreign capital, but Turkey just emerged out of a painful recession as geopolitical tension are on the rise.

This has caused a spike in borrowing requirements which already pushed it annualized budget deficit above 100 billion Turkish Lira in April. This is expected to increase as the Treasury announced plans to borrow 11 billion in June and an additional 19.5 billion in July after borrowing 14.9 billion this month. The Turkish Lira dropped 12% this year, 8% in the second-quarter, which further resulted in a decrease of foreign investors in the bond market. After dumping $2.6 billion worth of local currency bonds in 2019, foreign market share of the domestic bond market dropped to 13%. This can be compared to the record 28% ownership which was reported in 2013.

Is it time to buy the Turkish Lira? As the economy is transitioning through the aftermath of the last recession, the rise in tensions with the West as well as a series of policy mistakes, a growing number of economists forecast that the business community will adjust and power ahead the economy. The may be more pain before Turkey will be back on track, but long-term investors could find a great bargain at current prices. Open your PaxForex Trading Account now and build a profitable forex portfolio with the help of out expert analysts!

The Turkish bank regulator instructed banks to settle retail forex transaction valued at more than $100,000 the following business day. They used to be settled the same day. Turkey also added a 0.1% tax on currency sales for the first time in a decade. At the same time demand from households and business for a currency hedge surged which resulted in a surge in Euro and US Dollar deposits at local banks by over $20 billion this year to a total of $180 billion. Turkish banks have now increased the interest rates on Turkish Lira deposits. Viktor Szabo, fund manager at Aberdeen Standard Investments, noted that “The economic adjustment is happening. Many policy errors were made, but I still don’t see Turkey doomed.” This sentiment is shared by a growing number of smart money analysts. Is it time to buy the Turkish Lira? Here are three trades for a strong Turkish Lira addition to your forex portfolio!

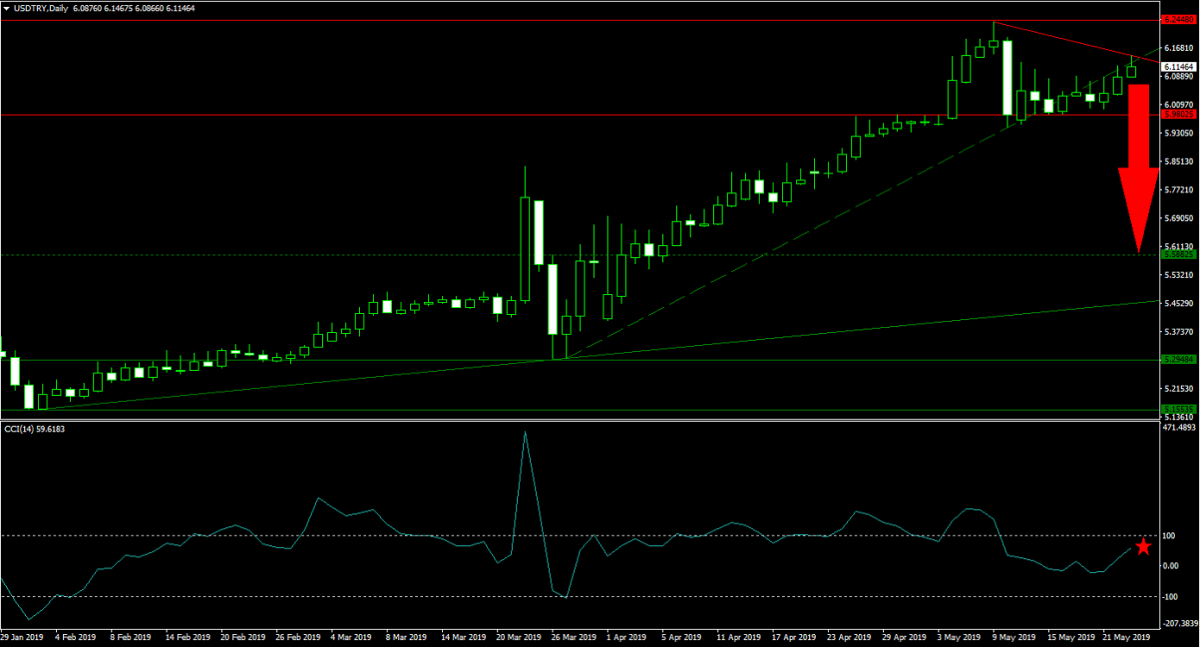

Forex Profit Set-Up #1; Sell USDTRY - D1 Time-Frame

While short-term pressures remain, the US Dollar is poised for weakness as the trade war with China intensifies. In addition, as the Turkish economy adjusts the Lira is likely to rally. The economic potential of Turkey is currently mispriced which creates a great value trade in the USDTRY. Price action is currently trading inside of its horizontal resistance area from where its primary descending resistance level is increasing bearish pressures. This currency pair also moved below its steep, secondary ascending support level and a breakdown is expected to attract more sellers to the USDTRY. Forex traders are recommended to spread their sell orders inside the horizontal resistance area as price action could accelerate to the downside until it will test its next horizontal support level.

The CCI completed a breakdown from extreme overbought conditions and this technical indicator is now drifting in neutral territory. A breakdown in price action is likely to be accompanied by a drop below the 0 mark for a bearish momentum change. Download the PaxForex MT4 Trading Platform now and join our fast growing community of profitable forex traders!

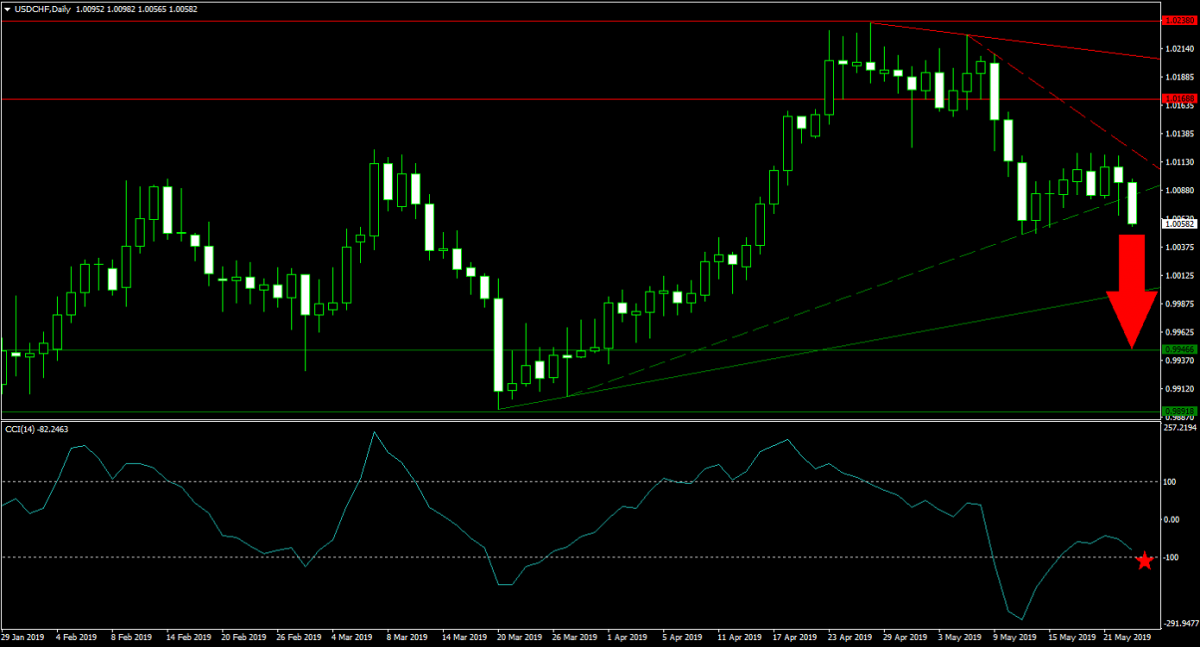

Forex Profit Set-Up #2; Sell USDCHF - D1 Time-Frame

As geopolitical risks rise, the Swiss Franc is well supported due to its safe haven status. This marks a great hedge to the short position in the USDTRY. Over the past four week the USDCHF has been in a corrective phase and today’s breakdown below its secondary ascending support level cleared the way for an extension. As bearish pressures increase, price action is expected to complete a second breakdown below its primary ascending support level and into the upper band of its next horizontal support area. The secondary descending resistance level is further applying downside pressure on this currency pair. Forex traders are advised to sell any rallies into the secondary descending resistance level.

The CCI pushed out of extreme oversold territory, but as bullish momentum collapsed it reversed. This technical indicator is now on track to push below the -100 mark and could be headed down to its previous low. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month in profits!

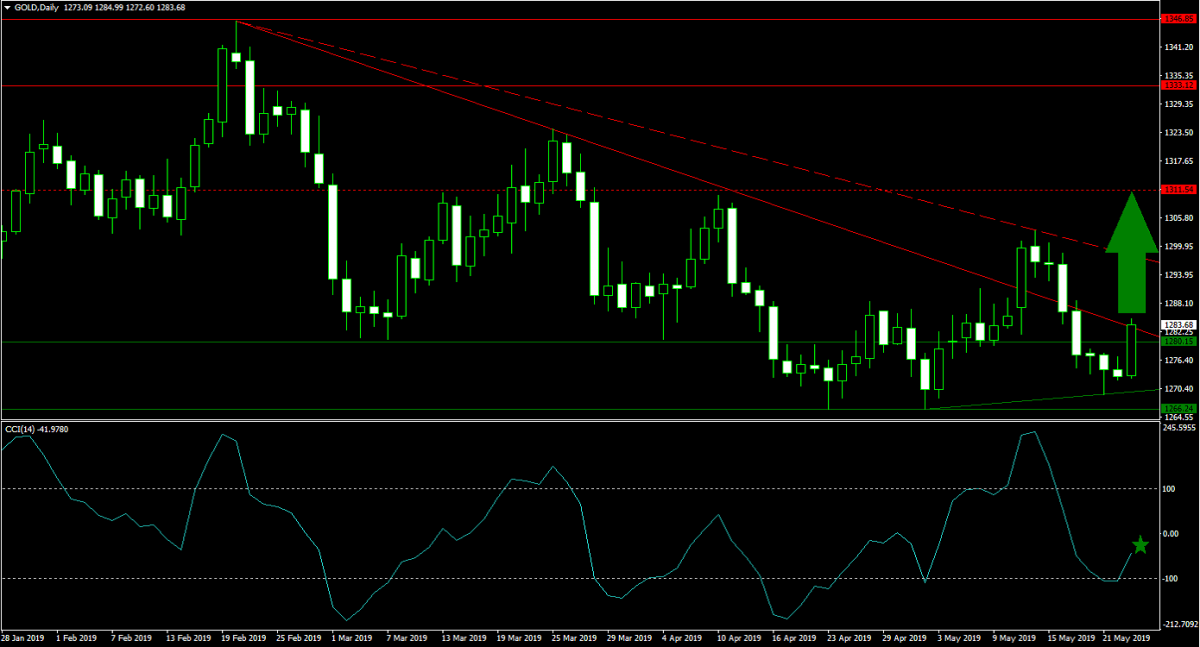

Forex Profit Set-Up #3; Buy Gold - D1 Time-Frame

Offering a smart hedge for the bullish Turkish Lira theme is a long position in Gold. Similar to the Swiss Franc, this is the top safe haven asset of traders and a great way to shield your portfolio from downside risks. This precious metal just completed a breakout from its horizontal support area which resulted in an increase in bullish momentum. Price action is now in the process of pushing above its primary descending resistance level from where a second breakout above its secondary descending resistance level is anticipated. This would clear the path for Gold to advance into its next horizontal resistance level. Buying any dips down to the lower band of its horizontal support area is the favored trading approach.

The CCI spiked following a brief dip into extreme oversold conditions and bullish momentum is anticipated to push above the 0 level for a bullish momentum change which will further accelerate price action. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts; we do the hard work so you can reap the easy profits!

To receive new articles instantly Subscribe to updates.