EURUSD remains bullish Resistance Levels Support Levels R3: 1.3190 R2: 1.2908 R1: 1.2605 S1: 1.2020 S2: 1.2738 S3: 1.1435 Recommendation: Entry Point: 1.2540 Stop Loss: 1.2465 Take Profit: 1.2615 For the coming week, the EURUSD is now projecting another bullish signal in its daily chart, as yesterday’s intraday trading showed a falling leg inside the consolidation pattern in which the MACD raises the possibility that a bullish reversal...

EURUSD projects a bearish reversal signals Resistance Levels Support Levels R3: 1.3186 R2: 1.2887 R1: 1.2731 S1: 1.2276 S2: 1.1977 S3: 1.1821 For the coming week, the EURUSD is projected to show a bearish reversal as its 5-day EMA and 9-day SMA are now crossing over, indicating a reversal for the coming week. In addition, its RSI (14) suggest that prices are now overbought which confirms that a reversal is about to take place....

The EURGBP staged a rally based on renewed hopes that the ECB would act, but traders have pushed it up beyond reasonable levels and woke up this Monday morning realizing that the only sophisticated approach is to take profits. The chart pattern neither offers a clear bearish picture not a bullish picture, but candlestick patters show that a top has been formed form which the correction will take place. MACD has been bullish, but a reversal of that trend is imminent as it has already started to fade. RSI has reached overbought...

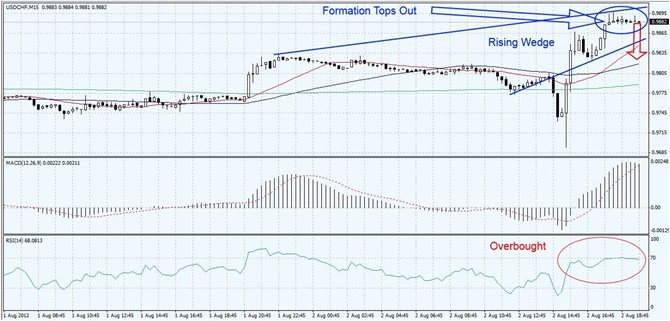

The USDCHF has formed a rising wedge formation and the most recent candlestick patterns point to another top for this pair. The highs reached are lower than the previous high and the most recent correction right before the spike set a lower low which further indicates that this safe-haven trade is ready to correct to more normalized levels. MACD did show strong momentum behind the sharp central bank (in)action which should ignore as those events cause only a temporary disruption before the price action continues back to reality....