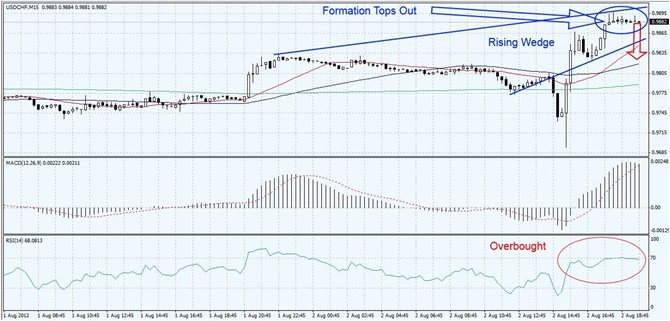

The USDCHF has formed a rising wedge formation and the most recent candlestick patterns point to another top for this pair. The highs reached are lower than the previous high and the most recent correction right before the spike set a lower low which further indicates that this safe-haven trade is ready to correct to more normalized levels.

MACD did show strong momentum behind the sharp central bank (in)action which should ignore as those events cause only a temporary disruption before the price action continues back to reality. Today will also feature the U.S. (un)employment report which will pressure this pair lower. RSI shows overbought levels which can’t be sustained.

I recommend taking an initial short position around the 0.9850 level with potential additions 50 pips higher. Place your T/L levels below the 0.9750.