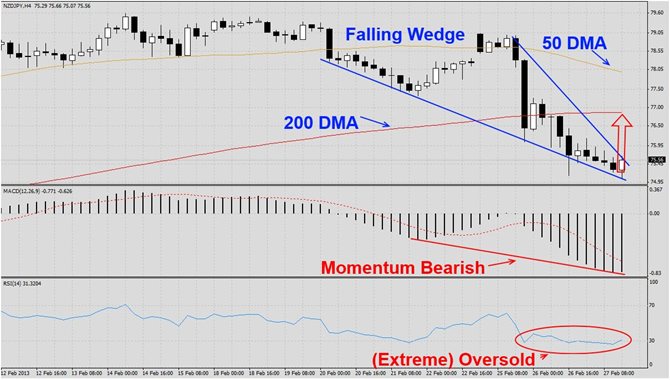

The NZDJPY has corrected sharply after remarks out of the Bank of New Zealand about the strength of the Kiwi. The correction forced the pair below its 50 DMA as well as 200 DMA and formed a falling wedge formation as visible in this H4 chart. We believe this pair will launch a short covering rally which will cause it to breakout from its formation and rally back to its 200 DMA. MACD remains very bearish and may suggest further weakness in the future. A rally is necessary in order to keep this pair in a healthy downtrend. RSI has...

The EURAUD has corrected from its recent highs as visible in this H4 chart and currently trades around its support level. The declining resistance level is enforced by its 50 DMA and has formed a triangle formation. We believe this pair will launch a micro-rally into its 50 DMA. MACD has showed improvement, but remains in bearish territory. A centerline crossover should fuel the rally into a breakout of its formation. RSI trades in neutral level close to oversold territory. Watch out for the RSI to reach overbought territory during...

The AUDNZD rallied from its support level as visible in this H1 chart and was halted by resistance. This pair has now formed a hammer at resistance which is a bearish sign. We believe this pair will trade down to its 50 DMA over the course of this week. MACD shows that momentum has reached its previous top as the moving average is stuck at that level. RSI is trading in and out of extreme overbought territory and a breakdown from this level should accelerate the sell-off into its 50 DMA. We recommend a short position at 1.2335...

The EURAUD has been trapped in a bearish price channel over the past few trading sessions as visible in this H4 chart. This currency pair currently rests at support levels and has started to form a temporary bottom which can be viewed by the last five candlestick formations. We believe this pair will attempt a rally back into its declining resistance level which is enforced by its declining 50 DMA. MACD has formed a positive divergence which supports the prediction for a rally while RSI has formed a positive divergence of its own...

The EURCHF has corrected from its resistance zone down to its support zone as visible in this H4 chart. While the Euro is under pressure due to negative economic reports, the Swiss Franc is still under manipulation by the Swiss National Bank and therefore this pair is troubled by twin bearish factors. We believe this pair will launch a finally rally before we can see new lows. MACD shows a stark improvement and adds to the theory of one final rally before further downside. RSI is trading in oversold territory and a breakout from...