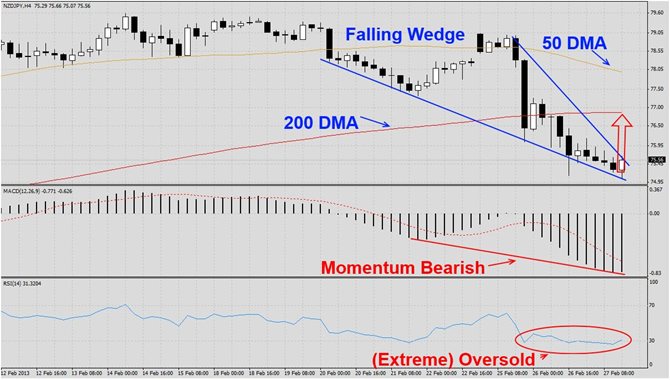

The NZDJPY has corrected sharply after remarks out of the Bank of New Zealand about the strength of the Kiwi. The correction forced the pair below its 50 DMA as well as 200 DMA and formed a falling wedge formation as visible in this H4 chart. We believe this pair will launch a short covering rally which will cause it to breakout from its formation and rally back to its 200 DMA.

MACD remains very bearish and may suggest further weakness in the future. A rally is necessary in order to keep this pair in a healthy downtrend. RSI has been trading in and out of extreme oversold territory and a breakout from this condition should accelerate the rally.

We recommend a long position at 75.60 with a potential second entry at 75.00. Should this pair breach the 75.20 level we advise traders to place a stop sell order around that level before committing to new long positions.

Traders who wish to exit this pair at a loss are advised to place their stop loss level at 75.00. We don’t use stop loss levels and will execute this trade as recommended. Place your take profit level at 76.60.