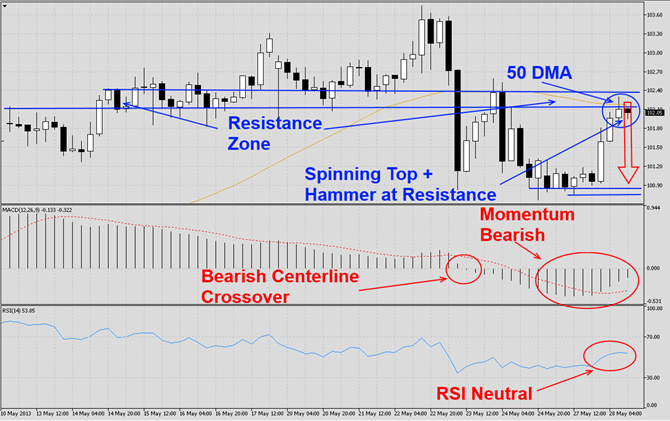

The USDJPY completed a major reversal trade on Thursday of last week. Today we witnessed a snap higher as visible in the H4 chart. Currently there are bullish as well as bearish forces acting on this currency pair which partially explains the increased volatility. This currency pair has formed a strong resistance zone above the 102 level which is also being enforced by its declining 50 DMA. The last two H4 candlesticks have formed a spinning top as well as a hammer formation at resistance which confirms overall bearishness. MACD...

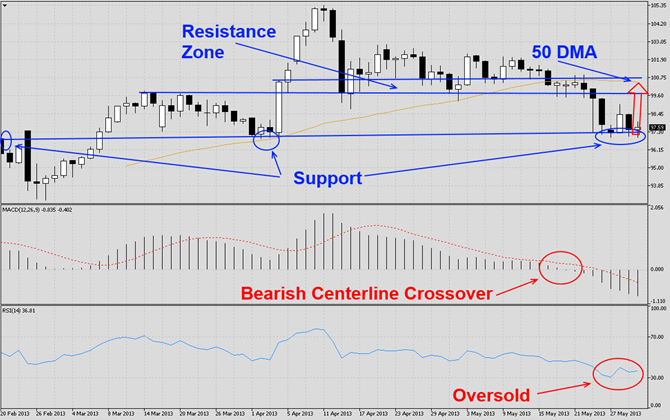

The AUDJPY currency pair has broken down below its 50 DMA as visible in this H4 chart after reaching a peak which was marked with a candlestick hammer formation and a subsequent melt-down in price action. This currency pair currently trades in at major support which indicates an imperfect triple bottom from which we believe it will rally back into its resistance zone which is also enforced by its 50 DMA. MACD has completed a bearish centerline crossover and momentum remains in very bearish territory and disconnected from its...

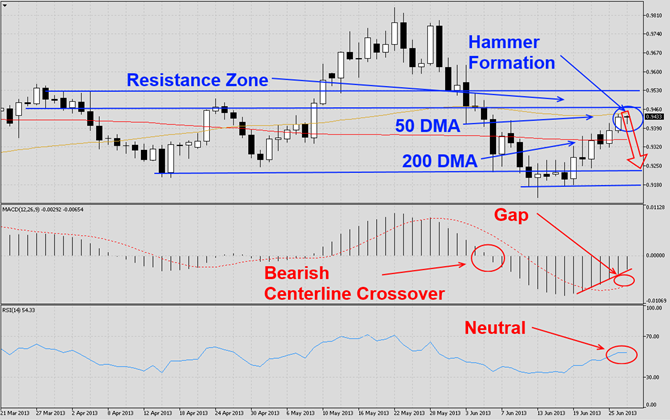

The USDCHF has rallied from new multi-week lows and eclipsed past its flat 200 DMA as visible in this D1 chart. This currency pair now ran into a strong resistance zone which is enforced by its 50 DMA and further increases the strength of bearish pressures. Additionally price action indicates a pending turnaround in the upward trend as the last D1 candlestick formed a hammer at resistance. We believe this currency pair will correct from current levels and retest the recent lows. MACD has completed a bearish centerline crossover...

The EURUSD has corrected sharply as visible in this D1 chart. Despite the continued debt contagion issues in the Eurozone the Euro remained very resilient, but the Portuguese-Greek combo sank this currency pair down to 1.2900. Additionally traders expect a positive surprise out of tomorrow’s NFP report in the U.S. which we believe will not occur. We expect the Euro to rally tomorrow after the release of the NFP data and see it heading higher and back to 1.3200. MACD indicates stable momentum despite the sell-off and the absence of...

This week saw plenty of turbulence in currency markets as forex traders adjusted positions heavily after several key developments. We started rather quiet on Monday as well as Tuesday without any major market moving surprises and more of a continuation trade of the previous week. Forex markets as well as equity markets hit turbulence on Wednesday. Ben Bernanke’s speech did not add as much volatility as usual, but the release of the FOMC minutes from the prior meeting took financial markets by surprise as voting members considered to...