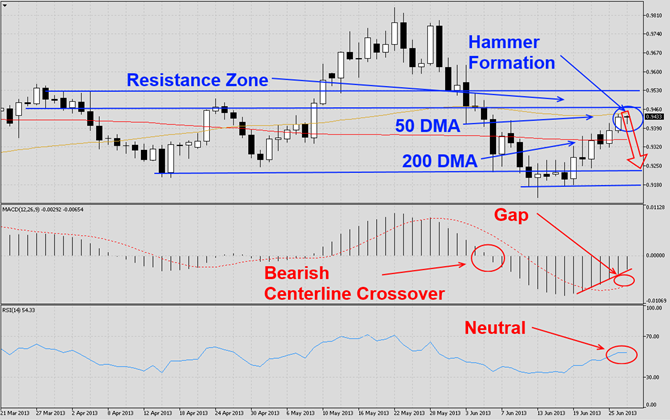

The USDCHF has rallied from new multi-week lows and eclipsed past its flat 200 DMA as visible in this D1 chart. This currency pair now ran into a strong resistance zone which is enforced by its 50 DMA and further increases the strength of bearish pressures. Additionally price action indicates a pending turnaround in the upward trend as the last D1 candlestick formed a hammer at resistance. We believe this currency pair will correct from current levels and retest the recent lows.

MACD has completed a bearish centerline crossover and while bearish momentum has faded during the current move higher the histogram has gaped away from its moving average and we believe the gap will be closed during the pending reversal. RSI has remained in neutral territory and we believe it will move into oversold territory over the next few trading days.

We recommend a short position at 0.9440. This would be an add-on trade to our previous short position which we took on June 13th at 0.9150. We also have one long position which we opened on June 5th at 0.9470.

Traders who wish to exit this trade at a loss are advised to place their stop loss order at 0.9520. We will not use a stop loss order and execute this trade as recommended. Place your take profit level for both short positions at 0.9200 and the take profit level for the open long position at 0.9520.

Here are the reasons we call the USDCHF currency pair lower

- USDCHF rally has been halted by strong resistance zone which is enforced by its 50 DMA

- Price action indicates a reversal as the last D1 candlestick formed a hammer formation at strong resistance levels

- MACD has completed a bearish centerline crossover and a gap has formed between the histogram and the moving average

- RSI is trading in neutral territory with a downward trend

- Profit taking in order to realize profits before the end of Q2 as well as H1

- New institutional short positions at very strong resistance levels

Open your PaxForex Trading Account now and add this currency trade to your forex portfolio.