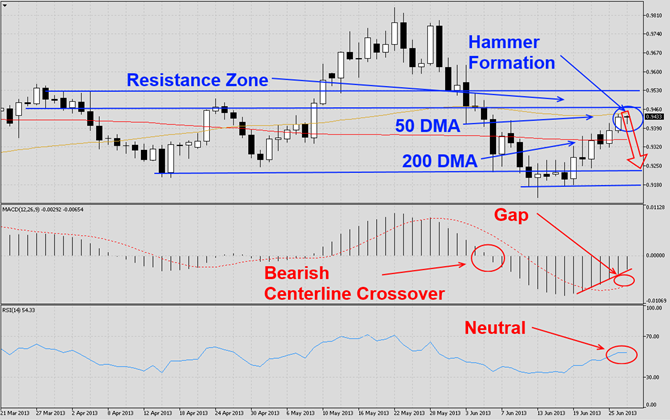

The USDCHF has rallied from new multi-week lows and eclipsed past its flat 200 DMA as visible in this D1 chart. This currency pair now ran into a strong resistance zone which is enforced by its 50 DMA and further increases the strength of bearish pressures. Additionally price action indicates a pending turnaround in the upward trend as the last D1 candlestick formed a hammer at resistance. We believe this currency pair will correct from current levels and retest the recent lows. MACD has completed a bearish centerline crossover...

The USDCHF has dropped from its latest peak as visible in this H4 chart and broken through support levels posed by its 50 DMA as well as 200 DMA as well as its ascending support line turning them into resistance. This currency pair has corrected too much too fast and its drop was halted by another ascending support level and has now formed a bullish price channel. We believe this pair will attempt to rally from back into its new resistance levels in order to retest and confirm them. MACD has completed a bearish centerline...

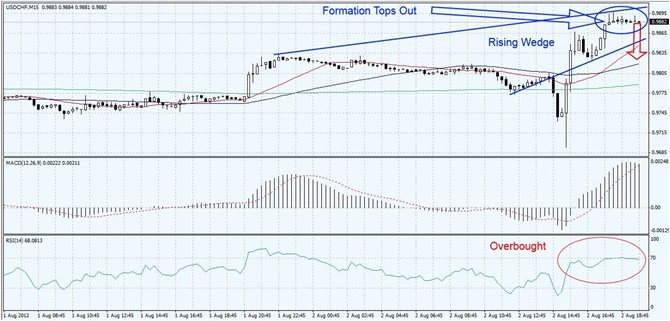

The USDCHF has launched a nice rally after reaching multi-week lows as visible in this H4 chart. This currency pair has formed a rising wedge formation which is a bearish chart formation. Current price action is approaching its descending 200 DMA and we believe this currency pair will start a counter-trend correction back down to its ascending support level with a potential breakdown to its 50 DMA. MACD has performed a bullish centerline crossover and indicates that momentum has turned bullish. This may point to future strength...

The USDCHF has corrected after it ran into its 200 DMA and currently dances around its new temporary support level as visible on this H4 chart. The last ten candlestick patterns have indicated a new support level and we believe this pair will use it to launch a small rally. MACD confirms the formation of a new support level and RSI has traded in extreme oversold territory for an extended period of time. Look out for a breakout into oversold territory and above which should accelerate the rally. We recommend taking a long position...

The USDCHF has formed a rising wedge formation and the most recent candlestick patterns point to another top for this pair. The highs reached are lower than the previous high and the most recent correction right before the spike set a lower low which further indicates that this safe-haven trade is ready to correct to more normalized levels. MACD did show strong momentum behind the sharp central bank (in)action which should ignore as those events cause only a temporary disruption before the price action continues back to reality....