Source: PaxForex Premium Analytics Portal, Technical Insight

After a short pause, technical stocks are back in fashion. On Tuesday the Nasdaq index rose 0.3%, while the Dow Jones index fell 1.1% and the S & P 500 dropped 0.8%. This continued on Wednesday as well. Return to technology may lead to a high return on Microsoft stock options. Microsoft (MSFT) closed at a new 52-week high on Tuesday and continued on Wednesday. This had a bullish look along with market changes. The critical support is around $175, which coincides with the rise of the 50-day moving average. There is also strong support for Microsoft shares at $186.

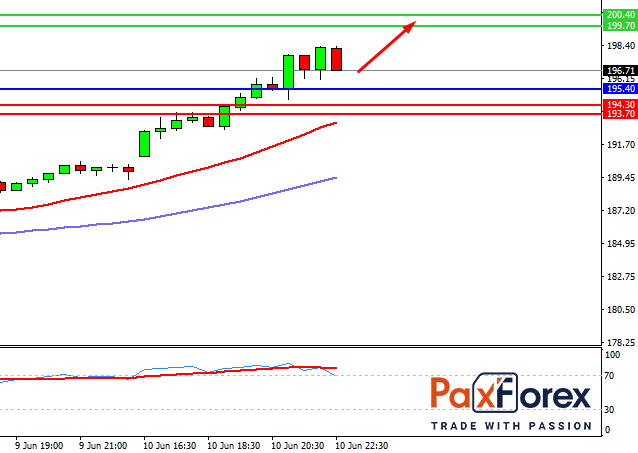

Microsoft, H4

Pivot: 196.71

Analysis:

Provided that the asset is traded above 195.40, follow the recommendations below:

- The time frame: H4

- Recommendation: long position

- Entry point: 196.71

- Take Profit 1: 199.70

- Take Profit 2: 200.40

Alternative scenario:

In case of breakdown of the level 195.40, follow the recommendations below:

- The timeframe: H4

- Recommendation: short position

- Entry point: 195.40

- Take Profit 1: 194.30

- Take Profit 2: 193.70

Comment:

RSI is traded above 70. This may mean that prices are either in a long uptrend or simply overbought, and therefore a correction may form (in this case, look for a bearish divergence). The MACD is positive and above the signal line. Configuration is positive. Microsoft trades above its 20 and 50-period moving averages (by 192.96 and 189.5 respectively).

Key levels:

| Resistance | Support |

| 201.00 | 162.00 |

| 200.40 | 160.00 |

| 199.70 | 158.10 |

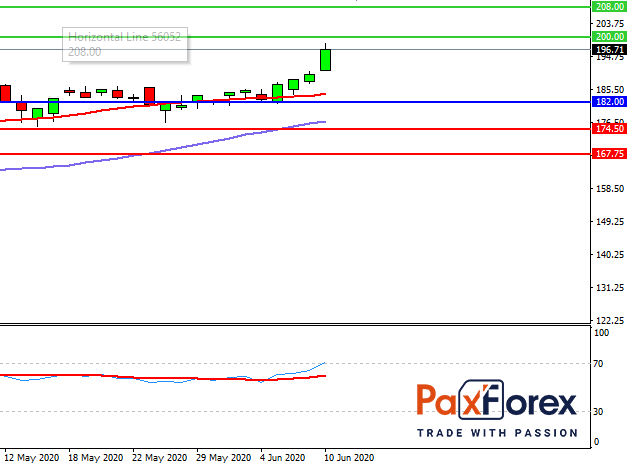

Microsoft, D1

Pivot: 193.00

Analysis:

While the asset is traded above 182.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 193.00

- Take Profit 1: 200.00

- Take Profit 2: 208.00

Alternative scenario:

If the level 182.00 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 182.00

- Take Profit 1: 174.50

- Take Profit 2: 167.75

Comment:

RSI shows an uptrend.

Key levels:

| Resistance | Support |

| 225.00 | 182.00 |

| 208.00 | 174.50 |

| 200.00 | 167.75 |

We also advise you to pay attention to General Electric for intra-day trading:

Pivot: 6.51

Analysis:

While the asset is traded above 7.14, follow the recommendations below:

- Time frame: H4

- Recommendation: long position

- Entry point: 8.02

- Take Profit 1: 9.41

- Take Profit 2: 10.00

Alternative scenario:

If the level 7.14 is broken-down, follow the recommendations below.

- Time frame: H4

- Recommendation: short position

- Entry point: 7.14

- Take Profit 1: 6.18

- Take Profit 2: 5.60