Source: PaxForex Premium Analytics Portal, Technical Insight

According to UOB Group analysts, they note an increasing probability that the Central Bank of New Zealand will cut the key interest rate, but they intend to revise their forecasts only after the November meeting of the Central Bank.

NZD/USD, 30 min

Pivot: 0.6556

Analysis:

Provided that the currency pair is traded above 0.6531, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.6556

- Take Profit 1: 0.6595

- Take Profit 2: 0.6612

Alternative scenario:

In case of breakdown of the level 0.6531, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.6531

- Take Profit 1: 0.6502

- Take Profit 2: 0.6485

Comment:

RSI above 50. MACD is positive and above its signal line. The configuration is positive. Moreover, the pair is above its 20 and 50 moving averages (by 0.6549 and 0.6553 respectively).

Key levels:

| Resistance | Support |

| 0.6629 | 0.6531 |

| 0.6612 | 0.6502 |

| 0.6595 | 0.6485 |

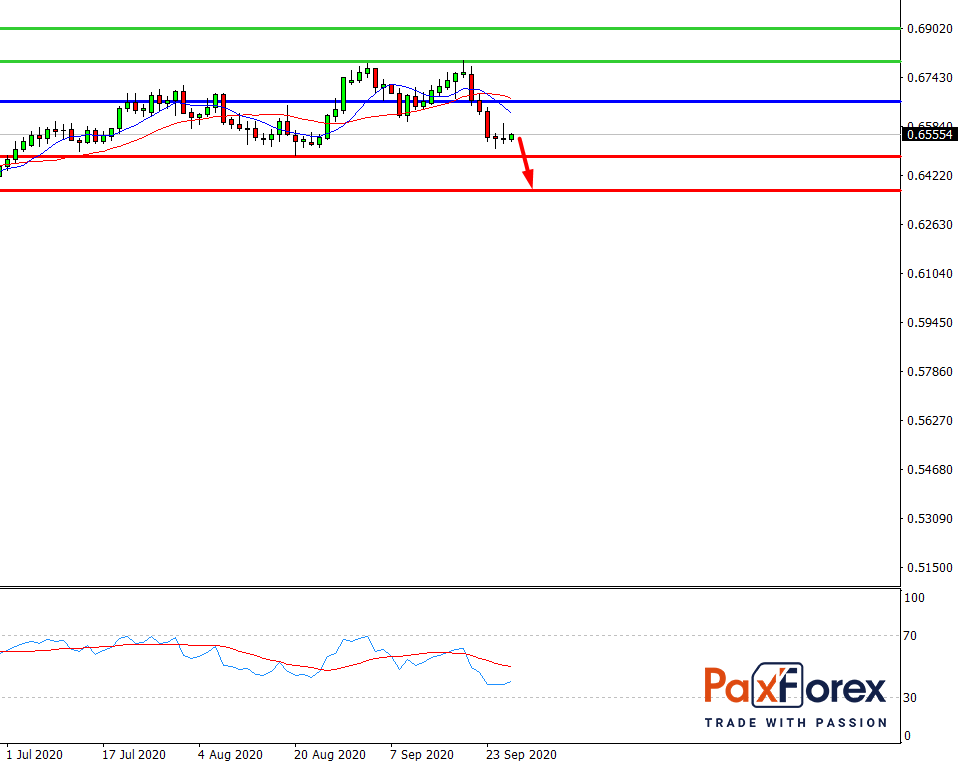

NZD/USD, D1

Pivot: 0.6551

Analysis:

While the price is below 0.6665, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 0.6551

- Take Profit 1: 0.6485

- Take Profit 2: 0.6375

Alternative scenario:

If the level 0.6665 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 0.6665

- Take Profit 1: 0.6795

- Take Profit 2: 0.6900

Comment:

RSI shows a downtrend in the medium term.

Key levels:

| Resistance | Support |

| 0.6900 | 0.6485 |

| 0.6795 | 0.6375 |

| 0.6665 | 0.6260 |