The coronavirus pandemic, which covered the whole world in early 2020, set up a real roller coaster for the world economy. What began as a local Chinese threat by the end of March had already resulted in record losses for the global market since 2008. The victims of the collapse were not only the most vulnerable and middle class, who had lost their jobs and income but also the richest people on the planet. Their fortunes fell by more than a trillion dollars in a short period. But every cloud has a silver lining, and while most of the world is sitting idle and watching the economy crash, some have made good money. Biotechnological companies have predictably become the undoubted beneficiaries of the coronavirus situation. In any epidemic, the search for a cure for the disease becomes the number one topic, so crises do not hinder the growth of such enterprises.

In this article, we will learn more about the biotechnology sector itself, will find out what are the best biotech stocks, and, of course, will discuss how traders can take advantage of the coronavirus situation with the help of biotech stocks and biotech ETFs.

What are Biotech Stocks?

Biotechnology companies, as their name suggests, use biotechnology to produce drugs, i.e. they work with microorganisms (bacteria) or biological substances (enzymes) to implement a specific process. Biotech manufacturers use such microorganisms or complex proteins of genetically modified living cells as components of medicines to treat various diseases and health disorders - from cancer to rheumatoid arthritis and different types of sclerosis.

Biotechnologists are mainly engaged in research and development, from the discovery of previously unknown compounds to the clinical trials of new drugs. It is clear that biotechnological discoveries and development processes often last longer, are heavier, and require more funds than similar stages in companies creating pure chemicals. Therefore, R&D costs for biotech companies are usually very high. In many cases, for a certain period, such manufacturers even work at a loss, as research costs are much higher than the income that usually comes from working with larger and established biotech companies, universities, and even pharmaceutical companies.

If the obtained substance successfully passes the final stage of testing, then the biotechnology firm can get ready for the launch. It is done by strengthening the marketing activities and increasing the sales capacity, so the company is prepared for commercial launch after receiving approval from the FDA, the U.S. Food and Drug Administration. It may also choose to join forces with another company that agrees to take on these cost functions in exchange for a share in sales.

Biotechnology is one of the most interesting and innovative directions, regardless of the current situation. The pandemic has made some adjustments to the sector. It can be noted both positive and negative consequences of investors' close attention to the sector.

The biotechnology sector has grown strongly in the last quarter with speculators' money. Some investors were not averse to buying some biotech stocks and understood that this sector could be considered quite protective in the background of the coronavirus story. Such investors will not keep funds on the long horizon in shares of biotechnological companies. As soon as there is more certainty in the economy, they will fix the profit and move to more understandable directions. As a result, stocks of companies in the sector will be subject to correction. It is an obvious disadvantage.

However, under these circumstances, there is one big plus that can make the sector even more attractive for investment in the long term. We initially expected this year to be very volatile and challenging for the sector itself. The U.S. election race has historically been such that everyone tries to humiliate biotech companies. Candidates, especially from the Democratic Party, in such a situation often offer to cut prices for medicines.

At the current difficult moment for the society, biotech stocks significantly win in the matter of trust and reputation, earning points to their karma. Dozens of coronavirus vaccines have been developed, and some have reached the testing stage. Companies are testing various drugs that could help cope with the disease. Expensive multi-million-dose medications are distributed free of charge to hospitals. Companies give up enhanced patents and allow competitors to use their technological capabilities to develop a vaccine faster. Large companies donate money directly to foundations.

The current stock market situation will allow thoughtful and careful investors to make good money. The recovery will begin before the global economy begins to recover from the negative effects of the recession. The biotech stocks will benefit significantly in the future. And this factor is much more important than local growth indicators against the background of speculative actions in the market.

The Top Biotech Stocks by Market Capitalization

There are three main reasons for the attractiveness of investments in the market of biotechnology and medicine. The first is that this market is based on the basic value - human life, it will grow and develop on the same exponent as the growth of the planet's population and its health care costs. The next reason is the high speed with which an individual company in this market comes to its "fair value". That is, an investor does not have to wait for a long revaluation of the company by the market, it happens at the moment of publication of new clinical data. Accordingly, the investor or trader, who made the correct prediction, "takes" the extra yield in a very short period (but it also works the other way around).

And one more reason for its attractiveness is the absence of a noticeable correlation between the dynamics of quotes of shares of a certain company and the general market, i.e. shares from this sector can be used for effective diversification of the investment portfolio.

While choosing biotech stocks to invest in, most traders can get confused by different balance sheets figures. It can be explained by a huge number of startups purchased after an impressive invention. Indeed, the industry is changing rapidly through constant mergers and acquisitions, these multinational corporations are constantly evolving to take advantage of the growing needs of global health care. Here are some top biotech stocks with the highest market cap:

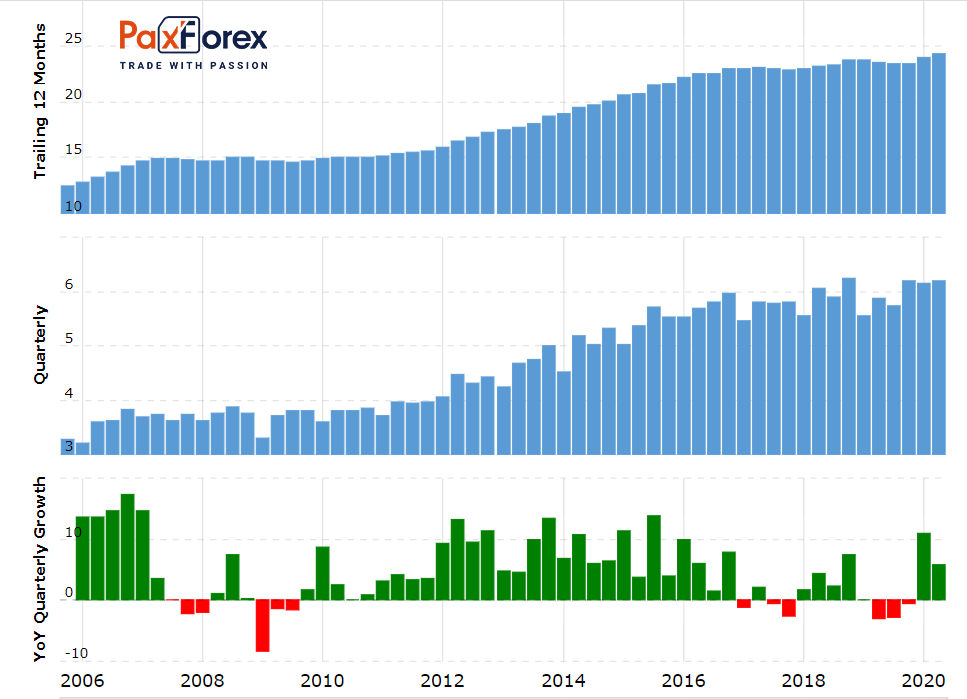

Amgen (US)

Capitalization: 132.75 billion dollars.

Share price as of 23.09.2020: $247.50.

Revenue for 2019: $23.362 billion.

Net profit for 2019: $7.842 billion.

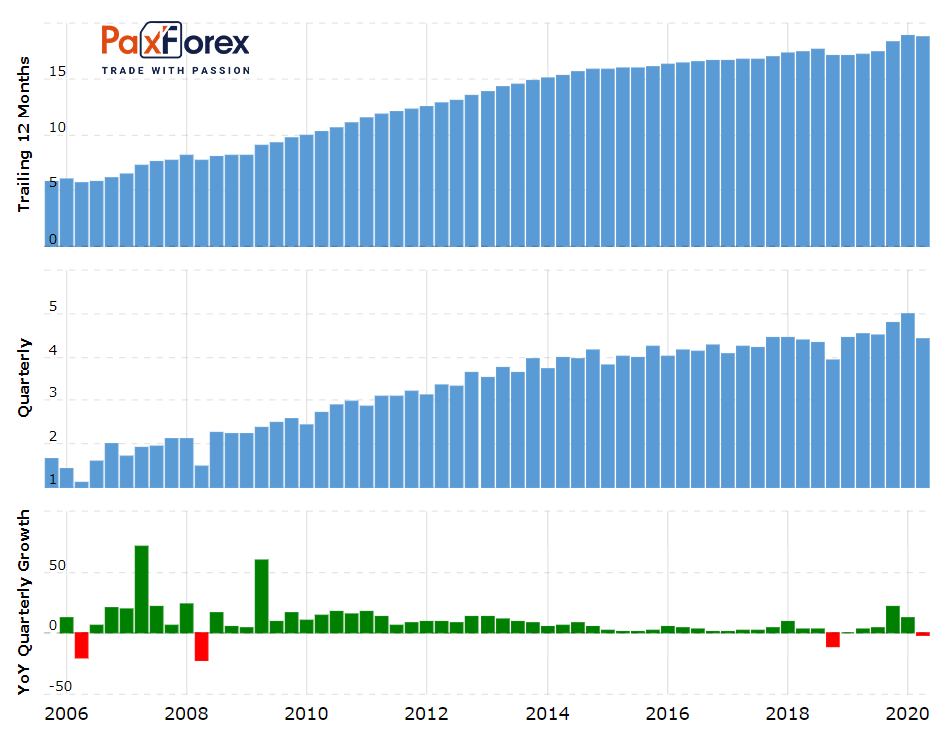

Novo Nordisk (Denmark)

Capitalization: $149.66 billion.

Share price as of 23.09.2020: 437.20 DKK

Revenue for 2019: $122.02 billion.

Net profit for 2019: $38.95 billion.

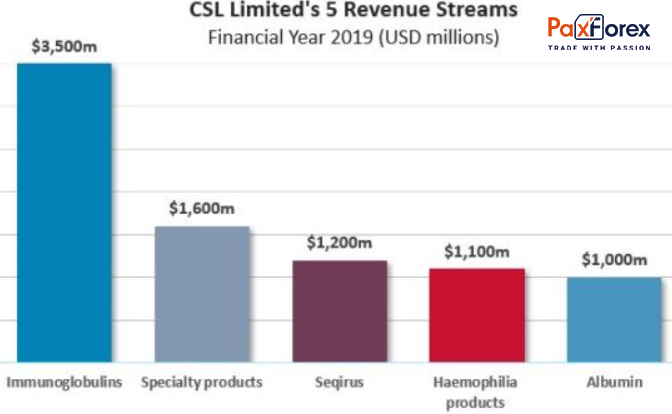

CSL (Australia)

Capitalization: $128.57 billion

Share price as of 23.09.2020: 286.35 AUD

Revenue for 2019: $8,5 billion.

Net profit for 2019: $1.9 billion

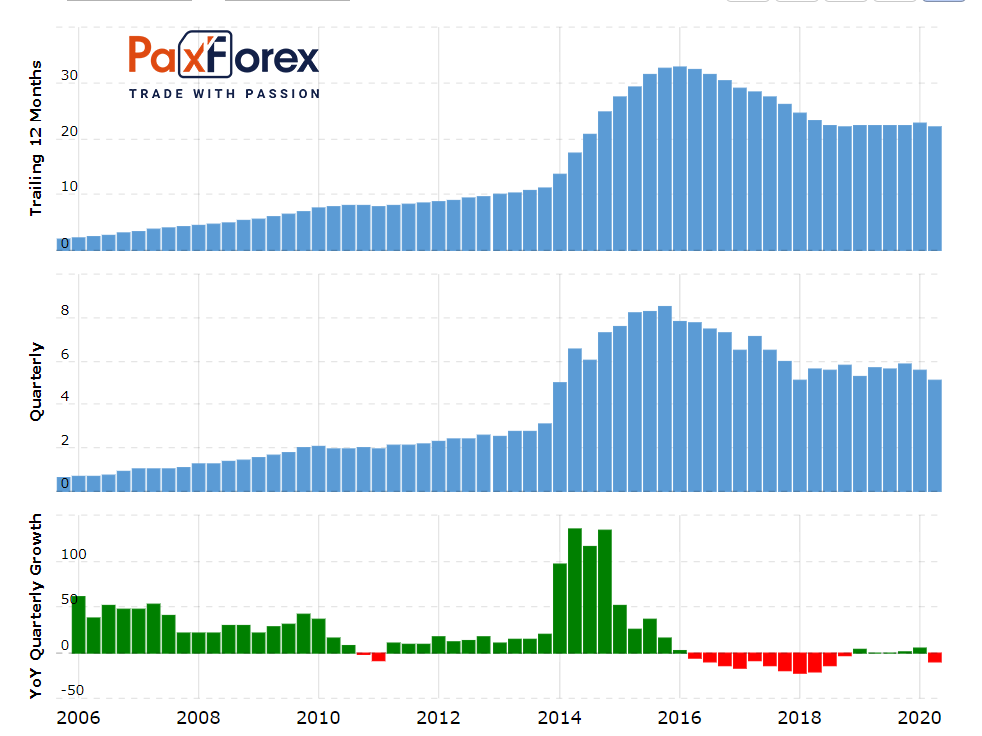

Gilead Sciences (US)

Capitalization: $96.27 billion.

Share price as of 23.09.2020: $63.40.

Revenue for 2019: $22.449 billion.

Net profit for 2019: $5.386 billion.

Biogen (US)

Capitalization: $50.94 billion.

Share price as of 23.09.2020: $272.76.

Revenue for 2019: $14.377 billion.

Net profit for 2019: $5.888 billion.

Vertex Pharmaceuticals (US) - $51.2 billion

Capitalization: $68.89 billion.

Share price as of 23.09.2020: $267.58.

Revenue for 2019: $4.162 billion.

Net profit for 2019: $1.176 billion.

Merck Group (Germany)

Capitalization: 45.80 billion EUR.

Share price as of 23.09.2020: 123.80 EUR.

Revenue for 2019: 16.2 billion EUR.

Net profit for 2019: 16,152 billion EUR.

Regeneron (US)

Capitalization: 67.18 billion dollars.

Share price as of 23.09.2020: $571.51.

Revenue for 2019: 7.863 billion dollars.

Net profit for 2019: 2.115 billion dollars.

How to Invest in Biotech Stocks

Before we move to the top biotech stocks to invest in, let us see how exactly you can do, from the technical side.

The sequence of actions goes as follows:

Create a trading account with the broker of your choice. Make sure to do due diligence since working with a non-reliable company will jeopardize the whole trading experience.

Verify your account by sending the documents needed. It will help the company meet all the banking requirements, as well as confirm that you are who you are.

Deposit the verified account with any convenient payment method - e-wallet, credit/debit card, bank transfer, or even cryptocurrency.

Launch the trading platform and find the company you are going to trade in the Market Watch list.

Right-click on the symbol and choose the New Order option.

In the window appeared, set the amount of the shares, place limit orders, and then click BUY.

What Are the Top Biotech Stocks to Buy

The long-term investment in biotech stocks takes a fundamental approach. We believe that more attention should be paid to the drug portfolio and its prospects rather than to the financial evaluation of the company itself.

Taking into account the current global situation, now is the best time to consider biotech stocks or biotech ETF, as coronavirus vaccine development and testing give hope to investors who will help mitigate the negative impact of the pandemic.

Let us start with the top 5 biotech stocks, and then we will move to the best biotech ETFs.

- Amgen (#AMGN)

Amgen Inc. specializes in the development, production, and implementation of innovative drugs based on genetic engineering methods. Founded in 1980, Amgen is a leader in the biotechnology industry, as the company was one of the first to unlock the potential of a new generation of effective and safe drugs to provide patients with innovative treatments for the most serious diseases: severe cases of cancer, hematological and nephrological diseases, rheumatoid arthritis and other serious pathologies.

During its development, the company has been constantly working on its expansion by absorbing several large and a large number of small pharmaceutical companies. Skilfully combining organic growth through the introduction of new drugs and M&A deals, over the past 20 years, the company has been able to multiply its financial performance, which is reflected in the stock exchange rate: the total capitalization of the company now exceeds 130 billion dollars.

The company's key drugs include ENBREL (a drug for the treatment of various forms of arthritis) and Neulasta (infection control against chemotherapy). These drugs account for more than 50% of the company's revenue. Among other drugs, annual revenue from the sale of each of which exceeds $1 billion, it is worth mentioning XGEVA (bone diseases), EPOGEN (treatment of anemia), Sensipar/Mimpara (complications of mineral metabolism against the background of renal failure).

- Novo Nordisk A-S (#NVO)

Novo Nordisk is a multinational biotechnology company headquartered in Denmark, with production facilities in seven countries and branches or offices in 75 countries. The company's main activities are diabetes therapy, hemophilia treatment, growth hormone therapy, and hormone replacement therapy. The company manufactures several drugs under different brand names, including Levemir, NovoLog, Novolin R, NovoSeven, NovoEight, and Victoza. As of 2018, the company employed 38 thousand people, and sales in 2019 amounted to DKK 122.0 billion. In 2019, the market capitalization of the company was $149.66 billion.

- CSL (#CSL.AU)

CSL Limited develops, manufactures, and sells pharmaceutical and diagnostic products derived from human plasma. The company's products include vaccines for children and adults, anti-infective and analgesic drugs, skin protection products, anticoagulants, and immunoglobulins.

One of the catalysts of the company's prospects is that he Australian government has entered into a deal with CSL to produce two COVID-19 vaccines: one developed by AstraZeneca and the University of Oxford, and one developed in its own CSL laboratories in conjunction with the University of Queensland. The country expects to receive its first shipments of potential vaccines in January.

It can be considered as good news and even a sign for investors to enter the market.

- Gilead Sciences (#GILD)

Gilead Sciences is a large biotechnology company with a $149.66 billion capitalization and annual revenues of over $22 billion. The growth of the company's shares since the beginning of the year can be explained by the development of its drug for the treatment of COVID-19. It is stated in several sources that one of the medicines produced by the company against other viral diseases has proved to be good in the treatment of a new disease. The first reports about the use of the drug were received back in February from China. In April, the University of Chicago gave a positive assessment of the effect of the drug.

GILD multipliers can not be called excessively high. LTM P/E is only 20x, forward P/E is 13.5x. But the company has a relatively high debt burden. The debt is comparable to equity, and concerning the annual EBITDA, it is 3.25 times higher. Excluding COVID-19, the company's revenue and profit forecasts for 2021 were quite moderate: $22.5 billion in revenue and $5.14 per share in earnings. Analysts believe that if the antiviral drug story does not find a continuation, the company may show similar, unimpressive results in 2022.

- Biogen (#BIIB)

Biogen is an American multinational biotechnology corporation that is engaged in the research and development of drugs for hematology, neurodegenerative, and autoimmune diseases.

The company was founded in 1978 in Geneva by a group of outstanding biologists, two of whom were subsequently awarded the Nobel Prize: Walter Gilbert received it in the chemical sciences in 1980 for his DNA decoding and Phillip Allen Sharp for his discovery of so-called split genes.

Biogen has two plants for the production of pharmaceuticals. The first is located in Research Triangle Park in North Carolina. The second one - Hillerød - in Denmark. The capacity of their bioreactors is 198 thousand liters in total, which puts Biogen among the world's leaders in production capacity.

What is a crucial thing to pay attention to is that recently Biogen has developed a drug to treat Alzheimer's disease called Aducanumab and has applied for registration. If the new drug receives approval from the U.S. Food and Drug Administration (FDA), Biogen will be the first company in the world to start producing a drug for this disease. Now existing drugs only help to combat symptoms, but do not cure the pathology itself.

The new development can significantly improve the financial performance of Biogen. Experts set the target price for the shares at $333.02 for April 2021 and recommended buying shares of the biotechnology company. Analytics estimates the upside potential of the pharmaceutical giant shares from current levels at 20%.

Aducanumab is not the only promising product that will help the company make billions of profits. In addition to a drug for the treatment of Alzheimer's disease, Biogen has promising developments in the field of analogs and treatment of Parkinson's disease. Currently, there are seven developments of promising drugs, including neurocognitive disorders, movement disorders, as well as painkillers, which are in the second and third stages of testing. The company may bring them to the market by the end of 2021. Expansion of the product line will allow the company to diversify its revenue.

Here is a comparative chart showing the revenue of the companies we have just gone through (without CSL there):

What is a Biotech Index and Biotech ETF?

Shares of biotech companies working on the coronavirus vaccine are rapidly becoming more expensive, as research is generously funded by government agencies, private foundations, and large investors. For example, Novavax (NVAX) shares grew by 70 percent after CEPI allocated $384 million for vaccine research and production. The shares of Moderna (MRNA), the developer of mRNA-vaccine, rose three times in two months. Pfizer (PFE) and BioNTech (BNTX) significantly increased in price due to the joint vaccine development agreement signed between them. Johnson & Johnson (JNJ) is trading close to its historical highs, and the shares of Emergent BioSolutions (EBS), which closed a production deal with it, almost doubled in price. After pharmaceutical giants Sanofi (SNY) and GlaxoSmithKline (GSK) joined forces, their stock charts began to show bullish trends.

All of these companies strive to find a cure for coronavirus before others and start industrial production. Investing in all biotech stocks at once or trying to guess the winner is not the best idea. In such cases, it is better to use biotech ETFs or biotech indices for investment.

Biotech ETF is a stock exchange investment fund that copies the structure of the underlying index and repeats the profitability of that index with maximum accuracy.

Basically, a biotech index is no different from any other stock market index like the S&P 500 or Nikkei 225. For instance, the NASDAQ Biotechnology Index is an American stock index, which is composed of biotech and pharmaceutical companies traded on the NASDAQ exchange.

As for the ETF, it is a stock exchange investment fund that copies the structure of the underlying index and repeats the profitability of that index with maximum accuracy. In simple words, an ETF is a basket of shares collected on some basis. That is, when you buy an ETF share, you actually buy shares of all the companies that make up this ETF. By investing in securities through an ETF, you get the same result if you own the same assets that make up the fund.

Best Biotech ETF Funds 2020 - SPDR S&P Biotech ETF (#XBI)

SPDR S&P Biotech is an ETF that provides access to one of the broadest portfolios of biotechnology companies.

XBI is focused exclusively on U.S. equities and consists mainly of medium and small capitalization securities. This ETF also focuses on the narrow healthcare sector. The investment strategy of the SPDR S&P Biotech Foundation is to follow the S&P Biotechnology Select Industry Index. The fund invests more than 80% of its assets in the securities included in the index.

As an investor, you might be wondering if there any risk involved in trading biotech ETFs. The first thing to understand is that an investment fund cannot go bankrupt. It is impossible by definition! A bank - may be a certain country - maybe, but a fund cannot. The fact is that the fund is not a legal entity, it is just a combination of investors' money and investing it following the fund's strategy. Theoretically, it may be a management company, broker, stock exchange, or insurance company, but the fund's assets are separated from all of this on a purely legal and legislative level. They will either be transferred under the management of another MC or returned to investors.

Of course, there is a risk that the value of the fund will be reduced. It may happen for two reasons. The first reason is that the management company does not manage well. It is possible for the funds with active management, where the management company tries to outplay the market, to get higher returns, and therefore takes additional risks. In index funds, this cannot happen. Here, the management company performs to a large extent a technical function - to ensure that the fund repeats the index as accurately as possible (S&P500, in our case). The second reason is a decrease in the market as a whole, i.e. a decrease in the value of shares included in the index. The market is fluctuating. Sometimes there are downs, even strong downs; then everything recovers. But at large intervals, the market is always growing. That's why you shouldn't be afraid of these fluctuations when investing in the long term. However, it's vital to make a portfolio that matches your risk tolerance, and even if one of the companies included in the S&P 500 - even the largest - goes bankrupt, the value of the fund will drop slightly, and that's all. All companies cannot go bankrupt at the same time. It is a huge advantage of investing through funds, especially index funds.

Biotech Stocks Investing Tips

The successful investment comes down to minimizing risk and maximizing potential profit at the same time. For stocks in the biotechnology sector, there are special methods to minimize risk and maximize profit. Here are some basic rules for investing in biotech stocks that will help you increase your chances of success.

- At what stage of development is the company

Shares in biotechnology companies that have reached the commercial stage usually represent the least risky investment targets, since one or more of their products have already been placed on the market.

- What diseases the company's drugs are aimed at

It will help you understand what the commercial potential of these drugs is. However, you should keep in mind that very small markets in the biotech industry can sometimes be the most profitable.

- Who competes with the company

Remember to study not only current but also potential competitors. Often, other companies may develop experimental drugs that target the same symptoms and sometimes have the same mechanism of action.

- What are the results of clinical trials

Biotech stocks are growing or decreasing depending on the results of clinical drug trials, especially for companies at the clinical stage. Keep a close eye on the reports about the results of these trials and carefully review the content of these reports.

- Who is the partner of the company

Find out who is the partner of the company of your choice, especially if it is in the preclinical or clinical stage. If a large pharmaceutical group collaborates with a small biotech company, it is often a good sign of great potential, especially if the partner owns a stake in the company.

- What is the financial position of the company

Regardless of the size of the company you are evaluating, be sure to examine its financial performance. For a small company, pay particular attention to how much cash it has and how quickly it spends it.

- Hope for the best but prepare for the worst.